Decred (DCR) has experienced a recovery of over 7% at the time of writing on Friday, following a three-session correction that caused the price to drop nearly 14%. This upward momentum was significantly supported by a trading volume surge of approximately 60% over the past 24 hours, reflecting a clear improvement in demand in the spot market. However, from a technical perspective, Decred still faces considerable resistance around the $26 mark — a zone that has repeatedly limited its upward movement since late November.

Decred Continues Effort to Break Through Key Resistance Zone

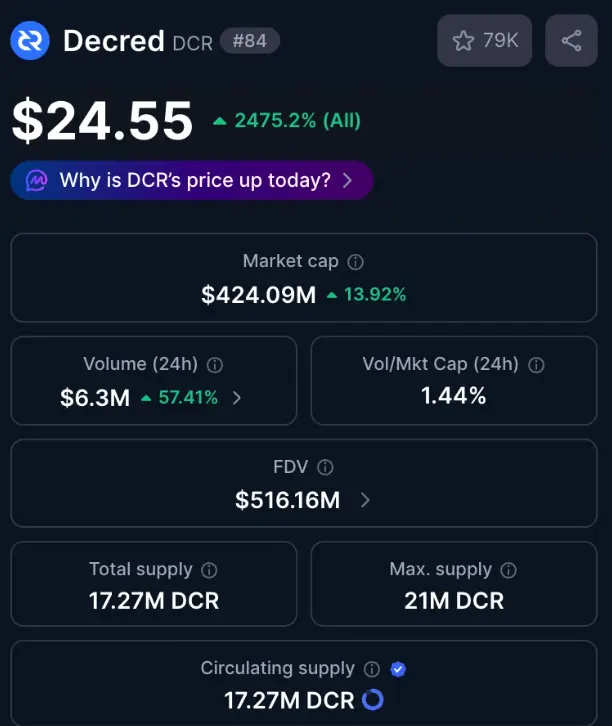

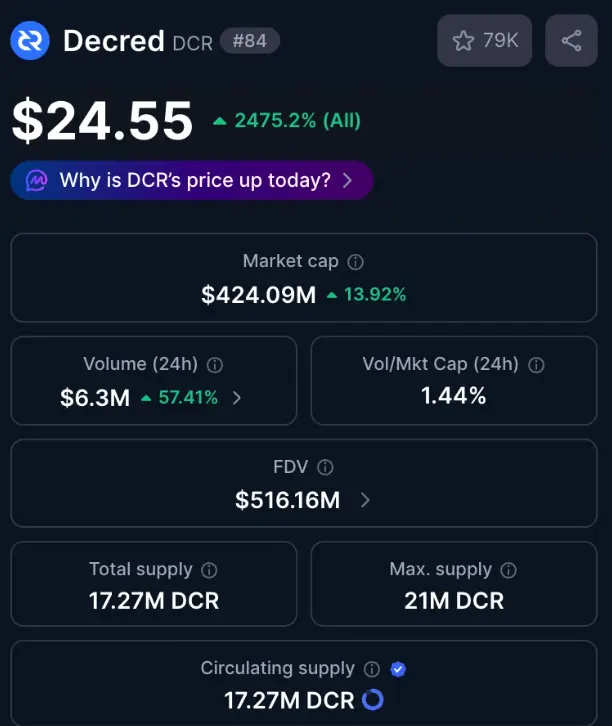

According to data from CoinMarketCap, Decred’s trading volume reached $6.3 million as of Friday, marking an impressive 57% increase compared to 24 hours earlier. This movement aligns with the recovery seen on Friday and indicates that market sentiment is increasingly bullish.

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance?

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance?

As of Saturday when this article was written, Decred is trading around the $24 level, showing a recovery after three consecutive declines with a gain of over 7%. Notably, this privacy-focused token remains above the 50-day and 200-day exponential moving averages (EMAs) — a technical signal suggesting that the bullish trend still dominates.

However, Decred’s recovery faces a significant obstacle at the Fibonacci 38.2% retracement level near $26.13. This level is based on the decline from the peak of $70.00 on November 4 to the bottom of $14.21 on December 23. In a positive scenario, if the price can break through and close firmly above this resistance zone on the daily timeframe, Decred is likely to target higher resistance levels at the Fibonacci 50% and 61.8%, corresponding to $31.54 and $38.07 respectively.

Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.

Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.

Conversely, the MACD indicator is trending sideways and faces the risk of crossing below the signal line — a potential sign of weakening momentum. Additionally, the shrinking green histogram bars suggest diminishing bullish momentum, increasing the likelihood of a correction in the near future.

