Is Telos (TLOS) a good investment?: A Comprehensive Analysis of Price Performance, Technology, and Future Prospects

Introduction: Telos (TLOS) Investment Status and Market Outlook

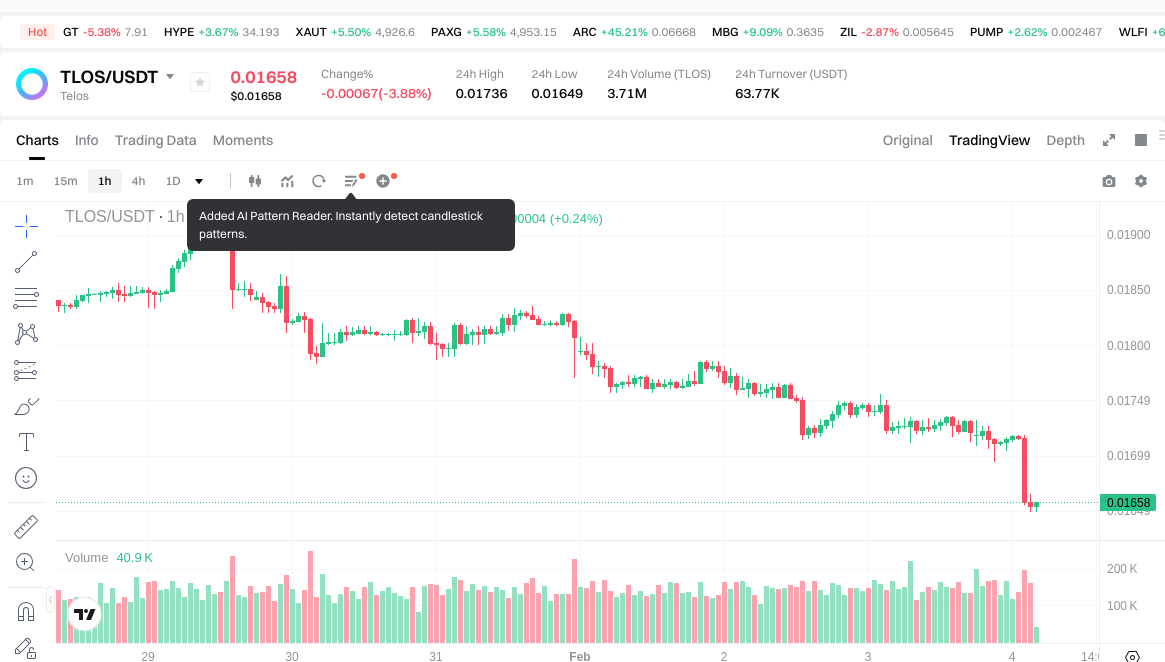

TLOS is a significant asset in the cryptocurrency field. Since its mainnet launch in December 2018, it has made notable achievements in hosting distributed applications. As of February 2026, Telos has a market capitalization of approximately $854,112, with a circulating supply of around 51.51 million tokens, and the current price is maintained at approximately $0.01658. With its positioning as a "third-generation blockchain platform," Telos has gradually become a focal point for investors discussing "Is Telos (TLOS) a good investment?" This article will comprehensively analyze the investment value, historical trends, future price predictions, and investment risks of TLOS to provide reference for investors.

I. Telos (TLOS) Price History Review and Current Investment Value

TLOS Historical Price Performance and Investment Returns (Telos(TLOS) investment performance)

- February 2024: TLOS reached a price level of $0.622416, representing a notable peak in its trading history, followed by subsequent market adjustments

- 2025-2026 Period: The token experienced significant volatility, with prices declining from higher levels to approximately $0.01658

- Recent 12 months: TLOS demonstrated a downward trend of 86.99%, reflecting broader market dynamics and evolving investor sentiment

Current TLOS Investment Market Status (February 2026)

- TLOS current price: $0.01658

- Market performance indicators: 24-hour price change of -4.5%, 7-day change of -8.93%, and 30-day change of -7.3%

