Memecoin: Phe Gấu pushes Dogecoin, Shiba Inu, Pepe into a difficult position

Meme coins such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are under significant pressure during Wednesday’s trading session, extending the downward trend that began on Sunday. Data from the derivatives market shows that capital is flowing out of DOGE, SHIB, and PEPE futures contracts, amid a wave of liquidations primarily focused on long positions. From a technical perspective, these meme coins are at risk of further correction as selling pressure reemerges and gains dominance.

Meme coins under overall market pressure, investor confidence wanes

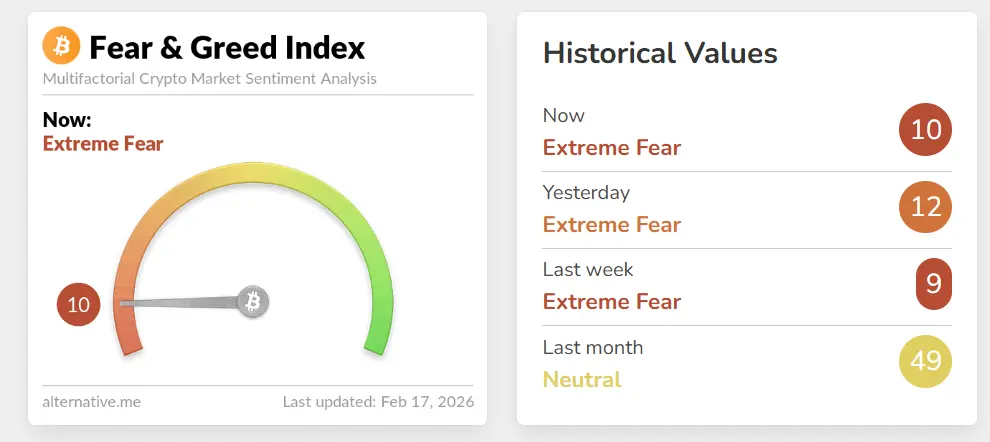

These meme coins are struggling to maintain buying support from retail investors amid volatile cryptocurrency markets. The Crypto Fear and Greed Index dropped to 10 on Wednesday, indicating extreme fear dominating the market.

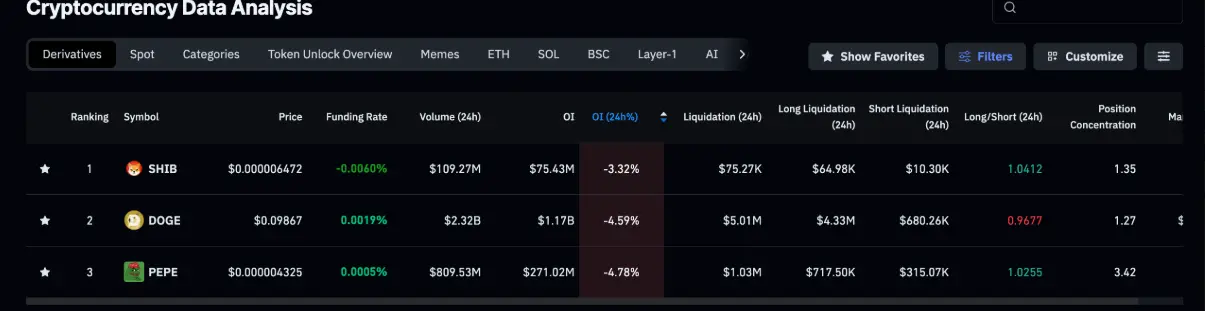

Crypto Fear and Greed Index According to data from CoinGlass, Dogecoin’s open interest (OI) reached $1.17 billion on Wednesday, down more than 4% from 24 hours earlier. This trend clearly reflects a reduced risk appetite among traders. The risk-averse sentiment is further reinforced as the total liquidation value over 24 hours hit $5.01 million, with liquidated long positions accounting for $4.33 million — indicating that capital outflows are mainly due to forced closures of buy orders.

Crypto Fear and Greed Index According to data from CoinGlass, Dogecoin’s open interest (OI) reached $1.17 billion on Wednesday, down more than 4% from 24 hours earlier. This trend clearly reflects a reduced risk appetite among traders. The risk-averse sentiment is further reinforced as the total liquidation value over 24 hours hit $5.01 million, with liquidated long positions accounting for $4.33 million — indicating that capital outflows are mainly due to forced closures of buy orders.

As a result, the long/short ratio continues to decline to 0.9677. When this ratio drops below 1, it indicates a significant increase in short positions, reflecting a market expectation of falling prices.

