Search results for "STORM"

Bitcoin Hashrate Falls Sharply as US Winter Storm Forces Mining Shutdowns

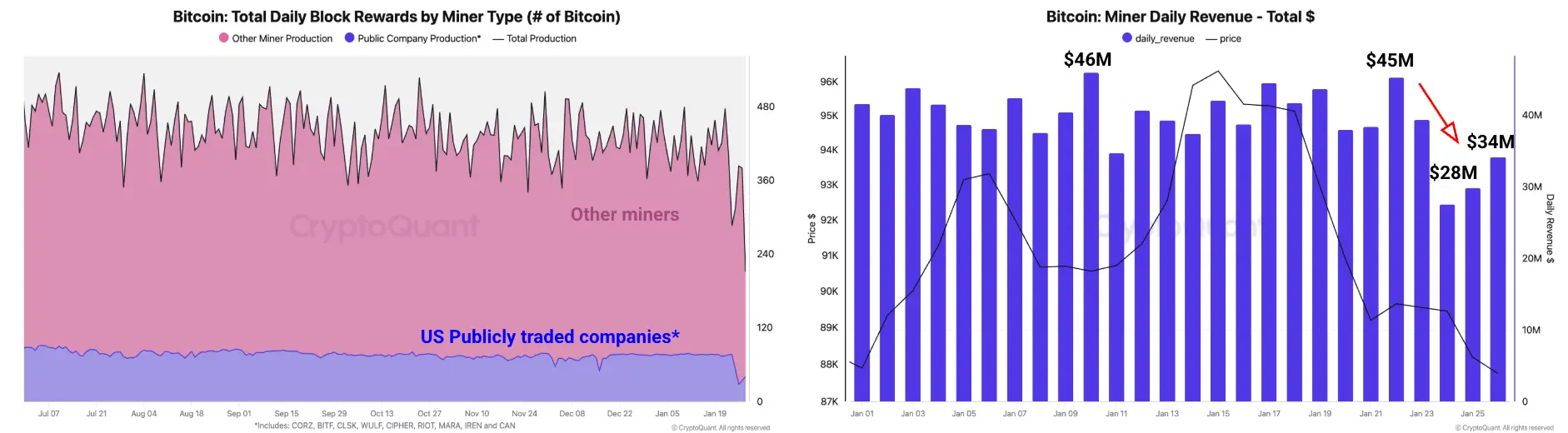

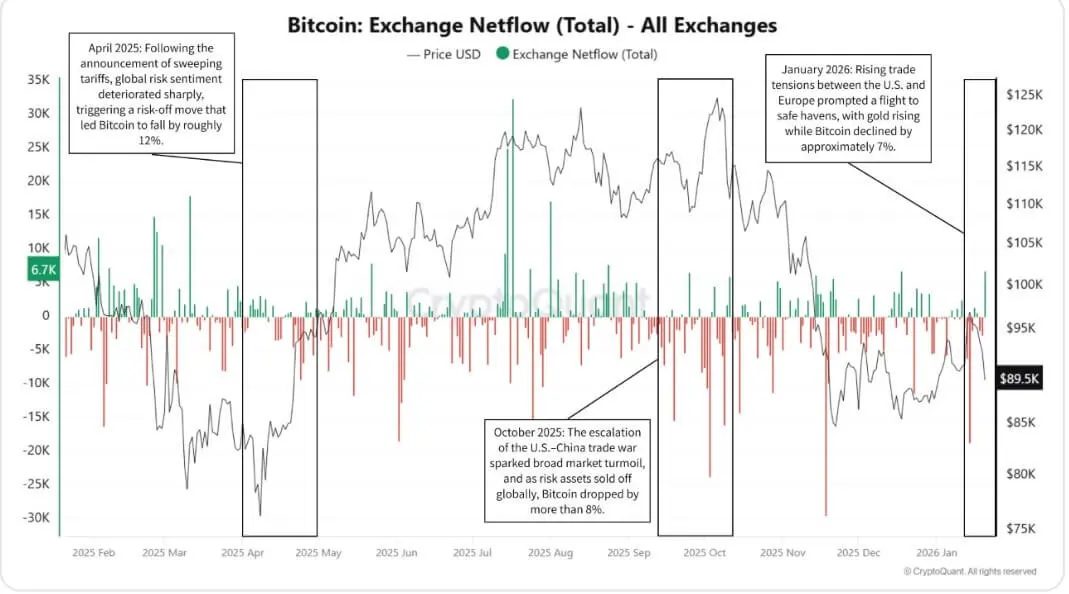

Bitcoin hashrate decline has grabbed market attention after network power dropped 12 percent since November. This marks the largest contraction since 2021. According to CryptoQuant, a severe US winter storm triggered widespread mining shutdowns across key regions. The event exposed how vulnerable

BTC1.67%

Coinfomania·8h ago

Storm in the US hits mining farms! Bitcoin hash rate drops by 12%, the worst decline since China's ban on mining.

Bitcoin mining activities are under severe pressure as US winter storms force several large mining companies to shut down their machines urgently, leading to a sharp decline in hash rate, output, and revenue. The total network hash rate has dropped to 970 EH/s, the lowest in nearly two years, and mining income has also hit a new low. Miners' survival space is shrinking, and more and more miners are facing losses.

区块客·17h ago

US Winter Storm Slows Bitcoin Miner Production, Data Shows

New data paints a clearer picture of how January’s US winter storm disrupted US Bitcoin (CRYPTO: BTC) mining operations, revealing a sharp downturn in daily production across publicly traded operators. The storm underscored the sector’s tether to energy-market dynamics, as grid stress, snow, ice

CryptoBreaking·02-01 21:35

Hashprice Near Yearly Lows Puts Bitcoin Miners Under Heavy Pressure

Bitcoin miners are kicking off February on shaky ground, with revenue slipping hard since mid-January and sitting well below July’s 12-month peak. On top of that, the U.S. winter storm has kept the hashrate stuck far beneath the lofty levels seen back in October.

Bitcoin Miners Start February

BTC1.67%

Coinpedia·02-01 18:34

US Winter Storm Weighs on Bitcoin Mining Network, Cryptoquant Finds

Bitcoin mining took a direct hit from January’s U.S. winter storm, with Cryptoquant data showing sharp declines in hashrate, production, and miner revenue across the network.

