Vitalik Buterin: Ethereum acts as the settlement layer for AI, but there are significant risks behind it

Vitalik Buterin has just announced a new research proposal, but instead of addressing the most frequently asked question—whether blockchain can run AI models directly—this approach takes a different direction.

The paper suggests that Ethereum could become a layer for privacy-preserving payments and settlements for AI usage and APIs, based on usage-based fee models. Co-authored by Vitalik Buterin and Davide Crapis on Ethereum Research, the article emphasizes that the real opportunity does not lie in bringing large language models onto the chain.

Instead, the opportunity is in building infrastructure that allows users and AI agents to pay for thousands of API calls without revealing identities or creating traceable payment data.

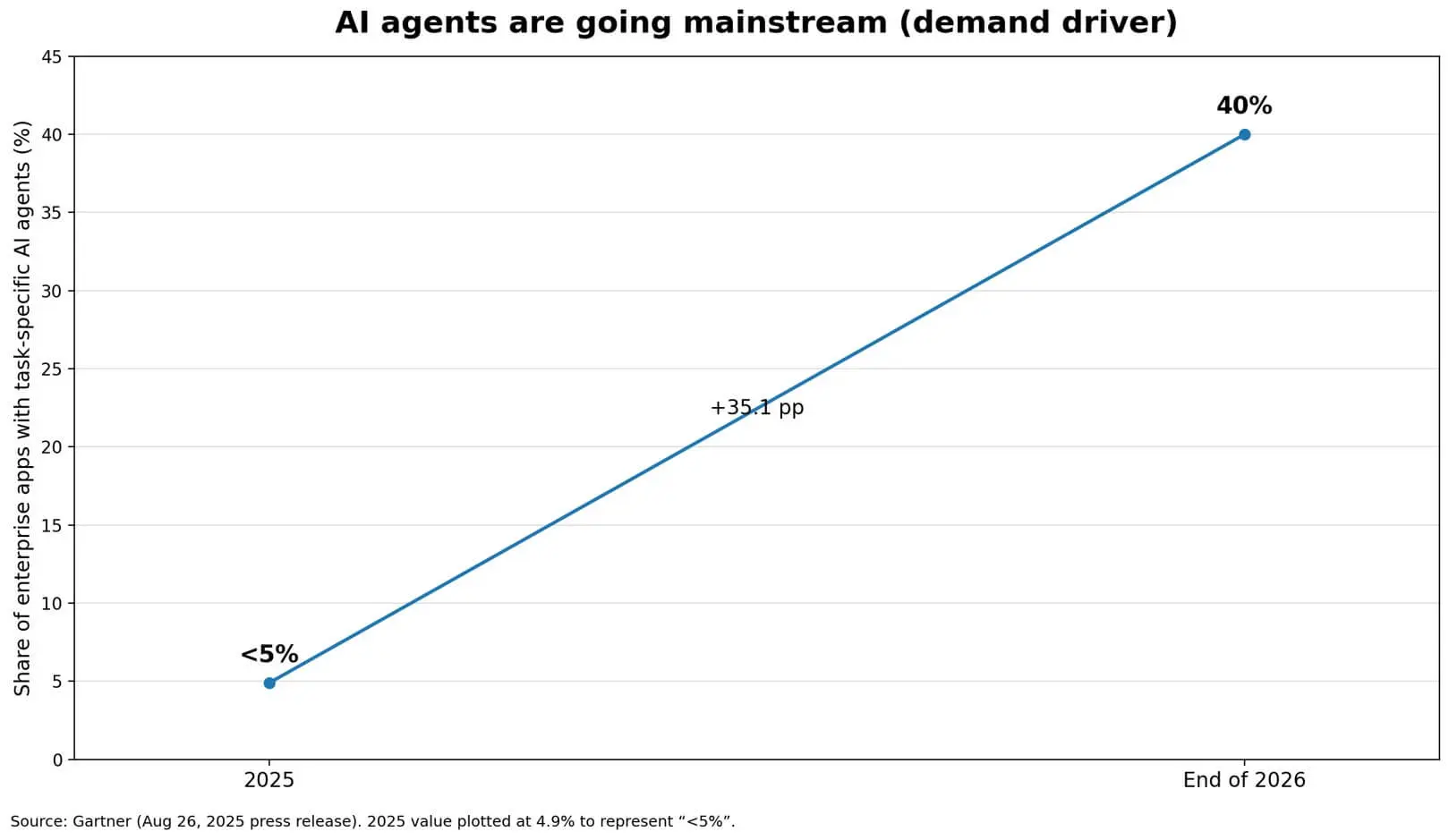

A critical moment is approaching as agentic AI shifts from experimental phases to enterprise deployment. Gartner forecasts that by the end of 2026, approximately 40% of enterprise applications will incorporate specialized AI agents by task, a significant increase from less than 5% in 2025.

