Search results for "ORDER"

Gold at $20K? Ron Paul Says Fiat Currency Breakdown Makes It Possible

Ron Paul says the global fiat monetary system is nearing a “climactic end,” warning that soaring debt, currency debasement, and political overreach are pushing the dollar—and the broader world order—toward a dangerous reckoning.

Liberty Advocate Ron Paul on Debt, Gold, and Why the Dollar’s

Coinpedia·3h ago

US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are teaming up for the first time to promote cryptocurrency regulation policies, aiming to establish clear boundaries for the industry. CFTC new Chairman Mike Selig explicitly stated that he will coordinate with the SEC to establish digital asset classifications and explore the creation of a transitional regulatory framework to reduce industry uncertainty. The two agencies will work together to lower regulatory friction, promote market order, and foster innovation.

ETH1.76%

区块客·01-31 13:55

Bitcoin Long Update: Re-Risking After Shutdown Noise Clears, $84K in Focus

_Bitcoin traders re-risk as shutdown noise fades, focusing on $84K and the monthly close for near-term direction._

Bitcoin traders reassessed risk exposure after uncertainty tied to a possible U.S. government shutdown faded.

Order flow conditions improved during late Asian trading, while

BTC1.38%

LiveBTCNews·01-31 08:20

Handled 350,000 Bitcoins over 3 years! U.S. Department of Justice seizes mixer Helix with over $400 million in cryptocurrency

The U.S. Department of Justice (DOJ) has officially completed a large-scale cryptocurrency seizure operation. Regarding the mixing service Helix, which played a key role in money laundering on the dark web, the U.S. government has lawfully obtained the final ownership of assets exceeding $400 million.

The DOJ issued a statement on Thursday stating that a final forfeiture order was issued by the court last week, confirming that the government can legally receive and dispose of previously seized cryptocurrencies, real estate, and financial account assets. These assets are closely related to Helix's operations and money laundering activities.

Investigations show that between 2014 and 2017, Helix handled at least 354,468 bitcoins. The platform's main users were individuals attempting to conceal the origins of illegal funds, including proceeds from dark web black markets.

A so-called "cryptocurrency mixer" or "mixing service" refers to the process of blending multiple cryptocurrency transactions to deliberately obscure the flow of funds.

区块客·01-30 08:12

Is a Single Entity Suppressing Bitcoin’s Price Below $90K?

_Bitcoin trades below $90K as order-book data suggests one large entity may be influencing price action and key support levels._

Bitcoin continued trading below the $90,000 level as market participants focused on unusual order-book behavior.

Analysts said price movement appeared restricted des

BTC1.38%

LiveBTCNews·01-30 07:50

SEC Backs Crypto in 401(k)s: A $10 Trillion Retirement Revolution Begins

In a landmark shift for the U.S. financial system, SEC Chair Paul Atkins has declared the "time is right" for cryptocurrencies to be included in 401(k) retirement plans, provided strong safeguards are in place.

This endorsement came during a pivotal roundtable on regulatory harmonization with CFTC Chair Mike Selig, who predicted digital assets will "flourish" under clear national rules. The move, building on a 2025 executive order, could unlock the vast capital of America's \$10 trillion

CryptopulseElite·01-30 03:56

US Seizes $400M in Crypto, Shattering Darknet Helix’s Anonymity Myth

In a landmark enforcement action, the U.S. Department of Justice (DOJ) has finalized the forfeiture of over \$400 million in assets linked to Helix, a notorious darknet cryptocurrency mixer.

This concludes a multi-year investigation into the service, which laundered more than \$311 million in Bitcoin between 2014 and 2017 for illicit darknet markets. The final order, entered by a federal judge in late January 2025, transfers legal title of the seized crypto and real estate to the U.S. go

CryptopulseElite·01-30 03:35

401K pensions can buy Bitcoin! SEC chairman stated that trillions of dollars in funds will be lifted

SEC Chair Atkins confirmed the inclusion of cryptocurrencies in 401K retirement plans, emphasizing the need for professional management rather than self-selected assets. In May 2025, the Department of Labor overturned the old guidance, and in August, Trump signed an order to clear the obstacles. 401K has total assets of more than $7 trillion, and a 1% allocation will bring $700 billion in inflows.

MarketWhisper·01-30 02:13

US Finalizes Forfeiture of $400 Million Tied to Helix Darknet Mixer

In brief

Helix processed over $311 million in Bitcoin at the time, operating as an unregistered mixer.

