Search results for "USDT"

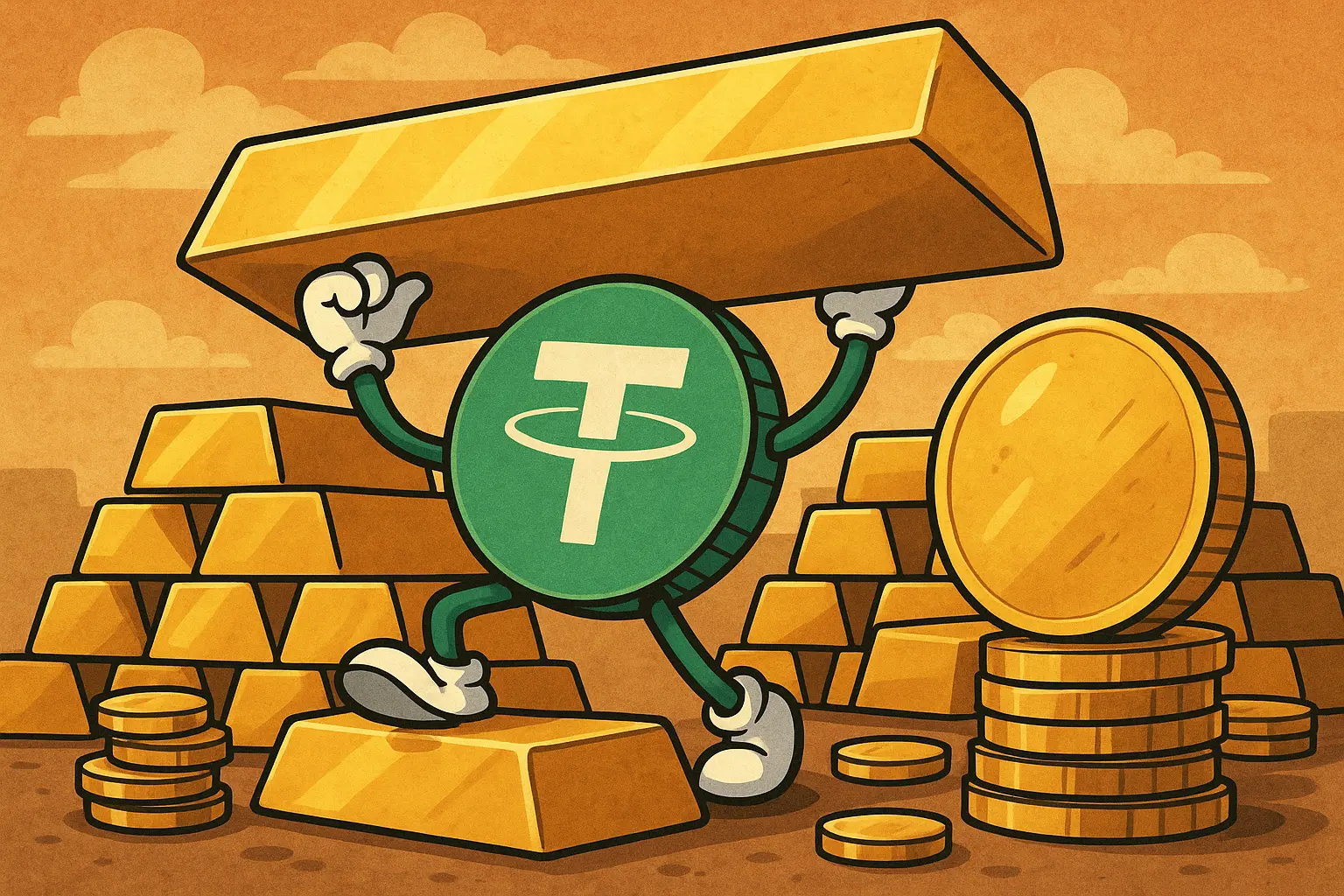

Tether profits exceed $10 billion in 2025! USDT issuance hits a new high, with total US debt exposure reaching $141.6 billion

Tether achieved over $10 billion in net profit in 2025, with optimized reserve structure, holding over $122 billion in U.S. Treasury bonds, reaching new highs in market value and issuance. As market demand surged, $USDT circulation exceeded 18.6 billion. The company actively expands compliant and diversified investments, demonstrating a strong market position and financial resilience.

