The Future of Tokenized Stocks—Three Potential Pathways

This lesson examines the long-term evolution of tokenized stocks from regulatory, technical, and market demand perspectives. It explores three possible development paths, emphasizing that tokenized stocks will not replace brokers but will fundamentally reshape how global users access U.S. equities.

Background: Key Clarifications on Tokenized Stocks

In the previous four lessons, we’ve clarified three key points about “tokenized stocks”:

- They are not the stocks themselves.

- They are not simply “stocks put on-chain.”

- They function more as a friction zone between TradFi and Crypto.

In this lesson, we move beyond “how useful are they now?” to address a more critical question: Where are tokenized stocks ultimately headed in the long run? Considering global regulatory trends, on-chain financial structures, and evolving user needs, the answer isn’t “one model wins”—rather, three paths will coexist, each serving different audiences.

Path One: “Securities On-Chain” Led by Regulated Financial Institutions

Core Model

This path is essentially TradFi proactively embracing blockchain. Banks, brokers, clearinghouses, and custodians lead the way by moving stock partially or entirely on-chain:

- issuance

- custody

- clearing

- transfer

In this structure, users still acquire real equity or legally recognized beneficial rights; blockchain serves only as the technology infrastructure—not the financial entity.

In summary: securities law system + blockchain infrastructure.

Main Advantages

The advantages are clear:

- Highly legal and compliant

- Acceptable to sovereign regulatory systems

- Suitable for institutional funds and large-scale assets

- Enables securitization and migration of existing assets

In this system:

- The chain can be understood as a next-generation clearing, registration, and settlement system.

- Identity, fund flows, and compliance requirements are highly controllable.

Limitations

There’s less of a Crypto flavor, reflected in three main aspects:

High barriers to entry

- Nationality restrictions

- Compliant accounts

- Strict KYC/AML

Weak composability

- Hard to participate in DeFi

- Difficult to use as on-chain financial Lego

Slower innovation

- Everything requires regulatory approval first

- Product forms tend to be conservative

Thus, this path will certainly exist, but it is more of a financial system upgrade rather than a paradigm shift.

Path Two: “Financial API-ization” of Stablecoins × Stocks

This is the path with the most Crypto character.

What is “Financial API-ization”?

Core idea: Stocks are no longer “assets held by users,” but “financial modules users can call.”

In this model:

- Stocks are mapped as composable on-chain assets.

- Stablecoins serve as the unified unit of account and settlement.

- Focus shifts from shareholder rights to financial functions.

Users no longer ask, “Am I a shareholder?” but instead, “Can I trade, hedge, combine, or structure with this?”

Closer to On-Chain Index/ETF Systems

In this path, tokenized stocks resemble:

- On-chain indices

- Structured assets

- ETF-like products

Examples include:

- Technology index tokens

- AI stock baskets

- On-chain SP500 alternatives

Their core value lies in:

- Unified liquidity

- Unified settlement

- Cross-asset portfolio capability

Why Are Stablecoins Key?

Stablecoins solve three core problems at once:

- Unified unit of account

- Global user accessibility

- Instant on-chain settlement

Here, stablecoins are the fuel; stocks are simply modular “volatility and data sources.”

Advantages and Risks Coexist

Advantages:

- Globally accessible

- Highly composable

- Well-suited for DeFi, quant, and structured products

Risks:

- Unclear legal status

- Uncertain compliance boundaries

- Highly dependent on issuer and custody design

From an innovation perspective, this path is most likely to yield new financial forms.

Path Three: Long-Term Coexistence of Synthetic Assets

This is the most practical and most easily underestimated path.

No Equity Involved—Only Price Exposure Provided

The core consensus for synthetic assets: you don’t need the actual stock—just its price volatility.

Therefore:

- No real equity involved

- No dividends or voting rights

- Only provides long/short, leverage, and hedging tools

On-chain “Global Perpetual Markets”

In this path:

- Stocks are treated as a type of global asset price,

- Alongside BTC, ETH, gold, and forex,

- All traded within the on-chain derivatives system.

What users trade isn’t the company itself but:

- Market consensus

- Volatility

- Macro expectations

Why Will It Exist Long-Term?

