Federal Reserve Document Reveals: Cryptocurrency Derivatives Risk Weights Are Independent, Higher Volatility Requires Higher Margin

The Federal Reserve released new analytical recommendations on Wednesday, suggesting that cryptocurrencies should be classified as a distinct asset category used in “non-cleared” derivatives markets (including OTC and other transactions not cleared through central clearinghouses). The working paper notes this is because cryptocurrencies are more volatile than traditional asset classes and do not fit within the risk categories outlined in the standardized initial margin model (SIMM).

Federal Reserve Recognizes Cryptocurrencies as a Separate Asset Class

(Source: Federal Reserve Board)

The new analytical recommendations issued Wednesday by the Federal Reserve propose that cryptocurrencies be categorized as a unique asset class used in “non-cleared” derivatives markets (including OTC and other non-centrally cleared transactions). This is a historic acknowledgment, meaning the Fed officially recognizes that cryptocurrencies cannot simply be mapped onto traditional risk management frameworks for assets and require specialized regulatory standards.

The working paper states that this is because cryptocurrencies exhibit greater volatility than traditional asset classes and do not conform to the asset risk categories outlined in the SIMM. According to authors Anna Amirdjanova, David Lynch, and Anni Zheng, traditional asset classes defined in SIMM include interest rates, equities, foreign exchange, and commodities. The volatility and correlations of these assets have been validated over decades of data, allowing the SIMM model to predict risks relatively accurately.

However, cryptocurrencies are fundamentally different. Bitcoin’s annualized volatility typically ranges from 50% to 80%, far exceeding stocks at 15-20%, forex at 10-15%, and even gold at 15-20%. More importantly, correlations among cryptocurrencies are extremely high (when Bitcoin crashes, nearly all crypto assets decline simultaneously), and their correlation with traditional assets is unstable (sometimes moving in tandem with stocks, other times decoupled). These characteristics invalidate traditional risk diversification logic in the crypto space.

Volatility Comparison: Cryptocurrencies vs Traditional Assets

- Bitcoin: Annualized volatility 50-80%, extreme fluctuations

- Stocks (S&P 500): Annualized volatility 15-20%

- Forex (US Dollar Index): Annualized volatility 10-15%

- Gold: Annualized volatility 15-20%

- Bonds: Annualized volatility 5-10%

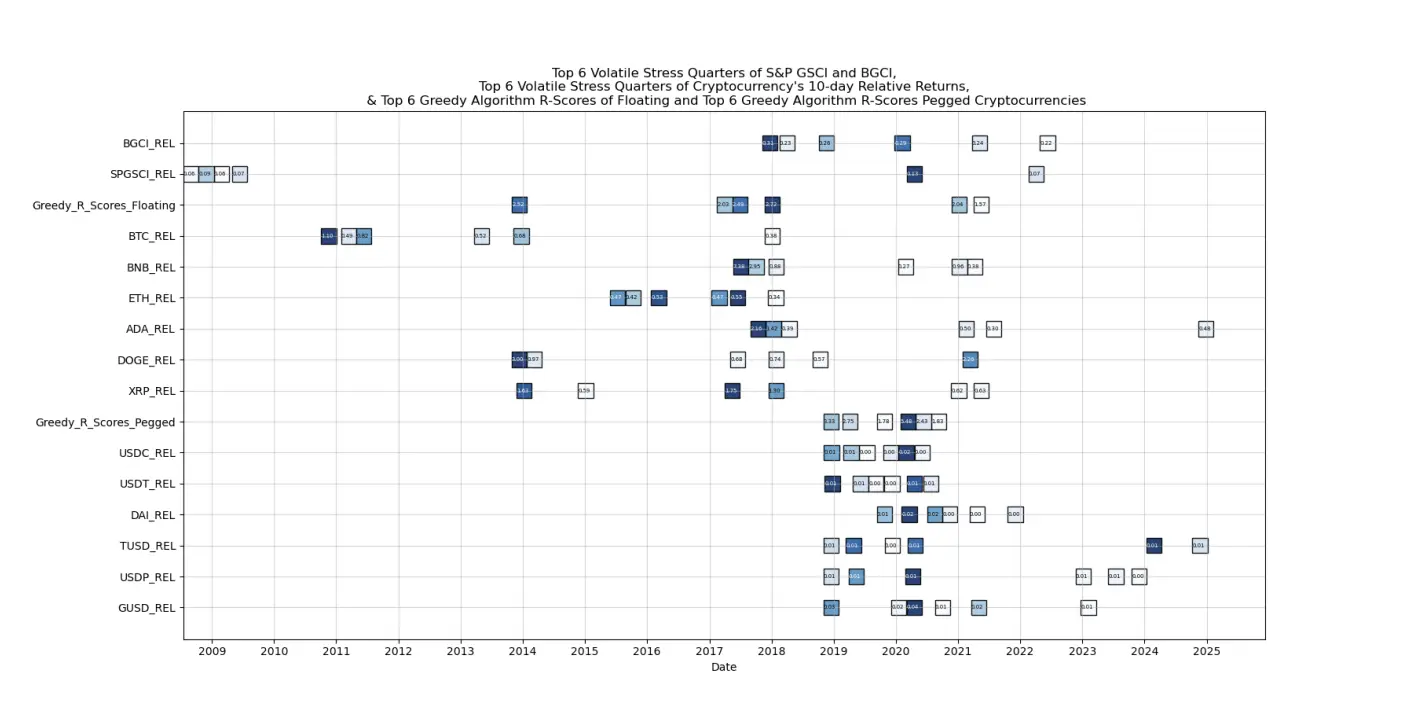

The authors propose a unique risk weighting scheme for “floating” cryptocurrencies (including Bitcoin, BNB, Ethereum, Cardano, Dogecoin, XRP) and “pegged” cryptocurrencies (such as stablecoins). They suggest that a baseline index comprising equal parts of floating digital assets and pegged stablecoins could serve as a proxy for crypto market volatility and behavior.

Initial Margin Requirements and Calibration of Risk Weights

(Source: Federal Reserve Board)

Initial margin requirements are critical in derivatives markets, as traders must post collateral at trade inception to mitigate counterparty default risk. Due to higher volatility in crypto, traders need to post more collateral as a buffer against liquidation. The working paper reflects the maturation of cryptocurrencies as an asset class and how U.S. regulators are preparing regulatory frameworks to accommodate the industry’s growth.

Specifically, if traditional equity derivatives require an initial margin of 10% (meaning a position with a nominal value of $1 million needs $100,000 margin), crypto derivatives might require 20-30% or even higher. This increased margin requirement is driven by risk management needs (preventing extreme volatility from triggering large-scale liquidations and systemic risk) and will also reduce market leverage and speculation (higher margins mean smaller positions for the same capital).

The authors believe that the performance and behavior of benchmark indices can be used as inputs to more accurately simulate “calibrated” risk weights for cryptocurrencies. This “dynamic calibration” concept is highly advanced. It implies that crypto margin requirements are not fixed but continuously adjusted based on actual market volatility and risk characteristics. During periods of extreme market movement (such as the October 2025 liquidation event), margin requirements would automatically increase; when markets stabilize, they could be lowered.

This proposal reflects the maturity of crypto as an asset class and how U.S. authorities are preparing regulatory frameworks to support industry growth. The Fed’s willingness to invest time and resources into studying crypto risk features and proposing dedicated regulation is itself a significant recognition of the industry. It indicates that the Fed no longer views crypto as a fringe or temporary phenomenon but as an important market requiring systemic oversight.

Reversal of Bank Participation Restrictions in December Last Year

Last December, the Federal Reserve overturned a previous guidance issued in 2023 that limited U.S. banks’ involvement in crypto activities. The 2023 guidance stated: “Supervised banks and insured banks will be subject to the same activity restrictions, including new banking activities such as those related to crypto assets.” This restriction was seen during the Biden administration as part of “Operation Chokepoint 2.0,” making it difficult for crypto firms to access banking services.

Reversing this restriction marks an important shift toward a more crypto-friendly policy under the Trump administration. It allows U.S. banks to open accounts for crypto companies, provide custody services, and even directly participate in crypto trading and derivatives market-making. This policy shift, combined with the current margin rule proposals, creates an “open but regulated” framework: banks can participate but are subject to higher risk management standards.

The Fed also proposed allowing crypto firms to use a “simplified” master account, which would provide direct access to the central banking system but with fewer privileges than a full master account. A master account is a bank’s account at the Fed, enabling participation in federal funds markets, access to emergency liquidity, and other core functions. Traditionally, only banks could hold master accounts, excluding crypto firms.

The “simplified” master account could permit basic clearing and settlement functions but not provide emergency lending or other advanced features. This compromise would give crypto firms some access to the financial system while limiting potential risks to financial stability. If implemented, it would be a major milestone for integrating crypto into the traditional financial system.

For the crypto derivatives market, the Fed’s proposals are a double-edged sword. On the positive side, official recognition and regulatory clarity could attract more institutional participants (especially regulated banks and hedge funds). On the negative side, higher margin requirements would reduce leverage and market liquidity, potentially increasing trading costs and spreads. However, in the long run, healthier leverage levels and risk management could reduce the frequency of extreme liquidations, benefiting overall market stability.

Related Articles

XRP Today's News: ETF Zero Outflows Outperform BTC, CPI Data Becomes the Key Catalyst

Standard Chartered: Bitcoin may drop to $50,000, Ethereum to $1,400, BTC year-end target lowered to $100,000

Ripple and Uniswap executives join CFTC committee, the game of the "CLARITY Act" escalates again

JPMorgan Turns Bullish Against the Trend! Bitcoin Bottom at 77,000, Betting on Hash Rate Rebound and Institutional Capital Flows

Why did Bitcoin drop today? ETF outflows exceed $3.2 billion, and non-farm payrolls before CPI data crushed hopes for interest rate cuts.

The Federal Reserve document proposes setting initial margin weights for cryptocurrency derivatives