CryptoCity·5h ago

Gate Research Institute: Cryptocurrency Market Under Pressure from US Stocks and Gold/Silver Plunge | Moltbook Sparks Agents Social Media Frenzy

Cryptocurrency Asset Panorama

BTC (-3.85% | Current Price 75,523 USDT)

Against the backdrop of a simultaneous plunge in US stocks and gold/silver, BTC price movement shows a pattern of sharp decline —> panic sell-off —> weak rebound —> low-level consolidation. Fundamentally, no new systemic negative news has emerged, but the liquidity events related to exchanges during the “1011 Event” have been repeatedly mentioned recently, and user confidence has yet to recover. The short-term moving averages MA5/MA10 have been regained by the price but still slope flatly; the key medium-term resistance is above MA30. Although the short-term decline has temporarily halted, the trend remains in a rebound phase within a downward channel. The next critical points are whether the $75,000 level can hold and whether the $80,000 level can be effectively reclaimed. If broken, it will once again test MicroStrategy’s cost basis and may lead to further panic or a move toward $70,000.

GateResearch·6h ago

Gate Research Institute: US Stock Gold and Silver Pullback Suppresses Cryptocurrency Market | Moltbook Sparks Agents Boom Spilling Over to Clanker

Cryptocurrency Market Overview

BTC (-3.85% | Current Price 75,523 USDT): Amid a synchronized plunge in US stocks and gold/silver, BTC experienced a "sharp drop—pinning—weak rebound—low-range consolidation." Although no new systemic negative news emerged, the "1011" liquidity dispute was repeatedly mentioned, leading to a slow recovery of confidence. The price has regained the MA5/MA10 but MA30 still acts as resistance, making the rebound more like a correction within a downward channel. Watch for support at 75,000 and resistance at 80,000; if broken, it may test MicroStrategy's cost basis again and look toward support around 70,000.

ETH (-9.9% | Current Price 2,197.86 USDT): ETH is significantly weaker than BTC. With risk appetite shrinking, it first experienced a volume surge and a sharp decline, with a pin at $2,220 and a limited rebound. It then shifted to sideways consolidation at low levels and moved downward with volatility. The price

GateResearch·7h ago

Libya to Iran miracle: National blackout, but Bitcoin miners keep running

In Iran and Libya, countries ravaged by sanctions and civil war, electricity is no longer just a public service but has become a hard currency that can be "financially exported." When hospitals go dark due to power outages, Bitcoin mining rigs never stop running. This energy arbitrage game reveals the absurdity and imbalance of resource allocation. This article is adapted from a piece in On-Chain Revelation, compiled, translated, and written by Foresight News.

(Previous context: The Central Bank of Iran secretly hoarded 500 million USD worth of USDT last year! It was revealed that this was used to stabilize the Rial exchange rate and respond to international sanctions.)

(Additional background: Night of the risk asset scare, under what conditions would the US go to war with Iran?)

Table of Contents

1. Power Run: When Energy Becomes a Financial Tool

2. Two Countries, Two Mining Histories

Iran: From "Export Energy" to "Export Hashpower"

Libya: Cheap

動區BlockTempo·9h ago

Gate TradFi Newcomer Exclusive Event Launch: Open an account to receive 20 USDT, and task rewards are doubled within 24 hours

Gate launches an introductory incentive activity for new users to learn about TradFi. Users can earn rewards by simply opening an account and making basic transactions. After opening an account, trading over 10 USDT will earn 20 USDT, and completing the task within 24 hours can double the reward. Additionally, trading volume reaching 1,000 USDT allows participation in a prize pool of a total of 100,000 USDT. The activity process is simple, but users should be aware of related risks and account restrictions. This initiative aims to help users quickly familiarize themselves with TradFi trading and expand participation in traditional financial markets.