On the support side, the 50-day and 200-day EMAs, located at $20.82 and $19.54 respectively, are expected to serve as important buffers if selling pressure resumes.

SN_Nour

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Solana Price Faces Bearish Pressure with $57 Fibonacci Extension in Sight

Key Insights:

Solana’s price faces a bearish shift after losing key support, with $170 now acting as resistance.

Low-volume bounces signal weak demand, leaving Solana vulnerable to further downside pressure.

The $57 Fibonacci extension could become a critical zone for Solana’s price

CryptoNewsLand2m ago

Cryptocurrency Market Rebounds Amid U.S. Government Shutdown: Bitcoin, Ethereum, XRP, and Solana Rise Simultaneously

February 14 News, the United States experienced a partial government shutdown due to the failure to pass the budget on time. However, against the backdrop of increasing political uncertainty, the cryptocurrency market defied the trend and rose. Mainstream assets such as Bitcoin, Ethereum, XRP, and Solana showed significant rebounds, driving the overall market capitalization to recover.

Market data shows that in the past 24 hours, the total market value of cryptocurrencies increased by nearly 5%, reaching approximately $2.38 trillion. The previous weeks of volatility and decline had kept many investors on the sidelines, but this round of rebound has injected new activity into the market. Although some analyses had predicted that the shutdown would increase selling pressure, the actual trend has contrasted with those expectations.

GateNewsBot8m ago

Solana rebounds back above $80, technical signals diverge, indicating two possible paths at $88 and $50

On February 14, news reports indicate that as the crypto market experienced a short-term rebound, Solana (SOL) surged approximately 10% on Friday, briefly breaking through the $85 mark and regaining the critical $80 zone. Over the past week, SOL has fluctuated between $78 and $88, with the lowest point during the recent correction touching $67. This rebound is seen as a technical correction following the recent breach of support levels.

Market analysis firm Daan Crypto Trades pointed out that the $80 level has historically served as an important support and resistance point multiple times. Whether this level can hold is key to determining if the short-term structure is turning bullish. Analyst Ali Martinez believes that if buying momentum continues, the price could test the short-term resistance at $88. A breakout above this level could pave the way for a renewed challenge of the $90 to $96 range, which corresponds to the previous low in April 2025.

GateNewsBot19m ago

CPI below expectations boosts Bitcoin prices, BTC firmly holds $70,000 but the bulls and bears are in increased tug-of-war

February 14 News, the latest U.S. Consumer Price Index (CPI) was 2.4%, below market expectations of 2.5%, providing a short-term boost to risk assets. Bitcoin subsequently strengthened, closing the day up 3.93%, marking its largest single-day gain in two weeks. However, despite the rapid rebound, BTC remains below a key resistance zone, and market opinions are divided on whether the rally can continue.

Earlier, the U.S. released employment data that exceeded expectations, indicating that the labor market remains resilient. This has sparked intense discussions about the pace of interest rate cuts. Some investors believe that an overheating economy will force the Federal Reserve to delay its easing cycle; meanwhile, the decline in CPI temporarily eased inflation concerns, restoring confidence among bulls.

GateNewsBot22m ago

Bitcoin NUPL drops back into the "Hope/Fear" zone: 0.18 reading signals a shift in market sentiment

February 14 News, on-chain metrics show that Bitcoin's Net Unrealized Profit/Loss (NUPL) has recently fallen sharply to 0.18, sparking market attention to sentiment shifts and price trends. On-chain analysis firm Glassnode pointed out that this level is within its "Hope/Fear" zone, indicating that the network as a whole remains profitable, but its advantage has significantly weakened.

NUPL is used to measure the unrealized profit and loss of all network investors. It is calculated by comparing the price at which each Bitcoin was last moved to the current spot price: above the current price indicates unrealized profit, below indicates unrealized loss. After aggregating this difference across the entire network, dividing by the market capitalization reflects the proportion of net profit or loss held by holders.

GateNewsBot22m ago

How long does it take for Bitcoin to rebound after a 50% drop? Top analysts provide timeframes based on three cycles of history

On February 14, news reports indicate that Bitcoin (BTC) has fallen about 50% from its all-time high, and the market is once again focusing on a core question: how long will this correction take to recover? Crypto market analyst Sam Daodu stated that by reviewing past cycles, a relatively clear timeframe can be identified.

Daodu pointed out that since 2011, Bitcoin has experienced over 20 deep corrections of more than 40%. Mid-cycle declines of 35% to 50% are typically used to release overheated sentiment and do not alter the long-term upward structure. In the absence of systemic shocks, prices generally return to previous highs within about 14 months.

GateNewsBot24m ago

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance?

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance? Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.

Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.