A judge entered a final forfeiture order in late January, transferring ownership of Helix-linked assets to the U.S. government.

The service pooled and redistributed Bitcoin to obscure tr

BTC1.38%

Decrypt·01-30 02:10

Gate Research Institute: Market downside risks have not yet been cleared, and funds are flowing into Ethereum options to pursue long volatility strategies

Latest data shows that BTC implied volatility is 38%, and ETH is 54%. The options market has a cautious outlook on short-term volatility, with demand mainly focused on downside protection. In the short term, market risk aversion is strong, and ETH's actual volatility has risen significantly. Recent block trades have been mainly bearish spreads, and Gate has launched a combined strategy order tool to improve trading efficiency.

GateResearch·01-29 10:51

Secured $8 million in seed funding, Bulk Trade aims to become the "performance king" of Perp DEXs

Bulk Trade in the Perp DEX space attempts to achieve centralized trading speed and decentralized settlement capabilities through a customized Solana validator client architecture. Its innovative order matching and propagation logic significantly improve trading efficiency, and by using a centralized current-price order book, it eliminates liquidity issues common in traditional DEXs, ensuring the security and execution efficiency of trades. Currently in internal testing, looking forward to its performance on the public testnet.

PANews·01-29 05:27

Flare Rolls Out FXRP/USDH, Edging Closer to an “XRP Standard” on Hyperliquid

Flare announced today that it has added an FXRP/USDH spot market to Hyperliquid, a move designed to deepen XRP liquidity and broaden the token’s utility inside one of DeFi’s fastest-growing on-chain order-book ecosystems. The FXRP/USDH pair follows the earlier rollout of FXRP/USDC and is part of Fla

BlockChainReporter·01-28 14:04

WhiteBIT firmly responds to Russia's ban order! Fully exited the Russian market in 2022

Ukrainian cryptocurrency exchange WhiteBIT strongly refutes Russia's ban allegations, stating that it has completely exited the Russian market since 2022. Russian authorities accused it of transferring $11 million to fund the Ukrainian military, but WhiteBIT clarified that this was a donation of the company's own funds and facilitated $160 million in cryptocurrency donations through Whitepay. The exchange lost 30% of its user base after withdrawing from Russia, but its business subsequently grew by 8 times.

MarketWhisper·01-28 03:05

Gold and silver hit new highs together! China enforces strict export controls, halving global supply

Gold breaks $5,100, silver hits $109 to reach a new high. China has increased its gold holdings for 14 consecutive months to 2,306.32 tons, and starting from January 2026, silver exports will undergo "one order, one review," halving exports of 70% of global refined silver and causing a surge. Zijin acquires a Canadian gold mine for $4 billion, with 533 tons accounting for 20% of China's reserves.