The weakening trend is not limited to Dogecoin. The open interest of SHIB and PEPE futures contracts decreased to $75.43 million and $271.02 million respectively on the same day, representing declines of over 3% and nearly 5%, indicating widespread selling pressure across the meme coin segment.

Data on meme coin derivatives | Source: CoinGlass## Dogecoin in a downtrend, at risk of losing all weekly gains

Data on meme coin derivatives | Source: CoinGlass## Dogecoin in a downtrend, at risk of losing all weekly gains

Dogecoin is currently trading below the key psychological level of $0.1000 as of Wednesday, down about 2% for the day. This meme coin continues its third consecutive correction, testing the closing price of February 6 at $0.0984.

In a scenario where the daily closing price decisively falls below this support zone, DOGE is likely to retest the February 11 low around $0.0879. Further down, the next notable support level is at the S1 pivot point, approximately $0.0803.

Daily DOGE/USDT chart | Source: TradingView Technical signals on the daily timeframe show a clear weakening of bullish momentum. The RSI is at 42 and continues to trend downward below the neutral line, indicating selling pressure still has room to grow before entering oversold territory. Meanwhile, although MACD remains above zero, the positive histogram is shrinking, suggesting the upward momentum is losing strength.

Daily DOGE/USDT chart | Source: TradingView Technical signals on the daily timeframe show a clear weakening of bullish momentum. The RSI is at 42 and continues to trend downward below the neutral line, indicating selling pressure still has room to grow before entering oversold territory. Meanwhile, although MACD remains above zero, the positive histogram is shrinking, suggesting the upward momentum is losing strength.

Conversely, if Dogecoin can regain a daily close above the psychological $0.1000 level, selling pressure may ease, opening the door for a recovery toward resistance around $0.1161.

Shiba Inu under pressure, risk of deeper decline

Shiba Inu declined 1.67% at the time of writing on Wednesday, extending its correction after being rejected at the supply zone of $0.00000700. Currently, the most probable scenario is that the price will continue to retreat toward the S1 pivot point around $0.00000528 — a potential decline of about 20%.

Daily SHIB/USDT chart | Source: TradingView Similar to Dogecoin, technical signals on the daily timeframe show Shiba Inu’s upward momentum weakening. The RSI has fallen to 45 and dropped below the neutral threshold, while the MACD histogram has narrowed significantly, reflecting diminishing buying pressure.

Daily SHIB/USDT chart | Source: TradingView Similar to Dogecoin, technical signals on the daily timeframe show Shiba Inu’s upward momentum weakening. The RSI has fallen to 45 and dropped below the neutral threshold, while the MACD histogram has narrowed significantly, reflecting diminishing buying pressure.

To confirm a bullish reversal, Shiba Inu needs to decisively break above the 50-day EMA at $0.00000723. If this occurs, the price could open up new upside potential toward the R1 pivot at around $0.00000921.

Pepe faces risk of returning to local lows

Pepe lost the 50-day EMA at $0.00000462 on Sunday, recording a decline of over 8%. As of Wednesday, this meme coin with the frog symbol has not shown signs of stabilization, continuing to decline by about 3%, amid increasing bearish pressure and focus on the key support at $0.00000363 — the low established on December 18.

Daily PEPE/USDT chart | Source: TradingView Pepe’s price action reflects the overall trend of meme coins, with bullish momentum gradually weakening. The RSI has fallen to 49 and dropped below the neutral line, indicating diminishing buying strength. Meanwhile, the MACD and signal line remain in negative territory, although the histogram above zero shows signs of narrowing, suggesting the downtrend is slowing but not yet reversing.

Daily PEPE/USDT chart | Source: TradingView Pepe’s price action reflects the overall trend of meme coins, with bullish momentum gradually weakening. The RSI has fallen to 49 and dropped below the neutral line, indicating diminishing buying strength. Meanwhile, the MACD and signal line remain in negative territory, although the histogram above zero shows signs of narrowing, suggesting the downtrend is slowing but not yet reversing.

To establish a sustainable recovery, Pepe needs to successfully break through the key resistance at $0.00000521 — a level that has repeatedly hindered upward movement in late January. A breakout above this level could open new growth avenues, with the next target at the R1 pivot point at $0.00000633.

Related Articles

Dogecoin Surges Towards $0.10 Amid Market Outperformance and Bullish Momentum

Dogecoin Breaks Channel Resistance as Momentum Builds Above $0.098

Dogecoin Rallies 20% as 4-Hour Contracting Triangle Breakout Lifts Price Toward $0.1168 Resistance