Gartner predicts that enterprise applications using specialized AI agents will rise from under 5% in 2025 to 40% by the end of 2026.## AI Agents Enter the Mainstream

Gartner predicts that enterprise applications using specialized AI agents will rise from under 5% in 2025 to 40% by the end of 2026.## AI Agents Enter the Mainstream

This shift implies a world where software automatically generates large volumes of API calls. In this context, usage-based payment systems are no longer auxiliary infrastructure but become a strategic layer.

Current measurement and billing systems force users to choose between two models:

ZK API Usage Credits Mechanism

The proposal introduces ZK API usage credits—a payment and abuse prevention mechanism based on Rate-Limiting Nullifiers (RLN).

RLN is a zero-knowledge tool designed to prevent spam in anonymous systems. This research repurposes RLN for paid service access based on usage.

Operational process:

An illustrative example:

The design targets a “multiple calls per deposit” model, meaning on-chain activity increases with the number of accounts and settlement frequency, rather than with the total AI inference volume.

The system also supports variable costs: users prepay a maximum per call, the server refunds signed tickets for unused calls, and users can privately accumulate refunds to increase their quota without additional deposits.

Payment Infrastructure Is Ready

This proposal emerges amid a well-developed on-chain payment infrastructure.

It deliberately avoids putting LLMs on-chain. Blockchain does not compete in computational power or inference speed but in serving as a neutral settlement layer, with programmable escrow and verifiable execution mechanisms.

AI inference is handled off-chain, while blockchain ensures trustworthy payments, measurement, and dispute resolution without requiring users to trust individual providers or reveal identities.

If AI providers accept escrow payments and rely on Ethereum or Layer 2 smart contracts for escrow management, refunds, and dispute resolution, this network could become the execution layer for AI commerce—similar to how it has served as the settlement layer for stablecoins and DeFi.

Metadata Challenges and Implementation Hurdles

Although the payment mechanism may not be cryptographically linkable, there remains a risk of metadata correlation. Servers could link users through timing patterns, token counts, cache hit ratios, and other behavioral signals.

Some suggest a “bucket” pricing mechanism with fixed input/output layers to reduce information leakage. The tension between cryptographic privacy and behavioral metadata is a key factor in whether the design truly achieves anonymity.

In terms of deployment, RLN is no longer actively maintained within the Privacy and Scaling Explorations project. Implementing ZK API usage credits in production may require forking or developing new tools.

Benchmark results for RLNJS indicate:

This is only initial performance testing; questions remain about mobile device compatibility and large-scale ZK circuits.

Beyond technical issues, market coordination is also a challenge. Web2 API providers already have established payment infrastructure and clear legal frameworks for identity-linked transactions. To persuade them to adopt ZK models, it’s necessary to demonstrate cost advantages or open new customer segments where privacy is a must-have feature.

Potential Impact on Ethereum

If this model gains acceptance, Ethereum’s value proposition would shift further toward serving as a neutral execution layer for digital commerce, rather than a general-purpose computing platform.

Blockchain would be viewed as a settlement layer where economic rules are enforced in a verifiable manner, rather than a platform where applications run directly.

Possible implications include:

Opportunities to serve user groups for whom privacy in payments is essential: businesses concerned about data leaks through payment logs, developers building AI agent toolchains that require auditable but non-surveilled measurement, and privacy-conscious users seeking high-frequency access to services anonymously.

The proposal suggests Ethereum could enforce payment agreements, arbitrate disputes, and support paid access without revealing identities—something difficult to achieve with traditional infrastructure. Whether this becomes a reality depends on solving metadata correlation issues, maintaining robust ZK implementations, and demonstrating enough economic value to incentivize providers to integrate.

Related Articles

Will USDT stablecoin surpass BTC and ETH? Mike McGlone makes a disruptive prediction: digital dollar becoming the new core

Mike McGlone Says USDT Stablecoin Could Become Larger Than Bitcoin And Ethereum

‘Extreme Fear’ at 5: $3B Options Expiry Meets US CPI as Strategy Buys Dip, BitMine Accumulates 4.3M ETH

BitMine's book loss is nearly $8 billion, yet BlackRock increased its holdings by 165.6%. Why is BMNR still being supported?

Ethzilla Launches First Tokenized Aviation Asset on Ethereum

"Maqi" Ethereum long positions are down to only 261 ETH, with a loss of over $760,000 in the past week.