HAPPY vs SAND: Which Beach Destination Will Bring You More Joy This Summer?

Introduction: Investment Comparison Between HAPPY and SAND

In the cryptocurrency market, the comparison between HAPPY vs SAND continues to be a topic that investors cannot overlook. These two assets demonstrate notable differences in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

HAPPY (HAPPY): Launched in 2024, it has gained market recognition based on its viral meme culture and community-driven approach.

SAND (SAND): Since its launch in 2020, it has been recognized for its metaverse gaming ecosystem positioning, becoming one of the widely traded digital assets in the virtual world sector.

This article will provide a comprehensive analysis of the investment value comparison between HAPPY vs SAND, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystem, and future projections, attempting to address investors' most pressing question:

"Which is the better buy right now?"

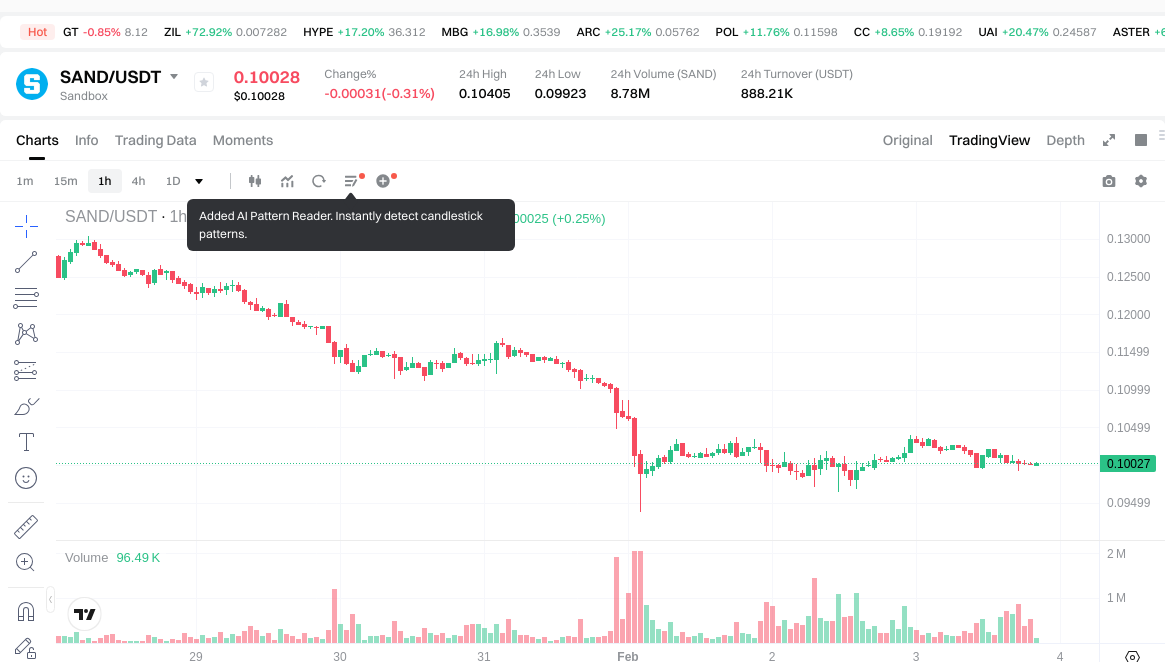

I. Historical Price Comparison and Market Status

HAPPY (Coin A) and SAND (Coin B) Historical Price Trends

- 2024: HAPPY reached its peak price of $0.04723 on November 16, 2024, following its initial launch in November 2024.

- 2021: SAND achieved its all-time high of $8.40 on November 25, 2021, driven by the metaverse and NFT market boom.

- 2026: Both assets experienced significant declines, with HAPPY dropping to its historical low of $0.000288 on February 2, 2026, while SAND traded at approximately $0.10011.

- Comparative Analysis: During the 2024-2026 market cycle, HAPPY declined from $0.04723 to $0.0002945, representing a decrease of approximately 99.38%, while SAND fell from its historical high of $8.40 to $0.10011, representing a decline of approximately 98.81%.

