Chainalysis: Human Trafficking Crypto Funds Increase by 85%, Stablecoins Become a Tool for Southeast Asian Crime

Cryptocurrency inflows suspected of funding human trafficking networks are projected to increase by 85% in 2025, but blockchain analysis firm Chainalysis states that blockchain transparency could help disrupt these operations. A report released Thursday indicates that total transactions flowing to suspected trafficking networks—primarily in Southeast Asia—reach hundreds of millions of dollars across identified services.

Hundreds of Millions of Dollars in Transactions and Southeast Asian Crime Hubs

(Source: Chainalysis)

The Chainalysis report released Thursday states that the total transaction volume directed toward suspected trafficking networks—mainly in Southeast Asia—has reached hundreds of millions of dollars across identified services. The report also notes that these services are closely linked to scam hubs, online casinos, and Chinese money laundering networks, which have been gaining popularity recently.

Southeast Asia has become a hotspot for human trafficking and related crimes due to geopolitical and economic reasons. Regions in Cambodia, Myanmar, Laos, and others are in legal vacuums or under weak government control, allowing criminal groups to operate relatively freely. These areas’ so-called “scam zones” have gained notoriety in recent years, with thousands of people deceived or kidnapped into these zones, forced into online scams, gambling, or sex services. While often controlled by Chinese criminal groups, victims come from around the world.

Although the “hundreds of millions of dollars” in transactions constitute a tiny fraction of the overall crypto market (daily trading volume in the trillions), they represent a significant sum for crimes like human trafficking. These funds are used to pay for victim “purchase fees,” bribe local officials, cover zone operational costs, and distribute profits among various levels of criminal networks. Cryptocurrencies, especially stablecoins, are favored as payment tools due to their ease of cross-border transfer and relative anonymity.

Chainalysis states that activities utilizing cryptocurrencies for human trafficking include: Telegram-based international escort services, kidnapping and forced labor intermediaries at scam zones, prostitution networks, and child sexual abuse material suppliers. These four categories cover the main forms of human trafficking, from relatively “mild” sex work to extreme cases involving child abuse and forced labor.

Four Main Uses of Cryptocurrency in Human Trafficking

Telegram Escort Services: International sex trade, using encrypted cross-border payments

Labor Intermediaries (Scam Zones): Kidnapping and forced labor, paying “headhunter” fees with crypto

Prostitution Networks: Organizing sex work, settling with stablecoins to protect privacy

Child Sexual Abuse Material: The most severe crime, using crypto payments to evade tracking

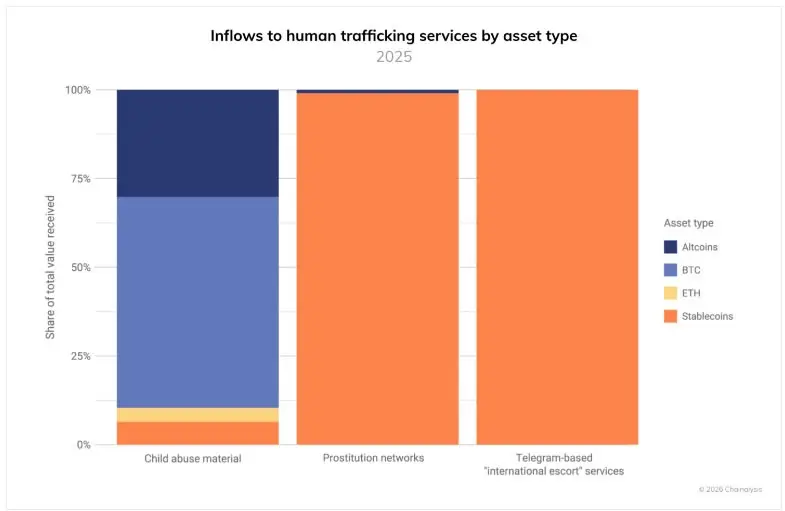

Payment methods vary greatly; international escort services and prostitution networks almost exclusively use stablecoins. Stablecoins (like USDT, USDC) are preferred because of their price stability and dollar peg. Criminals avoid the volatility risk associated with assets like Bitcoin, and stablecoins allow them to transact with near-fiat stability while enjoying the convenience and anonymity of crypto.

