Midnight (NIGHT) increased by 2% during the Friday morning trading session, shortly after founder Charles Hoskinson revealed plans to launch the mainnet by the end of March at the Consensus 2026 event. This news further boosted market sentiment, helping NIGHT maintain its short-term recovery momentum.

From a technical perspective, Midnight is signaling a relatively clear bottom formation, reinforcing expectations of a new bullish cycle if buying pressure continues in the upcoming sessions.

Mainnet launch announcement boosts demand

Charles Hoskinson, founder of Cardano, revealed that Midnight — a privacy-focused blockchain utilizing zero-knowledge proofs technology — will officially launch its mainnet in the last week of March. The project is positioned as a “partner chain” of Cardano, aiming to provide enhanced security layers and support legal compliance for decentralized applications (dApps).

According to Hoskinson, Midnight has established partnerships with several major industry players. “Google is one of them. Telegram as well,” he stated, emphasizing ambitions to expand the ecosystem early on.

In a significant speech, Hoskinson also announced plans to integrate LayerZero — a platform targeting enterprise clients — into the Cardano blockchain, to meet the trend of moving traditional activities on-chain.

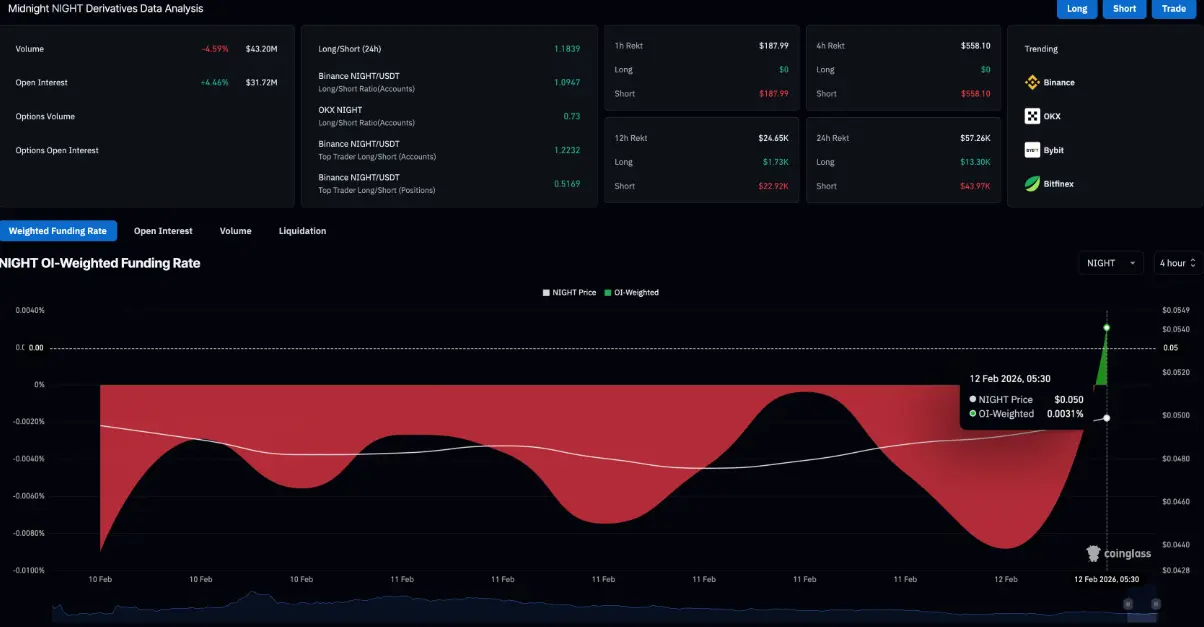

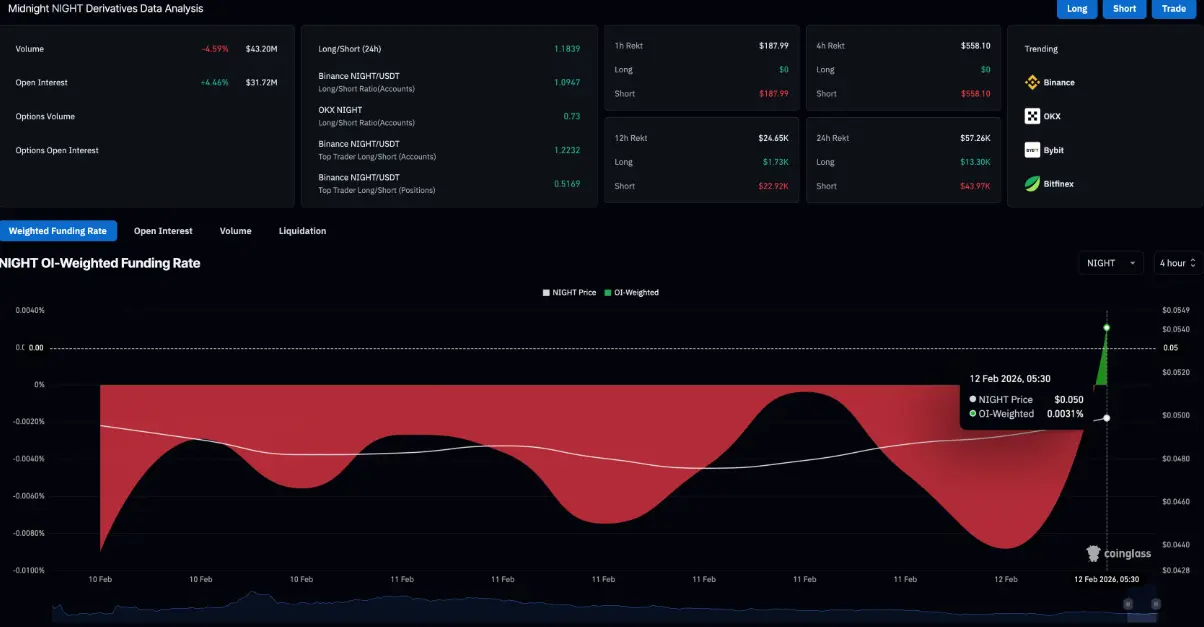

Data from CoinGlass shows that NIGHT futures contracts have increased open interest (OI) by over 4% in the past 24 hours, reaching $31.72 million, reflecting growing investor interest following the mainnet launch timeline announcement.

Night Derivatives Data | Source: CoinGlass## Midnight faces multiple resistance levels

Night Derivatives Data | Source: CoinGlass## Midnight faces multiple resistance levels

As of Friday, Midnight maintained trading above the psychological level of $0.0500, indicating notable recovery signals on the 4-hour timeframe. Notably, NIGHT has formed a higher low structure after a series of lower lows — an important technical signal suggesting a trend reversal is gradually being established.