Current Market Status (February 3, 2026)

- HAPPY current price: $0.0002945

- SAND current price: $0.10011

- 24-hour trading volume: HAPPY at $15,104.77 vs SAND at $883,412.44

- Market Sentiment Index (Fear & Greed Index): 17 (Extreme Fear)

View real-time prices:

- Check HAPPY current price Market Price

- Check SAND current price Market Price

II. Core Factors Influencing HAPPY vs SAND Investment Value

Supply Mechanism Comparison (Tokenomics)

- HAPPY: Current supply mechanism details are not available in the provided materials.

- SAND: Supply mechanism specifics are not available in the provided materials.

- 📌 Historical Pattern: Supply mechanisms typically influence price cycles through scarcity dynamics and emission schedules, though specific historical data for these tokens is not available.

Institutional Adoption and Market Applications

- Institutional Holdings: Comparative institutional preference data between HAPPY and SAND is not available in the provided materials.

- Enterprise Adoption: Specific applications of HAPPY and SAND in cross-border payments, settlement systems, or investment portfolios are not documented in the available resources.

- National Policies: Regulatory attitudes from different jurisdictions toward these specific tokens are not detailed in the provided materials.

Technological Development and Ecosystem Building

- HAPPY Technical Upgrades: Information regarding technical developments and their potential impact is not available in the provided materials.

- SAND Technical Development: According to available information, SAND's mining operations demonstrate extended longevity potential, with references to operational timelines spanning multiple decades. However, specific technical upgrade details are not provided.

- Ecosystem Comparison: Comparative analysis of DeFi integration, NFT applications, payment solutions, and smart contract implementations for both tokens is not available in the provided materials.

Macroeconomic Environment and Market Cycles

- Performance in Inflationary Environments: Comparative anti-inflation characteristics between HAPPY and SAND are not documented in the available materials.

- Macroeconomic Monetary Policy: The specific impacts of interest rates and dollar index movements on these tokens are not detailed in the provided resources.

- Geopolitical Factors: Cross-border transaction demand and international situation impacts on HAPPY and SAND are not available in the provided materials.

III. 2026-2031 Price Prediction: HAPPY vs SAND

Short-term Forecast (2026)

- HAPPY: Conservative $0.000260744 - $0.0002963 | Optimistic $0.0002963 - $0.000420746

- SAND: Conservative $0.0642112 - $0.10033 | Optimistic $0.10033 - $0.1374521

Mid-term Forecast (2028-2029)

- HAPPY may enter a gradual growth phase, with estimated price range of $0.0002288810832 - $0.000678150556776

- SAND may enter a consolidation and expansion phase, with estimated price range of $0.0949071584835 - $0.1657341237

- Key drivers: institutional capital inflows, ETF adoption, ecosystem development

Long-term Forecast (2030-2031)

- HAPPY: Baseline scenario $0.000362897268207 - $0.000583014327588 | Optimistic scenario $0.000583014327588 - $0.000811905752598

- SAND: Baseline scenario $0.075537470229367 - $0.152556067325977 | Optimistic scenario $0.152556067325977 - $0.161709431365536

Disclaimer

HAPPY:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000420746 | 0.0002963 | 0.000260744 | 0 |

| 2027 | 0.00044456852 | 0.000358523 | 0.00026172179 | 21 |

| 2028 | 0.0005742104368 | 0.00040154576 | 0.0002288810832 | 36 |

| 2029 | 0.000678150556776 | 0.0004878780984 | 0.000429332726592 | 65 |

| 2030 | 0.000647145903622 | 0.000583014327588 | 0.000483901891898 | 97 |

| 2031 | 0.000811905752598 | 0.000615080115605 | 0.000362897268207 | 108 |

SAND:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.1374521 | 0.10033 | 0.0642112 | 0 |

| 2027 | 0.1248356025 | 0.11889105 | 0.0630122565 | 18 |

| 2028 | 0.1657341237 | 0.12186332625 | 0.1133328934125 | 21 |

| 2029 | 0.1524266484735 | 0.143798724975 | 0.0949071584835 | 43 |

| 2030 | 0.156999447927705 | 0.14811268672425 | 0.075537470229367 | 47 |

| 2031 | 0.161709431365536 | 0.152556067325977 | 0.122044853860782 | 52 |

IV. Investment Strategy Comparison: HAPPY vs SAND

Long-term vs Short-term Investment Strategies

- HAPPY: May be suitable for investors with high risk tolerance who focus on meme culture and community-driven narrative potential, particularly those interested in emerging viral cryptocurrency movements.