- 24-hour trading volume: $63,836.70

- Circulating supply: 51,514,603.84 TLOS tokens

- Market capitalization: $854,112.13

- Total supply: 51,514,603.84 TLOS

- Maximum supply: Unlimited (∞)

- Market cap to fully diluted valuation ratio: 14.5%

Click to view real-time TLOS market price

II. Core Factors Affecting Whether TLOS is a Good Investment (Is Telos(TLOS) a Good Investment)

Supply Mechanism and Scarcity (TLOS investment scarcity)

- Unlimited maximum supply → affects long-term price dynamics and investment value assessment

- Current circulating supply of 51,514,603.839043 TLOS represents approximately 14.5% of total supply, indicating ongoing token distribution

- Investment significance: The unlimited supply model may influence scarcity-driven value appreciation differently compared to fixed-supply assets

Institutional Investment and Mainstream Adoption (Institutional investment in TLOS)

- Holder base: 2,343 holders as of February 2026

- Trading availability: Listed on 1 exchange, which may affect liquidity and institutional access

- Market share: 0.000032% of total cryptocurrency market capitalization, reflecting current adoption levels

Macroeconomic Environment's Impact on TLOS Investment

- Monetary policy and interest rate changes → alter investment attractiveness across digital assets

- Inflation environment's hedging role → digital asset positioning considerations

- Geopolitical uncertainty → potential influence on TLOS investment demand patterns

Technology and Ecosystem Development (Technology & Ecosystem for TLOS investment)

- Third-generation blockchain platform design: Focuses on building fast, scalable distributed applications with quick transaction capabilities

- Governance features: Innovative governance characteristics provide organizations with collaborative and transparent decision-making models, potentially supporting long-term ecosystem value

- Enterprise-grade blockchain capabilities: Hosting distributed applications with advanced governance and security features may drive ecosystem expansion and investment value support

III. TLOS Future Investment Forecast and Price Outlook (Is Telos (TLOS) worth investing in 2026-2030)

Short-term Investment Forecast (2026, short-term TLOS investment outlook)

- Conservative estimate: $0.01124 - $0.01654

- Neutral estimate: $0.01654 - $0.02255

- Optimistic estimate: $0.02255 - $0.02381

Mid-term Investment Outlook (2027-2028, mid-term Telos (TLOS) investment forecast)

- Market stage expectation: Potential consolidation phase with gradual growth trajectory as the platform continues development and seeks broader adoption.

- Investment return forecast:

- 2027: $0.01291 - $0.02381

- 2028: $0.02023 - $0.02331

- Key catalysts: Platform governance enhancements, ecosystem expansion through dApp development, and strategic partnerships within the blockchain infrastructure space.

Long-term Investment Outlook (Is TLOS a good long-term investment?)

- Base scenario: $0.01857 - $0.02627 (assuming steady ecosystem development and maintained market position)

- Optimistic scenario: $0.02447 - $0.03182 (assuming accelerated adoption and favorable market conditions)

- Risk scenario: Below $0.01124 (under adverse market conditions or significant competitive pressure)

View TLOS long-term investment and price forecast: Price Prediction

2026-2030 Long-term Outlook

- Base scenario: $0.01857 - $0.02627 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.02447 - $0.03182 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.03182 (contingent on breakthrough ecosystem developments and mainstream popularization)

- December 31, 2030 projected high: $0.02813 (based on optimistic development assumptions)

Disclaimer: The above forecast is based on current market data and analytical models. Cryptocurrency investments carry substantial risk, and actual price movements may differ materially from projections due to market volatility, regulatory changes, technological developments, and other unforeseen factors. This content does not constitute investment advice.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0238176 | 0.01654 | 0.0112472 | 0 |

| 2027 | 0.023810984 | 0.0201788 | 0.012914432 | 21 |

| 2028 | 0.02331458552 | 0.021994892 | 0.02023530064 | 32 |

| 2029 | 0.0262794969616 | 0.02265473876 | 0.0185768857832 | 36 |

| 2030 | 0.02813718553992 | 0.0244671178608 | 0.021286392538896 | 47 |

| 2031 | 0.031825603557435 | 0.02630215170036 | 0.024724022598338 | 58 |

IV. Telos Investment Strategy and Risk Management (How to invest in Telos)

Investment Methodology (Telos investment strategy)

When considering Telos (TLOS) as part of a cryptocurrency portfolio, investors may adopt different approaches based on their risk tolerance and investment horizon.

