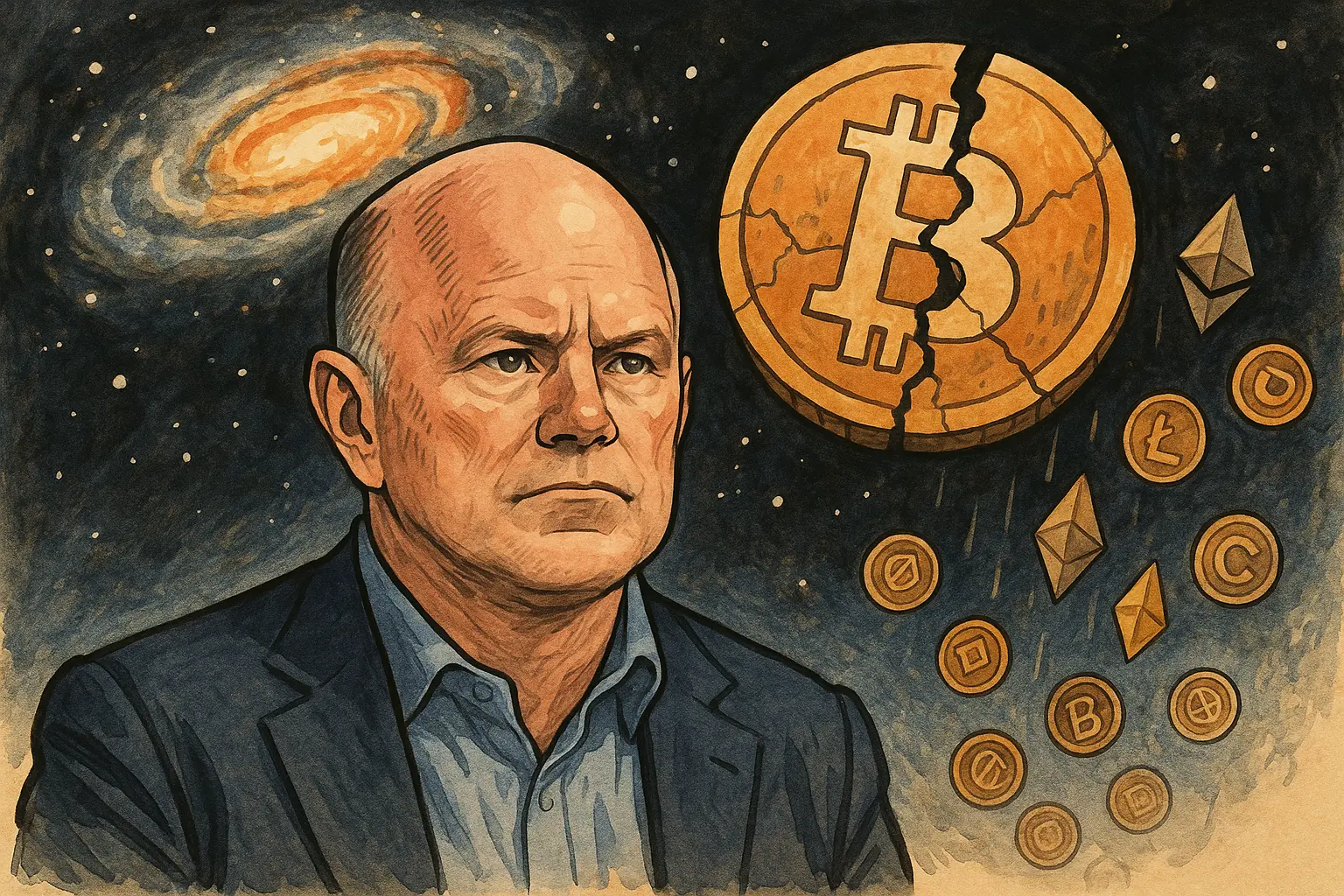

Galaxy CEO Mike Novogratz: The era of crypto speculation is over, and there are no longer excess returns

Galaxy founder and CEO Mike Novogratz said at the CNBC Digital Finance Forum in New York on Tuesday that as more risk-averse participants enter the crypto space, the era of investors seeking outsized returns may be coming to an end. Bitcoin has fallen over 21% this year, dropping to $60,062 last week to hit a nearly 16-month low.

From 30x Wealth to Stable 11% Paradigm Shift

Novogratz stated at the CNBC Digital Finance Forum in New York on Tuesday that the “speculative era” of cryptocurrencies may be ending, and this is not due to a single event but reflects a broader industry shift. He said, “Retail investors entered crypto not to earn an 11% annual yield, but to achieve 30x, 8x, or 10x returns.”

This shift from chasing 30x gains to accepting 11% represents a natural maturation process of the crypto market. Early crypto markets were purely speculative, with Bitcoin rising from a few dollars to tens of thousands, Ethereum from a few dollars to thousands, and countless altcoins surging 100x or even 1,000x within months. These extreme wealth effects attracted hundreds of millions of speculators worldwide, who entered with dreams of “one coin, one mansion,” hoping to leapfrog social classes through crypto investments.

