What Are Tokenized Stocks? Not the "On-Chain Stocks" Users Assume

This lesson breaks down the real meaning of "tokenized stocks," clarifies the difference between stock rights and price exposure, and helps users understand that on-chain stock tokens are not the same as actual stock ownership. This lays the groundwork for understanding structure and risk analysis in later lessons.

1. Buying a Token ≠ Becoming a Shareholder

In the crypto world, “tokenized stocks” is a highly misleading concept. Many users’ first reaction is: If I buy a token on-chain, does that mean I hold Apple or Tesla stock? The answer, in almost every real scenario, is no. To understand why, we need to go back to a basic question: What is a stock, fundamentally?

2. A Stock Is Not a Single Asset, But a Bundle of Rights

In traditional finance, a share of stock is not just “a tradable price.” It contains at least four layers of rights:

Economic Rights

- Capital gains from price appreciation

- Dividend rights (if the company pays dividends)

Legal Rights

- Shareholder status under company law

- Rights and protections in legal disputes

Governance Rights

- Voting rights

- Voting on board members and major issues

Liquidation Preference Rights

- In case of company bankruptcy or liquidation

- Priority in asset distribution

Here’s the key question: When a stock is “tokenized,” are all these rights truly transferred on-chain?

3. Reality: Most Tokenized Stocks Only Tokenize “Price Exposure”

Currently, most so-called tokenized stocks on the market are not on-chain representations of stock rights. They’re closer to one of these three forms:

- Price tracking of the stock

- Synthetic exposure to stock returns

- Indirect claim on custodied stocks

In other words, what users usually get isn’t “stock,” but a financial certificate highly correlated with the stock’s price.

4. “Stock” vs “Stock Price”

Two fundamentally different things: In traditional finance, they’re often tied together; but in crypto, they can be completely separated.

Stock itself means:

- Legal registration

- Shareholder registry

- Recognizable and enforceable by the legal system

Stock price means:

- Market consensus

- Tradable value

- Can be derived, synthesized, or mapped

Tokenized stocks almost always choose the latter. That’s why users see:

- 24/7 tradable “stock tokens”

- No ability to participate in company votes

- No access to official dividends

- Not legally recognized as shareholders

But price movements look “almost identical.”

