Search results for "US"

Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

Author: Nancy, PANews

Tokenized assets (RWA) are sweeping across the globe. The influx of capital and the enrichment of assets have transformed this on-chain movement from a crypto-native testing ground into a new battleground for Wall Street competition.

While the RWA track is rapidly developing, there are differences between TradFi (Traditional Finance) and cryptocurrencies. On one side, Wall Street is more focused on regulatory arbitrage and systemic risk, emphasizing stability and order; on the other side, the crypto industry pursues innovation speed and decentralization, worried that existing frameworks may limit development.

A few months ago, the SEC announced it would introduce a series of crypto innovation exemption mechanisms, planned to take effect in January this year. However, this pro-crypto aggressive policy naturally faced strong opposition from Wall Street, and due to the legislative pace of the Crypto Market Structure Bill, the originally promised implementation date has been delayed.

Blocked by Wall Street, crypto exemptions may be postponed

区块客·9h ago

How will Federal Reserve Chair Jerome Powell's contradictory strategy of "interest rate cuts + balance sheet reduction" affect the stock and bond markets, the US dollar, and the crypto market?

Donald Trump nominates a hawkish candidate, Warsh, to lead the Federal Reserve. He advocates for "cutting interest rates but shrinking the balance sheet." This article analyzes what potential impacts this could have on the stock market, bond market, US dollar, and the crypto market.

(Background: Will Warsh promote capital flow into Bitcoin? After being nominated by Trump, gold prices fell below $5,000, and BTC briefly rebounded to $83,700.)

(Additional context: Trump-appointed Federal Reserve Chair Kevin Warsh on Bitcoin: It is not a substitute for the dollar but a "supervisor" of monetary policy.)

Table of Contents

- From Hawkish to "Pragmatic": A Shift in Monetary Policy Beliefs

- "Cutting Rates + Shrinking the Balance Sheet": A Dangerous Balancing Act

- "Good Cop" and "Software": Warsh's Bitcoin Paradox

- Era of Liquidity Tightening: The Survival Rules of Cryptocurrency

- The Ghost of CBDC: The Perspective of Warsh

動區BlockTempo·10h ago

Trump Says He Was Not Involved in $500M Abu Dhabi WLFI Deal

Trump denied any involvement in the $500 million Abu Dhabi investment in World Liberty Financial.

The UAE-backed firm bought a 49% stake shortly before Trump’s 2025 inauguration.

US President Donald Trump has denied any knowledge of a $500 million investment by an Abu Dhabi company in WLFI. The W

TheNewsCrypto·11h ago

Barclays warns: History shows that when the Federal Reserve Chair changes, the US stock market faces an average 16% correction

Barclays report shows that within six months of a Federal Reserve chair change, the S&P 500 typically declines by an average of 16%. The new chair, Waller, is known for his hawkish stance, which could lead to liquidity tightening and market uncertainty, affecting U.S. stocks and cryptocurrencies. Waller's push to reduce the balance sheet may conflict with Trump-era policies, and the market has not yet fully priced in this risk.

動區BlockTempo·12h ago

Fed Atlanta CEO Raphael Bostic Speaks on Rate Cut, Crypto Market Reacts

Fed Atlanta's Raphael Bostic opposes rate cuts for 2026, citing economic strength. Meanwhile, the crypto market is thriving, boosted by a 3.47% gain and the India-US trade deal closure, alongside insights from BitGo CEO Mike Belshe.