However, the upward momentum still faces resistance at the 50-period exponential moving average (EMA) at $0.0502. If a successful breakout above this level occurs, Midnight could extend its rally toward the supply zone of $0.0551–$0.0558, approaching the 200-period EMA at $0.0568 — a key challenge area for bulls.

4-Hour NIGHT/USDT Chart | Source: TradingView Technical signals on the 4-hour chart lean toward a positive scenario. The relative strength index (RSI) has risen to 51 and crossed above the midline after a short accumulation phase, indicating improving buying pressure. Meanwhile, the MACD has crossed above its signal line but remains below zero, suggesting bullish momentum is gradually building.

4-Hour NIGHT/USDT Chart | Source: TradingView Technical signals on the 4-hour chart lean toward a positive scenario. The relative strength index (RSI) has risen to 51 and crossed above the midline after a short accumulation phase, indicating improving buying pressure. Meanwhile, the MACD has crossed above its signal line but remains below zero, suggesting bullish momentum is gradually building.

Conversely, if the price weakens and breaks the Wednesday low at $0.0472, the recovery outlook will be invalidated. In that case, NIGHT could retreat to test deeper support levels at $0.0446 and $0.0413 — corresponding to the lows set on January 31 and February 5.

SN_Nour

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Survival Guide for a Volatile Market: Earn More, But Live Longer

The article analyzes the phenomenon of four-cycle technical resonance and conflicts, pointing out that short-term rebounds coexist with medium to long-term bearish trends. On the news front, the situation is a tale of two extremes, with short-term negative news releases and medium to long-term positive support coexisting. Overall, the market is in a low-level oscillation and recovery phase. Short-term trading strategies recommend selling high and buying low, while medium-term positioning requires patience and careful observation of key support levels.

