Solana Drops to Two-Year Lows — What Can NVIDIA’s 2008 Fractal Tell Us?

Key Takeaways

-

Solana has dropped to two-year lows near $80, losing over 42% in the past month.

-

SOL has broken below both the 100 MA and 200 MA, confirming a bearish structural shift.

-

Current price action closely mirrors NVIDIA’s 2008 crash fractal, which preceded an ~80% drawdown.

-

If the pattern continues, SOL could revisit the $33–$40 support zone.

-

NVDA took nearly 6–7 months after bottoming to confirm a trend reversal via MA crossover—SOL may follow a similar timeline.

-

Any strong reclaim of key moving averages would invalidate this bearish fractal.

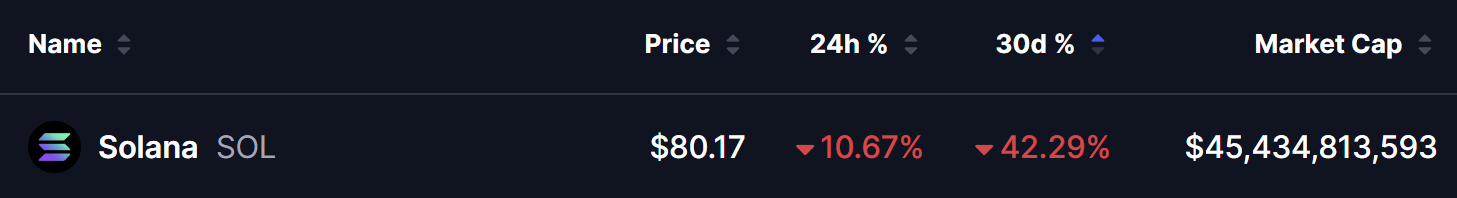

Solana (SOL) has plunged to two-year lows near $80, with price hovering around $80.17—down over 10% in the past 24 hours and more than 42% over the last 30 days. While the broader crypto market is under pressure, SOL’s decline stands out, wiping away much of the gains from previous cycles and dragging price back to levels last seen in early 2024.

But beyond the red candles and panic selling, an interesting historical comparison is emerging.

Source: Coinmarketcap

A fractal from NVIDIA’s 2008 bear market is starting to line up closely with Solana’s current structure—and it may offer clues about what could come next.

