TEN vs STX: A Comprehensive Comparison of Two Leading Blockchain Platforms and Their Impact on the Crypto Market

Introduction: TEN vs STX Investment Comparison

In the cryptocurrency market, the comparison between TEN vs STX remains a topic investors cannot overlook. The two differ notably in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape. TEN (TEN): Launched in 2024, it has gained market recognition through its positioning as a privacy Layer 2 solution for Ethereum, bringing smart transparency to smart contracts powered by Trusted Execution Environments (TEEs). STX (STX): Since its launch in 2019, it has been regarded as a blockchain browser infrastructure, building a decentralized internet ecosystem where users retain full control over their data and digital assets. This article will comprehensively analyze the investment value comparison of TEN vs STX around historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future forecasts, attempting to answer investors' most pressing question:

"Which is the better buy right now?"

I. Historical Price Comparison and Market Status

TEN Protocol (TEN) and Stacks (STX) Historical Price Trends

-

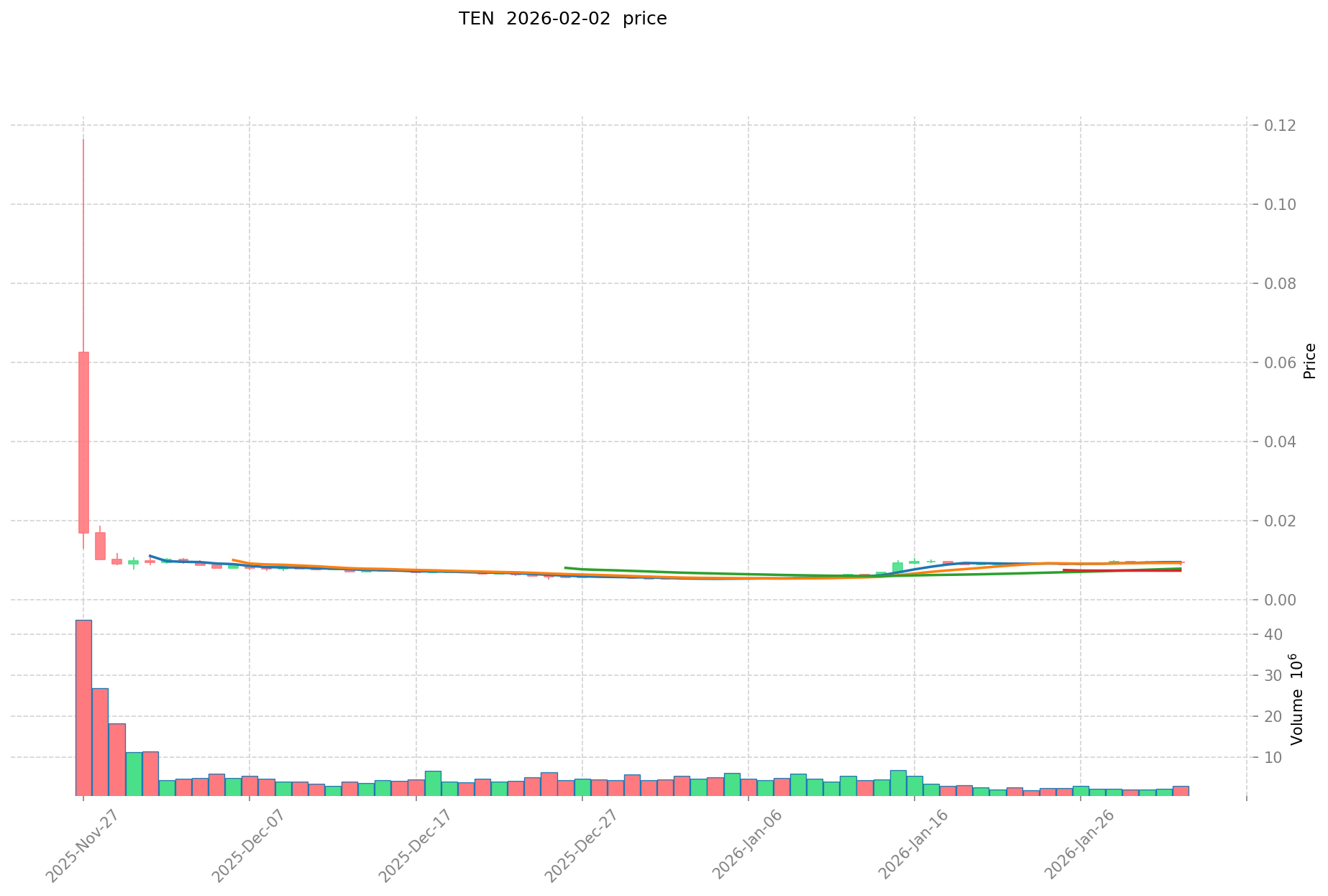

2024: TEN Protocol experienced a notable decline, with its price dropping from an all-time high of $0.11662 in November 2024 to a low of $0.005094 in December 2024, representing a significant correction period.