Blockchain Transparency: A Double-Edged Sword and Law Enforcement Breakthroughs

Chainalysis explains that blockchain can assist law enforcement by identifying transaction patterns, monitoring compliance, and pinpointing exchanges and illegal online marketplaces—helping to uncover and combat trafficking activities. The report states: “Unlike cash transactions that leave no trace, blockchain transparency offers unprecedented visibility into these operations, creating unique opportunities for detection and disruption that traditional payment methods cannot provide.”

This argument for “transparency” is crucial, countering the common criticism that “crypto is a haven for crime.” While crypto offers some degree of anonymity, all transactions are permanently recorded on the blockchain and can be viewed by anyone. Chainalysis and other blockchain analysis firms can trace fund flows, analyze transaction patterns, and identify related addresses, gradually revealing the structure of criminal networks. This capability is nonexistent in cash transactions, which are untraceable once handed over.

Chainalysis advises that compliance teams and law enforcement should monitor: large, regular payments to labor dispatch agencies; clusters of wallets involved in multiple illegal service categories; and regular stablecoin conversion patterns. These “anomalous patterns” are central to blockchain analysis. For example, a wallet receiving large USDT amounts weekly and immediately dispersing small amounts to multiple addresses may indicate profit-sharing from criminal proceeds.

The firm notes that law enforcement achieved several victories last year in combating human trafficking, including the shutdown of a child exploitation platform in Germany, with blockchain analysis playing a key role. German authorities successfully traced crypto payments to identify the platform’s operators and, through KYC data from centralized exchanges, located real identities and physical locations for arrests.

The Ethical Responsibility and Power to Freeze Held by Stablecoin Issuers

The differences in payment methods highlight the critical role of stablecoin issuers (mainly Tether and Circle) in anti-crime efforts. Since escort and prostitution networks predominantly use stablecoins, if Tether and Circle actively monitor and freeze addresses linked to human trafficking, it could significantly hinder these crimes.

Both Tether and Circle possess the technical capability to freeze specific addresses. When law enforcement provides evidence linking an address to criminal activity, issuers can blacklist that address, rendering USDT or USDC held there untransferable. Such freezes have precedent; Tether has frozen hundreds of millions of dollars in stolen funds or addresses associated with sanctions.

However, this power also raises controversy. Critics argue that centralized entities holding the authority to freeze assets contradicts the decentralized and censorship-resistant ethos of crypto. Abuse of this power—such as freezing assets of dissenters under political pressure—could have severe consequences. The “security versus freedom” dilemma is especially stark in cases of extreme crimes like human trafficking, where many favor asset freezes. But where to draw the line? This remains an ongoing debate.

For the crypto industry, Chainalysis’s report is a double-edged sword. On one hand, it provides evidence that crypto can facilitate crime, potentially fueling calls for stricter regulation or bans. On the other hand, it demonstrates that blockchain analysis can be a powerful tool in fighting crime, showing that crypto is not “untraceable” and that transparency could make it easier to regulate than cash.

Balancing these aspects requires the industry to cooperate actively with law enforcement to combat criminal use while safeguarding legitimate users’ privacy rights. Achieving this “crime-fighting without harming law-abiding users” balance is challenging, but failure to do so risks crypto being restricted or banned due to the actions of a few bad actors. The technology of firms like Chainalysis and the responsible stance of stablecoin issuers will be key to maintaining this balance.

Related Articles

U.S. Prosecutor Warns to Beware of Love Scams on Valentine's Day! San Jose Widow Loses Nearly $100,000

Tether EVO’s Brain-to-Text AI Secures Top-Five Finish in Global Benchmark

Tether Gold Token XAUT's new unit "Scudo," can be bought with the price of a cup of coffee.

Tether launches a new on-chain gold measurement unit, Scudo, which is equivalent to one-thousandth of an ounce.

Tether makes strategic investment in LayerZero! Supporting cross-chain infrastructure and promoting USDT0 cross-chain circulation