Because it addresses trading needs—not holding needs:

- High liquidity

- High-frequency trading

- Hedging and arbitrage

- Borderless access

Historical experience repeatedly proves: derivatives markets are often larger than spot markets.

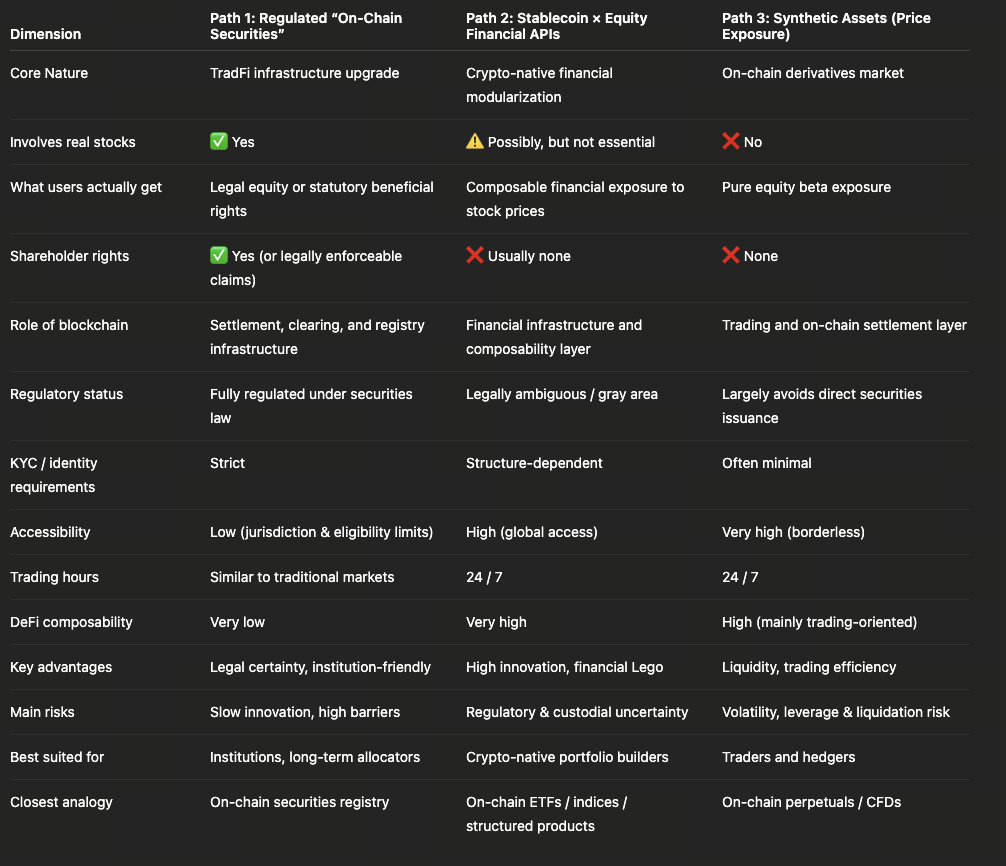

Key Distinction Between the Three Paths

The fundamental difference between the three future paths for tokenized stocks isn’t technical—it’s whether you’re getting “actual equity,” “composable financial functions,” or “pure price exposure.”

Gate Tokenized Stock Zone

The Gate Tokenized Stock Zone is a special trading section launched by Gate. Users can participate in price movements of select well-known public company stocks in a crypto trading environment via tokenized assets. Tokenized stock prices typically reference their corresponding stock market performance. Trading is similar to digital assets; users can buy, sell, and manage assets directly within their platform accounts. Note that tokenized stocks do not represent real stock ownership nor include dividends or shareholder rights—they’re best suited as trading tools for price movements rather than substitutes for traditional stock investments.

Conclusion: Tokenized Stocks Won’t Eliminate Brokers

Source: https://www.gate.com/tokenized-stocks

But they will undoubtedly reshape one thing: Who can access stocks?

- Traditional brokers: serve compliant clients, institutions, existing wealth.

- On-chain synthetic assets: serve global traders.

- Financial API structures: serve portfolio-focused and Crypto-native users.

These are not substitutes for one another but a reorganization of roles.