Is Bitcoin holding steady when economic uncertainty is twice as high as during the 2008 crisis?

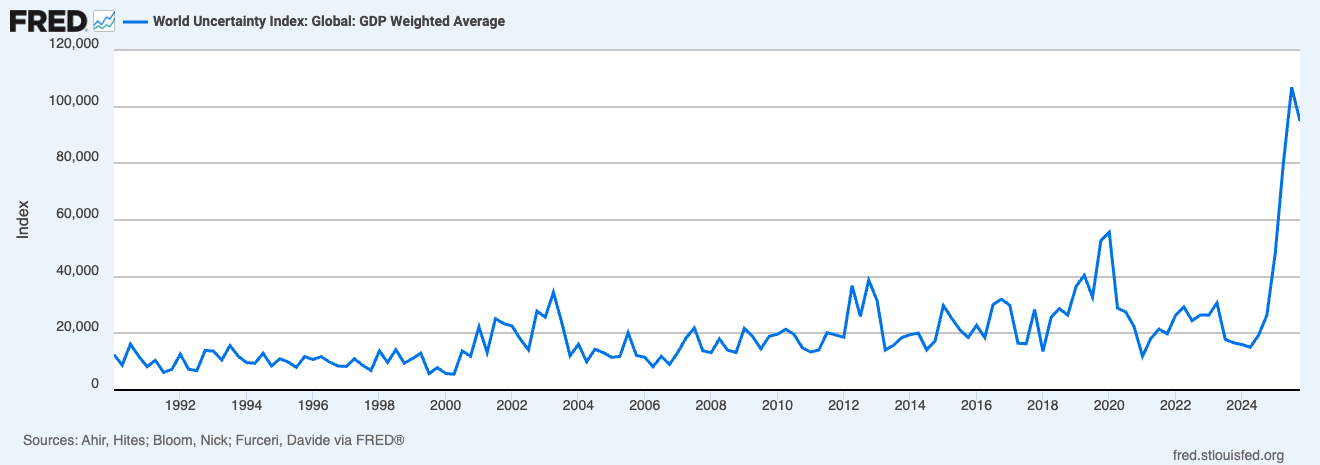

The Global Uncertainty Index (WUI)—a weighted measure based on the frequency of the word “uncertainty” in national reports from the Economist Intelligence Unit—rose to 106,862.2 in Q3 2025 and remained at a high level of 94,947.1 in Q4.

Historical WUI data compiled from FRED shows this is an unprecedented peak.

The calculation method of WUI normalizes keyword frequency and aggregates data per country. The current level corresponds to approximately 10–11 occurrences of “uncertain” or “uncertainty” in a 10,000-word quarterly report for each country—significantly higher than historical averages.

