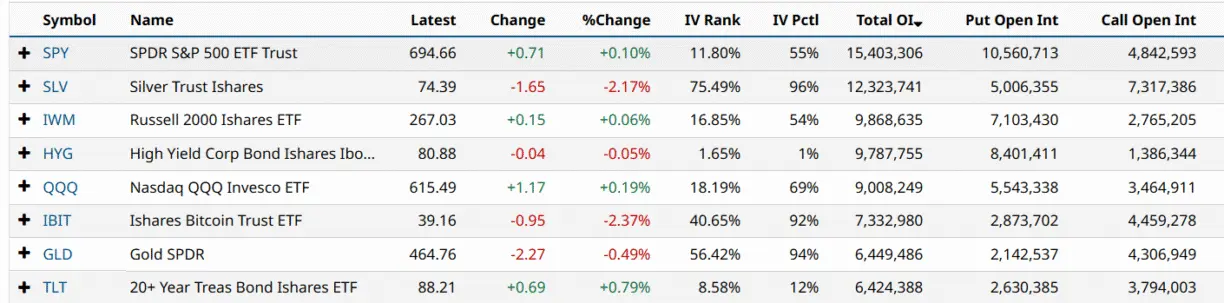

BlackRock IBIT options surpass 7.33 million contracts, exceeding gold! Bitcoin's attracting power outperforms traditional hedging

BlackRock Bitcoin ETF (IBIT) options trading volume surges, becoming the ninth-largest options trading platform in the U.S. As of February 10, there are 7.33 million IBIT contracts active or open interest, ranking ninth among options linked to U.S. listed stocks, ETFs, and indices. The open interest in options tied to the SPDR Gold ETF is 6.44 million contracts, below IBIT.

BlackRock IBIT Options 7.33 Million, Breaking Historical Records

(Source: Barchart)

As of Tuesday, BlackRock Bitcoin ETF (IBIT) options trading volume skyrocketed, making it the ninth-largest options trading platform in the U.S. IBIT options even surpassed gold ETFs, indicating that after a recent 30% plunge, market sentiment has shifted from gold to Bitcoin. According to Barchart data, as of February 10, there are 7.33 million IBIT contracts active or open interest, ranking ninth among options linked to U.S. stocks, ETFs, and indices.

The 7.33 million open interest contracts is an astonishing figure. Open interest represents the total number of contracts that have not yet been closed or settled, reflecting market attention and trading activity for the asset. The fact that IBIT options, launched only a few months ago (BlackRock Bitcoin ETF launched in early 2024, with options possibly coming in mid to late 2024 or 2025), have reached such scale demonstrates strong demand from institutions and professional traders for Bitcoin derivatives.

The open interest in options tied to the SPDR Gold ETF (644,000 contracts) is lower than IBIT. This is a historic surpassing. The SPDR Gold ETF (GLD), established in 2004, has been operating for over 20 years, with a highly mature and active options market. IBIT, as a new product, surpassing GLD in such a short time indicates that Bitcoin’s appeal to investors may be surpassing gold.

The put/call ratio for BlackRock Bitcoin ETF is 0.64, while for SPDR Gold ETF it is 0.50. This ratio shows the proportion of put options (betting on decline or hedging) versus call options (betting on rise). IBIT’s 0.64 suggests slightly more puts than calls, indicating market participants are somewhat cautious about Bitcoin’s short-term trend, with more buying protective puts. GLD’s 0.50 is more balanced.

IBIT vs GLD Options Comparison

Open Interest: IBIT 7.33 million vs GLD 6.44 million (IBIT leads)

Put/Call Ratio: IBIT 0.64 vs GLD 0.50 (IBIT more defensive)

Launch Time: IBIT about 2 years vs GLD over 20 years (IBIT’s rapid growth)

Market Rank: IBIT ninth (among all stocks/ETFs/indices options)

Among the options with the highest open interest in stocks, ETFs, and indices, the S&P 500, Dreyfus SPDR S&P 500 ETF Trust, and Nvidia lead amid increased market volatility and uncertainty. IBIT ranking ninth among these giants is highly notable.

Explosive Growth to $10 Billion in Nominal Value

BlackRock Bitcoin ETF trading volume hit a record high, exceeding 284 million shares, with a nominal value surpassing $10 billion. This surged 169% from the previous record set in November last year. A single-day nominal trading volume of over $10 billion is extreme in the ETF market, typically only seen with highly liquid products like the S&P 500 ETF (SPY).

This explosive volume growth partly reflects Bitcoin’s sharp price swings. When Bitcoin plunged from $72,000 to $60,000 and rebounded to $69,000, investors rushed to hedge, speculate, or arbitrage through IBIT options. High volatility creates trading opportunities, with professional traders and market makers participating heavily, boosting trading volume.

The 169% growth rate indicates that the IBIT options market is in a breakout phase. From November last year to February this year, trading volume nearly doubled in just three months, a rare pace in mature markets. This validates BlackRock’s strategic move into Bitcoin options and shows market hunger for Bitcoin derivatives.

On Monday, spot Bitcoin ETFs saw net inflows of $144.9 million, ending previous outflows and marking a second consecutive day of positive flows. Meanwhile, BlackRock Bitcoin ETF experienced redemptions of $20.9 million. This divergence—“overall inflows, IBIT outflows”—suggests funds may be rotating among different Bitcoin ETFs, with investors shifting from IBIT to lower-fee or better-performing alternatives.

Gold Retreats and Risk Appetite Improves

Meanwhile, Reuters reports that as risk appetite improves, global equities rose, leading to a decline in gold prices on Tuesday. Investors await later this week’s U.S. employment and CPI inflation data, which could hint at rate cut prospects. “Early this week, risk appetite rebounded in financial markets, stocks rose, which pressured gold prices,” said ActivTrades analyst Ricardo Evangelista.

The inverse capital flows between gold and Bitcoin reflect subtle shifts in investor risk appetite. During extreme panic, funds flock to safe-haven assets like gold, proven over millennia. But as panic eases and investors seek rebound opportunities, some capital shifts from gold to high-volatility assets like Bitcoin. The current situation appears to be at this turning point.

JPMorgan’s Nikolaos Panigirtzoglou states that gold’s large excess returns make Bitcoin more attractive long-term. He notes that the volatility ratio of Bitcoin to gold has fallen to a historic low of 1.5. Once negative sentiment subsides, Bitcoin is expected to rebound toward a target of $266,000. While this optimistic forecast is aggressive, it comes from top Wall Street firms and carries significant influence.

As of press time, Bitcoin is up over 0.50%, trading at $68,855. The 24-hour low and high are $68,291 and $71,076, respectively. This relatively stable trend, combined with active options markets, may indicate the market is bottoming and building momentum for the next wave.

The fact that IBIT options have surpassed gold ETFs is not just a numerical milestone but reflects a deeper trend: institutional and professional investors are increasingly viewing Bitcoin as a tradable, hedgeable mainstream asset with a mature derivatives market. This “institutionalization” and “financialization” are key steps in Bitcoin’s transition from fringe to mainstream.

Related Articles

Is it time to buy Bitcoin now? Robert Kiyosaki bets on BTC over gold, but analysts are dismissing the list.

Tom Lee: If Ethereum reaches $1890 again, it will form a perfect bottom.

Tokenized goods surpass $6 billion! The gold on-chain trend exceeds stocks and funds RWA

Bitcoin ETF capital inflow slows down, with the main reason being the narrowing of the basis

Non-Farm Payrolls Preview: January Expected to Surprise with Only 70,000 Jobs Added, Wages Cool Down Sparks Rate Cut Expectations