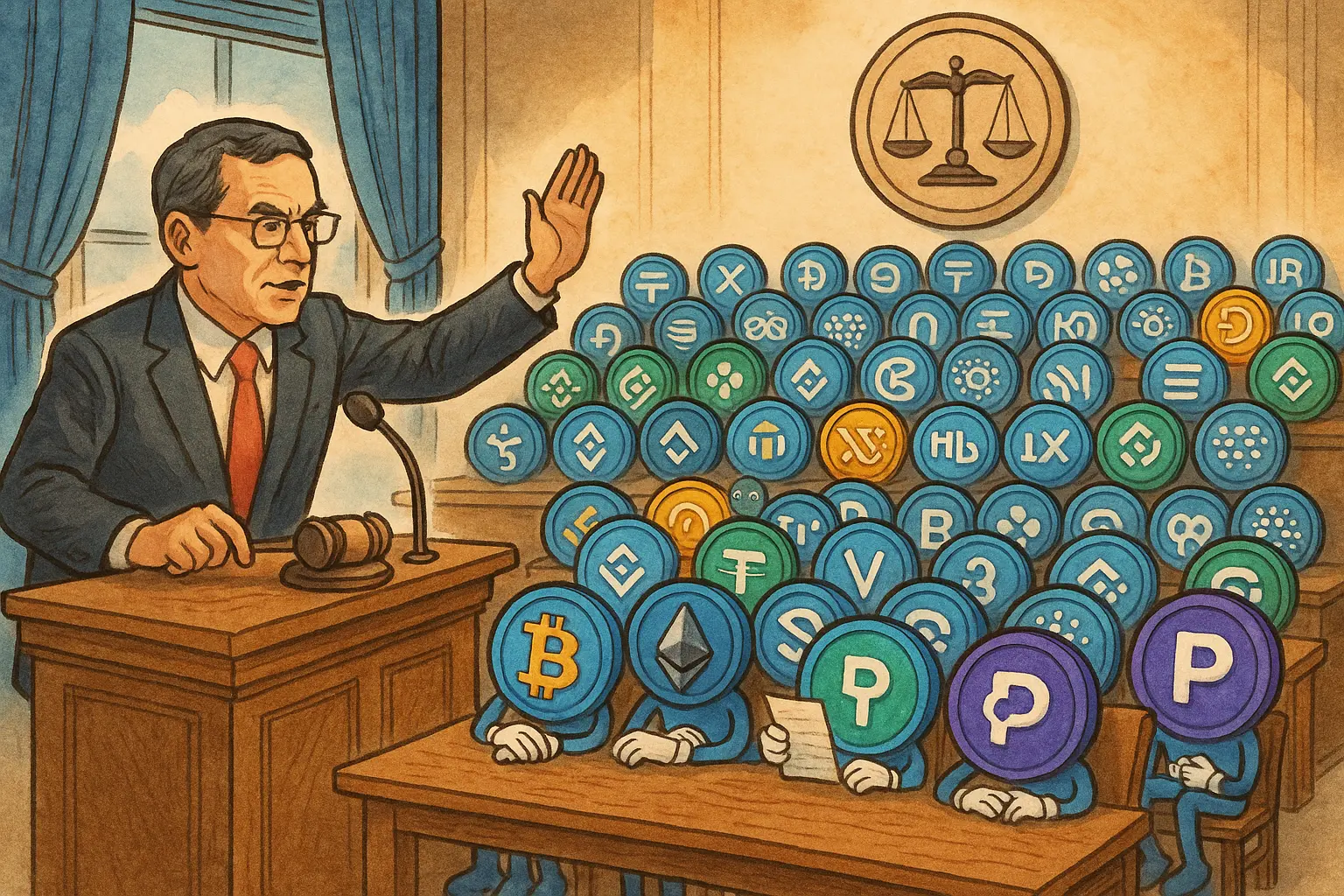

CFTC Chair Takes Action! 35 Crypto Big Names Join the Cabinet, Polymarket Gains Influence

The CFTC Chair Michael Selig has appointed a 35-member advisory committee composed of senior executives from the cryptocurrency industry to provide guidance on the regulation of breakthrough technologies such as AI and blockchain. Market founder Polymarket’s Shayne Coplan is predicted to be among the appointees. Traditional financial giants including CME, DTCC, and Nasdaq representatives are also part of the committee.

The 35-Person Dream Team: An Unprecedented Gathering of the Crypto Industry

The U.S. Commodity Futures Trading Commission has appointed several senior executives from the cryptocurrency sector to a new Innovation Advisory Committee, which will offer opinions on how the commodity regulator should oversee disruptive technologies like artificial intelligence and blockchain in the markets. “Today marks the official establishment of the CFTC Innovation Advisory Committee, an important and exciting milestone,” said CFTC Chairman Michael Selig. “The work of the advisory committee will help ensure that CFTC’s decisions reflect market realities, enabling the agency to future-proof its markets and establish clear rules for America’s financial markets’ golden era.”

Among the 35 advisors, nearly all have direct ties to the crypto industry. This overwhelming representation of crypto indicates Selig’s emphasis on digital assets. During the Gensler era at the SEC, crypto representatives held very few seats on advisory committees, with most positions allocated to traditional finance and investor protection organizations. In contrast, Selig’s IAC is predominantly composed of native crypto professionals.