MarketWhisper·01-27 05:39

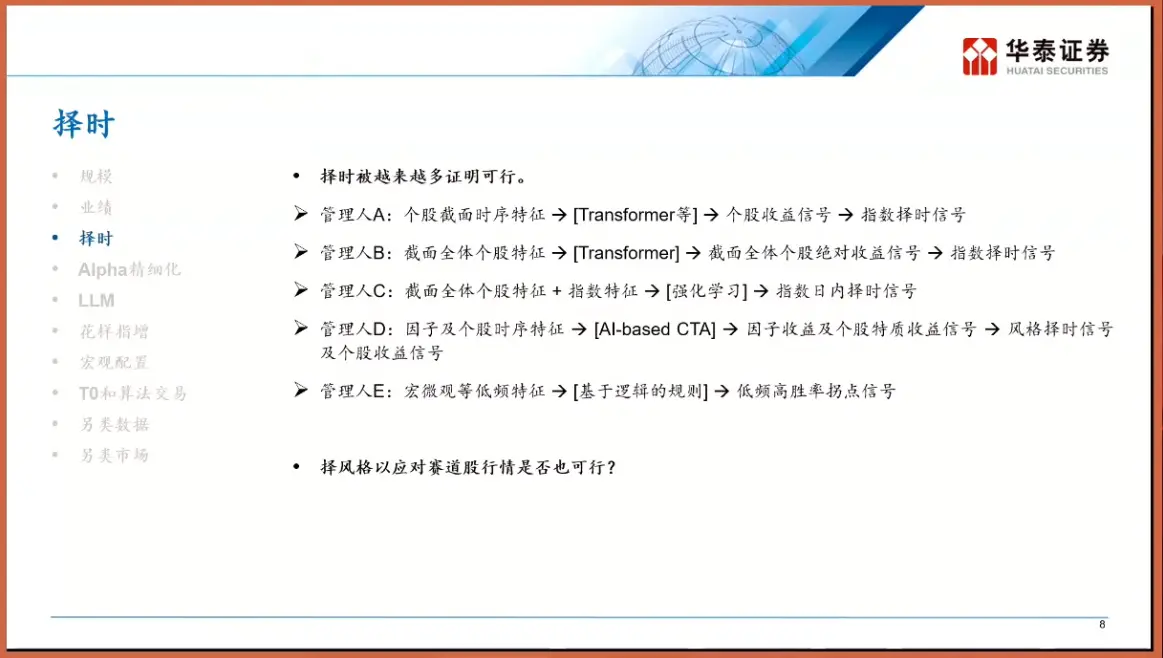

Forecast for 2026: Outlook on Quantitative Trading and How to Allocate Alternative Assets

Author: Max.s

After experiencing intense volatility in 2024 and profound reshuffling in 2025, the quantitative finance industry is standing at a new crossroads. At the 2025/2026 China Quantitative Investment Cross-Year Summit held last week, Dr. He Kang, Chief Strategist and Chief Financial Engineer at Huatai Securities Research Institute, delivered an in-depth speech titled "2025 Trends and 2026 Outlook for the Quantitative Industry." This is not only a strategic report on the A-share market but also a battlefield manual on how Alpha can find new survival spaces in an increasingly crowded market.

For practitioners at the intersection of Web3 and traditional finance, this report sends a clear signal: traditional Alpha is waning, and new paradigms — whether it is the "Order as Token" based on large models or alternative assets represented by cryptocurrencies — are emerging.

PANews·01-27 03:39

Bankless Founder: As Trump tears down the old order, Ethereum is establishing new rules

This year's Davos Forum focused on cryptocurrencies, but the statements from the Trump administration regarding the shift in the global order drew more attention. Speeches by the U.S. Secretary of Commerce and the Canadian Prime Minister mentioned the failure of the international order, emphasizing the fragility of cooperation between nations. Despite the failure of global cooperation efforts, decentralized protocols like Bitcoin and Ethereum may become a new hope for coordination mechanisms, potentially leading to a higher level of organizational structure.

PANews·01-26 09:06

AI rewrites Japanese manga creation! Good night Bubu author laments: Will I still be drawing next year?

"Good Night Bubu" author Ichiji Asano O is concerned about the rapid development of generative AI, believing that it struggles to provide innovation and is limited to imitating known styles. He points out that if the industry cannot explore the potential of AI, it will be difficult to achieve true breakthroughs. Furthermore, the manga industry faces the risk of a bubble, and creators need to learn how to utilize AI to improve creative efficiency in order to stay competitive in the market.

CryptoCity·01-25 03:41

Global Markets Send a Message in Q1 2026 — Here Are 10 Signals Investors Can’t Ignore

As markets lurch between relief rallies and sudden reversals, ten developments now unfolding across equities, bonds, currencies, and commodities suggest the global monetary order is quietly being rewritten heading into Q1 2026.

2026 Is Becoming a Stress Test for the Financial System

The

BTC1.38%

Coinpedia·01-24 19:56

Trump Talks ‘Crypto Capital’ At Davos As Bitcoin Defies Scrutiny

The host of a recent Discover Crypto video argues that the geopolitical and monetary order on display at Davos has shifted sharply, with President Donald Trump publicly embracing bitcoin and digital assets while global central bankers show visible discomfort.

The analyst from Discover Crypto

DailyCoin·01-23 15:12

Bought RTX 5080, received the product after refund, Amazon: The graphics card is on us for free! Netizens envy it

A player canceled their order and received a refund after purchasing an NVIDIA GeForce RTX 5080 graphics card on Amazon, but the graphics card was still delivered a few days later. Amazon customer service stated that the item could be kept by the player, leading to the unexpected receipt of a high-value graphics card. The incident has attracted community attention.

