Dogecoin loses the $0.10 support: Can the downtrend be prevented?

With downward pressure and prolonged market weakness, Dogecoin (DOGE) failed to hold the $0.10 support level, causing the price to drop to a local low of $0.095 before a slight rebound to $0.099.

At the time of writing, DOGE is trading at $0.098, up 0.73%, indicating that high volatility continues to dominate the market.

Selling pressure weighs heavily on DOGE’s structure

DOGE has once again lost the critical $0.10 support level, mainly due to a significant increase in selling activity. This shows that the bears have exploited every opportunity to sell off, pushing the market into greater stress than ever before.

According to the Bulls and Bears Power indicator on TradingView, the bears currently hold almost absolute control of the market. Over the past 30 days, since the dominance of the bulls on January 19, the bears have maintained the upper hand continuously, while all attempts by the bulls to regain control have failed.

Source: TradingView As of now, the bears’ index has reached 64, far exceeding the 9 of the bulls, reflecting a large disparity in market strength. Although the bulls are still present, their presence is not enough to cause a significant trend reversal.

Source: TradingView As of now, the bears’ index has reached 64, far exceeding the 9 of the bulls, reflecting a large disparity in market strength. Although the bulls are still present, their presence is not enough to cause a significant trend reversal.

The Buy-Sell Strength indicator further supports this view. The sellers continue to hold the advantage, with their strength index rising to 68 at present.

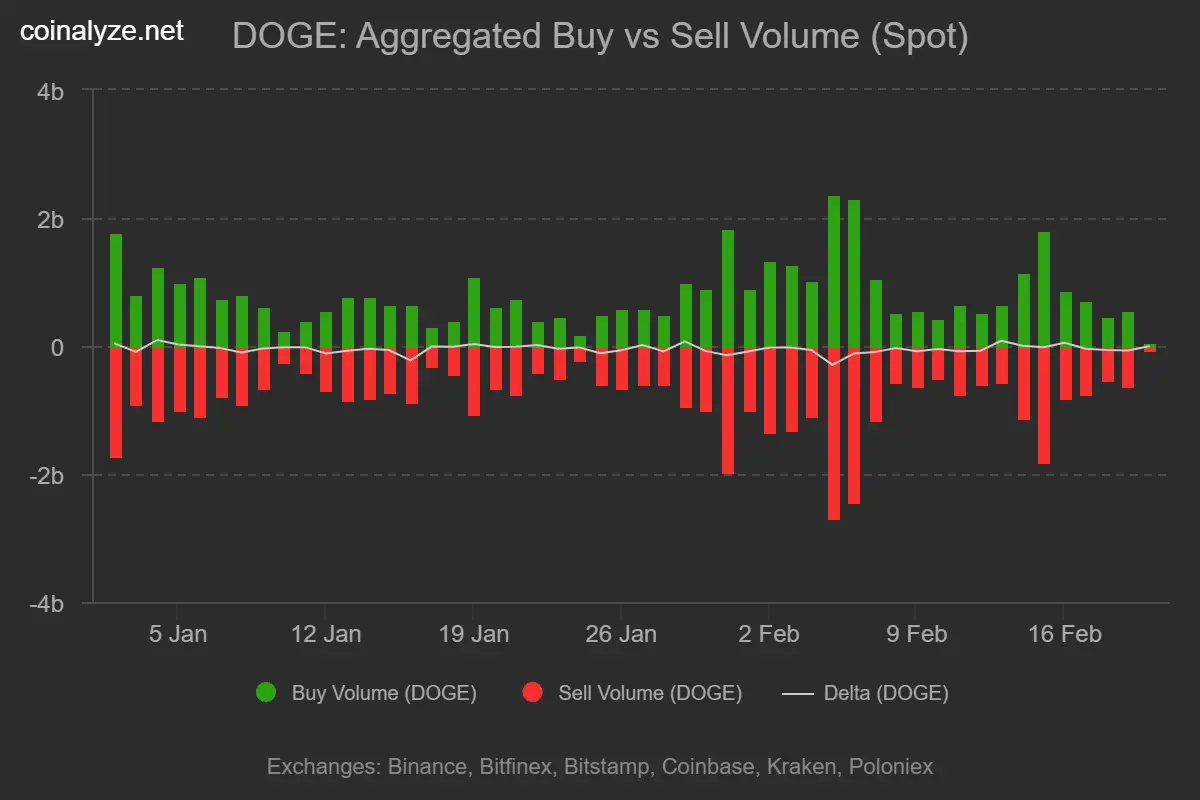

Additionally, trading activity data from exchanges also shows clear dominance by the bears. According to Coinalyze statistics, Dogecoin has recorded five consecutive days of higher selling volume compared to buying volume, reflecting a lack of confidence from the bulls.

Source: Coinalyze Specifically, in the past 24 hours, DOGE saw a selling volume of 697 million, while buying volume was only 619 million. As a result, the market recorded a negative buy-sell differential (-78 million), a clear sign that selling pressure is intensifying.

Source: Coinalyze Specifically, in the past 24 hours, DOGE saw a selling volume of 697 million, while buying volume was only 619 million. As a result, the market recorded a negative buy-sell differential (-78 million), a clear sign that selling pressure is intensifying.

History shows that such market behaviors often increase downward pressure and weaken any bullish momentum, leading to deeper price declines.

Will DOGE face further decline?

DOGE is currently trading below a key support level, amid ongoing dominance of selling pressure. With bears in full control, all attempts by the bulls to sustain an upward trend have been unsuccessful.

The Price Momentum Oscillator (PMO) for DOGE remains in negative territory, despite showing a bullish crossover a few days ago. This indicates that recent price movements are mainly downward. The market continues to close at lower prices, confirming the presence of a medium- to long-term downtrend rather than just a short-term correction.

Source: TradingView Moreover, DOGE’s Relative Strength Index (RSI) has remained below 50 throughout the past week, further reinforcing the bearish outlook. This prolonged downward momentum suggests that the downtrend is likely to continue.

Source: TradingView Moreover, DOGE’s Relative Strength Index (RSI) has remained below 50 throughout the past week, further reinforcing the bearish outlook. This prolonged downward momentum suggests that the downtrend is likely to continue.

If the downward trend persists, DOGE could drop to $0.092, with a risk of breaking below the $0.09 support level and continuing to slide toward $0.08. To reverse this negative scenario, DOGE needs to quickly regain the $0.10 level and stay stable above $0.11. Only then can the bulls have a chance to regain market control.

Giao

Related Articles

DOGE Coils at $0.1007 as Cup and Handle Tightens Below $0.1028

Dogecoin Price Holds $0.1016 Key Support After 34% 4H Ichimoku Rally Hits Daily Resistance

Dogecoin ETF 'Disconnect' in US as DOGE Price Sits Under $0.10 - U.Today