However, as market size expands and institutional participation deepens, such extreme returns become increasingly difficult to achieve. Bitcoin’s market cap has reached $1.3 trillion; to grow tenfold would require a market cap of $13 trillion—comparable to the total value of gold worldwide. Mainstream coins like Ethereum and Solana are already valued in hundreds of billions of dollars, and doubling their value requires massive capital inflows. When an asset’s market cap reaches a certain scale, its growth rate inevitably slows, which is a market law.

Novogratz said that some traders will still speculate, but overall, “we will use the same channels—these crypto channels—to bring banking and financial services to the whole world, thereby changing or replacing the existing financial system. Ultimately, the assets will be real-world assets, but the returns will be much lower.” He also pointed out that tokenized stocks as an asset class will have “different return characteristics.”

Evolution of Crypto Investment Return Expectations

Early (2013-2017): 100-1000x, pure speculation frenzy

Growth phase (2017-2021): 10-100x, still opportunities for quick wealth

Maturity (2021-2025): 2-10x, lower returns for mainstream coins

Institutionalization (2026+): Single to double-digit returns similar to stocks or bonds

This transition is brutal for retail investors. Many entered crypto attracted by stories of overnight riches. When they realize that future returns might only be 11% (comparable to the long-term S&P 500 return), the appeal of crypto investments diminishes significantly. Why endure high volatility and regulatory uncertainty for returns comparable to traditional assets? This “high risk, low return” combination will drive many retail investors away.

$19.37 Billion Liquidation Destroys Narrative Rebuilding Cycle

Novogratz pointed out that the October 2025 crash was a major event, where over 1.6 million traders lost a total of $19.37 billion in leveraged positions within 24 hours. He said this “destroyed many retail traders and market makers” and put significant pressure on prices. The $19.37 billion single-day liquidation is only second to a few extreme events in crypto history, such as the May 2021 “519 crash.”

“Crypto’s core is about narratives, about stories,” he said. “These stories take time to build—you need to attract people to participate—so when you let many people exit, the story doesn’t immediately recover.” This insight is profound. Unlike stocks, which are supported by corporate earnings and cash flow, crypto’s value heavily depends on market consensus and narratives. When the narrative is shattered, trust and consensus take a long time to rebuild.

After the FTX collapse in 2022, the market took about 15 months to truly recover. Although the October 2025 liquidation wasn’t a exchange bankruptcy, its psychological impact could be equally profound. The painful experience of 1.6 million traders will be echoed through social media and word of mouth, warning potential new investors. This “once bitten, twice shy” mentality makes narrative rebuilding extremely difficult.

But Novogratz also sees more lasting effects. He predicts that the current downturn will bring some changes. He said that as the crypto industry introduces “institutions with different risk tolerances,” the era of speculation will gradually fade. Institutional investors (such as pension funds, insurance companies, sovereign wealth funds) have much lower risk appetites than retail investors—they seek stable single- to double-digit returns rather than quick riches. When these institutions become the main market players, the fundamental nature of crypto will change.

Can the CLARITY Act Revive the Market?

Sigalos asked Novogratz whether the eventual passage of the CLARITY Act could serve as a catalyst for the industry, as the stalled crypto regulatory framework in Congress at least poses a short-term obstacle. He believes the crypto market structure bill will eventually become law. Novogratz said, “Two days ago I spoke with Senate Minority Leader Chuck Schumer, and he said ‘We need to pass that damn CLARITY Act.’ Democrats want to pass it, Republicans want to pass it.”

This rare bipartisan consensus indicates a high probability of the bill’s passage. Novogratz said, “There are many reasons why the industry needs this bill, but it’s worth noting that we need it to revitalize the crypto market.” Once passed, regulatory clarity could attract more institutional capital, but these funds will seek stability and compliance rather than speculation and quick profits.

For retail investors, Novogratz’s outlook is both a warning and a reality check. If they truly want to profit from crypto, they need to adjust expectations from chasing quick riches to steady growth. Those still hoping for “one coin, one mansion” may find themselves repeatedly disappointed in this new era. Alternatively, they might turn to higher-risk areas like meme coins or new blockchains, but they must also accept the risk of total loss.

Related Articles

A major whale in a certain wave re-entered the market after two months, accumulating 3,700 ETH worth $7.31 million.

Super short positions betting against ETH starting from $2940 are gradually closing, with a remaining position of $16.45 million.

Tom Lee: If Ethereum reaches $1890 again, it will form a perfect bottom.

Hong Kong Virtual Asset Regulation: Three Arrow Measures Announced! Margin, Perpetual Contracts, and Market Makers to be Opened

Hyperliquid's largest ETH long position increased by 5,000 ETH, with an overall unrealized loss of $10.43 million.

Ethereum Co-Founder Vitalik Buterin Sells 2,961 ETH Over Three Days for Planned Initiatives