Is Almanak (ALMANAK) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Introduction: Almanak (ALMANAK) Investment Position and Market Prospects

Almanak (ALMANAK) is a notable asset in the cryptocurrency sector, designed to democratize quantitative trading through AI-driven technology. As of February 4, 2026, ALMANAK maintains a market capitalization of approximately $856,231.15, with a circulating supply of 268,748,008 tokens and a current price of around $0.003186. Positioned as an accessible no-code platform for sophisticated financial strategies, ALMANAK has garnered backing from prominent investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, and Matrix Partners. With its focus on bringing hedge-fund-level capabilities to everyday users, ALMANAK has become a point of discussion among investors exploring "Is Almanak (ALMANAK) a good investment?" This article provides a comprehensive analysis of ALMANAK's investment value, historical performance, future price outlook, and associated risks to serve as a reference for potential investors.

I. Almanak (ALMANAK) Price History Review and Current Investment Value Status

ALMANAK Historical Price Trends and Investment Performance (Almanak (ALMANAK) Investment Performance)

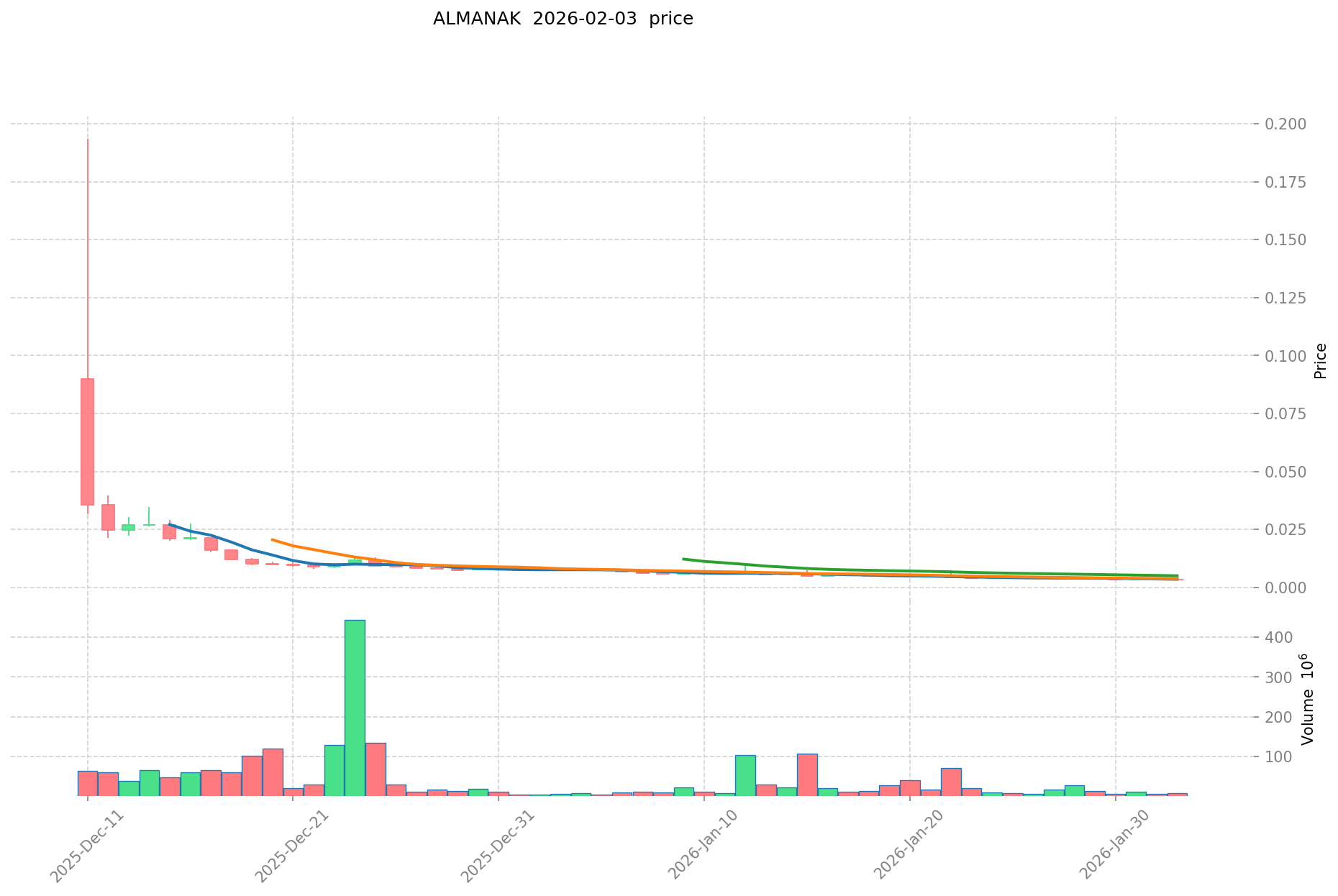

- December 2025: ALMANAK launched and experienced initial price discovery, with the token reaching significant trading activity during its early market phase

- December 11, 2025: The token experienced substantial price movement, reflecting market interest in AI-driven quantitative trading solutions

- January to February 2026: Market correction period → Price declined from higher levels to $0.003186, showing volatility typical of emerging DeFi-AI projects

Current ALMANAK Investment Market Status (February 2026)

- ALMANAK current price: $0.003186

- 24-hour trading volume: $25,671.90

- Market capitalization: $856,231.15

- Circulating supply: 268,748,008 ALMANAK (26.87% of total supply)

- Total supply: 1,000,000,000 ALMANAK

- 24-hour price change: -4.74%

- 7-day price change: -17.2%

- 30-day price change: -57.82%

- Number of exchanges listing: 8

- Token holders: 4,906

Click to view real-time ALMANAK market price

II. Core Factors Influencing Whether ALMANAK is a Good Investment

Supply Mechanism and Scarcity (ALMANAK Investment Scarcity)

- Total Supply Cap: ALMANAK has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of 268,748,008 tokens (26.87% of total supply), which may influence its long-term scarcity dynamics.