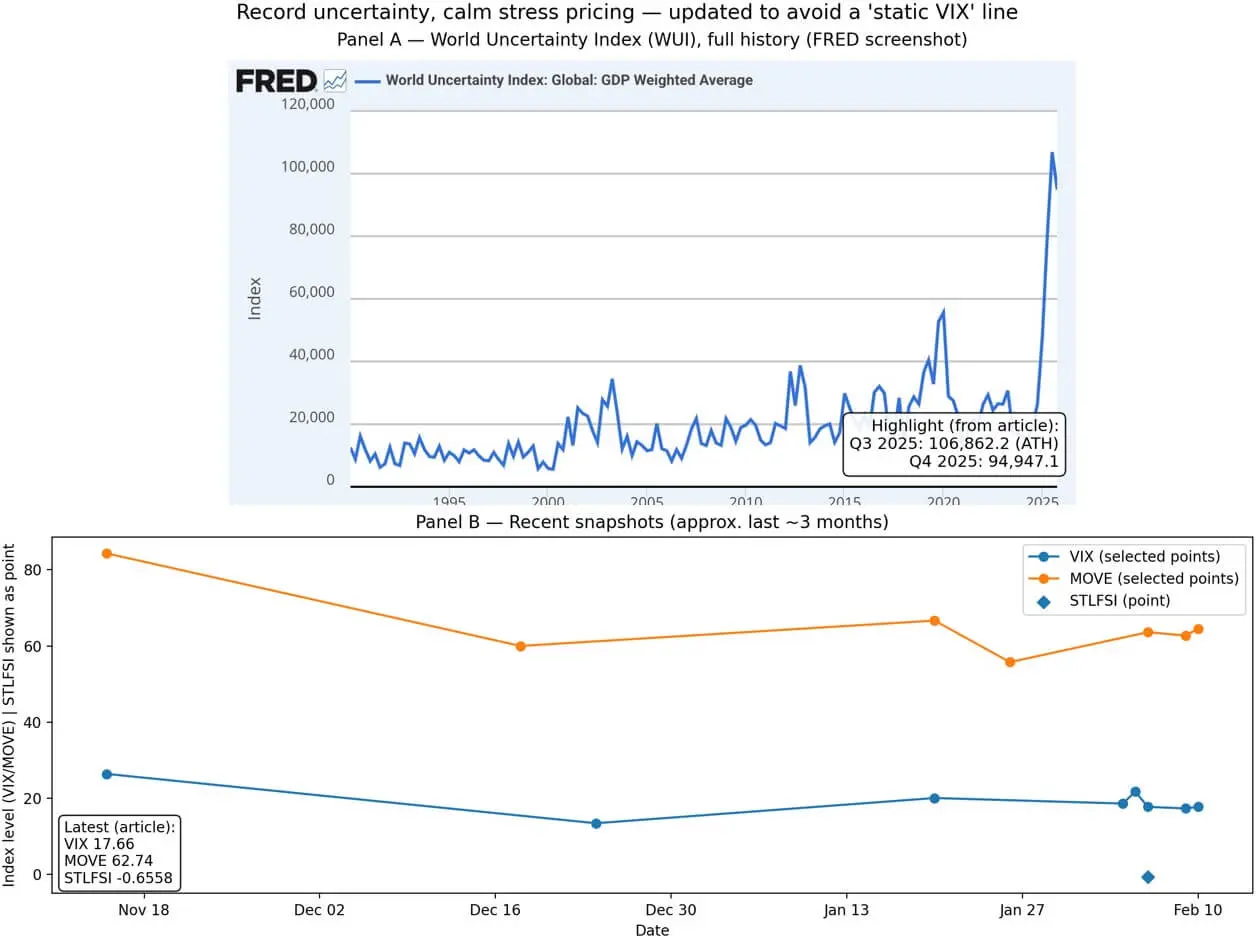

What is unusual now is the divergence between record-high uncertainty levels indicated by headlines and the fact that traditional markets are still pricing risk as low.

The CBOE VIX volatility index stood at 17.66 on February 11. The MOVE index—measuring bond market volatility—was at 62.74. Meanwhile, the Federal Reserve Bank of St. Louis’s financial stress index was at -0.6558, below its long-term average, indicating systemic risk is below normal as of the week ending February 6.

In other words, markets are still pricing a normal activity scenario, while national reports describe an environment of record uncertainty.

This gap is especially relevant for Bitcoin because its price behavior varies depending on whether uncertainty remains at the headline level or spills over into actual financial conditions.

Currently, macro variables still dominate Bitcoin’s trading as a risk asset, which remains in a tightening environment. The DXY index is at 96.762. The 10-year US Treasury yield is at 4.22%, and the 10-year TIPS real yield is at 1.87%.

A weaker US dollar combined with high real yields often leads to increased price volatility and higher sensitivity to policy expectations, capital flows, and hedging demand.

As a result, Bitcoin’s price swings sharply, trading around $66,901.93, down about 2.5% from the previous session.

Options markets also show increased hedging demand. The Deribit DVOL index rose from about 55.2 to nearly 58 over 48 hours. This indicates traders are willing to pay higher premiums for risk insurance, aligning with growing macro concerns, even though spot volatility has not yet exploded.