TheNewsCrypto·13h ago

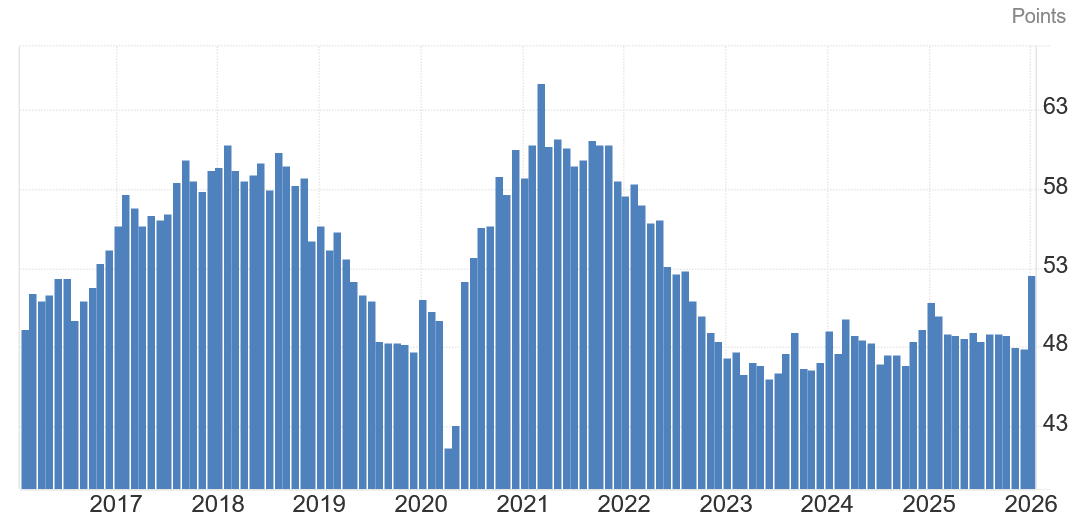

ISM Manufacturing PMI Index reaches its highest level in 40 months: Analysts believe BTC could benefit

An important indicator reflecting the "health" of the US economy has just recorded its highest monthly level since August 2022. Cryptocurrency analysts believe this signal could open up the possibility of a reversal for Bitcoin, which is currently trading around $78,000.

According to the report released on Monday by the Institute of Management

BTC-3.52%

TapChiBitcoin·14h ago

The Gold Top Effect: What the Last Cycle Tells Us About Ethereum

Gold tops historically align with Ethereum bottoms and deep pullbacks before strong recoveries.

Ethereum already mirrors the last cycle setup, including timing and magnitude of decline.

Regulatory clarity and asset tokenization could drive major Ethereum outperformance ahead.

Gold

CryptoNewsLand·15h ago

Storm in the US hits mining farms! Bitcoin hash rate drops by 12%, the worst decline since China's ban on mining.

Bitcoin mining activities are under severe pressure as US winter storms force several large mining companies to shut down their machines urgently, leading to a sharp decline in hash rate, output, and revenue. The total network hash rate has dropped to 970 EH/s, the lowest in nearly two years, and mining income has also hit a new low. Miners' survival space is shrinking, and more and more miners are facing losses.

区块客·15h ago

Bitcoin hash rate drops by 12%! A snowstorm in the United States paralyzes mining farms, marking the largest decline since China's ban.

The US winter storm impacts mining farms, causing Bitcoin hash rate to plummet 12% to 970 EH/s, the largest drop since China's ban on mining in 2021. Extreme cold temperatures have strained power supplies, leading many miners to limit electricity and shut down. Daily mining revenue has fallen from $45 million to $28 million, the daily production of listed mining companies has decreased from 77 coins to 28 coins, and the profit and loss index has dropped to 21, which is expected to trigger a more significant difficulty adjustment.

MarketWhisper·16h ago

Former Google engineer is a spy! Accused of stealing US AI technology for China, facing at least decades in prison

Former Google engineer Ding Linwei was convicted on all 14 charges for stealing over 2,000 pages of core AI technology data and profiting China. This case is the first AI economic espionage conviction in the United States. Between 2019 and 2023, Ding uploaded confidential information to his personal account and attempted to use the technology to establish an AI company in China. The sentencing outcome is still pending, with the most severe penalty potentially involving decades of imprisonment.

CryptoCity·16h ago

Bitcoin ETFs Face $7 Billion Dilemma: Is a Drop to $65,000 Next?

The recent Bitcoin price correction below \$80,000 has plunged a significant portion of US spot Bitcoin ETF investors into a collective \$7 billion paper loss, raising critical questions about market stability.