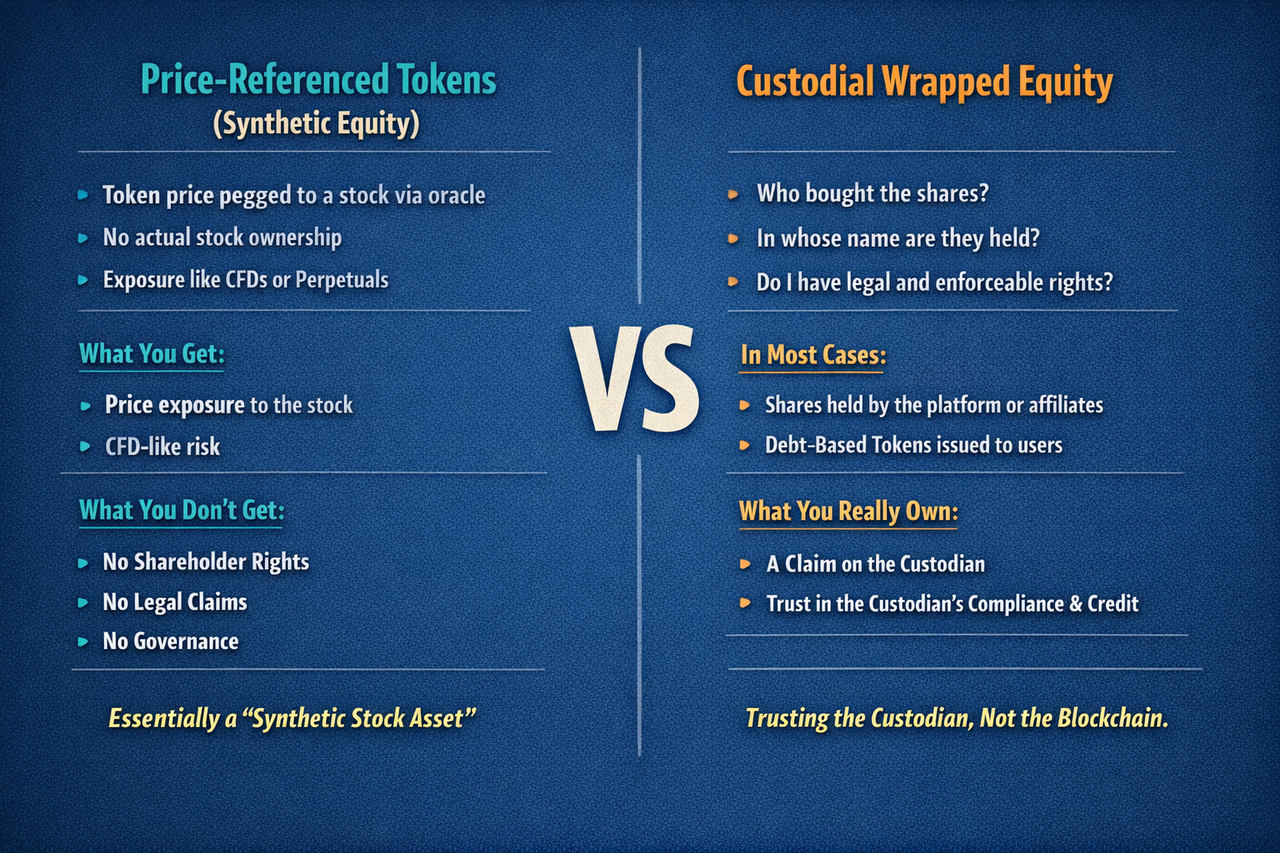

5. Two Basic Types of Tokenized Stocks

Before getting into complex financial engineering, you can understand the current market with these two structures.

Type 1: Price-Referenced Tokens

This is currently the most common and most misunderstood type.

Core Features

- Token price is pegged to a specific stock via an oracle

- May not involve actual stock purchase

- Essentially an on-chain synthetic asset

What users actually hold

- Exposure to stock price movements

- Similar risk exposure to CFDs or perpetual contracts

What users don’t have

- Shareholder status

- Legal rights

- Corporate governance rights

Key takeaway: This type of token is more like a “synthetic asset version of a stock,” not a “digital version of a stock.”

Type 2: Custodial Wrapped Equity

This structure usually describes itself as: “Each token is backed by 1 real share.”

It sounds great, but users must ask three questions:

- Who bought the stock?

- Whose name is the stock registered under?

- Do I have direct, enforceable legal claim?

In most real cases:

- The platform or its affiliates hold the stocks

- Users hold debt-type tokens issued by the platform

Essentially: Users are trusting the custodian’s creditworthiness, compliance, and legal structure—not the blockchain.

6. Why Does It “Sound Like a Stock,” But Legally Isn’t?

This is the core—and most overlooked—issue with tokenized stocks. There’s only one reason: Securities are always a legal issue, not a technical one. In almost all major jurisdictions:

- Stock issuance, trading, and registration

- Are highly regulated activities

If a token:

- Isn’t listed on the official shareholder registry

- Isn’t recognized by securities registration systems

Then legally: It’s not a stock.

Even if:

- The price matches perfectly

- Claims 1:1 custody

- On-chain data is fully transparent

None of this automatically converts into shareholder rights.

7. A Key Conclusion

Tokenized stocks ≠ Complete RWA. Many people habitually classify tokenized stocks as RWA (Real World Assets), but this is a misnomer. More accurately: It’s tokenization of real-world asset prices, not complete on-chain transfer of real-world asset rights.

At this stage: Tokenized stocks are more like an interface between TradFi price systems and crypto liquidity—not an actual migration of TradFi property rights.

8. Why Does the Market Keep Chasing Tokenized Stocks?

Despite these structural limitations, tokenized stocks keep coming back into focus for simple reasons.

For users

- No need for a brokerage account

- No need for traditional brokers

- No trading hour restrictions

- Can be directly combined with DeFi

For platforms

- Underlying assets are highly familiar (Apple, Tesla, NVIDIA)

- Easier user acquisition

- Easier liquidity management

What both sides are really trading isn’t equity itself, but “familiarity + liquidity.”