-

Long-term Holding (HODL Telos): This strategy suits conservative investors who believe in the long-term potential of the Telos blockchain platform. Given Telos's positioning as a third-generation blockchain focused on fast, scalable distributed applications, long-term holders may benefit from the ecosystem's growth and adoption over time. However, investors should be aware of significant price volatility, as evidenced by the 1-year decline of approximately 86.99%.

-

Active Trading: This approach relies on technical analysis and swing trading strategies. Active traders may attempt to capitalize on Telos's price movements, noting recent performance indicators such as a 24-hour decline of 4.5% and 7-day decline of 8.93%. This strategy requires substantial market knowledge and close monitoring of price trends.

Risk Management (Risk management for Telos investment)

-

Asset Allocation Ratio:

- Conservative investors: May allocate 1-3% of their cryptocurrency portfolio to Telos

- Aggressive investors: May allocate 5-10% depending on their risk appetite

- Professional investors: May adjust allocation based on comprehensive market analysis and portfolio rebalancing strategies

-

Risk Hedging Solutions: Investors should consider diversifying across multiple digital assets rather than concentrating holdings in a single token. Portfolio diversification across different blockchain platforms and use cases may help mitigate project-specific risks.

-

Secure Storage:

- Cold wallets: Recommended for long-term storage of significant TLOS holdings

- Hot wallets: Suitable for smaller amounts needed for active trading

- Hardware wallets: Provide enhanced security for storing private keys offline

V. Telos Investment Risks and Challenges (Risks of investing in Telos)

Market Risk

Telos exhibits considerable price volatility. Recent data shows the token trading at $0.01658, with a 24-hour range between $0.01649 and $0.01736. The significant year-over-year decline of approximately 86.99% demonstrates the substantial downside risk. With a relatively modest market capitalization of approximately $854,112 and 24-hour trading volume of $63,836, the token may be susceptible to price volatility from relatively small trading activities.

Regulatory Risk

As with all cryptocurrency projects, Telos faces regulatory uncertainty across different jurisdictions. Changes in cryptocurrency regulations, compliance requirements, or legal classifications could impact the project's operations and token value. The regulatory landscape for blockchain platforms continues to evolve globally, creating ongoing uncertainty for investors.

Technical Risk

While Telos positions itself as an enterprise-grade blockchain with advanced governance features, all blockchain platforms face potential technical challenges including:

- Network security vulnerabilities that could compromise user funds or data

- Protocol upgrade complications that might affect network stability

- Competition from other blockchain platforms offering similar capabilities

- Potential scalability challenges as the network grows

The circulating supply represents approximately 14.5% of the total supply, and with an infinite maximum supply indicated, there may be concerns regarding long-term token economics and potential dilution.

VI. Conclusion: Is Telos a Good Investment?

Investment Value Summary

Telos presents itself as a third-generation blockchain platform designed for building fast and scalable distributed applications. While the project offers technical features such as advanced governance and security, recent price performance has been challenging, with substantial declines across multiple timeframes. The relatively small market capitalization and trading volume indicate a developing project with potential growth opportunities, but also significant liquidity considerations.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging (DCA) strategies to reduce timing risk, combined with secure wallet storage. Start with a minimal allocation to understand the project before increasing exposure.

✅ Experienced Investors: May explore swing trading opportunities while maintaining proper risk management. Consider Telos as part of a diversified blockchain platform portfolio rather than a concentrated position.

✅ Institutional Investors: Should conduct comprehensive due diligence on the project's technology, governance structure, and competitive positioning before any strategic allocation.