- Circulating Supply Impact: The limited circulating ratio suggests a significant portion of tokens remains unreleased, potentially affecting future supply-side pressure and price volatility.

- Investment Significance: The fixed maximum supply provides a theoretical foundation for scarcity-driven value preservation, though the low current circulation rate warrants careful consideration of future unlock schedules.

Institutional Investment and Mainstream Adoption (Institutional Investment in ALMANAK)

- Institutional Backing: ALMANAK is supported by notable investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, Matrix Partners, Shima Capital, and multiple key opinion leaders, which may provide credibility and potential ecosystem development support.

- Exchange Availability: The token is listed on 8 exchanges, indicating a degree of market accessibility for institutional and retail participants.

- Holder Base: With 4,906 holders as of February 2026, the project demonstrates modest community participation, though broader adoption metrics remain to be observed.

Macroeconomic Environment's Impact on ALMANAK Investment

- Market Volatility: ALMANAK has experienced notable price fluctuations, with a 30-day decline of 57.82% and a 7-day decline of 17.2%, reflecting sensitivity to broader market conditions and risk appetite.

- Crypto Market Dynamics: As a relatively new token (launched in December 2025), ALMANAK's performance may be influenced by prevailing trends in the cryptocurrency market, including liquidity conditions and investor sentiment toward emerging projects.

- Market Capitalization: With a market cap of $856,231 and a fully diluted valuation of $3,186,000, the token represents a micro-cap asset, which typically carries heightened volatility and risk compared to more established cryptocurrencies.

Technology and Ecosystem Development (Technology & Ecosystem for ALMANAK Investment)

- AI-Driven Quant Trading Platform: ALMANAK enables users to build, optimize, and manage quantitative financial strategies using multi-agent AI systems in a no-code environment, positioning itself within the AI and DeFi intersection.

- Accessibility Focus: The platform's design aims to democratize advanced quantitative trading by eliminating the need for coding expertise or quantitative analysis skills, potentially expanding its user base beyond traditional quant traders.

- Ecosystem Maturity: As a recently launched project, the extent of ecosystem development, including DeFi integrations, partnership expansion, and real-world adoption metrics, remains in early stages and requires ongoing observation for long-term investment evaluation.