- SAND: May be suitable for investors seeking exposure to the metaverse and gaming ecosystem, particularly those with interest in virtual world infrastructure and NFT-related applications.

Risk Management and Asset Allocation

- Conservative Investors: HAPPY: 5-10% vs SAND: 15-20%

- Aggressive Investors: HAPPY: 15-25% vs SAND: 30-40%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risks

- HAPPY: Exhibits significant volatility with a historical decline of approximately 99.38% from peak levels, coupled with relatively low trading volume ($15,104.77 in 24-hour volume as of February 3, 2026), which may indicate liquidity challenges and heightened price fluctuation risks.

- SAND: Has experienced substantial price decline of approximately 98.81% from its historical peak, though maintains comparatively higher trading volume ($883,412.44 in 24-hour volume), suggesting better liquidity but continued exposure to broader market sentiment and metaverse sector developments.

Technical Risks

- HAPPY: Scalability and network stability considerations apply, though specific technical infrastructure details are limited in available information.

- SAND: Long-term operational framework suggests extended development timeline potential, though specific technical vulnerabilities and network concentration risks require ongoing monitoring.

Regulatory Risks

- Global regulatory policy developments may impact both assets differently, with meme-based tokens potentially facing scrutiny regarding utility and value proposition, while gaming and metaverse tokens may encounter regulations specific to virtual asset classifications and gaming industry oversight.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- HAPPY Strengths: Community-driven narrative appeal, launched during recent market cycle (2024), potential for viral momentum among meme cryptocurrency enthusiasts.

- SAND Strengths: Established presence since 2020, positioned within the metaverse and gaming ecosystem sector, comparatively higher trading volume indicating better market liquidity.

✅ Investment Recommendations:

- Beginner Investors: Consider starting with assets demonstrating higher liquidity and more established market presence. Extensive research and small position sizing are recommended given current extreme fear market sentiment (Fear & Greed Index: 17).

- Experienced Investors: May evaluate portfolio diversification strategies incorporating both assets based on individual risk tolerance, with careful attention to position sizing relative to the substantial historical declines both assets have experienced.

- Institutional Investors: Conduct comprehensive due diligence regarding liquidity requirements, regulatory compliance considerations, and alignment with specific investment mandates before allocation decisions.

⚠️ Risk Warning: The cryptocurrency market exhibits extreme volatility. Both HAPPY and SAND have experienced declines exceeding 98% from historical peaks. This content does not constitute investment advice. Investors should conduct independent research and consider their risk tolerance before making any investment decisions.

VII. FAQ

Q1: Which cryptocurrency offers better liquidity for trading - HAPPY or SAND?

SAND demonstrates significantly better liquidity with a 24-hour trading volume of $883,412.44 compared to HAPPY's $15,104.77 as of February 3, 2026. This approximately 58x difference in trading volume indicates that SAND provides substantially easier entry and exit points for investors, reduced slippage risk, and more stable price discovery mechanisms. For traders prioritizing execution quality and portfolio flexibility, SAND's higher liquidity profile represents a considerable advantage, particularly during volatile market conditions or when executing larger position sizes.

Q2: What are the primary risk factors distinguishing HAPPY from SAND investments?

Both assets carry distinct risk profiles: HAPPY presents higher volatility risk with a 99.38% decline from its peak and extremely low trading volume, indicating potential liquidity constraints and amplified price fluctuation exposure. SAND, despite experiencing a 98.81% decline from its historical high, maintains relatively stronger market presence with established ecosystem positioning in the metaverse sector. Additionally, HAPPY faces uncertainty regarding its long-term utility beyond meme culture appeal, while SAND's risks center on gaming sector adoption rates and metaverse ecosystem development sustainability.

Q3: How do institutional adoption levels compare between HAPPY and SAND?

Based on available information, specific institutional adoption metrics for both HAPPY and SAND remain undocumented in current market data. However, SAND's launch in 2020 and positioning within the metaverse gaming ecosystem suggests potentially greater institutional familiarity compared to HAPPY's recent 2024 launch. Investors seeking exposure to assets with clearer institutional pathways may need to conduct independent research regarding custody solutions, regulatory compliance frameworks, and institutional investment vehicles available for each token before making allocation decisions.

Q4: What is the realistic price recovery potential for HAPPY and SAND by 2030?

According to forecasting models, SAND shows more substantial absolute recovery potential with predicted ranges of $0.0755 - $0.1570 by 2030, representing potential increases from current levels of approximately $0.10011. HAPPY's 2030 projections range from $0.000363 - $0.000583, indicating modest growth from its current price of $0.0002945. However, these projections should be interpreted cautiously given both assets' historical volatility patterns and the extreme fear market sentiment (Fear & Greed Index: 17) currently prevailing. Neither asset is projected to approach their historical peak prices within the 2030 timeframe.

Q5: Which asset is more suitable for portfolio diversification strategies?

For diversification purposes, SAND may offer broader ecosystem exposure through its metaverse and gaming sector positioning, potentially providing correlation benefits distinct from traditional cryptocurrency narratives. HAPPY represents exposure to meme culture and community-driven movements, which historically demonstrate different volatility patterns and catalyst responses. Conservative investors might allocate 15-20% to SAND versus 5-10% to HAPPY, while aggressive portfolios could consider 30-40% SAND versus 15-25% HAPPY allocations, always maintaining substantial stablecoin or traditional asset positions given both cryptocurrencies' extreme historical drawdowns.

Q6: How does the current market sentiment affect HAPPY and SAND differently?

The current Fear & Greed Index reading of 17 (Extreme Fear) impacts both assets but with varying implications. HAPPY's lower liquidity ($15,104.77 24-hour volume) makes it more vulnerable to sentiment-driven price dislocations and panic selling, potentially creating both heightened downside risk and opportunistic entry points for contrarian investors. SAND's higher trading volume ($883,412.44) provides some buffer against extreme sentiment swings but remains exposed to broader metaverse sector sentiment and gaming adoption narratives. During extreme fear periods, established assets like SAND typically demonstrate more predictable price behavior compared to newer, community-driven tokens like HAPPY.

Q7: What are the key timeframes investors should monitor for HAPPY and SAND?

Short-term (2026): Both assets face immediate pressure from extreme fear sentiment, with HAPPY potentially testing $0.000260 support levels and SAND approaching $0.064 ranges. Mid-term (2028-2029): Critical evaluation periods for ecosystem development, with HAPPY's community sustainability and SAND's metaverse adoption becoming clearer. Long-term (2030-2031): Forecasting models suggest potential stabilization phases, though investors should monitor quarterly developments in regulatory frameworks, technological upgrades, and competitive positioning within their respective sectors. Regular reassessment every 3-6 months is recommended given the dynamic nature of cryptocurrency markets.

Q8: What due diligence steps should investors prioritize when comparing HAPPY and SAND?

Essential due diligence includes: (I) Verifying current supply mechanisms and tokenomics for both assets, as this information remains limited in available materials; (II) Researching regulatory developments specific to meme tokens versus gaming/metaverse assets in relevant jurisdictions; (III) Analyzing development team track records, GitHub activity, and ecosystem partnership announcements; (IV) Assessing liquidity depth beyond 24-hour volume metrics by examining order book structures and exchange listings; (V) Evaluating community engagement quality and sustainability indicators; (VI) Understanding custody solutions and security infrastructure for each asset. Given both assets' substantial historical declines, comprehensive risk assessment should precede any allocation decision.

XRP Price Analysis 2025: Market Trends and Investment Outlook

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

Mastering the Crypto Fear and Greed Index: 2025 Trading Strategies

What Is the Best Crypto ETF in 2025: Top Performers and Beginner's Guide

What is SwissCheese (SWCH) and How Does It Democratize Investment?

What Is the Best AI Crypto in 2025?

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest