Why did Bitcoin drop today? ETF outflows exceed $3.2 billion, and non-farm payrolls before CPI data crushed hopes for interest rate cuts.

Bitcoin has fallen to around $66,000, and US Bitcoin ETF outflows over the past 30 days have exceeded $3.2 billion. Data released on Wednesday shows that the US labor market in 2026 started stronger than expected, with January non-farm payrolls increasing by 130,000, well above the forecast of 66,000, and the unemployment rate dropping from 4.4% to 4.3%. Friday’s release of January CPI will be a key focus, with expectations of both overall and core CPI month-over-month increases of 0.3%.

ETF Six Consecutive Outflows with $3.2 Billion Capital Exodus

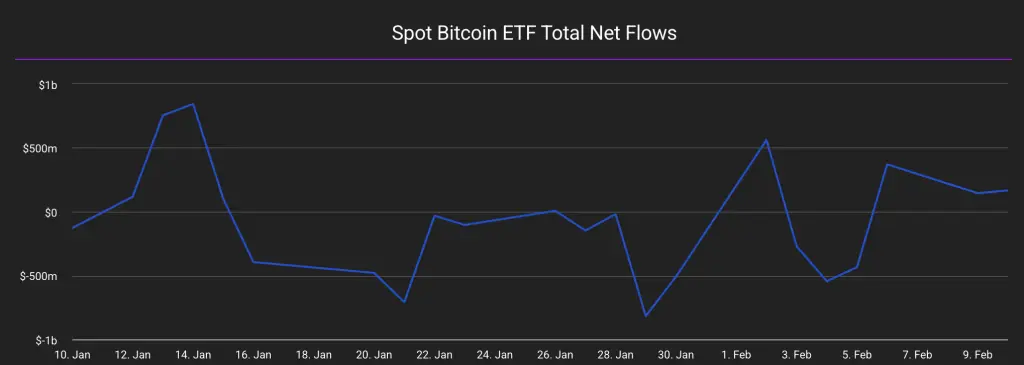

US Bitcoin ETFs have experienced outflows for six consecutive days, with over $3.2 billion flowing out in the past 30 days. This figure is approaching the worst month on record, with November’s total outflows reaching $3.5 billion. So far, there are almost no signs of market sentiment improving. The six-day streak of outflows is extremely rare and indicates that institutional investors are systematically withdrawing from Bitcoin ETFs, rather than reacting to short-term volatility or rebalancing.

If the $3.2 billion monthly outflow continues, February could surpass November to become the worst month ever. With about two weeks remaining in the month, if outflows persist at $500 million to $1 billion per week, total outflows could reach $4 to $4.5 billion. Such a scale of capital withdrawal exerts ongoing downward pressure on Bitcoin prices. ETF redemptions force funds to sell Bitcoin on the market, directly increasing selling pressure.

Bitcoin has declined over 27% this month, with ETF outflows being a core reason. All these price movements have led many to believe this is just the beginning of a bear market. An analyst known as “Against Wall Street” suggests that Bitcoin’s current price action nearly perfectly reflects the late-stage bull market and early bear market phases of the previous cycle. If this indeed signals the early stage of a bear market, Bitcoin’s next price move could be crucial.

Three Warnings from ETF Outflows

Persistence: Six consecutive days of outflows, not short-term volatility

Scale: $3.2 billion in 30 days, approaching the record $3.5 billion in November

Trend: Almost no signs of reversal, possibly reaching new highs

Even Bitcoin’s most optimistic supporter, Michael Saylor, appeared tense during a recent public appearance. An observer noted that it was the first time he seemed so uneasy when discussing Bitcoin. As a staunch Bitcoin advocate and the largest corporate holder, his emotional state is highly indicative. If even he is starting to worry, it may suggest that the current market environment is more severe than ever.

Non-Farm Payrolls of 130,000 Exceed Expectations, Dashing Rate Cut Hopes

Wednesday’s data showed that the US labor market in 2026 started stronger than expected, reinforcing the view that policymakers may keep interest rates high for longer. According to data released by the US Department of Labor on Wednesday, January non-farm payrolls increased by 130,000, far above the market forecast of 66,000. The unemployment rate fell from 4.4% in December 2025 to 4.3%. Additionally, data released on Thursday indicated that initial jobless claims for the week ending February 7 decreased to 227,000.