Data reveals that the average ETF buyer entered at approximately \$90,200 per Bitcoin, nearly 16% above current levels, with 62% of all ETF inflows now underwater. This is occurring alongside a sustained capital exodus, marking the longest monthly outflow streak since the funds' i

CryptopulseElite·16h ago

Stablecoin Yield Showdown: Why the White House Meeting Signals a Final Battle Over US Crypto Regulation

Amid a partial government shutdown, Trump administration officials convened crypto industry leaders and traditional bankers at the White House for a high-stakes negotiation on a single, seemingly technical issue: whether stablecoins should be allowed to offer yield.

This narrow focus reveals the core, irreconcilable conflict at the heart of the CLARITY Act—a battle not just over regulation, but over the future architecture of the US financial system itself. The meeting, while described a

CryptopulseElite·17h ago

XRP Today's News: Five consecutive declines halt bloodshed, US ISM data triggers rebound

XRP ends five consecutive declines, rising 1.90% on February 2 to close at $1.6192. The US ISM Manufacturing Index exceeded expectations, boosting risk appetite and offsetting uncertainties from the White House crypto meeting. The meeting highlighted the deadlock between banks and the crypto industry over legislation on stablecoin yields. On the technical side, XRP found support at $1.50, with a breakout above $2.00 confirming a reversal. The medium-term target is $2.50, and the long-term target is $3.00.

XRP-2.33%

MarketWhisper·18h ago

Rising ISM PMI Signals Bullish Bitcoin

A January ISM Manufacturing PMI reading of 52.6 signals a return to expansion for the US manufacturing sector, the strongest showing since August 2022 and well above the 50 mark that denotes growth. The data arrive as Bitcoin trended near $78,000 after sliding to a 10-month low around $75,442

CryptoBreaking·18h ago

Digital assets are booming! 40% of businesses in the US have accepted cryptocurrencies, and 84% are optimistic about becoming mainstream.

PayPal and the U.S. National Cryptocurrency Association survey show that 39% of American merchants have accepted digital asset payments, and 84% predict they will become mainstream within five years. Among the adopting merchants, cryptocurrencies account for 26% of sales, with 72% reporting annual growth. Millennials (77%) and Generation Z (73%) are driving demand, with the hotel and travel industry leading at 81%. Ninety percent of merchants say they would adopt digital assets if it were as convenient as credit cards.

MarketWhisper·18h ago

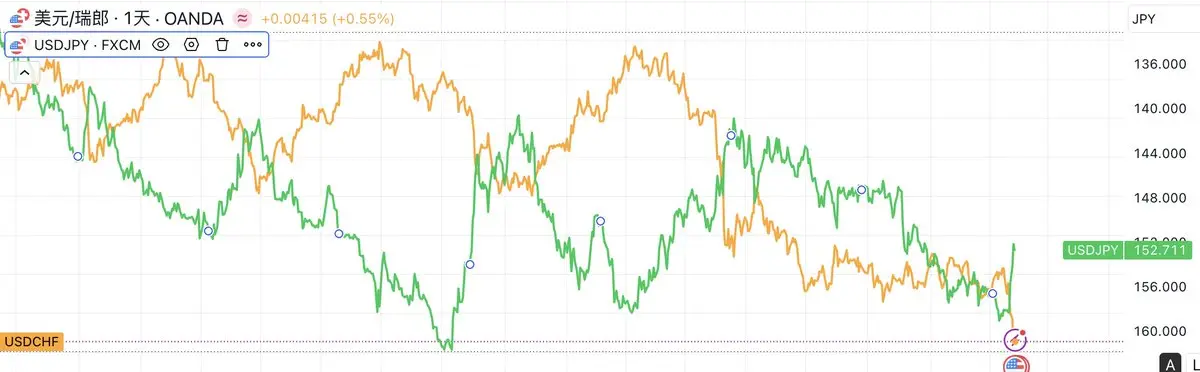

The US dollar is weakening, but Bitcoin remains "stagnant." What is the reason behind this?