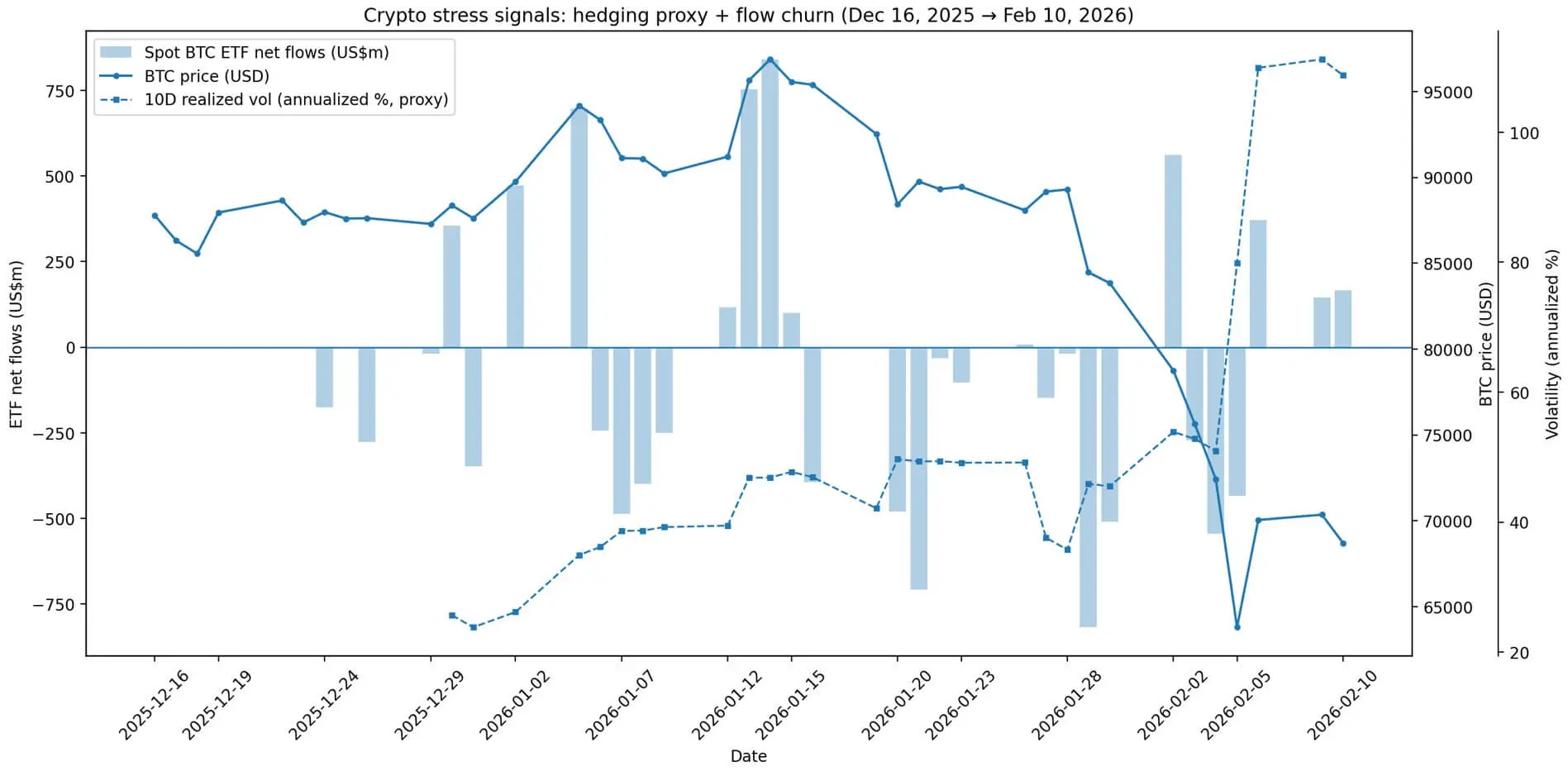

The flow of spot Bitcoin ETF capital also reflects uncertainty about market regimes rather than trend confidence. According to Farside Investors, January saw over $1.6 billion in net outflows; by February 10, February continued to see nearly $7 million in net withdrawals, although the last three sessions have mostly reversed these outflows.

