MicroStrategy loses 12.6 billion but still buys coins! Saylor predicts: Bitcoin will crush the S&P 3 times

MicroStrategy founder Michael Saylor predicts that Bitcoin’s performance over the next 4-8 years will be 2-3 times that of the S&P 500, reaffirming his stance of never selling and buying every quarter. The company purchased 1,142 BTC this week, bringing its total holdings to 714,644 BTC, with an average cost of $76,056. Despite a $12.6 billion loss in Q4, MicroStrategy emphasizes a long-term focus.

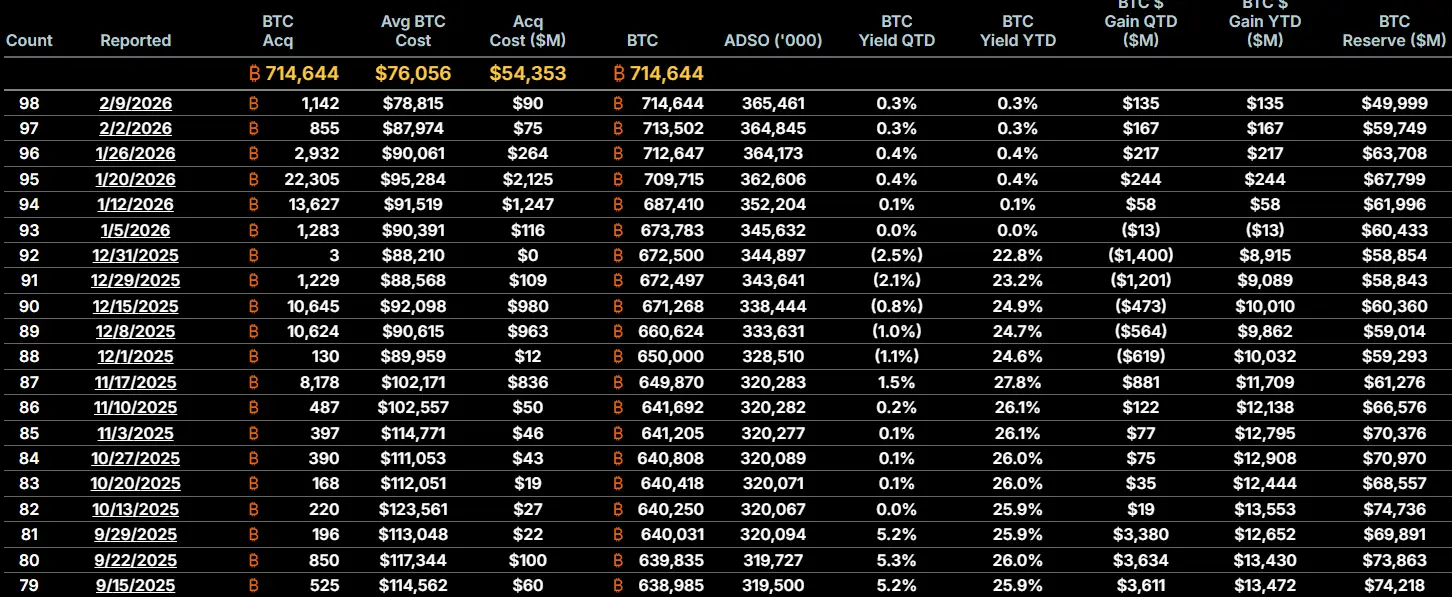

MicroStrategy’s Total Bitcoin Holdings of 714,644 BTC and Continuous Quarterly Purchases

(Source: MicroStrategy)

MicroStrategy disclosed this week that it recently invested approximately $9 million to acquire 1,142 Bitcoin, bringing its total Bitcoin holdings to 714,644 BTC, representing over 3.4% of the fixed total supply of Bitcoin. This ongoing buying strategy has remained unchanged even as Bitcoin has fallen from $126,000 to the current $69,000, demonstrating Saylor’s strong conviction.

$9 million for 1,142 BTC at an average price of about $78,809 per Bitcoin. This purchase price is roughly $10,000 above the current market price, meaning this batch of Bitcoin is currently at a paper loss. This “buy the dip” or even “buy on rebound” approach has raised questions about MicroStrategy’s decision-making. Wouldn’t waiting for further price drops allow acquiring more Bitcoin at a lower cost?

From Saylor’s perspective, there is logic in this approach. He believes Bitcoin will inevitably rise long-term, and short-term price differences are negligible over a 10-year horizon. Instead of trying to precisely time the bottom—which is nearly impossible—he advocates for consistent, periodic purchases to smooth out costs over time. Additionally, MicroStrategy’s buying activity provides market support; if the company stops buying, it could be perceived as a loss of confidence, potentially triggering more significant sell-offs.

According to data from their website, MicroStrategy’s average cost (Avg Cost) is $76,056, while the acquisition cost (Acq Cost) is $54,353. The difference between these figures warrants explanation. The average cost is a weighted average of all purchases, while the acquisition cost considers accounting treatments and asset impairments. With Bitcoin currently around $69,000, below the $76,056 average, the entire position is at a paper loss.

