Analyzing why the drop in BCH price below $500 could be good news for buyers

Bitcoin Cash (BCH) is currently one of the few cryptocurrencies in the top 10 with a weekly price chart trending upward. Meanwhile, BNB was once considered a potential next candidate but has been under heavy pressure, experiencing a 54% decline over the past four months.

In contrast, BCH has maintained trading within a stable range for nearly 20 months. The price range fluctuates from $272 to $640, offering many attractive opportunities for swing traders.

According to a report from Coinphoton, long-term investors expect this range’s high to be broken and turned into support before considering participation in a stronger bullish trend. Although buyers attempted a breakout in early January, this effort was unsuccessful due to a market-wide sell-off that caused the price to reverse and correct.

However, currently, the Bitcoin Cash network appears to be maintaining a stable state. The significant increase in transaction volume along with active whale movements recently indicates strong on-chain liquidity circulation.

Short-term traders focus on the middle of the range to predict the next move

Since the second week of October, BCH price has touched below the support level in the middle of the $456 range three times on the weekly timeframe. However, no weekly close has fallen below this level, keeping the outlook positive.

Source: TradingView The accumulation/distribution (A/D) indicator has maintained an upward trend since 2024, reflecting steady buying pressure. Additionally, the weekly RSI is currently at 47, indicating neutral momentum.

Source: TradingView The accumulation/distribution (A/D) indicator has maintained an upward trend since 2024, reflecting steady buying pressure. Additionally, the weekly RSI is currently at 47, indicating neutral momentum.

Combined with long-term price action, the $440–$460 zone is considered a low-risk, high-reward buying opportunity for investors.

Local supply zones may exert downward pressure

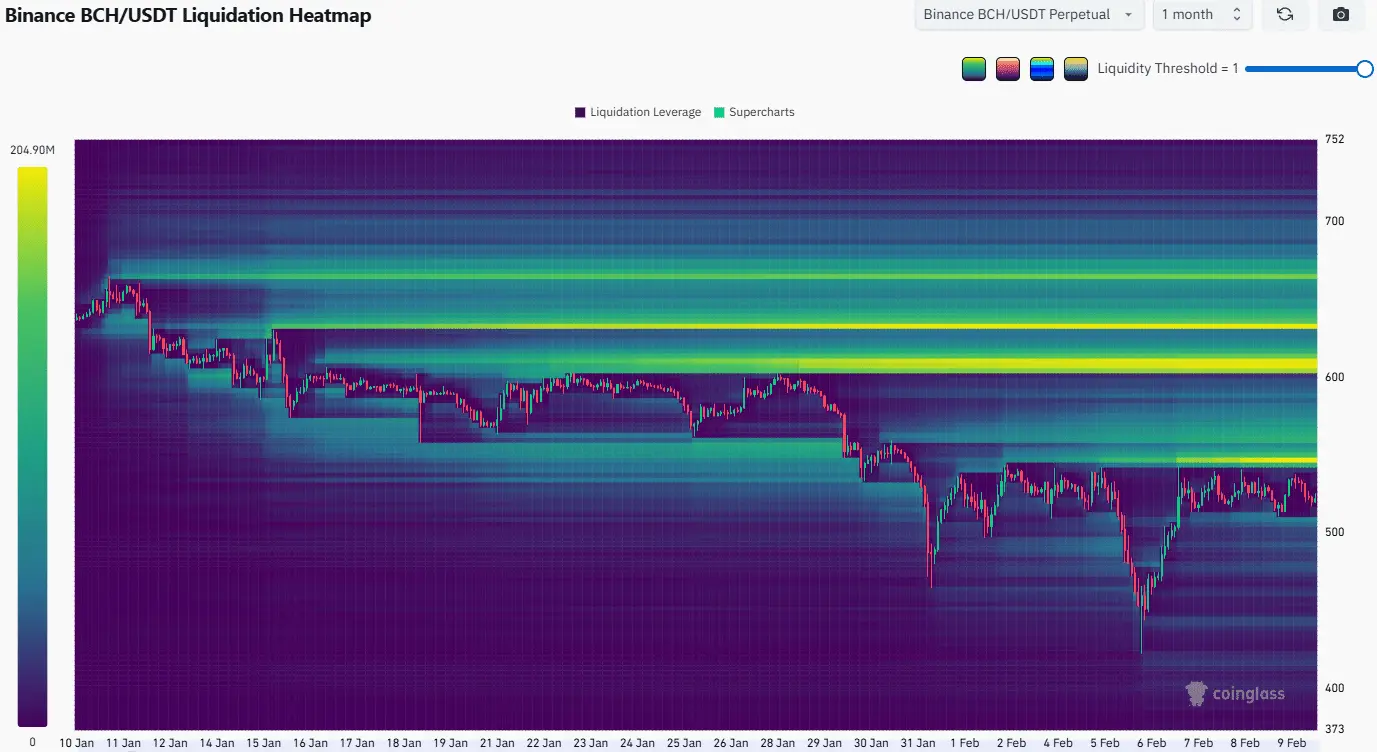

Liquidation heatmaps show that the $550 and $610 price levels are important nearby zones with significant potential to attract upward price movement before a reversal occurs. Notably, the supply zone at $550 has accumulated liquidity over the past 10 days.

Source: CoinGlass Furthermore, the 4-hour chart indicates that BCH buyers have failed to break through the resistance at $540.

Source: CoinGlass Furthermore, the 4-hour chart indicates that BCH buyers have failed to break through the resistance at $540.

Source: TradingView Therefore, a possible scenario is that the price will be pushed higher in the short term to the $550–$560 zone before correcting downward to around $460. However, if BCH can break above $580, this scenario will be invalidated, opening the potential for a stronger rally.

Source: TradingView Therefore, a possible scenario is that the price will be pushed higher in the short term to the $550–$560 zone before correcting downward to around $460. However, if BCH can break above $580, this scenario will be invalidated, opening the potential for a stronger rally.

Related Articles

Analysis: Bitcoin has fallen for three consecutive days after dropping below $70,000, but the timing for medium- to long-term positioning may have already appeared.

Bloomberg strategist Mike McGlone: By 2026, Bitcoin may continue to underperform precious metals, and cryptocurrencies may lose key support levels

The probability of Bitcoin falling below $65,000 exceeds 70%. What is the market worried about?

Bloomberg analyst: Cryptocurrency to precious metals ratio has broken below a key support level, and the former may continue to underperform until 2026

Anthony Pompliano Says BTC Volatility Has Structurally Shifted

Into The Cryptoverse Founder Takes a Dig at Meme Coins as Segment Shows Decline