GateLearn·12h ago

Trump sanctions cryptocurrency exchanges! US bans $94 billion money laundering UK platform

The Trump administration on Friday imposed sanctions through OFAC on the UK-registered cryptocurrency exchanges Zedcex and Zedxion, citing facilitation for the Iranian Islamic Revolutionary Guard Corps (IRGC). This is the first time the United States has blacklisted a digital asset exchange. Zedcex has processed over $94 billion in transactions since 2022, primarily through Tether's USDT on the Tron platform.

TRX-0.82%

MarketWhisper·13h ago

Litecoin Charts Show Market Indecision With Resistance Near $71.30 Level

Litecoin trades near critical support with indecisive momentum across BTC and USDT pairs.

A move above $71.30 may open the path toward $80.00 in the short term.

Long-term projections show rising price bands with wide scenario ranges through 2032.

Litecoin price outlook reflects

CryptoFrontNews·16h ago

Chinese Hacker Gets 46 Months for $36.9M Crypto Scam

_Jingliang Su sentenced 46 months for $36.9M crypto scam targeting 174 U.S. victims._

_Stolen funds converted to USDT, routed to Cambodia scam centers via fake trading platforms._

_DOJ warns public as global scam networks exploit digital assets and social media outreach._

A Chinese

LiveBTCNews·21h ago

Tether Posts $10B Profit as USDT Supply Hits Record High

Tether's Q4 2025 report reveals significant growth, ending with 186.5B USDT issued and over $192B in assets. The company earned over $10B in profit, driven by demand in underserved regions, while bolstering U.S. Treasury and gold reserves.

BTC-0.39%

CryptoFrontNews·02-01 08:51

Tether Ends 2025 With $10B+ Profit $6.3B Excess Reserves and Growing Treasury Holdings

Tether earned over $10 billion in 2025 while keeping strong reserves and stable earnings quality across global crypto.

Excess reserves reached $6.3 billion giving USDt stronger protection during market stress periods worldwide.

Tether treasury exposure hit $141 billion showing a clear

CryptoNewsLand·01-31 12:41

Tether Posts $10B Profit as USDT Supply Hits Record High

Tether's Q4 2025 report reveals significant growth, with 186.5B USDT issued and $10B profits. Its asset composition includes over $141B in U.S. Treasuries, $17.4B in gold, and $8.4B in Bitcoin, driven by increased global demand for USDT in underserved regions.

BTC-0.39%

CryptoFrontNews·01-31 08:46

Gate Research Institute: Ethereum core members reboot The DAO | SENT 24-hour increase exceeds 60%

Cryptocurrency Asset Overview

BTC (-1.35% | Current Price 81,364 USDT)

BTC has shown a clear downward trend over the past 24 hours. After peaking at $90,600 on the 29th, the price failed to stabilize and continued to decline, breaking below key support levels at $89,000 and $88,000. During the early trading hours of the 30th, there was a surge in volume as the price dropped, with a low near $81,000. Market sentiment shifted rapidly from cautious to panic. From a technical perspective, MA5 and MA10 have clearly crossed below MA30 and are diverging downward. The price is trading below the moving average system, indicating a dominant bearish trend. During the decline, trading volume increased, reflecting concentrated selling pressure. Currently, around $81,000 is an important short-term support level. If the price stabilizes with reduced volume, there is potential for a technical rebound, with resistance levels at $83,500.