PANews59m ago

Will Bitcoin have a "red envelope market" during the 2026 Spring Festival? A review of the past 10 years of Bitcoin's Spring Festival price increases

Spring Festival is approaching, and attention is on BTC red envelope market. Over the past 10 years, 9 of those years have seen gains with an average of 11%, with the strongest increase of 24.7% in 2018, driven by year-end bonuses and red envelopes. However, ARK investment managers say the structure has changed, with ETFs absorbing 12% of supply and volatility dropping to 36%. Institutional re-accumulation has altered the explosive growth pattern, with ARK targeting a $1.5 million price in a bull market scenario by 2030.

MarketWhisper1h ago

Trading Time: AI Panic Escalates Ahead of CPI, Bitcoin Fluctuates and Bottoms Out, Difficult to Reproduce "Spring Festival Market"

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

The current macro market is experiencing a profound confidence crisis triggered by AI, with the narrative shifting from "AI frenzy" to "AI panic." Investors are no longer focused on who will benefit but are instead worried about which industries will be disrupted and replaced. On Thursday, financial markets experienced a broad sell-off, with US stock market capitalization evaporating by $1 trillion. Cisco plummeted 12% after releasing weak profit margin guidance. The Nasdaq dropped over 2%, the S&P 500 declined 1.57%, breaking below the 50-day moving average, and the Dow Jones Industrial Average fell below 50,000 points. The seven tech giants all declined, with Apple dropping over 5%, losing approximately $202 billion in market value in a single day. Amazon's stock price, after eight consecutive days of decline, officially entered a technical bear market on Thursday, down 21.4% from its high. Industry insiders expect NVIDIA's February 25 earnings report to become an important event in the AI field.

PANews1h ago

Bitcoin Approaches Key MVRV Threshold That Has Marked Every Major Low

The −1.0 MVRV band has aligned with Bitcoin’s macro bottoms across multiple bear market cycles.

Current data places this statistical undervaluation zone near $52,040 as a potential support area.

On-chain metrics show repeated transitions from capitulation to accumulation near this band.

Th

CryptoFrontNews1h ago

Shiba Inu Price at Risk? Key Levels Traders Should Watch

Shiba Inu faces bearish pressure with a pattern of lower highs and ongoing selling within a descending channel. Despite a recent bounce, risks of further declines remain unless it breaks key resistance levels around $0.0000062.

TheCryptoBasic1h ago

Year of the Horse meme coin Chinese memes explode! I'm riding the horse, dark horse, crying, success at once, who is the Golden Dog?

2026 Year of the Horse (Bing Wu Year) meme coins mainly feature Chinese themes, with "I’m on my horse" gaining the most attention, once soaring over 700%, with a market capitalization surpassing $52 million. The token name combines a Chinese swear word pun, quickly becoming popular in Chinese-speaking communities. Other popular ones include "Horse to Success" (a lucky phrase emphasizing the New Year atmosphere), "Dark Horse" (a narrative of reverse rise), "Crying Horse" (self-deprecating trapped emotions), "Teng Little Horse" (cute pet style), and others.

MarketWhisper1h ago

Night Derivatives Data | Source: CoinGlass## Midnight faces multiple resistance levels

Night Derivatives Data | Source: CoinGlass## Midnight faces multiple resistance levels 4-Hour NIGHT/USDT Chart | Source: TradingView Technical signals on the 4-hour chart lean toward a positive scenario. The relative strength index (RSI) has risen to 51 and crossed above the midline after a short accumulation phase, indicating improving buying pressure. Meanwhile, the MACD has crossed above its signal line but remains below zero, suggesting bullish momentum is gradually building.

4-Hour NIGHT/USDT Chart | Source: TradingView Technical signals on the 4-hour chart lean toward a positive scenario. The relative strength index (RSI) has risen to 51 and crossed above the midline after a short accumulation phase, indicating improving buying pressure. Meanwhile, the MACD has crossed above its signal line but remains below zero, suggesting bullish momentum is gradually building.