動區BlockTempo·01-23 07:20

"Based on activity rewards" mandatory order: Restructuring DeFi architecture for the US crypto bill

Coinbase withdraws support for the Senate's "Market Structure Bill," prompting DeFi developers to face legal and technical challenges. The bill requires redefining on-chain revenue standards, promoting a shift from static to dynamic revenue models, affecting the design of lending, DEXs, and aggregators. Developers need to proactively build verifiable contribution systems and participate in industry standard setting to adapt to regulatory changes and maintain innovation.

DEFI1.34%

TechubNews·01-23 02:17

When information becomes noise: How GateAI reconstructs the understanding order of the crypto market

Although the crypto market is rich in information, decision-making has become difficult. An overabundance of single indicators and short-term fluctuations lead to distorted decisions. GateAI aims to help users clarify the structural factors behind the market, reduce comprehension costs, and does not directly provide judgments. It integrates into the trading process, assisting users in distinguishing important information from short-term noise, with the final decision still in the hands of the user. This tool also supports market analysis and review, helping users understand the reasons behind price fluctuations, and is dedicated to enhancing traders' market understanding.

GateLearn·01-23 02:05

The body is the ultimate cold wallet. Don't lose your healthy private key.

The article discusses the necessity of physical health as an important asset in the crypto market. The author builds a biological moat by employing methods such as data monitoring, diet optimization, and supplement enhancement to improve metabolic efficiency and cognitive ability, in order to cope with high-intensity mental decision-making and market volatility. He emphasizes that ensuring physical health through scientific means is actually laying the foundation for future capital appreciation.

BTC1.38%

PANews·01-23 01:37

Lawyer Lin Shanglun's article: When Silicon Valley has already banned "manual handwritten drafts," is Taiwan still obsessed with using AI to beautify photos?

This article discusses misconceptions about AI application in Taiwan, pointing out that many professionals have not yet integrated AI with their expertise, resulting in missed opportunities for efficiency gains. Lawyer Lin Shanglun shares real cases of using AI for legal work in financial courses, shocking the audience and emphasizing that future professional work will be redefined. He calls on professionals to understand their own strengths and identify parts of their workflow that can be delegated to AI in order to adapt to future workplace changes.

動區BlockTempo·01-22 13:30

U.S Senate Delays Key Crypto Market Bill to Address Rising Housing Costs

Senate delays crypto bill to focus on housing issues before the 2026 elections.

Trump signs order limiting big investors from buying single-family homes.

Crypto oversight remains unsettled as committees work on separate bill drafts.

The U.S. Senate postponed a major cryptocurrency

CryptoNewsLand·01-22 12:36

Trump Davos Calls Out: Make America the Crypto Capital, Signing the Genius Act is a Strategic Move

Trump at Davos Reiterates Building the "Crypto Capital" to Beat China, Signs the "GENIUS Act" and Promotes Market Structure Legislation. However, the CEO of a US bank warns that stablecoins could lead to $6 trillion in deposit outflows. Last year, Trump signed an executive order banning CBDC and established a regulatory task force, reversing Biden's tough enforcement.

MarketWhisper·01-22 08:04

A detailed explanation of the NYSE's tokenized securities platform: Why conduct 7x24 hours trading

Writing: Cookie

January 19th, according to official sources, ICE Group's New York Stock Exchange announced today that it is developing a platform for tokenized securities trading and on-chain settlement, and will seek regulatory approval for this.

The NYSE's new digital platform will support tokenized trading experiences, including 24/7 operation, instant settlement, order placement in USD amounts, and fund transfers based on stablecoins. Its design integrates the NYSE Pillar matching engine with a blockchain-based post-trade system, capable of supporting multi-chain settlement and custody.

ICE Group President Lynn

TechubNews·01-22 06:15

Guernsey Seizes $11.4M in OneCoin Proceeds: The Slow Clawback From Crypto's Biggest Scam

Authorities in Guernsey have enforced a major forfeiture order, seizing approximately \$11.4 million (£9 million) linked to the infamous OneCoin Ponzi scheme.

The funds, held in a Guernsey bank account under a company name, were confiscated under proceeds of crime laws following an order from German prosecutors. This represents one of the most significant tangible financial recoveries to date in a fraud that siphoned an estimated \$4 billion from investors worldwide. The seizure highlight

IN-2.98%

CryptopulseElite·01-22 01:17

K1 Research: Funds have not exited the market; they just no longer love competing coins.