III. ALMANAK Future Investment Forecast and Price Outlook (Is Almanak(ALMANAK) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term ALMANAK investment outlook)

- Conservative forecast: $0.00195 - $0.00260

- Neutral forecast: $0.00260 - $0.00320

- Optimistic forecast: $0.00320 - $0.00342

Mid-term Investment Outlook (2027-2029, mid-term Almanak(ALMANAK) investment forecast)

- Market stage expectation: The mid-term period may reflect gradual adoption of AI-driven DeFi platforms and potential expansion of quantitative trading accessibility. Market sentiment and broader crypto trends could influence price movements.

- Investment return forecast:

- 2027: $0.00248 - $0.00444

- 2028: $0.00314 - $0.00554

- 2029: $0.00278 - $0.00532

- Key catalysts: Platform development progress, user adoption rates, strategic partnerships, and overall DeFi market growth.

Long-term Investment Outlook (Is ALMANAK a good long-term investment?)

- Baseline scenario: $0.00296 - $0.00676 (assuming steady platform development and moderate market conditions through 2030-2031)

- Optimistic scenario: $0.00459 - $0.00866 (assuming accelerated adoption of AI trading tools and favorable regulatory environment)

- Risk scenario: Below $0.00278 (in cases of prolonged market downturns or significant competitive pressure)

Click to view ALMANAK long-term investment and price forecast: Price Prediction

2026-02-04 - 2031 Long-term Outlook

- Baseline scenario: $0.00296 - $0.00501 USD (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.00459 - $0.00677 USD (corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.00866 USD (in cases of breakthrough ecosystem developments and mainstream adoption)

- 2031-12-31 forecast high: $0.00866 USD (based on optimistic development assumptions)

Disclaimer: The forecasts presented are based on available data and market analysis models. Cryptocurrency investments carry significant risks, and historical performance does not guarantee future results. Investors should conduct independent research and consider their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00342186 | 0.003198 | 0.00195078 | 0 |

| 2027 | 0.0044353062 | 0.00330993 | 0.0024824475 | 3 |

| 2028 | 0.005537843883 | 0.0038726181 | 0.003136820661 | 21 |

| 2029 | 0.005316911020395 | 0.0047052309915 | 0.002776086284985 | 47 |

| 2030 | 0.006764945858029 | 0.005011071005947 | 0.002956531893509 | 57 |

| 2031 | 0.008655372395022 | 0.005888008431988 | 0.00459264657695 | 84 |

IV. Almanak Investment Strategy and Risk Management (How to invest in Almanak)

Investment Methodology (Almanak investment strategy)

Long-term Holding (HODL Almanak)

For conservative investors seeking long-term exposure to AI-powered quantitative trading platforms, holding Almanak may offer participation in the emerging intersection of artificial intelligence and decentralized finance. This approach involves acquiring ALMANAK tokens and maintaining positions through market cycles, anticipating potential value appreciation as the platform develops its user base and expands its multi-agent AI trading capabilities.

Active Trading

Active traders may engage with ALMANAK through technical analysis and swing trading strategies, leveraging the token's price movements. Given the observed volatility patterns—including a 4.74% decline over 24 hours and 17.2% decrease over 7 days as of February 4, 2026—traders may identify entry and exit points based on support and resistance levels, momentum indicators, and volume analysis.

Risk Management (Risk management for Almanak investment)

Asset Allocation Proportions

- Conservative Investors: May consider allocating 1-3% of their cryptocurrency portfolio to ALMANAK, maintaining majority holdings in more established assets

- Aggressive Investors: Could allocate 5-10% to ALMANAK as part of a higher-risk, higher-reward strategy within their crypto holdings

- Professional Investors: May implement dynamic allocation strategies based on market conditions, platform developments, and risk-adjusted return calculations

Risk Hedging Strategies

Investors may consider diversifying across multiple asset classes, including established cryptocurrencies, stablecoins, and traditional financial instruments. Portfolio construction could incorporate correlation analysis to reduce concentration risk. Additionally, setting predefined stop-loss levels and taking partial profits at predetermined price targets can help manage downside exposure.