The weakening of the US dollar failed to boost Bitcoin, as market sentiment dominated this dollar decline, which was not driven by economic expectations. JPMorgan believes that Bitcoin exhibits characteristics inconsistent with a weak dollar environment, resembling a risk asset sensitive to liquidity, and does not serve as a "store of value."

区块客·02-02 19:45

Crypto Funds Suffer $1.7bn Weekly Outflows As Bitcoin Leads Exodus

Digital asset investment products suffered another bruising week as investors pulled US$1.7 billion from funds, a run of outflows that has pushed year-to-date flows into a US$1 billion net withdrawal and erased roughly US$73 billion from assets under management since the October 2025 highs,

BlockChainReporter·02-02 19:14

Alternative Inflation Data Signals Sharp Cooling for US CPI

Alternative inflation gauges are signaling a sharp cooling in US price growth, a development that could tilt the Federal Reserve toward policy easing and ripple through risk assets, including cryptocurrencies. After the Fed paused rate cuts last week and offered no clear path to near-term

CryptoBreaking·02-02 17:35

Trump announces that India’s tariffs will be "cut from 25% to 18%"! India agrees to stop purchasing Russian oil and to buy $500 billion worth of goods from the United States

Trump posted on Truth Social that he has reached trade and energy agreements with Indian Prime Minister Modi, including lowering tariffs, expanding purchases of American goods, and stopping the purchase of Russian oil. He stated that this will help facilitate the end of the Russia-Ukraine war and further strengthen US-India relations.

動區BlockTempo·02-02 17:25

Trump’s Fed Nomination: Mixed Signals on Bitcoin, US Liquidity

President Donald Trump has tapped former Federal Reserve governor Kevin Warsh to lead the central bank, a move that has rippled through crypto markets and liquidity expectations in the U.S. ahead of a potential Senate confirmation. The nomination was announced on Friday, with Warsh positioned to

CryptoBreaking·02-02 14:55

US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

The Chairmen of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have jointly stated for the first time that they will work together to promote cryptocurrency regulation policies and clearly define jurisdictional boundaries. Even though congressional legislation has not yet been completed, the two agencies have already begun collaborating to reduce uncertainty for cryptocurrency businesses and are exploring the establishment of a transitional regulatory framework to promote stable industry development.

ETH-3.97%

区块客·02-02 14:00

The World of Gold, Dollars, and Debt: Reassessing the Balance Sheet

The core coordination mechanism in modern society is debt relationships, and economic growth stems from expectations about the future. The US dollar is a tool of debt, while gold is an asset without a counterparty. Currently, through AI reshaping, productivity is constrained by physical limits, the nature of debt is being challenged, and the US dollar also faces risks of credit changes and relative decline.

PANews·02-02 13:41

Bitcoin Hashrate Falls Sharply as US Winter Storm Forces Mining Shutdowns

Bitcoin hashrate decline has grabbed market attention after network power dropped 12 percent since November. This marks the largest contraction since 2021. According to CryptoQuant, a severe US winter storm triggered widespread mining shutdowns across key regions. The event exposed how vulnerable

BTC-3.52%

Coinfomania·02-02 13:21

3 Tokens Lead Gains Amid Crypto Market Drop

Key Notes

The crypto market fell to extreme fear conditions again amid a market-wide bloodbath.

Despite the downtrend, Stable, MYX Finance and MemeCore recorded notable gains.

Four key macro events in the US will expectedly impact the financial markets this week.

While the leading

Coinspeaker·02-02 11:25

Bitcoin Isn’t Broken, Liquidity Is: Raoul Pal Explains

_Bitcoin and SaaS declines are driven by US liquidity constraints, not broken markets._

_Resolution of the US government shutdown could restore liquidity and ease market pressure._

_Full-cycle

BTC-3.52%

LiveBTCNews·02-02 11:20

Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

Tokenized assets (RWA) are rapidly developing worldwide, but there are significant differences between traditional finance (TradFi) and the crypto industry. Wall Street is concerned that crypto exemption mechanisms could lead to economic risks, opposing broad regulatory exemptions for tokenized securities, and advocating for existing securities laws to apply. At the same time, the SEC has provided guidance on tokenized securities and plans to determine securities regulation based on legal classification, paving the way for compliant pathways.