The committee includes representatives from major blockchain projects such as Vivek Raman of Etherealize, Anatoly Yakovenko of Solana Labs, Brad Garlinghouse of Ripple, Sergey Nazarov, CEO of Chainlink Labs, and Hayden Adams, CEO of Uniswap Labs. This “big collection of public chains” is extremely rare; Ethereum, Solana, and Ripple are among the top five market cap public chains, Chainlink is the largest oracle network, and Uniswap is the biggest decentralized exchange. These projects differ greatly in technical approach and business model, even competing directly, yet all are included in the same advisory committee.

Executives from centralized crypto exchanges like Bullish, as well as leaders from other trading platforms such as Bitnomial and Robinhood, are also listed. These five major exchanges account for a significant share of crypto trading in the U.S. and globally. Coinbase is the only U.S.-listed crypto exchange, with Bullish having a traditional finance background. Their participation ensures that the IAC’s recommendations are practically actionable.

Core Members of the 35-Person IAC

Public Chain Representatives: Ethereum, Solana, Ripple, Chainlink, and other infrastructure projects

Exchanges: Bullish and other market participants

DeFi Protocols: Uniswap and other decentralized finance applications

Prediction Markets: Polymarket, Kalshi, and other innovative financial products

Venture Capital: a16z, Paradigm, Framework, and other capital firms

Traditional Finance: CME, DTCC, Nasdaq, and other legacy giants

This cross-sector combination is highly strategic. It includes technical developers (public chains and protocols), business operators (exchanges and platforms), capital providers (VCs), and traditional finance voices. This diversity helps ensure that the IAC’s advice balances innovation with prudence, efficiency with security, crypto-native interests with traditional finance needs.

Founders of leading prediction markets, such as Polymarket’s Shayne Coplan and Kalshi’s Tarek Mansour, are also members. This appointment is highly symbolic because, as previously mentioned, SEC Chair Gensler recently characterized prediction markets as a “major problem.” Selig’s inclusion of these founders signals that the CFTC is adopting an “embrace and regulate” approach rather than suppression. This difference also reflects the fundamental divergence in regulatory philosophy between the CFTC and SEC.

Crypto venture investors like Chris Dixon of a16z crypto, Vance Spencer of Framework Ventures, and Alana Palmedo of Paradigm are also on the list, along with executives from traditional financial giants such as Cboe, CME, DTCC, Nasdaq, and options clearinghouses. The participation of VCs brings a capital perspective, while involvement from traditional finance ensures new rules remain aligned with existing systems.

Project Crypto and the Accelerated Modernization of Regulation

This move aligns with signals from the Selig-led CFTC, indicating that the government aims to establish a more relaxed regulatory environment for digital assets and promote financial innovations like prediction markets. The CFTC and SEC jointly launched “Project Crypto,” aiming to modernize cryptocurrency regulation. Such cross-agency cooperation was nearly impossible during Gensler and Behnam’s tenures, reflecting a unified regulatory front under the Trump administration.

“By bringing together participants from various market sectors, the IAC will be a valuable asset for the committee, helping us improve regulations to accommodate current and future innovations,” Selig said. This statement shows that the CFTC recognizes that regulation cannot be made behind closed doors and must incorporate industry voices. However, this “regulatory capture” also carries risks: when regulated entities become the rulemakers, rules may become overly lenient, potentially failing to adequately protect investors.

In terms of timing, the establishment of the IAC coincides with the March 1 deadline for the CLARITY Act, indicating that the CFTC is preparing to take over most crypto regulation. If the CLARITY Act passes, the CFTC will oversee the majority of cryptocurrencies (with the SEC retaining only securities tokens), and the advice from the IAC will directly influence future regulatory frameworks. This makes the perspectives and interests of IAC members critically important.

Regarding operational mechanisms, the IAC typically meets quarterly to discuss specific issues and submit recommendations to the CFTC. The CFTC is not obligated to adopt the IAC’s advice, but in practice, regulators tend to highly value advisory committee input. Becoming an IAC member effectively provides a direct channel to influence regulatory policy, offering a significant strategic advantage for participating companies and individuals.

Politically, Democrats might criticize the composition of the IAC as too industry-biased, lacking voices from investor protection groups and consumer advocates. If, after the 2026 midterm elections, Democrats regain control of Congress, they could push to reorganize or weaken the IAC. Therefore, the “golden window” for the IAC may only last a few months to a year, requiring rapid action to push key rules forward.

For the crypto industry, the establishment of the IAC is a major positive. It signifies that crypto is no longer merely a regulated target but a participant in rulemaking. This elevated status could clear many obstacles for industry growth. However, this influence also comes with responsibility: if the rules promoted by the IAC are too lax, leading to investor losses or market chaos, the crypto industry could face political and reputational repercussions.

From an investment perspective, companies and projects represented by IAC members may gain advantages under future regulatory frameworks. Their involvement in rulemaking and early insight into upcoming regulations can allow them to adjust business models and compliance strategies proactively. While this “information asymmetry” is legally compliant, it provides a competitive edge over others. Investors should pay close attention to developments involving IAC member companies.

Related Articles

Analysis: January CPI is expected to continue the cooling trend, and the Federal Reserve may remain on hold in the short term.

NY Fed Has Tied Inflation to Tariffs When Crypto Prices Are Already on Report Speculation

XRP Today's News: ETF Zero Outflows Outperform BTC, CPI Data Becomes the Key Catalyst

Standard Chartered: Bitcoin may drop to $50,000, Ethereum to $1,400, BTC year-end target lowered to $100,000

Ripple and Uniswap executives join CFTC committee, the game of the "CLARITY Act" escalates again

Federal Reserve Document Reveals: Cryptocurrency Derivatives Risk Weights Are Independent, Higher Volatility Requires Higher Margin