-

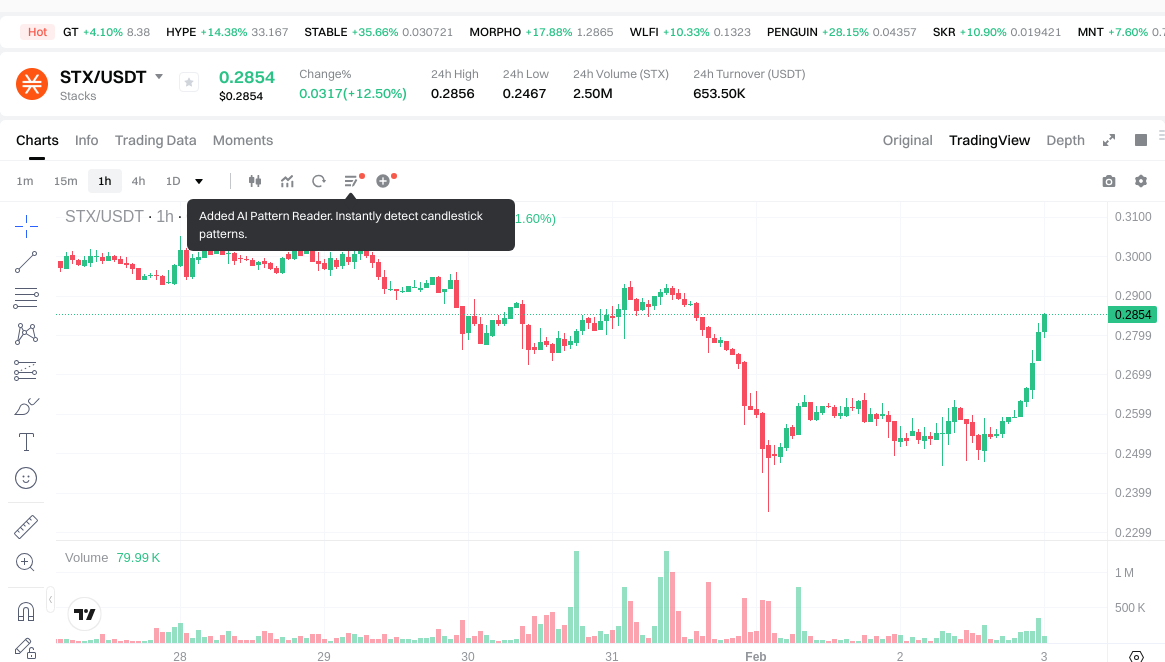

2024: Stacks (STX) faced considerable downward pressure, declining from its all-time high of $3.86 in April 2024 to lower levels, reflecting broader market volatility and sector-specific challenges.

-

Comparative Analysis: During the recent market cycle, TEN demonstrated higher volatility with approximately 95.6% decline from its peak, while STX experienced approximately 92.7% decline from its all-time high, indicating both assets faced substantial correction phases.

Current Market Status (February 3, 2026)

-

TEN Protocol Current Price: $0.009403

- 24-hour change: +3.15%

- 7-day change: +5.72%

- 30-day change: +73.57%

- 1-year change: -49.68%

-

Stacks Current Price: $0.2811

- 24-hour change: +11.15%

- 7-day change: -5.65%

- 30-day change: -5.33%

- 1-year change: -77.03%

-

24-Hour Trading Volume: TEN recorded $22,683.41 compared to STX's $642,295.27, indicating notably higher liquidity for Stacks.

-

Market Capitalization: TEN's market cap stands at approximately $1.26 million (ranking #2357), while STX maintains a market cap of approximately $498.84 million (ranking #118).

-

Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear), reflecting heightened caution among cryptocurrency market participants.