Bitcoin Mining Production Falls to Post-Halving Lows

According to Cryptoquant researchers, several large U.S.-based mini

BTC1.67%

Coinpedia·01-31 15:13

Kevin Wash: Inflation is an "option," I see Bitcoin as an important asset

Summary: A Fish CoolFish

Source: Hoover Institution

Note: The original video was recorded in May 2025

Host: Welcome to "Extraordinary Insights." I am Peter Robinson. Kevin Wash was born in northern New York, graduated from Stanford University, and later earned a law degree from Harvard University. Mr. Wash's early career included positions on Wall Street and in Washington. In 2006, President George W. Bush appointed him to the Federal Reserve Board, where he served until 2011. Notably, Mr. Wash served as a Federal Reserve Governor during the 2008 financial crisis—which was arguably the most severe financial storm in over half a century. Today, Mr. Wash commutes between New York and Stanford: he works at an investment firm in New York and is a researcher at the Hoover Institution at Stanford University.

Kevin, welcome back.

BTC1.67%

PANews·01-30 09:12

Why Is Crypto Market Down Today? $2B Liquidated as Bitcoin Plunges to $81K Amid Geopolitical Storm

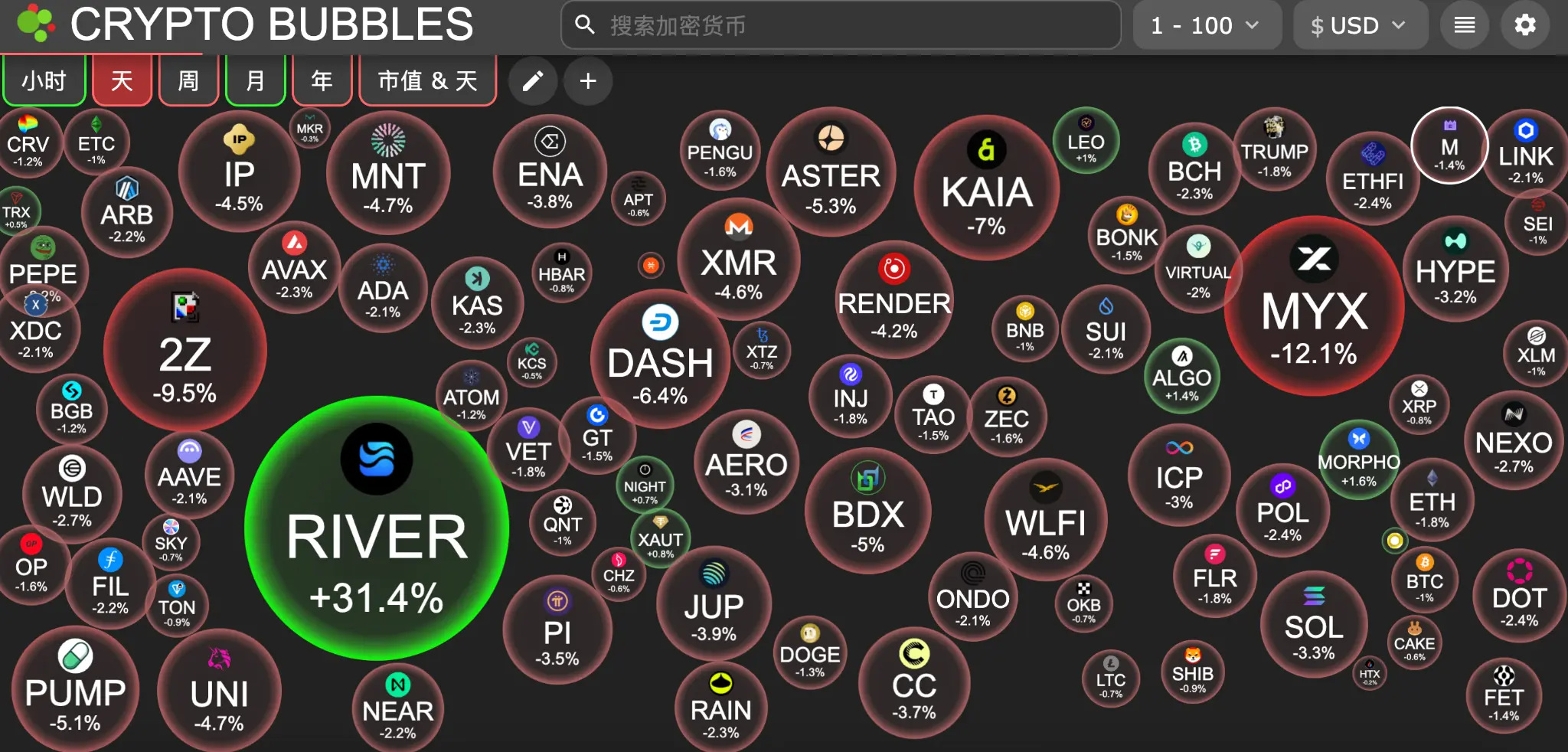

The cryptocurrency market experienced a violent and broad-based crash, wiping out over \$240 billion in total market capitalization in a severe downturn. Bitcoin plunged more than 7% to breach \$81,000, while Ethereum fell 8% to \$2,689, dragging major altcoins down 6-13%.