Key Data on MicroStrategy’s Bitcoin Holdings

Total holdings: 714,644 BTC (over 3.4% of total supply)

Latest purchase: 1,142 BTC at approximately $78,809 each

Average cost: $76,056 (all holdings at a loss)

Acquisition cost: $54,353 (accounting basis)

Saylor dismisses concerns that market pressure might force MicroStrategy to sell Bitcoin, explicitly stating the company will not sell and plans to continue buying each quarter. This “never sell” pledge is central to MicroStrategy’s business model. If the company were to start selling, the narrative of “Bitcoin treasury company” would collapse, MSTR stock could plummet, financing channels might close, creating a death spiral. Therefore, unless absolutely necessary, MicroStrategy cannot sell Bitcoin.

The $8,000 Red Line and Two Major Conditions for Selling

CEO Phong Le recently explained to investors that only if Bitcoin crashes about 90% to around $8,000 and remains at that level for 5 to 6 years would the company’s balance sheet face severe stress. During the Q4 earnings call, Le reiterated that MicroStrategy’s strategy is designed for the long term and can withstand short-term volatility—even in extreme market conditions like recent times.

How is the $8,000 figure calculated? MicroStrategy holds about 714,644 BTC with roughly $5.7 billion in debt. If Bitcoin’s price drops to $8,000, the total value of holdings would be about $5.7 billion, equal to the debt. This would wipe out shareholder equity but not cause insolvency. The “5-6 years” condition is also critical because of the maturity of convertible bonds; if Bitcoin remains at $8,000 long-term, the company would need to repay principal at maturity, potentially forcing a sale at low prices.

While Saylor insists on “never selling,” Le revealed last year that the company might consider selling Bitcoin if two conditions are met: if MicroStrategy’s mNAV (market net asset value) falls below 1, meaning the company’s market cap is less than its Bitcoin holdings’ value; and if MicroStrategy cannot raise new capital through equity or debt issuance, facing a market shutdown or prohibitively high financing costs.

Le explained that if these conditions occur, selling Bitcoin would be a rational choice to protect per-share Bitcoin value, based on mathematical logic. However, he emphasized that selling would be a last resort, and the company’s policy remains unchanged. He personally does not want MicroStrategy to become a “selling Bitcoin” company, but in dire market conditions, financial discipline must override emotion.

This “conditional non-sale” contrasts with Saylor’s absolute stance. As founder and spiritual leader, Saylor plays the role of a faith advocate, maintaining an unwavering narrative. Le, as CEO, must be responsible to shareholders and creditors, keeping rational options open in extreme scenarios. This balance between ideals and reality reflects the pragmatic approach of MicroStrategy’s management team.

Q4 Loss of $12.6 Billion but Long-Term Logic Remains Unchanged

Despite a $12.6 billion unrealized loss in Q4 due to digital asset holdings, MicroStrategy emphasizes that its financial structure is responsibly planned to weather difficult quarters or even years. The $12.6 billion quarterly loss is rare in corporate financial reports, but crucially, it is an unrealized loss, not an actual realized loss.

Saylor’s forecast that Bitcoin will outperform the S&P 2-3 times over the next 4-8 years is based on several logical points. First, scarcity: Bitcoin’s fixed supply of 21 million and halving events, versus the S&P 500 companies’ ability to dilute shareholders through stock issuance. Second, adoption: institutional, national, and retail participation will accelerate Bitcoin’s network effects. Third, inflation hedge: as major countries continue to print money, Bitcoin’s value as a hard asset will become more prominent.

However, this forecast faces challenges. The S&P 500 represents real companies producing tangible products and services, generating cash flow and dividends. Bitcoin does not produce cash flow; its value depends entirely on market consensus. If confidence in Bitcoin erodes, its price could remain depressed or even collapse to zero. While the S&P 500 may fluctuate, as long as the economy continues, companies will generate profits, making it a more stable long-term investment.

For MicroStrategy shareholders, Saylor’s high-stakes gamble remains to be proven. If Bitcoin indeed rises to $200,000–$300,000 within 4-8 years, MSTR stock could deliver extraordinary returns. Conversely, if Bitcoin remains weak or crashes, MicroStrategy could become one of the largest corporate failures in history. This extreme risk-reward profile makes MSTR one of the most controversial stocks.

Related Articles

Confident that Bitcoin will outperform US stocks! Michael Saylor reaffirms the strategy: never sell one coin, keep adding more.

Tom Lee: If Ethereum reaches $1890 again, it will form a perfect bottom.

Tom Lee: If Mr. Beast launches an IPO and achieves 100x growth, it will cause the BMNR price to triple from the current level.

Price predictions for top Layer 2s: Mantle, Arbitrum, Optimism

From Key Support to Breakout Ranges: 4 Crypto Assets Eyeing 30%+ Monthly Growth

XRP Today's News: White House legislative negotiations break down, ETF funds become the only lifeline