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk, including the potential loss of principal. This content is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is the current investment status of Telos (TLOS) as of February 2026?

As of February 2026, TLOS is trading at approximately $0.01658 with a market capitalization of $854,112 and a circulating supply of 51.51 million tokens. The token has experienced significant volatility, declining approximately 86.99% over the past 12 months, with recent performance showing a 24-hour decline of 4.5%, 7-day decline of 8.93%, and 30-day decline of 7.3%. The 24-hour trading volume stands at $63,836.70, indicating relatively modest liquidity levels.

Q2: How does Telos's unlimited supply model affect its investment value?

Telos features an unlimited maximum supply model, which differs from fixed-supply cryptocurrencies. Currently, the circulating supply represents approximately 14.5% of the total supply, indicating ongoing token distribution. This unlimited supply mechanism may influence scarcity-driven value appreciation dynamics differently compared to assets with capped supplies, potentially affecting long-term price appreciation prospects and requiring investors to consider token economics carefully.

Q3: What are the projected price ranges for TLOS from 2026 to 2030?

Short-term projections for 2026 range from $0.01124 to $0.02381 across different scenarios. Mid-term forecasts show potential growth to $0.01291-$0.02381 in 2027 and $0.02023-$0.02331 in 2028. Long-term projections for 2030 suggest a base scenario of $0.01857-$0.02627, an optimistic scenario of $0.02447-$0.03182, and a projected high of $0.02813 by December 31, 2030. These projections assume steady ecosystem development and market conditions, though actual results may differ materially.

Q4: What are the primary risks associated with investing in Telos?

Investing in Telos carries several key risks: (1) Market risk, evidenced by significant price volatility and an 86.99% year-over-year decline; (2) Liquidity risk, with a relatively modest market capitalization of $854,112 and limited exchange availability; (3) Regulatory uncertainty affecting blockchain platforms globally; (4) Technical risks including network security, protocol upgrades, and competition from other blockchain platforms; (5) Token economics concerns related to the unlimited supply model and potential dilution effects.

Q5: What investment strategies are recommended for different types of Telos investors?

For beginners, dollar-cost averaging (DCA) combined with secure wallet storage is recommended, starting with minimal allocation (1-3% of cryptocurrency portfolio). Experienced investors may explore active trading opportunities while maintaining diversification, potentially allocating 5-10% depending on risk tolerance. Institutional investors should conduct comprehensive due diligence on technology, governance, and competitive positioning before strategic allocation. All investors should implement proper risk management through portfolio diversification across multiple blockchain platforms.

Q6: What technical features distinguish Telos as an investment opportunity?

Telos positions itself as a third-generation blockchain platform focused on building fast, scalable distributed applications with quick transaction capabilities. The platform offers enterprise-grade blockchain capabilities with innovative governance features that provide organizations with collaborative and transparent decision-making models. These advanced governance and security features are designed to support ecosystem expansion, though the project's relatively small holder base of 2,343 and limited exchange listing indicate early-stage adoption levels.

Q7: How should investors approach asset allocation for Telos in their portfolios?

Conservative investors may consider allocating 1-3% of their cryptocurrency portfolio to Telos, while aggressive investors might allocate 5-10% based on risk appetite. Professional investors should adjust allocation based on comprehensive market analysis and portfolio rebalancing strategies. Diversification across multiple digital assets rather than concentration in a single token is recommended to mitigate project-specific risks. Secure storage solutions include cold wallets for long-term holdings, hot wallets for active trading, and hardware wallets for enhanced security.

Q8: What factors could drive Telos's future price performance?

Key potential catalysts for future price movement include platform governance enhancements, ecosystem expansion through decentralized application (dApp) development, strategic partnerships within the blockchain infrastructure space, and broader mainstream adoption. The project's market share of 0.000032% of total cryptocurrency market capitalization suggests substantial room for growth, though this also reflects current adoption levels. Macroeconomic factors such as monetary policy, inflation environment, and geopolitical uncertainty may also influence investment demand patterns for TLOS.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest