BONK surges 11% after breaking the price channel: Reversal or just a short-term hit?

BONK has experienced a strong breakout, rising 11.5% in just 24 hours, reaching $0.0000057189. Notably, trading volume surged 157%, officially breaking the long-term downtrend structure that had been suppressing the price. Market capitalization reached $632.66 million, indicating that speculative capital is returning decisively.

Simultaneously, open interest increased by 13.4% to $7.63 million, reflecting a significant expansion in derivatives activity. This is not a quiet movement but a signal that more aggressive traders using leverage are entering the market.

On the technical side, the price has broken through a key structural zone. On-chain data and funding rates suggest a deeper repositioning of market participants. Momentum is gradually being rebuilt, but this comes with increasing leverage—an all-too-familiar double-edged sword in the crypto market.

BONK is now at a critical turning point. Will this be the start of a sustainable structural recovery, or just a catalyst for a volatile wave driven by excessive speculation? The answer may soon become clear in the upcoming sessions.

BONK Price Movement

BONK has clearly broken out, surpassing the upper boundary of the descending channel on the daily timeframe, marking a notable change in the short-term trend structure. This breakout indicates that selling pressure has weakened, making room for buying interest to return.

Currently, the price is oscillating around $0.00000696 after successfully reclaiming a key support level at 0.00000557. However, the area around 0.00000743 is becoming a crucial pivot point in the short term, determining whether the current recovery momentum can be maintained.

In a positive scenario, if bulls defend this price zone firmly, upward momentum could extend to 0.00001221—an area that previously acted as strong supply and halted prior upward attempts. Further, 0.00001361 will be the next structural resistance to overcome.

A key difference in this rally is that the price has broken above the resistance line of the downtrend channel, rather than being rejected below as in previous technical rebounds. This suggests a shift in technical bias from a continuation of the downtrend to a potential reversal zone.

Regarding momentum, the RSI is currently around 45.44 after sharply rebounding from oversold levels below 30. This recovery reflects a rebalancing of buying and selling forces, though it’s not yet strong enough to confirm a robust bullish trend.

A move above the neutral 50 level on RSI would reinforce the bullish reversal signal. Even now, this rebound indicates a significant change in the market’s internal dynamics.

Instead of remaining suppressed in a downtrend, BONK is signaling that underlying strength is quietly accumulating, laying the groundwork for more positive volatility ahead.

Source: TradingView## Outflows Suggest Quiet Accumulation

Source: TradingView## Outflows Suggest Quiet Accumulation

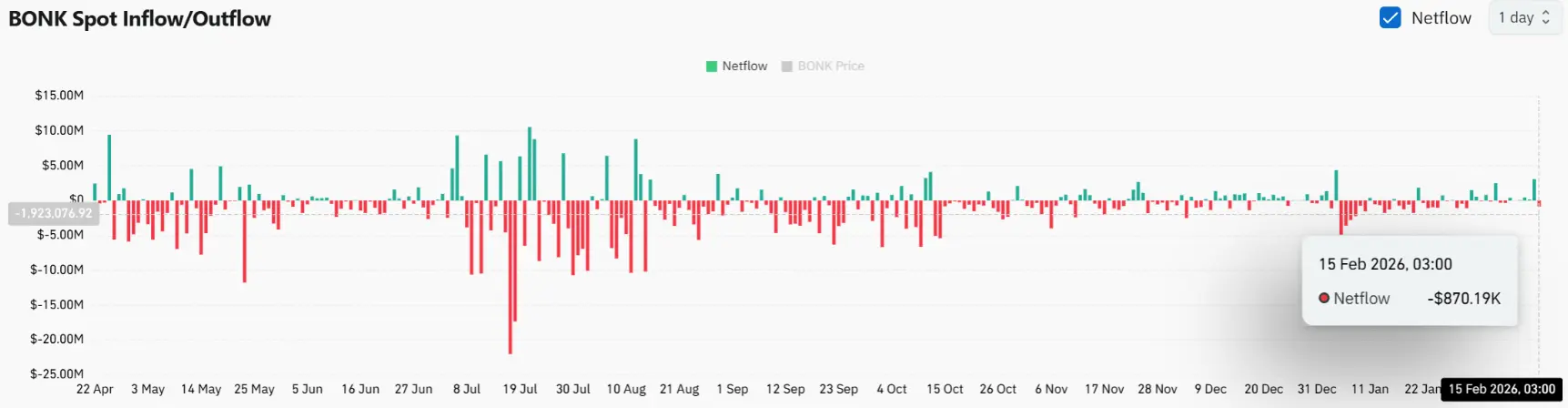

Net spot outflows have continued to stay negative over multiple sessions. The latest data shows approximately $870,000 worth of BONK has been withdrawn from exchanges—an indication that investors are favoring holding tokens rather than selling on exchanges.

In recent weeks, red bars have dominated the inflow/outflow chart. Notably, even as prices weaken, traders persist in withdrawing BONK from centralized platforms, reflecting a defensive mindset and accumulation trend.

This behavior directly reduces short-term sell liquidity. While outflows do not guarantee an immediate price increase, historically, they often precede periods of tightening supply in the market.

Contrasting with panic-driven token inflows—often early signs of crashes—the current flow pattern for BONK shows holders prioritizing storage over liquidation. Therefore, structural supply pressure at this moment does not support a strong distribution scenario.

Source: CoinGlass### Stacking short positions could lead to a short squeeze

Source: CoinGlass### Stacking short positions could lead to a short squeeze

The weighted funding rate currently stands at -0.0143%, indicating that bearish sentiment still dominates the derivatives market. This means shorts are paying longs to maintain their positions—a clear sign of market expectation divergence.

Importantly, open interest has surged by 13.4% to $7.63 million, reflecting increased trader participation and capital flow. The combination of a negative funding rate and rising open interest suggests that short positions are being stacked, especially as the price shows signs of breaking out.

When the funding rate remains negative while the price continues upward, this imbalance can intensify. If the bullish momentum persists, a short squeeze could occur, forcing short traders to close positions quickly and amplifying upward volatility.

Conversely, if the price fails to sustain current momentum, this scenario would reinforce bearish bets. Although technical structures are improving, most derivatives traders remain heavily short, creating a tense standoff in the market.

Source: CoinGlass## Summary

Source: CoinGlass## Summary

BONK has officially exited the downtrend channel, with RSI gradually recovering, on-chain outflows continuing, and funding rates remaining negative.

Structurally, the market currently leans toward a continuation of the upward trend. However, the rising open interest and dense short positions also increase the risk of sharp volatility.

If the price can hold above the recently reclaimed support zone, upward momentum is likely to extend to higher levels. Conversely, losing this support could trigger rapid deleveraging and sharp declines.

At present, technical developments are noteworthy, but the key factor will be how the derivatives market’s new positioning influences whether this breakout can develop into a sustainable recovery.