View real-time prices:

- Check TEN current price Market Price

- Check STX current price Market Price

II. Core Factors Influencing TEN vs STX Investment Value

Supply Mechanism Comparison (Tokenomics)

- STX: Features a capped total supply of 1.818 billion tokens, creating built-in scarcity that may influence price dynamics and long-term investment considerations.

- TEN: Supply mechanism details were not available in the reference materials.

- 📌 Historical Pattern: Supply mechanism changes have shown correlation with price cycle movements in crypto assets, though specific patterns vary by project.

Institutional Adoption and Market Application

- Institutional Holdings: Seagate Technology Holdings PLC (stock ticker STX) demonstrates notably high institutional ownership percentage, with multiple analysts providing coverage in recent months.

- Enterprise Adoption: STX (Stacks) positions itself as a Bitcoin smart contract layer, enabling DeFi applications directly on Bitcoin without modifying the base protocol.

- Regulatory Environment: Regulatory attitudes vary across jurisdictions, though specific national policies toward these assets were not detailed in available materials.

Technical Development and Ecosystem Building

- STX Technical Architecture: Utilizes a Proof-of-Transfer consensus mechanism that connects to Bitcoin, allowing smart contract functionality while leveraging Bitcoin's security model.

- STX Ecosystem: Focuses on bringing smart contracts and DeFi capabilities to the Bitcoin blockchain, with development centered on Bitcoin-native applications.

- TEN Technical Development: Technical upgrade details and ecosystem development information were not available in the reference materials.

- Ecosystem Comparison: STX concentrates on DeFi and smart contract deployment within the Bitcoin ecosystem, though comparative metrics with TEN were not provided.

Macroeconomic Environment and Market Cycles

- Performance Under Inflation: The investment value of crypto assets can be influenced by broader macroeconomic conditions, though specific performance data under inflationary environments was not available for these particular tokens.

- Macroeconomic Monetary Policy: Interest rate movements and dollar index fluctuations may impact crypto asset valuations, with STX showing particular sensitivity to Bitcoin's macro trends due to its Proof-of-Transfer model.

- Geopolitical Factors: Cross-border transaction demand and international developments can affect crypto asset adoption, though specific impacts on TEN and STX were not detailed in available materials.

III. 2026-2031 Price Prediction: TEN vs STX

Short-term Forecast (2026)

- TEN: Conservative $0.00743 - $0.00940 | Optimistic $0.00940 - $0.01109

- STX: Conservative $0.181 - $0.284 | Optimistic $0.284 - $0.318

Medium-term Forecast (2028-2029)

- TEN may enter a growth phase with projected price range of $0.00710 - $0.01567 in 2028, expanding to $0.01307 - $0.01509 by 2029

- STX may enter an expansion stage with projected price range of $0.221 - $0.491 in 2028, adjusting to $0.389 - $0.468 by 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- TEN: Baseline scenario $0.00942 - $0.01428 (2030) | Optimistic scenario $0.01428 - $0.01813 (2030), extending to $0.00989 - $0.02075 (2031)

- STX: Baseline scenario $0.257 - $0.443 (2030) | Optimistic scenario $0.443 - $0.563 (2030), extending to $0.352 - $0.533 (2031)

Disclaimer

TEN:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01109436 | 0.009402 | 0.00742758 | 0 |

| 2027 | 0.012297816 | 0.01024818 | 0.0083010258 | 8 |

| 2028 | 0.01566946722 | 0.011272998 | 0.00710198874 | 19 |

| 2029 | 0.0150877805232 | 0.01347123261 | 0.0130670956317 | 43 |

| 2030 | 0.018134973339582 | 0.0142795065666 | 0.009424474333956 | 51 |

| 2031 | 0.020745267139956 | 0.016207239953091 | 0.009886416371385 | 72 |

STX:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.31752 | 0.2835 | 0.18144 | 1 |

| 2027 | 0.390663 | 0.30051 | 0.180306 | 7 |

| 2028 | 0.49073283 | 0.3455865 | 0.22117536 | 23 |

| 2029 | 0.4683388248 | 0.418159665 | 0.38888848845 | 49 |

| 2030 | 0.562926541023 | 0.4432492449 | 0.257084562042 | 58 |

| 2031 | 0.53327316653919 | 0.5030878929615 | 0.35216152507305 | 79 |

IV. Investment Strategy Comparison: TEN vs STX

Long-term vs Short-term Investment Strategies

- TEN: May appeal to investors focused on emerging privacy-focused Layer 2 solutions with higher risk tolerance, given its early stage development and smaller market capitalization positioning