GateResearch·01-30 08:23

Gate Research Institute: Bitcoin drops below $82,000 | Bit Digital shifts focus to Ethereum vault

Cryptocurrency Market Overview

BTC (-1.35% | Current Price 81,364 USDT): BTC has shown a clear bearish trend over the past 24 hours. After spiking to $90,600 on the 29th, the price failed to stabilize and subsequently continued to decline, breaking below key support levels at $89,000 and $88,000. During the early trading hours of the 30th, there was a surge in volume as the price was pushed downward, reaching a low of around $81,000. Market sentiment shifted rapidly from cautious to panic. From a technical perspective, MA5 and MA10 have clearly crossed below MA30 and are diverging downward. The price is trading below the moving average system, indicating a dominant bearish trend. During the decline, trading volume increased, reflecting concentrated selling pressure. Currently, around $81,000 is an important short-term support level. If the price stabilizes with reduced volume, there is potential for a technical rebound, with resistance above at $83,500.

GateResearch·01-30 08:13

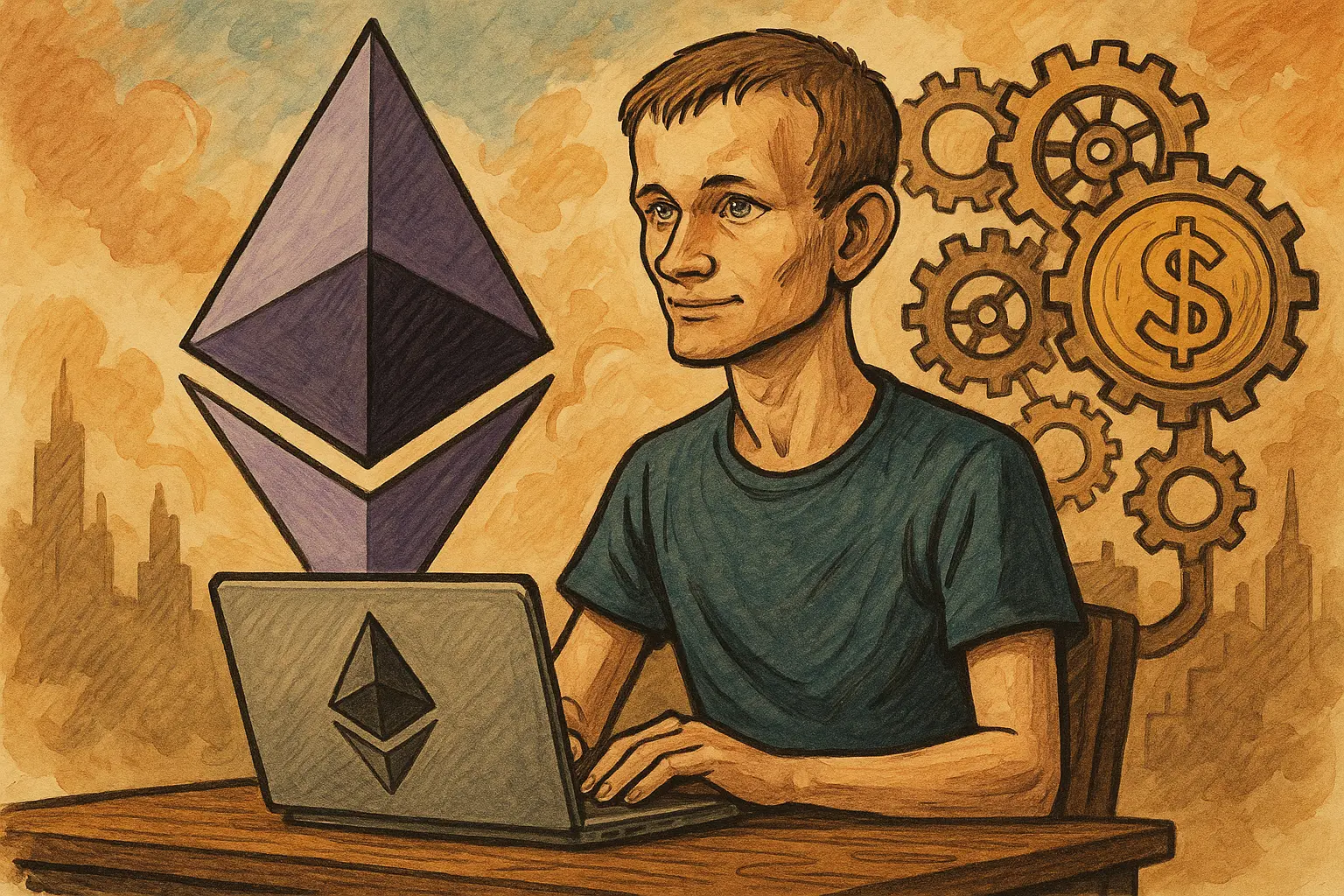

Vitalik finalizes Ethereum's ultimate goal! No developer intervention needed for operation, the stablecoin revolution is imminent

Vitalik envisions 2026: Ethereum aims to achieve "protocol finality" that can operate autonomously without developer intervention through "letting go of testing." Seven major tasks are proposed, including quantum resistance, scalability, state management, account abstraction, and more. Criticizing decentralized stablecoins, it is necessary to address issues such as dollar dependence, oracle security, and staking yield conflicts to challenge USDT and USDC.

MarketWhisper·01-30 06:17

COTI Launches No-Staking Rewards Program for USDT and ADA Holders

USDT and wADA held on COTI earn 200 TPS per $100 with no staking and no lockups and TPS is minted daily to wallets.

Users bridge USDT from Ethereum or Base and bridge ADA from Cardano via ChainPort and TPS converts to COTI at season end.

COTI has introduced a rewards option for users who

CryptoNewsFlash·01-29 13:20