The sell-off triggered a massive deleveraging event, with over \$1.7 billion in long positions liquidated in 24 hours, affecting more than 267,000 traders. This panic was driven by a confluence of macro shocks: escalat

CryptopulseElite·01-30 06:52

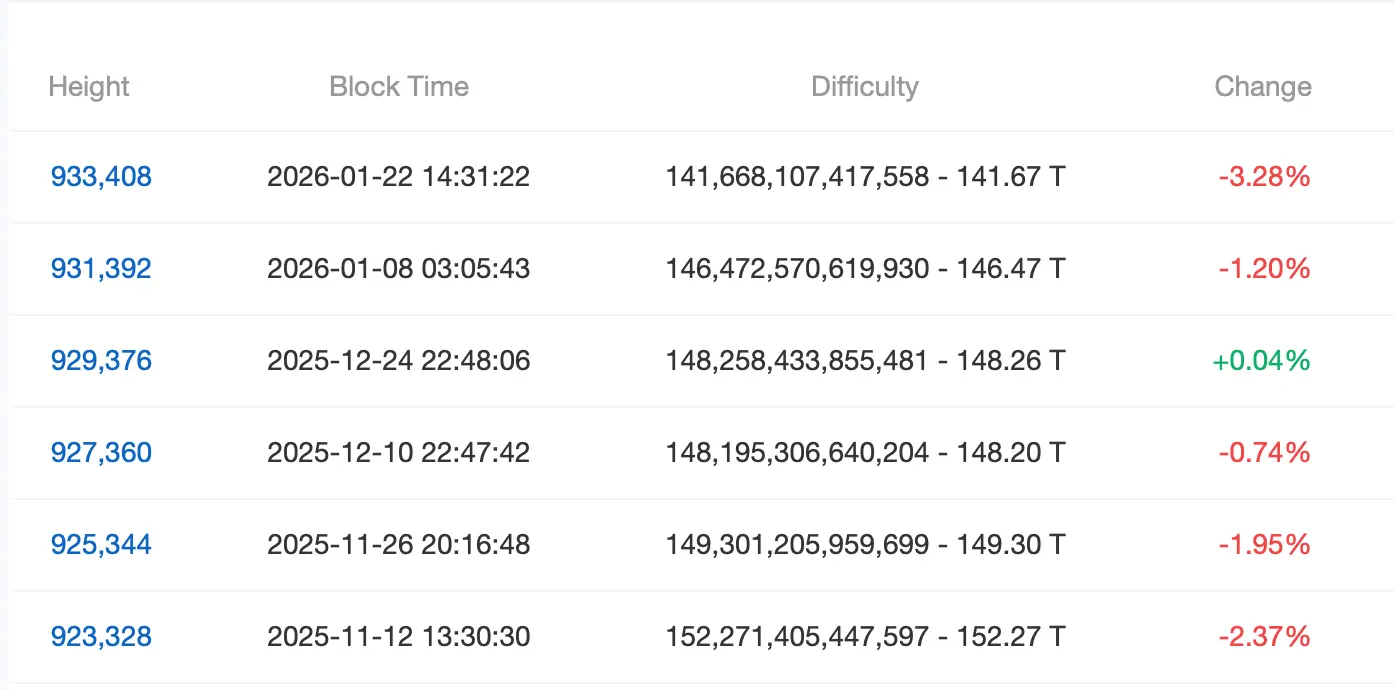

Massive Bitcoin Difficulty Cut Looms After Hashrate Loses Nearly 250 EH/s

As an Arctic storm front batters multiple U.S. states, bitcoin mining activity across the country has pulled back sharply, with American-based operators scaling down operations to ease pressure on the power grid during a difficult stretch. As a result, Bitcoin’s network hashrate has declined

BTC1.67%

Coinpedia·01-28 17:45

Bitcoin Hashrate Plummets 40% Amid U.S. Winter Storm

_Bitcoin hashrate reaches a seven-month low after an ice storm takes miners offline in the U.S. Big players, including MARA, reduce production as grid pressure mounts._

The mining network of Bitcoin collapsed dramatically over the weekend. The hashrate dropped to a seven-month low.

There

BTC1.67%

LiveBTCNews·01-28 05:50

Senior Trader: Countdown to Collapse Has Started, All 3 Major Indicators of Recession Triggered

Senior Trader NoLimit warns on Sunday that "a full-scale crash countdown has begun," citing White House sources indicating that the market pattern in early 2026 is eerily similar to the 2008 Great Recession. Key indicators include a surge in Federal Reserve repurchase tools, gold and S&P 500 falling out of balance and breaking support levels, and the Sam rule hovering in the danger zone between 0.35% and 0.50%. The real estate debt bomb, waves of corporate bankruptcies, and de-dollarization trends form a potential perfect storm for a collapse.

MarketWhisper·01-28 02:33

Brent Crude Price Fell Today Even as U.S. Oil Production Took a Hit

Brent Crude price moved lower on January 27, 2026, even as major disruptions hit U.S. oil output. The decline caught attention because it came on a day when nearly 2.0 million barrels per day of American production were knocked offline by a powerful winter storm. The reason behind the move

CaptainAltcoin·01-27 18:35

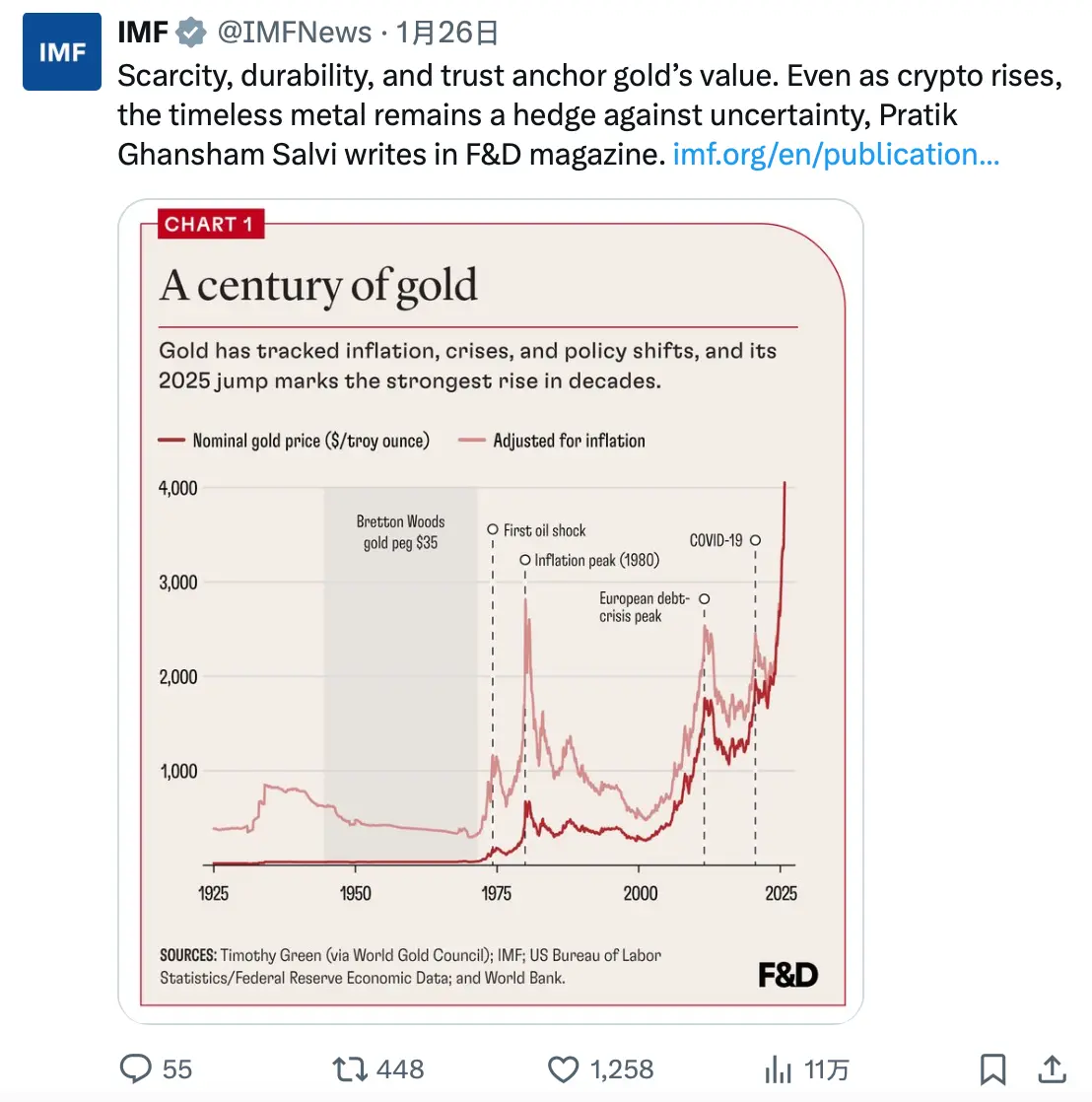

The hottest market since 1979, why does it appear in gold, silver, and copper?

Author: Eli5DeF

Compilation: Yuliya, PANews

Driven by a "perfect storm" of supply scarcity, the booming infrastructure of artificial intelligence(AI), and central banks worldwide distancing from the US dollar, gold, silver, and copper are experiencing their hottest market since 1979.

This article will analyze over 40 research reports, distill key insights, and explore their future trends.

TL;DR

Data perspective: Since 2025, gold prices have increased by 72%, silver by 120%, and copper by 40%. This is the first time in 45 years that all three have simultaneously hit record highs.

Core argument: This is not a cyclical rebound but a fundamental shift in the valuation logic of hard assets(hard assets) on a global scale.

Investment opportunity: In 2025, the return on silver mining ETFs reached as high as 195%, and this round of trading has yet to

PANews·01-27 09:10

Winter Storm Fern Exposes Bitcoin’s Vulnerability: Hashrate Drops 8% as US Miners Curtail Operations

A severe winter storm sweeping across the United States has triggered a significant stress test for the Bitcoin network, leading to an estimated 8-10% drop in global hashrate as major American mining operations voluntarily curtailed power to stabilize local grids.

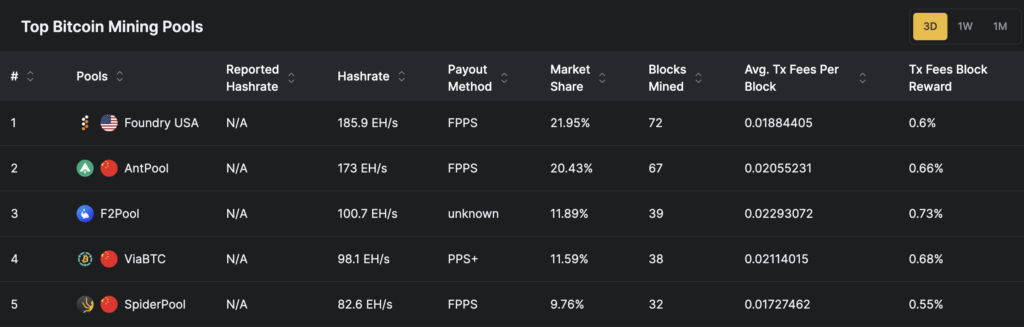

Leading mining pool Foundry saw its hashpower plummet by as much as 60%, from 340 EH/s to 136 EH/s, highlighting the network's growing dependence on geographically concentrated, grid-responsive mining. This event underscores a

CryptopulseElite·01-27 03:32

Bitcoin hash rate drops 30% in emergency! US winter storm paralyzes Foundry mining pool

The US storm caused Foundry's hash rate to drop from 340 to 242 EH/s (-30%), and the block time surged to 14 minutes. Luxor also took offline 110 EH/s. Texas miners participated in the ERCOT power outage plan, with CleanSpark reducing hundreds of megawatts in just a few minutes. Geographic coordination and dual concentration expose vulnerabilities.

MarketWhisper·01-27 02:39

Deadly US Winter Storm Disrupts Foundry USA and Other Mining Pools

The winter storm sweeping across much of the United States has forced adjustments in energy consumption by Bitcoin mining operators, with Foundry USA—home to the largest Bitcoin mining pool by hash power—scaling back its output by roughly 60% since Friday. The curtailment translates to a loss of

CryptoBreaking·01-26 22:10

US Bitcoin Miners Slow as Winter Storm Hits Power Grids

In brief

U.S.-based Bitcoin mining pools reduced activity during a major winter storm.

Foundry USA’s hashrate dropped from about 260 EH/s to near 124 EH/s before rebounding.

The slowdown reflects grid curtailments and demand-response practices during extreme weather, Decrypt was told.

Bi

Decrypt·01-26 14:20

Severe cold weather in the United States impacts Bitcoin mining industry! Miners cooperate with power outages, and the hash rate of mining pool Foundry USA drops by 60%

The US winter storm severely damaged the power grid, forcing Bitcoin miners to shut down on a large scale, leading to a decrease in overall network hash rate and extended block generation times. Although the short-term impact is evident, the network's automatic adjustment mechanism will ensure normal operation. The event highlights the new role of miners in the energy system, and future attention should be given to whether resilience can be maintained under extreme conditions.

動區BlockTempo·01-26 14:00

Trading time: Gold and silver hit new highs again and again, with Bitcoin's next support zone between $84,000 and $86,000.

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

The global macro market is currently in a fierce storm triggered by geopolitical games, fiscal crises, and industrial cycle resonances, with risk aversion and speculative fervor coexisting. As the US ICE shooting incident led to a breakdown in congressional budget negotiations, Polymarket data shows that the probability of the US government shutting down before January 31 has soared to 79%. Coupled with the Trump administration's tariffs and island purchase threats against Canada and Greenland, as well as the deployment of the US Navy's "Lincoln" aircraft carrier to the Middle East to address the Iran situation, global "credit devaluation" trading has reached a climax. Spot gold has historically broken through the $5,000 mark, rising over 2.3% intraday to a high of $5,106, with US banks aggressively predicting it will reach $6,000 by spring 2026; spot silver is also driven by the rigid demand from AI and solar energy industries, breaking

PANews·01-26 07:23

Foundry USA Plummets 60%: Winter Storm Exposes Mining’s Grid Role & 2026’s Top Pools

Winter Storm Fern has forced a dramatic, voluntary shutdown of Bitcoin mining operations across the United States, triggering a near 60% collapse in the hashrate of Foundry USA—the world's largest mining pool.

This event highlights a critical evolution in the industry: miners are no longer just power consumers but active, flexible assets for stabilizing national power grids during crises. As block production slowed to 12 minutes, the incident provides a stark real-time case study on the

STORM1.59%

CryptopulseElite·01-26 03:43

The Looming but Distant Storm: A Realistic Timeline for Quantum Threats to Blockchains

The narrative surrounding quantum computing’s imminent threat to cryptography, and by extension blockchains, is often marked by hype and misunderstanding.

While the risk is genuine, the timeline to a cryptographically relevant quantum computer (CRQC) capable of breaking today's public-key cryptography is frequently overstated, leading to potentially costly and risky premature transitions. This analysis, building upon a16z Crypto's expert perspective, dissects the distinct risk profiles fo

STORM1.59%

CryptopulseElite·01-26 02:02

Deadly US Winter Storm Disrupts Foundry USA and Other Mining Pools

The winter storm sweeping across much of the United States has forced adjustments in energy consumption by Bitcoin mining operators, with Foundry USA—home to the largest Bitcoin mining pool by hash power—scaling back its output by roughly 60% since Friday. The curtailment translates to a loss of

CryptoBreaking·01-25 22:05

Bitcoin miners face shutdown crisis! An 1800-mile ice storm hits the US, potentially crippling 38% of global hash rate

AccuWeather warns that an ice storm will sweep across 1,800 miles of the southern United States, affecting 60 million people. The US controls 38% of the global Bitcoin hash rate, and 137 mining farms in Texas and other areas face power outages. Bitcoin miners may repeat the voluntary shutdowns of 2022 to reduce grid load, saving Texas $18 billion in grid costs.

MarketWhisper·01-23 07:13

$1.5 billion settlement storm! Bitcoin drops below 90,000, wiping out all gains in 2026

Bitcoin falls below the $90,000 psychological threshold, erasing all gains for 2026. Over the past 48 hours, liquidations have exceeded $1.5 billion, and bulls are surrendering. Turmoil in the Japanese bond market has triggered global liquidity tightening, with whales depositing $400 million into exchanges, and spot ETFs experiencing outflows of $900 million over two days. The key support level of $89,800 to $90,000 serves as the dividing line between bulls and bears.

MarketWhisper·01-22 02:26

Best AI Crypto Coins: DeepSnitch AI Gearing Up To Take AI Sector by Storm With a 100x Move, FET and TAO Log Heavy Correction

The Injective Protocol community was in favor of a massive tokenomics update with over 99% support. The proposal introduced changes to issuance and buyback parameters that maintain the rules of the INJ token’s removal from circulation.

Despite its resilience for the majority of Q4, many

CaptainAltcoin·01-21 10:05

XRP Under Siege: 7-Day Slide Meets AI's $10 Dream Amidst Global Risk-Off Storm

XRP has extended its losing streak to seven consecutive days, trading around \$1.89 as a potent cocktail of global risk aversion triggers the second-ever day of outflows from U.S. spot XRP ETFs.** **

Geopolitical tremors—from Trump's NATO tariff threats to a snap election in Japan spiking bond yields—have forced a flight to safety, overshadowing XRP's robust fundamentals. Despite this technical breakdown, a starkly bullish counter-narrative emerges from AI analysis, with the latest ChatGP

CryptopulseElite·01-21 04:04

Altcoin liquidation storm! XRP, AXS, DUSK may face $600 million bloodbath this week

In the third week of January, the market cleared nearly $900 million, with Trump's tariffs causing volatility. XRP, AXS, and DUSK are the most dangerous altcoins. XRP rebounded to $2.29, risking liquidation of $600 million in shorts, with whales buying at low levels. AXS surged over 120% but exchange deposits reached a three-year high. DUSK, after rising sixfold, fell below $0.13, risking liquidation of over $12 million in longs.

MarketWhisper·01-20 03:26

Silver Supply Squeeze and Gold Surge Indicate Rising Financial Storm, Cautions Peter Schiff

Peter Schiff warns that rising gold and silver prices reveal significant vulnerabilities in the banking system, as banks face a severe silver shortage. He predicts a potential financial crisis as investors seek tangible assets for protection against economic stress.

BTC1.67%

BlockChainReporter·01-19 11:13

Platform X slashes "manure removal," InfoFi narrative collapses: KAITO drops 20% in a single day

One of the world's largest social media platforms, X, has carried out a "surgical" crackdown on its developer API policies, explicitly banning applications from rewarding users for posting on the platform. This move directly targets the core of the so-called "InfoFi" narrative in the crypto space.

Relying on this model, leading project Kaito's token KAITO plummeted nearly 20%, and similar tokens like COOKIE from Cookie DAO also experienced a sharp decline. The product head of X openly stated that this move aims to eliminate "AI spam" and reply spam generated by incentives, thereby improving the platform's content quality. This sudden regulatory storm not only caused the market value of related tokens to evaporate but also forced platforms like Kaito and Cookie to urgently shut down their core incentive features and seek transformation. The incident exposes the significant policy risks inherent in crypto business models built on a single centralized platform and serves as a wake-up call for the entire crypto industry’s over-reliance on social data and the attention economy.

MarketWhisper·01-16 01:56

Bitcoin breaks through $97,000! Nearly $800 million in shorts liquidated, is BTC returning to $100,000 soon?

Bitcoin broke through strongly this Wednesday, with the price soaring to around $97,000, reaching a new high since mid-November last year. This sudden surge triggered a large-scale liquidation storm in the crypto market, with nearly $800 million in liquidations across the network in the past 24 hours, of which 87% were short positions liquidated.

The rally was driven by multiple positive factors: legislative progress on the US "Clear Act" reshaping regulatory expectations, the latest CPI data showing stabilized inflation boosting risk assets, and the US Bitcoin spot ETF recording a massive net inflow of $754 million in a single day, the best performance since October last year. On-chain data shows that active buying in the spot market has regained dominance, ending nearly two months of sideways consolidation, with the market now focusing on the key psychological level of $100,000.

MarketWhisper·01-15 05:22

The Calm Before the Storm – Why Buying $HUGS Now Is Smarter Than Chasing the Next SHIB or SOL Rally!

As of mid-January 2026, the crypto market total cap has climbed to $3.14 trillion. While experts look at the Solana price prediction 2026 reaching $200, Shina Inu news focus is on a slow recovery from recent exploits. Famous coins have huge sizes, making big gains harder to find now.

Could there be

BlockChainReporter·01-14 19:03

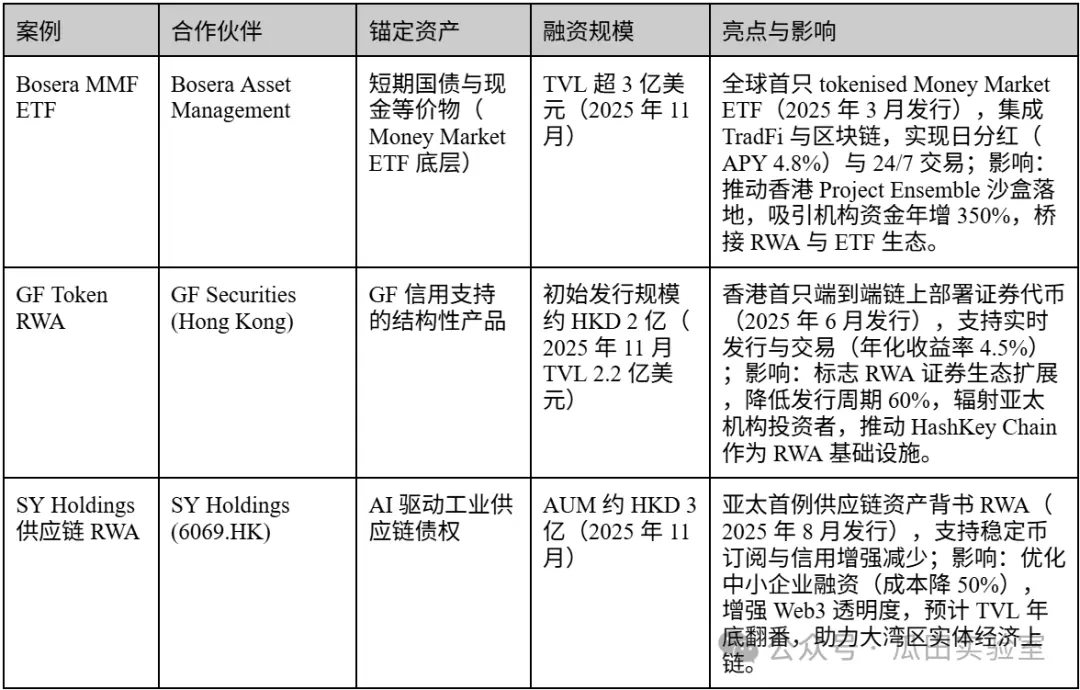

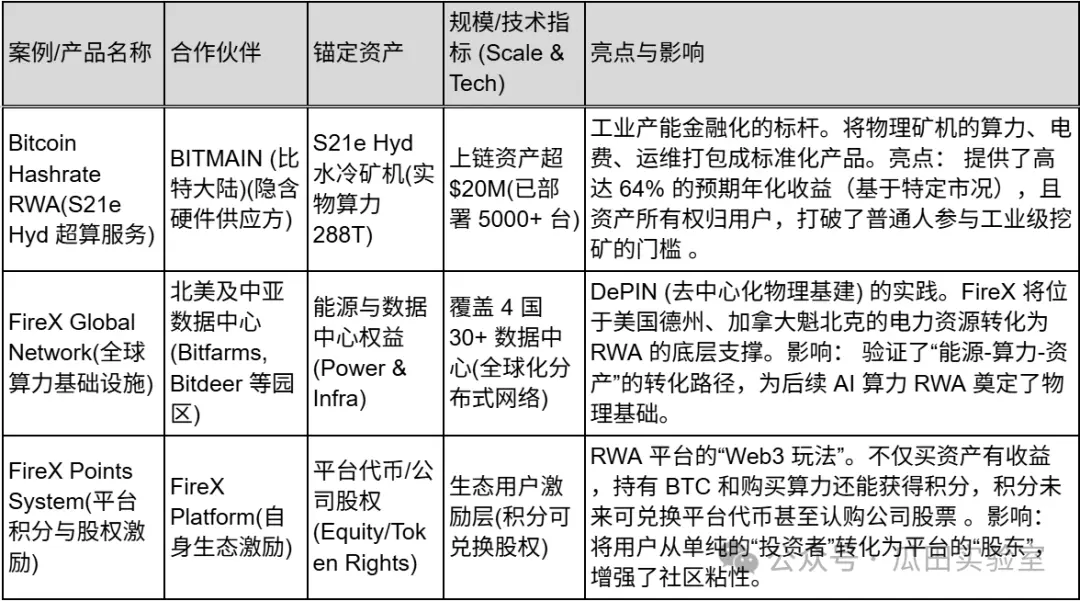

Hong Kong RWA Storm (Part 1): From Frenzy to Reconstruction, an Analysis of the Nine Major Factions

Author: Brian, Gua Tian Laboratory W Labs

In early August 2025, Hong Kong's RWA and stablecoin sectors reached their hottest peak in nearly five years. At that moment, the entire city was filled with the passion that had not been seen since 2017-2018: senior executives from traditional financial institutions, AI entrepreneurs, and even industry capital leaders flocked to Hong Kong to explore Web3 integration pathways. Dinner parties and hotel lobbies were abuzz with discussions on tokenized government bonds, cash management tools, and stablecoin legislation. A Wall Street banker who had just transitioned from New York to Hong Kong openly stated: In terms of crypto topic density and participation breadth, Hong Kong has replaced New York to become the world's hottest blockchain city.