Continuous inflow–outflow patterns suggest institutional allocators are reducing risk then increasing it again in waves, rather than maintaining a stable stance—characteristic of an environment with unclear macro signals but no acute financial stress.

The stablecoin market adds context to crypto liquidity. Total stablecoin supply is around $307.5 billion, nearly unchanged over the past 30 days, with only a 0.25% decrease. This indicates on-chain buying power remains intact—“dry powder” still ready for a catalyst or regime shift.

The global uncertainty index hit a record above 106,000 in Q3 2025, while indices like VIX, MOVE, and other financial stress measures remain low.## Two Contrasting Scenarios

The global uncertainty index hit a record above 106,000 in Q3 2025, while indices like VIX, MOVE, and other financial stress measures remain low.## Two Contrasting Scenarios

The next move for Bitcoin depends on how the market interprets this record-high uncertainty.

Scenario one views the high WUI as a signal that financial conditions will tighten further. If policy and geopolitical uncertainty translate into higher risk premiums, weaker growth expectations, or flight-to-safety flows, Bitcoin tends to behave like a high-beta risk asset—prone to sharp declines when the USD strengthens and real yields rise. Continued ETF outflows would reinforce this view.

Scenario two considers high uncertainty as a sign of sovereign and policy trust risks. In this case, Bitcoin could benefit as a non-sovereign safe haven. However, history shows this effect is only clear when real yields fall or liquidity loosens—which has not yet occurred.

The “non-sovereign safe haven” narrative only works when holding cash or government bonds becomes less attractive—contrary to the current environment.

The current market setup is quite unusual: WUI hits a peak, yet financial conditions are not easing, and the financial stress index has not spiked. Markets are not pricing panic, nor are they pricing risk relief.

The result is a sideways stance: Bitcoin fluctuates within a range, options markets signal caution, and institutional capital flows are oscillating without forming a clear trend.

Bitcoin ETF flows have been highly volatile, swinging from massive outflows at the end of January to inflows again in early February, while actual volatility spiked over 80% annualized.## Key Variables to Watch

Bitcoin ETF flows have been highly volatile, swinging from massive outflows at the end of January to inflows again in early February, while actual volatility spiked over 80% annualized.## Key Variables to Watch

The two most important simple variables are real yields and the strength of the USD.

If the 10-year TIPS real yield declines or the USD weakens, it signals a shift to the second scenario—where uncertainty becomes a supporting factor rather than an obstacle for Bitcoin. Historically, the largest rallies occur when real yields fall and liquidity expands, even amid high headline uncertainty.

ETF flows are another indicator. If inflows stabilize and remain positive after the January outflows, it suggests institutions see uncertainty as an opportunity to increase exposure. Conversely, if outflows resume, Bitcoin remains a risk-off asset.

Options market signals are also crucial. If DVOL stays high and hedging demand continues to rise on the downside, traders are preparing for significant volatility—potentially a sharp breakout in either direction, depending on macro developments.

The gap between the record-high WUI and traditional volatility indices remains the most notable sign. If policy and geopolitical uncertainty start reflecting in classic volatility measures, the current calm could end, and Bitcoin’s risk asset reflex could dominate.

Conversely, if WUI stays high but volatility indices remain low, it indicates that uncertainty is still in the narrative and forecast stage, not yet embedded in market positioning—setting the stage for a sharp move when the next macro catalyst appears.

Clearly, Bitcoin is trading in a mode where both identities—high-beta risk asset and non-sovereign safe haven—are plausible, but require opposite macro conditions to activate. The record uncertainty level does not resolve this contradiction—it only amplifies it.

Thach Sanh

Related Articles

California Public Employees' Retirement Fund increases holdings of Strategy shares to 470,000 shares, valued at approximately $59 million

Harvard’s $442M Bitcoin ETF Move Puts Crypto Ahead of Tech Shares

Bitcoin Faces Uncertainty in 2026 as Michael Terpin Warns of Possible Drop to $40,000