Secure Storage

- Cold Wallets: Hardware wallets such as Ledger or Trezor provide offline storage for long-term holdings, minimizing exposure to online threats

- Hot Wallets: For active traders, reputable software wallets with robust security features may be used for operational liquidity

- Multi-signature Solutions: Advanced users may implement multi-signature wallets for enhanced security on larger holdings

V. Almanak Investment Risks and Challenges (Risks of investing in Almanak)

Market Risks

Almanak exhibits notable price volatility, with the token experiencing a 57.82% decline over 30 days as of February 4, 2026. The cryptocurrency market's inherent volatility affects ALMANAK's price stability, with fluctuations ranging from a 24-hour low of $0.003132 to a high of $0.003372. The token's relatively small market capitalization of approximately $856,231 may expose it to liquidity constraints and potential price manipulation. Lower trading volumes can amplify price swings, creating challenges for larger position entries and exits.

Regulatory Risks

Cryptocurrency regulations continue to evolve across jurisdictions, creating uncertainty for token holders and platform operations. Different countries maintain varying approaches to digital asset classification, taxation, and permissible trading activities. Changes in regulatory frameworks could impact Almanak's operational capabilities, token utility, or market accessibility. Investors should monitor regulatory developments in their respective jurisdictions and consider potential compliance requirements.

Technical Risks

As a platform leveraging AI agents and blockchain technology, Almanak faces technical vulnerabilities including smart contract risks, potential security exploits, and integration challenges. The ERC-20 token standard on Ethereum exposes ALMANAK to network congestion and gas fee fluctuations. Platform upgrades, algorithm modifications, or unexpected technical failures could affect user experience and token value. The complexity of multi-agent AI systems introduces additional layers of technical risk that may impact platform reliability and performance.

VI. Conclusion: Is Almanak a Good Investment?

Investment Value Summary

Almanak presents an innovative approach to democratizing quantitative trading through AI-powered, no-code solutions. The platform's backing from notable investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, and Matrix Partners provides credibility to the project's vision. However, ALMANAK has experienced considerable price fluctuations, with the current price of $0.003186 representing a substantial decline from its high of $0.19366 recorded on December 11, 2025. The token's circulating supply represents 26.87% of the maximum supply of 1 billion tokens, indicating potential future supply increases that could affect price dynamics.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging strategies to mitigate timing risk, and prioritize secure storage solutions such as hardware wallets. Start with modest allocations while developing understanding of the platform's value proposition and market dynamics.

✅ Experienced Investors: May implement swing trading strategies based on technical indicators while maintaining a core long-term position. Portfolio diversification across multiple assets can help balance exposure to Almanak's specific risks.

✅ Institutional Investors: Could evaluate strategic long-term allocations as part of a broader thesis on AI integration in decentralized finance, with appropriate risk management frameworks and due diligence processes.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. This content is provided for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is Almanak (ALMANAK) and what makes it unique in the cryptocurrency market?

Almanak is an AI-driven quantitative trading platform that democratizes sophisticated financial strategies through a no-code interface. It enables users to build, optimize, and manage quantitative trading strategies using multi-agent AI systems without requiring coding expertise or advanced quantitative analysis skills. What distinguishes ALMANAK from traditional trading platforms is its accessibility-first approach, bringing hedge-fund-level capabilities to everyday users. The project has secured backing from prominent investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, and Matrix Partners, positioning itself at the intersection of artificial intelligence and decentralized finance.

Q2: What is the current market performance of ALMANAK as of February 2026?

As of February 4, 2026, ALMANAK trades at approximately $0.003186 with a market capitalization of $856,231.15. The token has experienced significant volatility, declining 4.74% over 24 hours, 17.2% over 7 days, and 57.82% over 30 days. The circulating supply stands at 268,748,008 tokens (26.87% of the 1 billion maximum supply), with 24-hour trading volume of $25,671.90 across 8 exchanges. The token holder base consists of 4,906 participants, indicating modest community adoption in its early market phase since launching in December 2025.