SOL Mirrors NVDA’s 2008 Bottoming Path

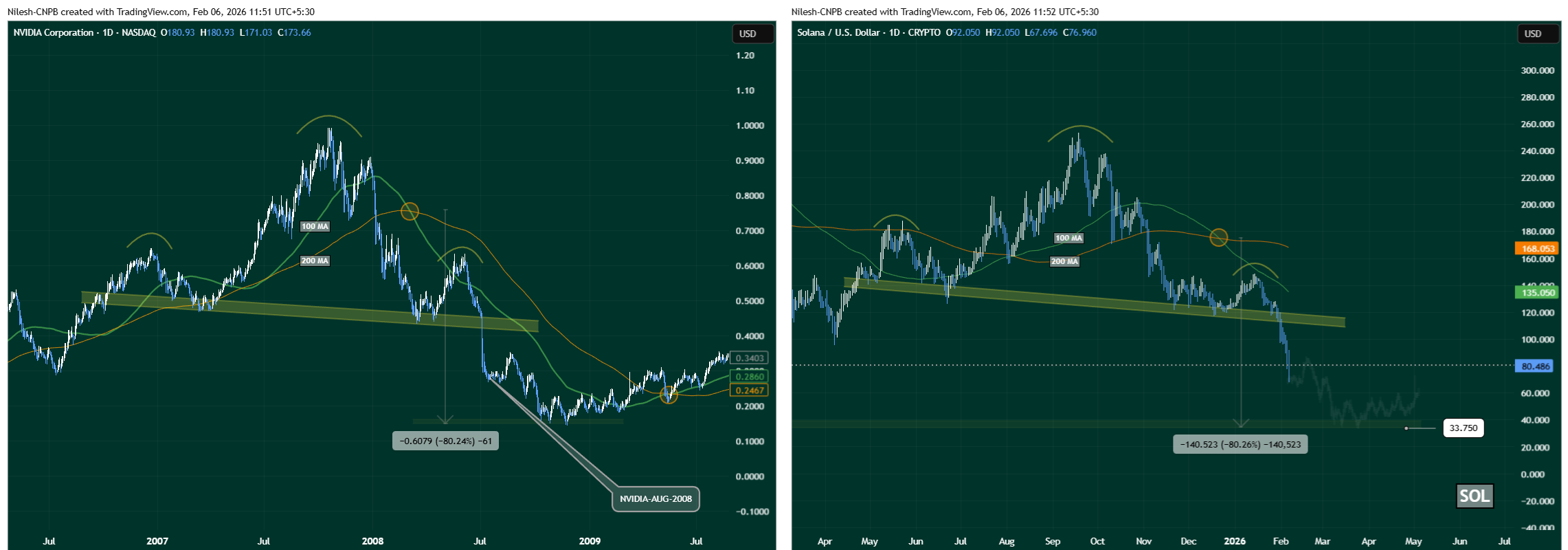

On the chart, Solana appears to be tracing a structure strikingly similar to NVDA’s August 2008 setup, right before NVIDIA entered its deepest capitulation phase.

Back during the global financial crisis, NVIDIA formed a classic head-and-shoulders breakdown. After peaking, price lost both the 100-day and 200-day moving averages, broke its neckline, and spiraled lower in a brutal selloff—eventually collapsing by roughly 80% from the top before finally stabilizing.

That decline wasn’t quick.

NVDA went through months of heavy selling, failed bounces, and weak rallies before eventually carving out a bottom and beginning a slow recovery.

NVIDIA-SOL Fractal Chart/Coinsprobe (Source: Tradingview)

Solana’s current chart echoes many of those same elements:

-

A parabolic run-up followed by a clear head-and-shoulders structure

-

Loss of the 100 MA and 200 MA

-

A decisive neckline breakdown

-

Weak rebound attempts that roll over beneath key moving averages

Even the projected downside move on SOL closely mirrors NVDA’s historical ~80% drawdown. If this fractal continues to play out, it points toward a potential dip into the $33–$40 zone, a major historical support area. That would represent another ~57% downside from current levels—though this remains speculative and highly dependent on broader market conditions.

What’s Next for Solana (SOL)?

If the NVIDIA-style fractal remains intact, Solana may still be in its capitulation phase.

In NVDA’s case, price didn’t immediately rebound after hitting the lows. Instead, it spent roughly 6–7 months consolidating, allowing moving averages to flatten and eventually cross back bullish before a sustainable recovery began.

For SOL, that suggests a similar roadmap could unfold:

-

Possible continuation toward the $33–$40 support band

-

A prolonged basing period marked by choppy price action

-

Only later, a potential moving-average crossover signaling trend reversal

In other words, even if SOL finds a bottom soon, a fast V-shaped recovery is unlikely. History favors a slower, emotionally exhausting accumulation phase.

Key Risk Note

Fractals provide context—not certainty.

While the structural similarities between SOL and NVDA 2008 are compelling, crypto markets operate under very different liquidity dynamics, narratives, and macro influences. Any deviation—such as strong inflows, ETF-driven demand, or a broader market reversal—could invalidate this setup entirely.

Downside levels must be respected, and confirmation should always come from price itself.

Bottom Line

For now, Solana appears to be following a classic bear-market script: breakdown, failed bounces, and potential capitulation ahead.

If the NVIDIA 2008 fractal continues to guide price action, SOL may still have unfinished business lower before a true bottom forms. While that sounds grim, it’s often these painful reset phases that lay the groundwork for the next long-term opportunity.

As history shows—markets don’t end in fear.

They rebuild quietly, after most participants have already given up.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Solana Price Faces Bearish Pressure with $57 Fibonacci Extension in Sight

Cryptocurrency Market Rebounds Amid U.S. Government Shutdown: Bitcoin, Ethereum, XRP, and Solana Rise Simultaneously

Solana rebounds back above $80, technical signals diverge, indicating two possible paths at $88 and $50

X Product Manager: Planning to update API policies to prevent applications from creating fee pools without user consent

Solana Crypto Phone Saga Focuses on Hardware-Level Security, Tucker Carlson Program Highlights, Web3 Wallet Protection Becomes a New Necessity