_This article is jointly published by K1 Research & Klein Labs_

2025 Monthly Event Review Calendar. source: Klein Labs

Looking back at 2025, this year was not simply a bull or bear market, but a re-positioning of the crypto industry within the multiple coordinates of politics, finance, and technology—laying the foundation for a more mature and institutionalized cycle in 2026.

At the beginning of the year, Trump’s inauguration and the digital asset strategy executive order significantly changed regulatory expectations. Meanwhile, $TRUMP token issuance brought cryptocurrencies into the mainstream, and market risk appetite rapidly increased. Bitcoin achieved a historic breakthrough of $100,000, marking the first transition from a "speculative asset" to a "political and macro asset."

Subsequently, the market quickly faced the backlash of real-world constraints. The celebrity coin decline, the Ethereum needle event, and Bybit experiencing an epic hacker attack

区块客·01-21 14:40

Guernsey Authorities Seize $11.4M Tied to ‘Cryptoqueen’ OneCoin Fraud

In brief

Local authorities in Guernsey have confiscated $11.4 million (£9 million) held in a local bank account linked to the OneCoin crypto scam.

The Royal Court enforced an overseas forfeiture order under Guernsey’s proceeds of crime laws.

The

IN-2.98%

Decrypt·01-21 14:06

SlowMist Flags Snap Store Attack Targeting Crypto Seed Phrases

The attackers hijacked the publishers on the Snap Store using expired domains and distributed malicious updates for the wallet.

The fake apps imitated Exodus, Ledger Live, and Trust Wallet in order to deceive users into entering their recovery phrases.

The attack is indicative of the increasing t

DEFI1.34%

TheNewsCrypto·01-21 13:58

ONDO Market Structure Analysis: Critical Support and Bullish Outlook for 2026

ONDO is at a critical market inflection point, with bullish order flow and key support zones signaling potential for significant 2026 growth.

Whale spot orders dominate ONDO’s accumulation phase, with rising CVD and strategic positioning ahead of the 2026 unlock event.

The $0.20 support l

ONDO0.74%

CryptoFrontNews·01-21 05:36

Davos Forum | Canadian Prime Minister Mark Carney Declares the Collapse of the International Order: Small Nations Unite to Counter Hegemony of Major Powers

Canadian Prime Minister Justin Trudeau emphasized at the World Economic Forum in Davos, Switzerland, that the "rules-based international order" has become a fiction, calling for middle powers to unite against great power hegemony. He declared that the traditional partnership between the US and Canada has ended, promoted a variable geometry diplomacy strategy, and supported Denmark's sovereignty over Greenland, demonstrating a commitment to uphold international rule of law. Additionally, after visiting Beijing, he successfully reached a trade consensus, expanding Canada's negotiation space.

ChainNewsAbmedia·01-21 04:13

Billionaire Bitcoin Holder Dalio: Monetary Order Breaking Down - U.Today

Billionaire Ray Dalio argues that the global monetary order is deteriorating, transitioning from trade wars to "capital wars," as nations hesitate to hold U.S. debt. He suggests a shift to hard currencies, evidenced by the rise in gold investments amidst geopolitical uncertainties.

BTC1.38%

UToday·01-20 18:14

K1 Research: Funds have not exited the market; they just no longer love competing coins.

_This article is jointly published by K1 Research & Klein Labs_

2025 Monthly Event Review Calendar. source: Klein Labs

Looking back at 2025, this year was not simply a bull or bear market, but a repositioning of the cryptocurrency industry within the multiple coordinates of politics, finance, and technology—laying the foundation for a more mature and institutionalized cycle in 2026.

At the beginning of the year, Trump's inauguration and the digital asset strategy executive order significantly changed regulatory expectations. Meanwhile, $TRUMP token issuance brought cryptocurrencies into the mainstream, and market risk appetite rapidly increased. Bitcoin historically broke through $100,000, marking the first transition from a "speculative asset" to a "political and macro asset."

Subsequently, the market quickly faced the backlash of real-world constraints. Celebrity coins declined, the Ethereum "injection" incident occurred, and Bybit experienced an epic hack.

区块客·01-20 14:35

Smart Contracts: On-Chain Exploration of the Final Form of Human Order

The history of human civilization is a pursuit of the "ideal order." The Wisdom Protocol (Prajna Protocol) aims to reconstruct social order through universal laws and address conflicts between individuals and the collective. It promotes the evolution of decentralized finance into a civilization by depersonalizing rules, automatically executing causality, and cycling value, guiding humanity to jointly build a just and sustainable future social model.

TechubNews·01-20 07:08

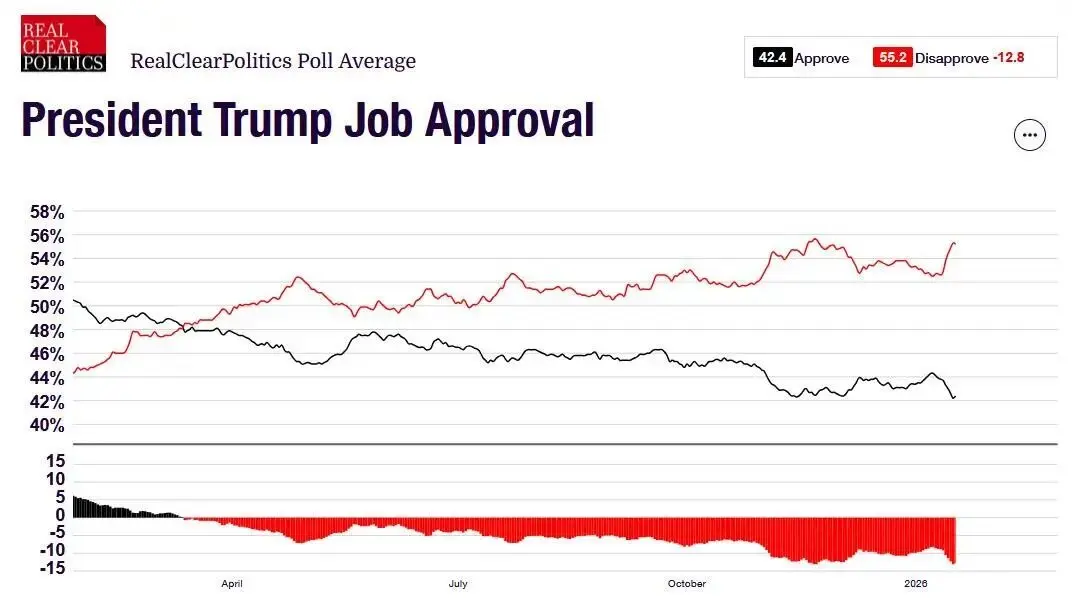

One year since Trump returned to the White House: American deterrence is rewriting the global risk order

During the second year of his second term, Trump faced domestic divisions and high inflation challenges. His governing style became increasingly unrestrained, implementing radical policies that raised concerns abroad. His approval rating remained relatively low, with voters dissatisfied with the economic management, which could impact the Republican Party's performance in the upcoming elections. Trump's policies and rhetoric have strengthened his power but have failed to effectively address people's livelihood issues.

動區BlockTempo·01-20 07:05

The funds haven't disappeared; they just no longer love altcoins.

This article is jointly published by K1 Research & Klein Labs

2025 Monthly Event Review Calendar source: Klein Labs

Looking back at 2025, this year was not simply a bull or bear market, but a reorientation of the cryptocurrency industry within the multiple coordinates of politics, finance, and technology—laying the foundation for a more mature and institutionalized cycle in 2026.

At the beginning of the year, Trump's inauguration and the digital asset strategic executive order significantly changed regulatory expectations. Meanwhile, $TRUMP token issuance brought cryptocurrencies into the mainstream, market risk appetite rapidly increased, Bitcoin historically broke through $100,000, completing its first leap from a "speculative asset" to a "political and macro asset."

Subsequently, the market quickly faced the backlash of real-world constraints. Celebrity coins declined, the Ethereum "插针" incident, and Bybit experienced an epic

PANews·01-20 01:31

BlackRock CEO warns: Capitalism is facing a crisis of trust! Calls for "democratization of investment," or it will lose its legitimacy

BlackRock CEO Fink pointed out at the Davos Forum that capitalism is facing a crisis of trust, mainly because the benefits of economic growth are not shared fairly. He advocates for "investment democratization," calling for reforms in institutional design to involve more investors, in order to rebuild social trust and reduce inequality.

動區BlockTempo·01-19 18:30

Legendary Peter Brandt is pessimistic about altcoins, stating that the Bitcoin cycle has not yet ended.

Peter Brandt warns that altcoins could become a "side effect" in the process of rebuilding the global monetary order as confidence in fiat currency declines. He emphasizes that Bitcoin is a unique phenomenon but remains skeptical about the sustainability of digital assets.