However, just over two months later, market enthusiasm sharply declined. Mainland regulatory authorities signaled a clear tightening of policies on mainland financial institutions and assets heading to Hong Kong for RWA tokenization, with several previously imminent real-world asset tokenization projects being put on hold.

RWA5.28%

PANews·01-14 08:08

Hong Kong RWA Storm (Part 2): Bipolar Narratives, Regulatory Red Lines, and the Future Game Plan

Author: Brian, Gua Tian Laboratory W Labs

(Continuing from Part One) "Hong Kong RWA Storm (Part One): From Frenzy to Reconstruction, Analyzing the Strengths of the Nine Major Factions"

7. AlloyX — The "Hybrid Aggregator" Connecting DeFi Liquidity and Real Assets

In the grand narrative of Hong Kong RWA, if HashKey and OSL are building "heavy asset" infrastructure similar to Nasdaq or bank vaults, then AlloyX represents another agile force in the RWA market — a "DeFi native aggregator."

As a Web3 financial technology company originating from San Francisco, later fully acquired by Hong Kong-listed broker Solowin Holdings (NASDAQ: SWIN), AlloyX plays a unique role in the Hong Kong RWA landscape.

RWA5.28%

PANews·01-14 08:08

The Calm Before the Crypto Storm: Bitcoin Preps for a Technical Twist

On Tuesday morning (8:30 a.m. EST), bitcoin’s price action danced between $91,800 and $92,479 today, carving out a narrow but significant range in a broader game of “will they or won’t they” among traders. With a market cap firmly seated at $1.83 trillion and a hearty $44.68 billion in 24-hour

BTC1.67%

Coinpedia·01-13 13:50

Monero (XMR) Peaks At ATH Of $596.87, Crypto Community Rallies Support For Roman Storm

Privacy-focused Monero (XMR) recorded a new all-time high (ATH) at $596.87.

Other privacy tokens logged significant gains, but XMR surpassed Zcash (ZEC) following its recent governance restructuring.

Monero founder Roman Storm gains support from the crypto community amid his upcoming sentencing a

Blockzeit·01-12 07:10

V condemns criminalizing code and speaks out for Tornado Cash developers

Article by: Brian Danga

Translation: Block unicorn

Summary

Ethereum co-founder Vitalik Buterin published a public letter on Friday in support of Tornado Cash developer Roman Storm. Storm was convicted in August of conspiracy to commit illegal money transmission and faces up to five years in prison.

Storm's defense fund is supported by backers including V God and the Ethereum Foundation, totaling over $6.3 million (as of 2025). Meanwhile, law enforcement efforts against privacy-focused crypto tools are also intensifying worldwide.

V God’s Public Letter

Ethereum co-founder Vitalik Buterin published a public letter on Friday in support of To

TechubNews·01-12 02:30

Venezuela's "Oil Dollar" Major Shift: Maduro Arrested, Tether (USDT) in the Eye of the Storm

Former Venezuelan President Maduro was arrested in Brooklyn, placing the world's largest stablecoin Tether (USDT) at the center of a geopolitical and financial regulatory storm. USDT is not only a key tool for the state-owned oil company PdVSA to bypass US sanctions and settle up to 80% of oil revenues, but also a financial lifeline for over 24 million ordinary people suffering from hyperinflation.

This incident reveals the complex duality of cryptocurrency in failing economies: it is both a lifeline for civilians and a potential channel for sanctions evasion. As the US may adjust its policies toward Venezuela and Tether seeks to enter the US mainstream market, its global role is facing unprecedented scrutiny and challenges.

MarketWhisper·01-12 01:19

Vitalik: Current decentralized stablecoins are not good enough; these three major issues need to be addressed

Ethereum co-founder Vitalik Buterin highlights the need to establish decentralized stablecoins with "national-level resistance," which must address three major issues: USD dependence, oracle security, and yield competition.

(Background: The U.S. Department of Justice verdicts Tornado Cash founder Roman Storm on "unauthorized remittance" charges, prompting collective support from the crypto community)

(Additional context: From sanctions to legal trials: the privacy and responsibility debate surrounding the mixer Tornado Cash)

Table of Contents

The crisis of highly centralized prosperity

Breaking free from USD dependence

Governance and capture costs

Competition in staking yields

In

Stablecoins on Ethereum saw on-chain trading volume surpass $8 trillion in 2025. Against the backdrop of traditional giants like BlackRock entering the space, Ethereum co-founder Vitali

動區BlockTempo·01-11 09:25

Ethereum Co-founder Endorses Roman Storm, Highlights Privacy Commitment

Ethereum Co-Founder Supports Tornado Cash Developer Amid Legal Challenges

Vitalik Buterin, the co-founder of Ethereum, has publicly reaffirmed his support for Roman Storm, a developer involved in the Tornado Cash privacy protocol who faces serious legal scrutiny in the United States. Despite

ETH0.8%

CryptoBreaking·01-10 16:50

Vitalik Buterin Defends Privacy as Tornado Cash Verdict Approaches, Voices Support for Roman Storm

Ethereum co-founder Vitalik Buterin has publicly expressed support for Roman Storm, a developer of the crypto-mixing service Tornado Cash, just days ahead of a key court hearing that could have far-reaching implications not only for Storm’s fate, but also for the future of open-source software devel

ETH0.8%

Moon5labs·01-10 05:01

Vitalik Buterin supports Tornado Cash developer Roman Storm amid mounting legal pressure

Ethereum co-founder Vitalik Buterin supports Tornado Cash developer Roman Storm, facing up to 5 years in prison for money laundering. Buterin emphasizes the importance of software development tools for privacy and has contributed funds to Storm's legal defense amidst growing legal pressures on security tools.