The 130,000 new non-farm jobs nearly double the expected 66,000. This “significantly surpasses expectations” figure typically triggers strong market reactions. In the current environment, strong employment is interpreted as negative rather than positive. The reason is that it reduces the urgency and likelihood of the Federal Reserve cutting rates. Markets had expected soft employment data to pressure the Fed into rate cuts in March or June, but the 130,000 figure shows the labor market remains healthy, giving the Fed no reason to cut hastily.

The unemployment rate dropping from 4.4% to 4.3% further confirms a robust labor market. While a declining unemployment rate is usually seen as a sign of economic health, in this context, it suggests wage pressures may rise (due to labor shortages forcing companies to increase wages), which could push inflation higher. The logic chain of “strong employment → wage growth → rising inflation → no rate cuts” explains why markets view strong employment as negative.

A strong employment situation will bolster the Fed’s confidence in the economy, likely maintaining higher interest rates and ensuring inflation continues to ease. Bitcoin itself does not generate interest, and in a high-rate environment, it is generally at a disadvantage. When the US 10-year Treasury yields 4.2% risk-free, holding highly volatile, non-yielding assets like Bitcoin becomes less attractive. Rational institutional investors will prefer Treasuries over Bitcoin, which is exactly what is happening now.

CPI Release on Friday and the Collapse of AI Narratives

On the macro front, markets are still digesting the strong employment report from the previous trading day. Although the employment data initially boosted stocks intraday, sentiment cooled off afterward, partly because economists remain cautious about the sustainability of the employment rebound. Revised data in the report suggest weaker employment growth in the second half of 2025, leading markets to view recent improvements as volatility rather than a trend.

Focus now shifts to Friday’s January CPI release. According to a survey of economists by Dow Jones, both overall CPI and core CPI (excluding food and energy) are expected to increase 0.3% month-over-month. Some strategists believe that, given the employment data already providing space for the Fed to remain on hold longer, CPI’s marginal impact on policy path may diminish: even if inflation remains hot, upcoming data over the next few months will be needed to confirm the trend; if inflation softens, markets could see a phase of risk-on recovery. However, unless the data significantly exceeds expectations, a single report is unlikely to completely overturn the current cautious pricing.

Overall, Thursday’s US stock market was characterized by a shift in AI narratives from “valuation catalyst” to “sources of earnings and employment uncertainty,” driven by corporate news and cross-asset volatility, pushing markets into a more defensive, selective, and profit-taking phase. This defensive shift in equities is highly unfavorable for risk assets like Bitcoin.

71,000 Resistance and 60,000 Critical Support

(Source: Trading View)

Bitcoin recently broke out of its short-term downtrend channel and is now slowly moving below the 71,000 resistance level. This is a critical point. Successfully breaking and holding above 71,000 would suggest a trend reversal rather than just a rebound. Next targets are 80,000, then 90,000, and even 98,000 is not out of reach, given the nature of cryptocurrencies.

Downside risks first target 64,000, with 60,000 being the real support level that bulls must defend. Losing 60,000 would be a very different scenario. A break below this psychological level could trigger a new wave of panic selling, testing 55,000 or even 50,000. Currently, the market structure is improving, but pressure continues to build. If the environment turns more favorable, Bitcoin could still have room to rise.

For investors, current strategies depend on time horizon and risk appetite. Short-term traders should closely watch for a breakout above 71,000 and Friday’s CPI data. Medium-term investors need to assess when ETF outflows might stop, which could signal a true bottom. Long-term investors who believe in Bitcoin’s fundamental logic may see this as an opportunity to accumulate gradually, but they should be prepared for further declines.

Related Articles

Silver continues to fluctuate, with Gate XAG's 24-hour trading volume ranking among the top three globally

Superform(UP) will be officially launched on Gate for global spot trading on February 11.

MICA Daily|U.S. economic data disappoints, BTC drops again to $65,000

Overview of popular cryptocurrencies on February 13, 2026, with the top three in popularity being: Bitlayer, ULTILAND, and Yei Finance