Major Capital Withdrawal from the Cryptocurrency Market! Stablecoin Market Cap Plummets, Bitcoin's Rebound May Not Last?

The cryptocurrency market is facing warning signs of shrinking stablecoin supply, with the market caps of USDT and USDC falling to new lows, reflecting a trend of traders withdrawing funds. USDC is under greater pressure, with its market cap decreasing by over $4 billion, indicating that investors are choosing to cash out directly rather than stay in the market, which could impact the market's rebound strength.

区块客·01-29 11:11

Tether CEO: Has accumulated 140 tons of gold reserves and will become the gold central bank of the post-era

Tether CEO revealed to Bloomberg that the company holds 140 tons of gold (valued at $23.3 billion), stored in a Swiss nuclear bunker, with plans to buy 1-2 tons weekly. They have recruited HSBC traders to enter the arbitrage market. The gold stablecoin XAUT has a market capitalization of $2.32 billion, accounting for 50% of the market. The funds come from USDT treasury yields, and a compliant version USAT has been launched.

XAUT-2.09%

MarketWhisper·01-29 03:58

Tether’s 140-Ton Gold Bet: Inside the $24B Bunker Strategy Reshaping Crypto

Tether, the issuer of the world's dominant stablecoin USDT, has unveiled an aggressive, multi-billion dollar pivot into physical gold. CEO Paolo Ardoino announced plans to allocate 10-15% of the company's massive investment portfolio to bullion, revealing a staggering accumulation of approximately 140 metric tons already held—a hoard worth roughly \$24 billion stored in a high-security Swiss vault.

This strategic move, involving weekly purchases of up to two tons, positions Tether among

CryptopulseElite·01-29 03:48

USAT plays three cards, why does Tether urgently need a "legitimate clone"

Authors: Peggy, Lin Wanwan, BlockBeats

The most stable asset in the crypto market is a dollar without an ID card.

Over the past decade, USDT has become the "de facto dollar" in the crypto world with $170 billion in assets and ubiquitous liquidity. But the more successful it is, the sharper its identity anxiety becomes: a dollar without U.S. backing is always a vulnerability.