BTC1.38%

TapChiBitcoin·01-19 14:37

Dark Pools and the Hidden Side of Crypto Trading

Introduction

When you trade in the crypto market on centralized exchanges, you can see order books, ask and bid prices and trade data on your screens. On decentralized exchanges, this is not the case. There are no order books or ask and bid prices. Yet, you can see buying and selling on chain.

BlockChainReporter·01-19 13:13

"New global order = new global bull market = gold and silver bull market!" Bank of America: Gold is expected to break through 6000

Bank of America strategist Hartnett believes that Trump's fiscal expansion has contributed to a "new world bull market," and the bull markets in gold and silver will continue. However, the appreciation of East Asian currencies such as the yen may trigger liquidity tightening. It is recommended to invest in international stocks and assets related to economic recovery, while also paying attention to the Chinese market.

BTC1.38%

PANews·01-19 12:41

From Tweets to Trading: How Smart Cashtags Are Turning X into the Ultimate Web3 "Super Gateway"

The launch of the Smart Cashtags feature marks a significant transformation in the financial sector for the X platform, enabling users to complete the entire process from information acquisition to trade execution on social media. This new feature integrates real-time data and social sentiment analysis to structure financial information, reducing users' decision-making cycles. In the future, X may further integrate trading functionalities to create a new "social order flow," thereby challenging traditional financial systems and redefining investors' decision-making and trading methods.

TechubNews·01-19 10:09

Accused of the Ministry of Justice secretly selling Bitcoin reserves? White House investigation results: No sales, and will not sell in the future.

The White House clarified that the U.S. government has not sold confiscated Bitcoin and will incorporate it into the "National Strategic Bitcoin Reserve" in the future, marking a shift in U.S. crypto policy from liquidation to long-term holding. This decision is based on an executive order signed by Trump, emphasizing Bitcoin's status as a strategic resource and potentially influencing policy directions in the global crypto market.

TRUMP2.15%

CryptoCity·01-19 06:25

Interpreting predictive market data: How Polymarket becomes a leading indicator of Bitcoin trends

This article explores the application of prediction markets Polymarket in Bitcoin trend analysis, emphasizing the use of correlation information to build multi-dimensional models. By analyzing probability distributions of price resistance, linking macroeconomic indicators, and order book depth, investors can gain more forward-looking market insights than traditional analysis and improve the accuracy of asset allocation.

ChainNewsAbmedia·01-19 05:33

Warren Challenges Crypto in 401(k) Plans Amid Risk Fears

_Senator Elizabeth Warren is against the idea of cryptocurrency inclusion in 401(k) plans under the executive order issued by President Trump. She cautions that employees may face volatility and regulatory loopholes._

Senator Elizabeth Warren has expressed some concerns about the possibility of

BTC1.38%

LiveBTCNews·01-18 22:00

Nasdaq Warns Bitcoin Hardware Maker Canaan About Delisting

Canaan must raise its stock price above $1 for 10 consecutive days by July to avoid Nasdaq delisting. Currently trading at $0.79, the company experienced a brief rise after a significant order but lost its largest investor in December.

BTC1.38%

Decrypt·01-18 17:45

DOJ Confirms No Sale of Bitcoin Forfeited in Samourai Case

The US government confirms that forfeited Bitcoin remains unsold and is part of the Strategic Bitcoin Reserve, as mandated by Executive Order 14233. Concerns over compliance were addressed following reports of a suspicious transfer. Currently, the US holds over 328,000 Bitcoin, with ongoing efforts to develop its digital asset policy.

CryptoBreaking·01-18 00:30

Nasdaq Warns Bitcoin Hardware Maker Canaan About Delisting

Canaan must raise its stock price above $1 for 10 consecutive days by July to avoid Nasdaq delisting. Currently trading at $0.79, the company experienced a brief rise after a significant order but lost its largest investor in December.

BTC1.38%

Decrypt·01-17 17:41

US Confirms Bitcoin Forfeited in Samourai Wallet Case Remains in Strategic Reserve

US officials confirmed Samourai Wallet Bitcoin remains unsold and held in the Strategic Bitcoin Reserve.

Executive Order 14233 blocks the sale of forfeited Bitcoin and requires long term federal custody.

Government Bitcoin holdings now exceed three hundred thousand coins through

CryptoNewsLand·01-17 13:36

Load More