- STX: May appeal to investors seeking exposure to Bitcoin-native smart contract capabilities with relatively established market presence and infrastructure development

Risk Management and Asset Allocation

- Conservative Investors: TEN: 10-15% vs STX: 20-30% allocation within crypto portfolio segments

- Aggressive Investors: TEN: 25-35% vs STX: 35-45% allocation within high-growth crypto segments

- Hedging Tools: Stablecoin allocations, diversified token combinations across different blockchain ecosystems, potential derivatives strategies

V. Potential Risk Comparison

Market Risk

- TEN: Experiences notably higher volatility with limited liquidity ($22,683.41 24-hour volume), ranking #2357 by market cap indicates exposure to significant price fluctuations and potential liquidity constraints

- STX: Demonstrates moderate volatility with substantially higher trading volume ($642,295.27 24-hour), ranking #118 provides relatively better market depth, though remains subject to Bitcoin ecosystem correlation risks

Technical Risk

- TEN: Scalability considerations and network stability factors related to Trusted Execution Environment implementation require ongoing monitoring

- STX: Proof-of-Transfer consensus mechanism dependency on Bitcoin network creates unique technical interdependencies, with smart contract layer security requiring continuous evaluation

Regulatory Risk

- Evolving global regulatory frameworks may impact both assets differently, with STX's connection to Bitcoin potentially attracting different regulatory scrutiny compared to TEN's privacy-focused positioning

- Jurisdictional variance in crypto asset classification may affect adoption trajectories and institutional participation for both tokens

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- TEN Advantages: Early-stage positioning in privacy Layer 2 solutions, potential for growth from lower market cap base, recent 30-day performance showing +73.57% momentum

- STX Advantages: Established Bitcoin smart contract ecosystem, higher liquidity and market capitalization (#118 ranking), institutional recognition through Proof-of-Transfer mechanism connecting to Bitcoin security model

✅ Investment Recommendations:

- Novice Investors: Consider STX for relatively established market presence and higher liquidity, enabling easier position management and lower execution risk

- Experienced Investors: May evaluate portfolio allocation across both assets based on risk tolerance, with TEN representing higher-risk/higher-potential-return positioning and STX offering Bitcoin ecosystem exposure

- Institutional Investors: STX may align better with institutional requirements given market depth, regulatory clarity around Bitcoin-connected assets, and established infrastructure

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate extreme volatility. This content does not constitute investment advice. Conduct thorough due diligence and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between TEN and STX in terms of blockchain functionality?

TEN (TEN Protocol) is a privacy-focused Layer 2 solution for Ethereum that leverages Trusted Execution Environments (TEEs) to bring smart transparency to smart contracts, while STX (Stacks) is a blockchain infrastructure that enables smart contracts and DeFi applications directly on Bitcoin through its Proof-of-Transfer consensus mechanism. TEN addresses Ethereum scalability and privacy challenges, launched in 2024 as an emerging solution in the privacy technology sector. STX, operational since 2019, focuses specifically on extending Bitcoin's capabilities without modifying the base protocol, creating a bridge between Bitcoin's security model and smart contract functionality. The fundamental distinction lies in their base layer integration: TEN enhances Ethereum's ecosystem, whereas STX builds upon Bitcoin's infrastructure.

Q2: Which asset demonstrates better liquidity and market accessibility?

STX exhibits significantly superior liquidity with 24-hour trading volume of $642,295.27 compared to TEN's $22,683.41, representing approximately 28 times higher trading activity. STX ranks #118 by market capitalization at approximately $498.84 million, while TEN ranks #2357 with a market cap of approximately $1.26 million. This substantial liquidity differential translates to easier position entry and exit for STX investors, reduced slippage on larger orders, and generally lower execution risk. For investors prioritizing market accessibility and position management flexibility, STX provides notably better trading conditions across major exchanges.

Q3: How do the supply mechanisms of TEN and STX affect their long-term investment potential?

STX features a capped total supply of 1.818 billion tokens, creating built-in scarcity that may support price appreciation dynamics over time, similar to Bitcoin's deflationary model. This fixed supply mechanism provides transparency for long-term valuation modeling and may attract investors focused on scarcity-driven value propositions. Unfortunately, TEN's specific supply mechanism details were not available in the reference materials, limiting comparative analysis on this dimension. Historical patterns in cryptocurrency markets suggest that clearly defined supply caps with decreasing emission rates can correlate with sustained price cycles, though project fundamentals and adoption remain primary value drivers.