Q3: What are the price forecasts for ALMANAK from 2026 to 2031?

Short-term forecasts for 2026 suggest a conservative range of $0.00195-$0.00260, neutral range of $0.00260-$0.00320, and optimistic range of $0.00320-$0.00342. Mid-term projections indicate potential ranges of $0.00248-$0.00444 for 2027, $0.00314-$0.00554 for 2028, and $0.00278-$0.00532 for 2029. Long-term baseline scenarios for 2030-2031 suggest $0.00296-$0.00676, while optimistic scenarios project $0.00459-$0.00866, with a forecast high of $0.00866 by December 31, 2031. These projections assume steady platform development, user adoption growth, and favorable market conditions, though actual results may vary significantly based on market dynamics and project execution.

Q4: What are the main risks associated with investing in ALMANAK?

ALMANAK investment carries substantial risks across multiple dimensions. Market risks include pronounced volatility with a 57.82% decline over 30 days, low liquidity due to its micro-cap market capitalization of $856,231, and potential price manipulation. Regulatory risks stem from evolving cryptocurrency frameworks across jurisdictions that could impact token utility and market accessibility. Technical risks encompass smart contract vulnerabilities, potential security exploits, network congestion on Ethereum affecting gas fees, and the complexity of multi-agent AI systems that may introduce platform reliability issues. Additionally, the token's early stage and limited circulating supply (26.87% of total) present uncertainties regarding future token unlock schedules and supply-side pressure.

Q5: How should different types of investors approach ALMANAK investment?

Conservative investors should consider allocating 1-3% of their cryptocurrency portfolio to ALMANAK, implementing dollar-cost averaging strategies and prioritizing secure cold wallet storage through hardware solutions like Ledger or Trezor. Aggressive investors might allocate 5-10% with active trading strategies leveraging technical analysis and swing trading based on volatility patterns. Professional investors could implement dynamic allocation strategies with risk-adjusted return calculations while diversifying across multiple asset classes. All investor types should establish predefined stop-loss levels, take partial profits at predetermined targets, and maintain awareness that cryptocurrency investments carry potential for total loss of principal.

Q6: What factors could drive ALMANAK's future value appreciation?

Several factors may influence ALMANAK's potential value growth: successful platform development demonstrating real user adoption of AI trading capabilities; strategic partnerships expanding ecosystem integrations; broader DeFi market growth increasing demand for quantitative trading tools; continued institutional backing and credibility from existing investors; favorable regulatory developments supporting AI-driven financial platforms; and achievement of key technical milestones showcasing the platform's multi-agent AI functionality. The fixed maximum supply of 1 billion tokens provides a theoretical scarcity framework, though actual value realization depends on demonstrable utility and sustained market demand.

Q7: Is ALMANAK suitable for long-term holding or active trading strategies?

ALMANAK may serve both approaches depending on investor objectives and risk tolerance. Long-term holding (HODL) strategies suit investors seeking exposure to the AI-powered quantitative trading thesis, anticipating value appreciation as the platform matures and expands its user base over multiple market cycles. This approach requires tolerance for significant volatility and extended holding periods through 2026-2031. Active trading strategies may capitalize on ALMANAK's price movements, with observed volatility patterns offering potential entry and exit opportunities through technical analysis, momentum indicators, and volume analysis. However, the token's lower liquidity and micro-cap status may present challenges for larger position management, making active trading more suitable for experienced traders with appropriate risk management frameworks.

Q8: What security measures should ALMANAK investors implement?

Investors should prioritize multi-layered security approaches based on their investment strategy. Long-term holders should utilize cold storage solutions through hardware wallets (Ledger, Trezor) to minimize online exposure and protect against cyber threats. Active traders requiring operational liquidity may employ reputable hot wallets with robust security features, two-factor authentication, and regular password updates. Advanced users managing larger holdings could implement multi-signature wallet solutions for enhanced security requiring multiple approvals for transactions. Additionally, investors should maintain diversification across secure storage methods, avoid storing significant holdings on centralized exchanges, and regularly audit wallet security configurations to protect against evolving threat vectors.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest