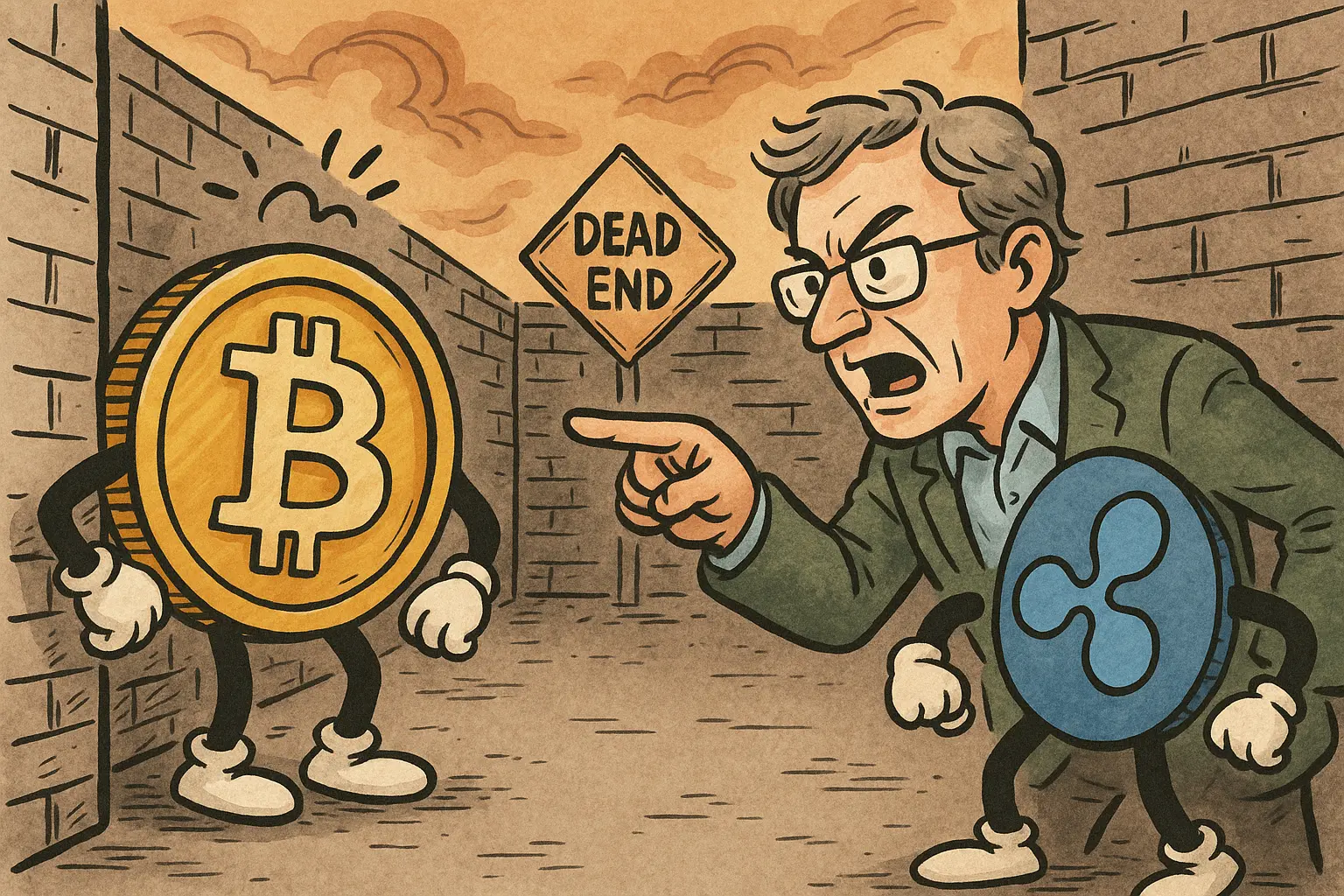

Ripple CTO blasts Bitcoin technology dead end! Can XRP make a comeback over BTC through innovation?

Ripple Chief Technology Officer and one of the founders, David Schwartz, states that Bitcoin is a dead end in terms of technology, criticizing not the price but the architecture design. Schwartz’s recent article points out that Bitcoin’s continued dominance relies more on network effects than genuine innovation, warning that lack of development could become a long-term weakness. XRP remains within a downtrend channel but recently surged to $1.10, currently seeking support above $1.30.

Schwartz Criticizes Bitcoin’s Reliance on Network Effects Rather Than Innovation

Bitcoin is often seen as an unshakable entity, the founding force of the crypto space, with fundamentals rarely challenged. However, one of Ripple’s most prominent spokespeople holds a different view. David Schwartz, CTO and co-founder of XRP, describes Bitcoin as a technological dead end. His criticism is not about the price but about its architecture.

In a recent article, Schwartz states that Bitcoin’s ongoing dominance depends more on its network effects than on real innovation, warning that this lack of development could be a long-term vulnerability. He believes the protocol has hardly evolved. Its survival is due to being one of the earliest protocols, not because it is the most advanced.

This criticism is highly controversial within the crypto community. Bitcoin maximalists would counter: Bitcoin’s “immutability” is its strength; currencies need stability and predictability, not constant technological experiments. Bitcoin’s proof of work, capped supply of 21 million, and conservative upgrade approach ensure its credibility as “digital gold.” Frequent upgrades like Ethereum’s could undermine its store-of-value status.

But Schwartz’s point also has merit. Bitcoin’s transaction speed (7 TPS), confirmation time (10 minutes per block), and fees (up to dozens of dollars at peak times) are technically behind XRP (1,500 TPS, 3-5 seconds confirmation, fees under $0.01) and other new blockchains. Comparing technical performance alone, Bitcoin is indeed “outdated.”

He likens it to the US dollar. Technology alone doesn’t determine market dominance; widespread application does. This analogy is very insightful. The dollar isn’t the most technologically advanced currency (some countries’ digital payment systems surpass the US), but it remains the global reserve currency due to the size of the US economy, military strength, and the inertia of pricing major commodities like oil in dollars. Similarly, Bitcoin is the “reserve currency” of the crypto world, not because it’s the best technically, but because of first-mover advantage, brand recognition, and network effects.

Bitcoin vs XRP Technical Comparison

Transaction Speed: BTC 7 TPS vs XRP 1,500 TPS

Confirmation Time: BTC 10 minutes vs XRP 3-5 seconds

Fees: BTC peak tens of dollars vs XRP under $0.01

Energy Consumption: BTC proof of work consumes massive energy vs XRP consensus protocol low energy

XRP Seeks Stability at $1.30 Support

(Source: Trading View)

XRP remains within a downtrend channel but recently spiked to $1.10, showing typical exhaustion signs. Since the last decline, the price has been seeking stability above $1.30, which is now a critical short-term support level. If this support breaks, $1.10 is likely to become the next resistance. From an upward perspective, $1.50 is the first real resistance. If the price can break through that, it’s expected to reach $1.90, at which point the overall trend structure might start to shift.

Until the price breaks above the upper channel line, the trend remains technically bearish. However, recent movements resemble bottom-building rather than panic selling, often a sign of recovery. The $1.30 support has been tested multiple times over the past weeks, each time triggering buying support, indicating genuine demand at that level.

The competition between Bitcoin and Ripple, innovation versus network effects, is just a matter of different cycles. While this debate continues, prices still reward attention as usual. Schwartz’s criticism has sparked discussion, but whether it can truly change market valuation of Bitcoin and XRP remains to be seen.

In terms of market cap, Bitcoin is about $1.3 trillion, XRP around $80 billion, making Bitcoin more than 16 times larger. For XRP to “overtake” Bitcoin, its market cap would need to grow 16-fold, which is nearly impossible under current conditions. A more realistic goal might be narrowing the gap, for example, reducing the Bitcoin-to-XRP market cap ratio from 16:1 to 10:1 or 8:1. This would require XRP’s price to rise significantly faster than Bitcoin’s, or Bitcoin to fall sharply while XRP remains relatively resilient.

Historically, XRP briefly reached a market cap of about $130 billion in early 2018 (with XRP price around $3.4), roughly 1:15 compared to Bitcoin’s market cap at that time. But that was during a frenzy of ICO hype and retail FOMO, difficult to replicate. In the current more rational market environment, whether technical advantages can translate into market cap depends on actual adoption and institutional support, not just narratives and hype.

Timing and Motivation Behind Schwartz’s Criticism

David Schwartz’s choice to criticize Bitcoin now may have several motives. First, to boost XRP’s profile—during a crypto market downturn, attacking a competitor can highlight one’s own advantages and attract investor attention. Second, to respond to market skepticism toward Ripple and XRP; when XRP’s price remains low, emphasizing technical strengths can bolster community confidence. Third, to align with Ripple’s institutional strategy, emphasizing technical performance as critical for financial institutions, supporting Ripple’s commercial expansion.

However, such criticism could backfire. The Bitcoin community is highly united and sensitive to criticism; Schwartz’s remarks might provoke strong counterattacks from Bitcoin maximalists, deepening the divide. Publicly criticizing Bitcoin could also be seen as “sour grapes,” implying Ripple is attacking competitors due to poor market performance.

For XRP investors, Schwartz’s perspective offers a “value investing” narrative: XRP’s technology surpasses Bitcoin’s, but due to network effects and brand recognition, it is undervalued. Over the long term, technical advantages should reflect in price. But this narrative must be approached cautiously, as the market has spent 13 years validating the “network effects > technical performance” logic. XRP’s better technology but much lower market cap illustrates the market’s choice.

The Bitcoin vs XRP debate—innovation versus network effects—is just a matter of different cycles. Ultimately, the market will give an answer, likely that both can coexist: Bitcoin as a store of value, XRP as a means of payment and settlement, each serving its role rather than being mutually exclusive.

Related Articles

Whale 3NVeXm Deposits Additional 2,035 BTC Worth $135.23M to Centralized Exchange

Data: Bitcoin spot ETF experienced a net outflow of $410.57 million yesterday

Ethereum ETF Holders Stare at 43% Losses as ETH Tumbles Below $2,000—Far Worse Than Bitcoin ETF

This week's mining data highlights: Bitcoin mining difficulty experienced the largest single adjustment since summer 2021; Cangu has raised an additional $75.5 million, focusing on transforming into an AI distributed computing platform.