ETH0.8%

TapChiBitcoin·01-10 03:58

Ethereum Co-founder Endorses Roman Storm, Highlights Privacy Commitment

Ethereum Co-Founder Supports Tornado Cash Developer Amid Legal Challenges

Vitalik Buterin, the co-founder of Ethereum, has publicly reaffirmed his support for Roman Storm, a developer involved in the Tornado Cash privacy protocol who faces serious legal scrutiny in the United States. Despite

ETH0.8%

CryptoBreaking·01-09 16:49

Vitalik supports Tornado Cash developer Roman Storm: If coding is criminalized, society will pay a greater price

Ethereum co-founder Vitalik Buterin recently published an open letter supporting Tornado Cash developer Roman Storm, directly stating that criminalizing software development activities could have far-reaching impacts on privacy rights, open-source innovation, and the overall tech industry.

(Background: The U.S. Department of Justice convicted Tornado Cash founder Roman Storm of "unauthorized remittance," prompting collective support from the crypto community)

(Additional context: From sanctions to legal trials: The debate over privacy and responsibility of the mixer Tornado Cash)

Ethereum co-founder Vitalik Buterin recently issued an open letter supporting Tornado Cash co-developer Roman Storm and criticized the recent trend of criminalizing software development activities.

ETH0.8%

動區BlockTempo·01-09 13:20

From "The Glory of the Chinese" to the Regulatory Storm: What Will Be the Future of Manus?

After Manus was acquired by Meta for $2 billion, it drew attention, but regulatory review notices cooled the market. Analyzing historical cases, predicting outcomes, and considering factors such as the founders' nationality, it points out issues like intellectual property rights, core technology leakage, and data security, warning founding teams to be cautious in the US-China AI competition.

Biteye·01-08 10:01

"All-in" signal? Arthur Hayes is calling signals with full force, RIVER's 12% daily increase is just the appetizer?

Emerging token RIVER experienced a remarkable start to 2026, surging another 12% in the past 24 hours, breaking through $18, with a market cap approaching $366 million. Its nearly one-month increase exceeds 340%, and the year-to-date gain has reached nearly 469%, making it the most eye-catching short-term target in the market.

This wave of frenzy was directly triggered by a public call from BitMEX co-founder Arthur Hayes and was strongly boosted by massive leveraged trading in the derivatives market, with daily trading volume on Binance futures alone reaching up to $2 billion. This "perfect storm" driven by opinion leaders, technological breakthroughs, and leveraged funds vividly demonstrates the emotional and highly volatile speculative nature of the crypto market.

MarketWhisper·01-08 03:08

Why 114514 Meme Coin Is Leading the Japanese Subculture Rally on Solana in 2026

The 114514 meme coin has taken the cryptocurrency world by storm, emerging as a standout token on the Solana blockchain amid a resurgence of Japanese subculture-driven trends.

CryptopulseElite·01-07 05:14

Behind the AI frenzy, an overlooked debt gamble

Written by: thiigth

Wall Street veteran and Oak Tree Capital's Howard Marks recently made a wake-up call. The gist is: if this AI frenzy doesn't end up becoming a classic bubble burst, it will be the only exception in human financial history.

But the problem is, most people are looking in the wrong place.

We are still debating whether Nvidia's stock price is too high, or who will be the next Cisco. Everyone is obsessively watching every flicker on the K-line chart, trying to find clues of a collapse. However, the real storm is not at the bustling stock exchanges, but in the silent, hidden corner that determines life and death — the credit market.

This is not a math problem about Price-to-Earnings (P/E) ratios, but a high-stakes gamble built on massive debt.

01 The Disappearing "Cash Cow"

In this story, our biggest mistake

TechubNews·01-07 05:12

Hackers Can't Break In, So They Just Storm Your Home With Guns! Offline Violent Robbery Cases Surge Among Small Cryptocurrency Investors

As cryptocurrency prices rise and blockchain transactions become irreversible once transferred, a new form of crime is emerging worldwide. Criminals are no longer just hacking accounts online; they are directly targeting investors themselves through home invasions, gun threats, and even kidnapping, forcing victims to unlock their phones and wallets to complete transfers on the spot. Statistics show that since 2020, over 215 physical cryptocurrency attack cases have been recorded globally, with the number of cases in 2025 nearly doubling that of the previous year. Victims are no longer limited to high-level crypto insiders or those flaunting wealth; instead, an increasing number of ordinary-looking, small to medium-sized investors with modest assets but holding certain crypto holdings are being targeted.

From remote hackers to offline violence, small investors are more easily targeted

An example is Julia (, a retired woman investor from Florida, who used a pseudonym. In 2021, she was targeted in a SIM card swap attack, and within just a few minutes...

ChainNewsAbmedia·01-06 08:14

Elon Musk's artificial intelligence Grok sparks AI exploitation controversy; Europe, India, and Malaysia launch multi-country investigations

Elon Musk's social platform X (formerly Twitter) and its AI chatbot Grok have recently been embroiled in a sexual exploitation storm. The platform allows users to create and share AI-generated sexualized images of children and women, sparking strong concern and investigations from regulatory agencies worldwide. The EU, India, Malaysia, and Brazil have all taken action, demanding reviews of the related features and even suspending their use. Despite ongoing controversy, X's traffic and download numbers have grown against the trend, raising more questions and unease from the public.

Grok Controversy: AI Sexualized Generation Images Become Global Focus

Recently, X platform has become an international news focus due to the controversy surrounding its AI chatbot Grok. According to multiple media reports, users can access Grok

ChainNewsAbmedia·01-06 07:04

Bitcoin, politics, and silver shocks fuel crypto’s latest narrative storm

Political scandal, Bitcoin accumulation, silver volatility, and creator coins collide as narratives---not fundamentals---drive short-term crypto sentiment and volatility.

Summary

Santiment flagged four hot narratives: Nick Shirley's Minnesota daycare fraud probe, Strategy's fresh Bitcoin buy, g

Cryptonews·2025-12-30 09:36

Load More