Q4: What are the primary risk factors investors should consider when choosing between TEN and STX?

TEN presents higher risk through its limited liquidity ($22,683.41 24-hour volume), lower market cap positioning (#2357), and early-stage development status since 2024, resulting in greater price volatility and potential execution challenges. STX carries different risk profiles including technical dependencies on Bitcoin's network through its Proof-of-Transfer mechanism, regulatory considerations specific to Bitcoin-connected assets, and moderate volatility correlated with Bitcoin ecosystem dynamics. Both assets face regulatory uncertainty as global frameworks evolve, though STX's established market presence and connection to Bitcoin may provide somewhat clearer regulatory pathways. Conservative investors should consider STX's relatively lower risk profile, while risk-tolerant investors may evaluate TEN's higher-risk/higher-potential-return positioning.

Q5: Which asset is more suitable for different investor profiles?

Novice investors should consider STX for its established market presence, higher liquidity enabling easier position management, and relatively lower execution risk through better market depth. Experienced investors may evaluate portfolio allocation across both assets: STX offering Bitcoin ecosystem exposure with moderate risk characteristics, and TEN representing early-stage privacy technology positioning with potential for substantial growth from a lower market cap base but accompanied by higher volatility. Institutional investors may find STX more aligned with institutional requirements given its market depth ($642,295.27 daily volume), regulatory clarity around Bitcoin-connected assets, and established infrastructure since 2019. TEN may appeal to institutional venture portfolios focused on emerging Layer 2 privacy solutions with appropriate risk allocation frameworks.

Q6: How have TEN and STX performed during recent market cycles?

Both assets experienced significant corrections during recent market cycles. TEN declined approximately 95.6% from its all-time high of $0.11662 in November 2024 to $0.005094 in December 2024, demonstrating extreme volatility characteristic of newly launched assets. STX fell approximately 92.7% from its all-time high of $3.86 in April 2024, reflecting broader market downturn pressures. As of February 3, 2026, TEN shows recent momentum with +73.57% 30-day performance despite -49.68% 1-year change, while STX demonstrates +11.15% 24-hour change but -77.03% 1-year decline. These patterns indicate both assets remain highly sensitive to overall cryptocurrency market cycles, with TEN showing particularly acute volatility due to its lower liquidity and market cap positioning.

Q7: What are the projected price trajectories for TEN and STX through 2031?

Short-term projections for 2026 suggest TEN may trade within $0.00743 - $0.01109 range, while STX targets $0.181 - $0.318 range under conservative to optimistic scenarios. Medium-term forecasts for 2028-2029 project TEN expanding to $0.00710 - $0.01567 range, while STX may reach $0.221 - $0.491 range, driven by potential institutional capital inflows and ecosystem expansion. Long-term projections through 2030-2031 estimate TEN reaching $0.00989 - $0.02075 range and STX achieving $0.352 - $0.533 range under baseline to optimistic scenarios. These projections assume continued ecosystem development, favorable regulatory environments, and broader cryptocurrency market growth, though actual outcomes depend on numerous variables including technological advancement, competitive dynamics, and macroeconomic conditions.

Q8: How do institutional adoption patterns differ between TEN and STX?

STX demonstrates notably higher institutional recognition through its positioning as a Bitcoin smart contract layer, enabling DeFi applications that leverage Bitcoin's security model without base protocol modifications. The Proof-of-Transfer consensus mechanism connecting to Bitcoin provides institutional investors with familiar infrastructure considerations and established security frameworks. Institutional holdings data shows substantial ownership percentages in related entities, with multiple analysts providing coverage indicating professional investor interest. TEN's institutional adoption patterns were not detailed in available materials, likely reflecting its early-stage status since 2024 and smaller market capitalization ($1.26 million versus STX's $498.84 million). Institutional investors typically require higher liquidity thresholds, established regulatory clarity, and proven technical infrastructure—factors currently favoring STX over TEN for institutional portfolio allocation.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Comprehensive Guide to Web3 Marketing

2026 TLOS Price Prediction: Expert Analysis and Market Forecast for Telos Network Token Growth

2026 RWAINC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 RING Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Coming Year