区块客·02-02 10:40

Tether profits exceed $10 billion in 2025! USDT issuance hits a new high, with total US debt exposure reaching $141.6 billion

Tether achieved over $10 billion in net profit in 2025, with optimized reserve structure, holding over $122 billion in U.S. Treasury bonds, reaching new highs in market value and issuance. As market demand surged, $USDT circulation exceeded 18.6 billion. The company actively expands compliant and diversified investments, demonstrating a strong market position and financial resilience.

CryptoCity·02-02 08:00

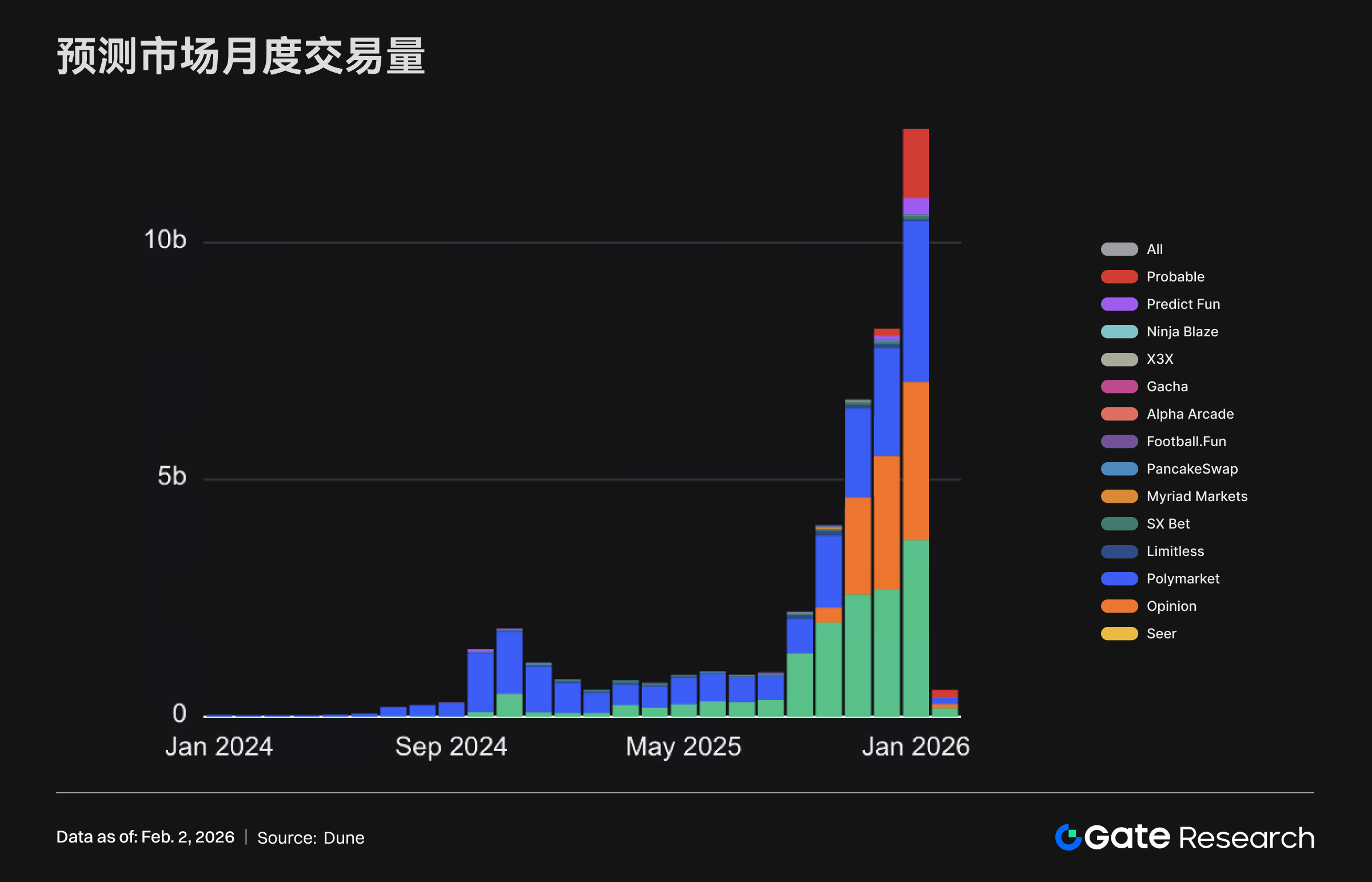

Gate Research Institute: Cryptocurrency Market Under Pressure from US Stocks and Gold/Silver Plunge | Moltbook Sparks Agents Social Media Frenzy

Cryptocurrency Asset Panorama

BTC (-3.85% | Current Price 75,523 USDT)

Against the backdrop of a simultaneous plunge in US stocks and gold/silver, BTC price movement shows a pattern of sharp decline —> panic sell-off —> weak rebound —> low-level consolidation. Fundamentally, no new systemic negative news has emerged, but the liquidity events related to exchanges during the “1011 Event” have been repeatedly mentioned recently, and user confidence has yet to recover. The short-term moving averages MA5/MA10 have been regained by the price but still slope flatly; the key medium-term resistance is above MA30. Although the short-term decline has temporarily halted, the trend remains in a rebound phase within a downward channel. The next critical points are whether the $75,000 level can hold and whether the $80,000 level can be effectively reclaimed. If broken, it will once again test MicroStrategy’s cost basis and may lead to further panic or a move toward $70,000.

GateResearch·02-02 07:40

Gate Research Institute: US Stock Gold and Silver Pullback Suppresses Cryptocurrency Market | Moltbook Sparks Agents Boom Spilling Over to Clanker

Cryptocurrency Market Overview

BTC (-3.85% | Current Price 75,523 USDT): Amid a synchronized plunge in US stocks and gold/silver, BTC experienced a "sharp drop—pinning—weak rebound—low-range consolidation." Although no new systemic negative news emerged, the "1011" liquidity dispute was repeatedly mentioned, leading to a slow recovery of confidence. The price has regained the MA5/MA10 but MA30 still acts as resistance, making the rebound more like a correction within a downward channel. Watch for support at 75,000 and resistance at 80,000; if broken, it may test MicroStrategy's cost basis again and look toward support around 70,000.

ETH (-9.9% | Current Price 2,197.86 USDT): ETH is significantly weaker than BTC. With risk appetite shrinking, it first experienced a volume surge and a sharp decline, with a pin at $2,220 and a limited rebound. It then shifted to sideways consolidation at low levels and moved downward with volatility. The price

GateResearch·02-02 06:51

Japan's largest brokerage increases investment against the trend! Nomura Securities still applies for three licenses despite losses

Nomura Securities announced on January 30th that Laser Digital has reported losses for two consecutive quarters. However, just 48 hours ago, they applied for a banking license with the US OCC. Nomura is adopting a dual-track strategy: trading losses are considered short-term risk management, while infrastructure investments are part of a long-term strategy, with license applications being simultaneously pursued in the US, Japan, and Dubai.

MarketWhisper·02-02 05:44

Bitcoin Price Holds Firm as Brief US Government Shutdown Fuels Market Uncertainty

Bitcoin trades near $82,500 as lawmakers delay budget approval amid immigration enforcement disputes and rising political tensions in Washington.

Senate backs funding deal, but House delay triggers shutdown and fuels short-term volatility across crypto and broader financial markets.

BTC-3.52%

CryptoFrontNews·02-02 05:36

Storm in the US hits mining farms! Bitcoin hash rate drops by 12%, the worst decline since China's ban on mining.

Bitcoin mining activities are under severe pressure as US winter storms force several large mining companies to shut down their machines urgently, leading to a sharp decline in hash rate, output, and revenue. The total network hash rate has dropped to 970 EH/s, the lowest in nearly two years, and mining income has also hit a new low. Miners' survival space is shrinking, and more and more miners are facing losses.

区块客·02-02 04:40

Libya to Iran miracle: National blackout, but Bitcoin miners keep running

In Iran and Libya, countries ravaged by sanctions and civil war, electricity is no longer just a public service but has become a hard currency that can be "financially exported." When hospitals go dark due to power outages, Bitcoin mining rigs never stop running. This energy arbitrage game reveals the absurdity and imbalance of resource allocation. This article is adapted from a piece in On-Chain Revelation, compiled, translated, and written by Foresight News.

(Previous context: The Central Bank of Iran secretly hoarded 500 million USD worth of USDT last year! It was revealed that this was used to stabilize the Rial exchange rate and respond to international sanctions.)

(Additional background: Night of the risk asset scare, under what conditions would the US go to war with Iran?)

Table of Contents

1. Power Run: When Energy Becomes a Financial Tool

2. Two Countries, Two Mining Histories

Iran: From "Export Energy" to "Export Hashpower"

Libya: Cheap

動區BlockTempo·02-02 04:00

ETF funds have been flowing out for consecutive days! Bitcoin drops to $77,000, and the crypto market faces a critical stress test

Bitcoin recently fell below the $80,000 mark, leading to $1.7 billion in forced liquidations, resulting in a market cap evaporation of $100 billion, reflecting market fragility. Geopolitical tensions and uncertainties in US economic policy have exacerbated this situation. Related ETFs are experiencing the highest net outflows in history, with institutional investors reducing risk exposure, causing market liquidity to decline and signaling potential technical sell-offs. Analysts are divided on the market bottom, with focus on upcoming economic data releases.

CryptoCity·02-02 03:00

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-02 01:20

Trump sanctions cryptocurrency exchanges! US bans $94 billion money laundering UK platform

The Trump administration on Friday imposed sanctions through OFAC on the UK-registered cryptocurrency exchanges Zedcex and Zedxion, citing facilitation for the Iranian Islamic Revolutionary Guard Corps (IRGC). This is the first time the United States has blacklisted a digital asset exchange. Zedcex has processed over $94 billion in transactions since 2022, primarily through Tether's USDT on the Tron platform.

TRX0.36%

MarketWhisper·02-02 00:52

The US sanctions two crypto exchanges Zedcex and Zedxion for Iran-related activities

The U.S. Treasury's OFAC has sanctioned UK crypto exchanges Zedcex and Zedxion for allegedly aiding transactions related to Iran's Islamic Revolutionary Guard Corps (IRGC), marking a first for such punitive action against an entire exchange in connection to Iran's economy.

TRX0.36%

TapChiBitcoin·02-02 00:10

US Winter Storm Slows Bitcoin Miner Production, Data Shows

New data paints a clearer picture of how January’s US winter storm disrupted US Bitcoin (CRYPTO: BTC) mining operations, revealing a sharp downturn in daily production across publicly traded operators. The storm underscored the sector’s tether to energy-market dynamics, as grid stress, snow, ice

CryptoBreaking·02-01 21:35

Cardano (ADA) ETFs Take a Step Forward After SEC Filing Updates

Cardano just popped back onto the ETF radar. A document circulating online shows updated SEC filings from Volatility Shares, and it’s not a small update.

The firm is actively moving ahead with three different ADA-related ETFs, telling us this isn’t a stalled idea or a placeholder filing.

The

ADA-1.79%

CaptainAltcoin·02-01 19:05

Alternative Inflation Data Signals Sharp Cooling for US CPI

Alternative inflation gauges are signaling a sharp cooling in US price growth, a development that could tilt the Federal Reserve toward policy easing and ripple through risk assets, including cryptocurrencies. After the Fed paused rate cuts last week and offered no clear path to near-term

CryptoBreaking·02-01 17:30

US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

The Chairmen of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have jointly stated for the first time that they will work together to promote cryptocurrency regulation policies and clearly define jurisdictional boundaries. Even though congressional legislation has not yet been completed, the two agencies have already begun collaborating to reduce uncertainty for cryptocurrency businesses and are exploring the establishment of a transitional regulatory framework to promote stable industry development.

ETH-3.97%

区块客·02-01 13:55

Latam Insights: Venezuelan Oil Flows to the US Again, El Salvador Buys the Gold Dip

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this edition, Citgo buys Venezuelan heavy crude once again, El Salvador buys the gold dip, and Nubank receives approval to launch as a digital bank in the U.S.

Citgo’s Venezuelan

Coinpedia·02-01 12:35

The US dollar is weakening, but Bitcoin remains "stagnant." What is the reason behind this?

Recently, the US dollar has weakened but failed to drive Bitcoin higher. JPMorgan pointed out that this is because the dollar's decline was mainly driven by market sentiment rather than changes in economic outlook, leading to Bitcoin's underperformance. Currently, Bitcoin is more like a liquidity-sensitive risk asset and needs a clear shift in monetary policy before attracting new capital into the market.

区块客·02-01 12:25

US Sanctions UK Crypto Exchanges Linked to Iran’s Regime

The U.S. Treasury's OFAC has sanctioned crypto exchanges Zedcex and Zedxion for aiding Iran's IRGC and money laundering. High-ranking Iranian officials also face sanctions for violence and internet suppression. The actions block assets in the U.S. and warn against transactions with these entities.

CryptoFrontNews·02-01 12:06

US Treasury Sanctions Iran-Linked Crypto Exchanges for the First Time

The United States tightened its Iran sanctions regime by targeting digital asset platforms for the first time, signaling a new phase in how financial enforcement leverages crypto infrastructure. In a Friday statement, the Treasury Department’s Office of Foreign Assets Control (OFAC) announced the

CryptoBreaking·02-01 12:00

Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

Tokenized assets (RWA) are rapidly developing worldwide, with regulatory disagreements between traditional finance and cryptocurrencies. Wall Street strongly opposes the SEC's push for crypto exemption policies, believing that strict regulation within the existing legal framework is necessary. The SEC's classification of tokenized securities will clarify the regulatory pathway and require the market to adhere to traditional securities laws, paving the way for traditional institutions to enter this field.

区块客·02-01 10:36

SpaceX applies to the US FCC to launch millions of satellites to create solar-powered data centers, Elon Musk's space AI gamble

SpaceX proposes a plan to deploy millions of solar-powered data center satellites in orbit, aiming to alleviate the energy consumption and resource issues of ground data centers. Despite several technical and economic challenges, this concept has placed space computing at the forefront of policy discussions, reflecting an important direction for future cloud computing.

動區BlockTempo·02-01 09:20

SBF Steps Up Donald Trump Support After Ellison Release

Disgraced FTX founder Sam Bankman-Fried has ramped up his social media praise for US president Donald Trump while taking aim at former president Joe Biden, just days after Caroline Ellison, the former CEO of Alameda Research, was released from federal custody. Since Bankman-Fried’s February 2025

CryptoBreaking·02-01 08:15

In the final moments of the US-Iran escalation, Trump confirms negotiations are making progress. Has gunboat diplomacy won?

Against the backdrop of tense US-Iran relations, Iran's Supreme National Security Council Chairman Ali Larijani confirmed progress in negotiations, while Trump stated that the US has a fleet deployed in the Middle East. Although the US has proposed restrictions on Iran's nuclear program and ballistic missiles, Iran insists on its nuclear capabilities. In this complex situation involving multiple parties, the market may feel somewhat stable due to negotiations, but the situation could deteriorate at any time.

動區BlockTempo·02-01 05:30

Regulation Turns Bullish: US Positioned as Global Hub for Crypto, DeFi, Derivatives

U.S. crypto regulation is entering a decisive new chapter as federal leaders move to align oversight, clarify rules, and cement American dominance in digital asset markets through coordinated action across agencies and existing regulatory authority.

Crypto Takes Center Stage as U.S. Regulators

DEFI-7.8%

Coinpedia·02-01 02:34

Load More