In recent years, Circle has applied for a trust bank license, Paxos has built a global clearing network, and Visa and Mastercard are also increasing their focus on stablecoin settlements. In comparison, Tether has remained within the narrative of an "offshore shadow empire."

Under regulatory pressure and competition, in September 2025, Tether, the parent company of USDT

PANews·01-29 02:51

USDT Dominance Rejected: Top 5 Altcoins Ready for Massive 2×–3× Gains

USDT dominance faced rejection at a known range, prompting renewed altcoin monitoring.

XRP, FLOKI, and BONK featured prominently in relative strength tracking discussions.

MOMO, MMODENG, WKC, and 15xp appeared in extended speculative screening lists.

Market participants closely tracked s

CryptoNewsLand·01-28 23:31

Fidelity Investments will launch an Ethereum-based stablecoin "FIDD" in February... officially competing with USDT and USDC

Fidelity Investments will launch an Ethereum-based stablecoin "FIDD" in February, targeting both institutional and retail investors, potentially competing with USDC and USDT in the market. This move is based on new regulatory legislation, and Fidelity aims to improve payment efficiency and introduce new financial products. The launch of this token will impact the stablecoin market structure, particularly by lowering the barriers for institutional investment.

TechubNews·01-28 17:41

Major Capital Withdrawal from the Cryptocurrency Market! Stablecoin Market Cap Plummets, Bitcoin's Rebound May Not Last?

The cryptocurrency market is facing warning signs of shrinking stablecoin supply, with the market caps of USDT and USDC falling to new lows, reflecting a trend of traders withdrawing funds. USDC is under greater pressure, with its market cap decreasing by over $4 billion, indicating that investors are choosing to cash out directly rather than stay in the market, which could impact the market's rebound strength.

区块客·01-28 11:10

Tether CEO Ardoino Says Gold Will Anchor a Post-Dollar Era

Tether now holds about 140 metric tons of gold, buying one to two tons weekly and ranking among the largest private holders.

Gold purchases are funded by USDT profits, with bullion stored under direct custody in a secure Swiss bunker.

XAUT represents roughly 60% of gold-backed

XAUT-2.09%

CryptoFrontNews·01-28 10:21

Tether Gold Holdings: How 140 Tons ($24B) Quietly Built a Crypto Fort Knox

Tether Holdings, the issuer of the world's largest stablecoin USDT, has stealthily amassed approximately 140 tons of gold, a hoard valued at over \$24 billion.

This staggering accumulation positions the crypto behemoth among the top global holders of bullion, surpassing the reserves of nations like Greece and Australia. In an exclusive interview with Bloomberg, CEO Paolo Ardoino revealed ambitions to transform Tether into a "gold central bank," actively trading its reserves to compete wi

CryptopulseElite·01-28 08:34

Gate Research Institute: Short-term recovery and rebound in the crypto market | Polygon leads with x402 smart agent payment transaction volume

Cryptocurrency Asset Overview

BTC (+0.85% | Current Price 89,342 USDT)

BTC has shown a volatile correction trend over the past day, with prices repeatedly oscillating within the 88,800–89,800 USD range. The rebound following the sharp decline on the 26th continues, but selling pressure above remains. The moving average system has shifted from bearish to bullish, with MA5, MA10, and MA30 forming a bullish alignment, and the current price trading above these three moving averages, indicating a short-term bullish trend but still in the recovery phase. The MACD is above the zero line and maintains a golden cross structure, with the red histogram gradually enlarging, suggesting short-term bullish momentum. Overall, if BTC can hold steady above 89,000 USD and increase volume to break through 90,000 USD, it may further challenge the previous high near 91,200 USD; conversely, if it falls back and breaks below the support zone of 88,800–88,400 USD, caution should be exercised for a potential rebound failure and

GateResearch·01-28 06:16

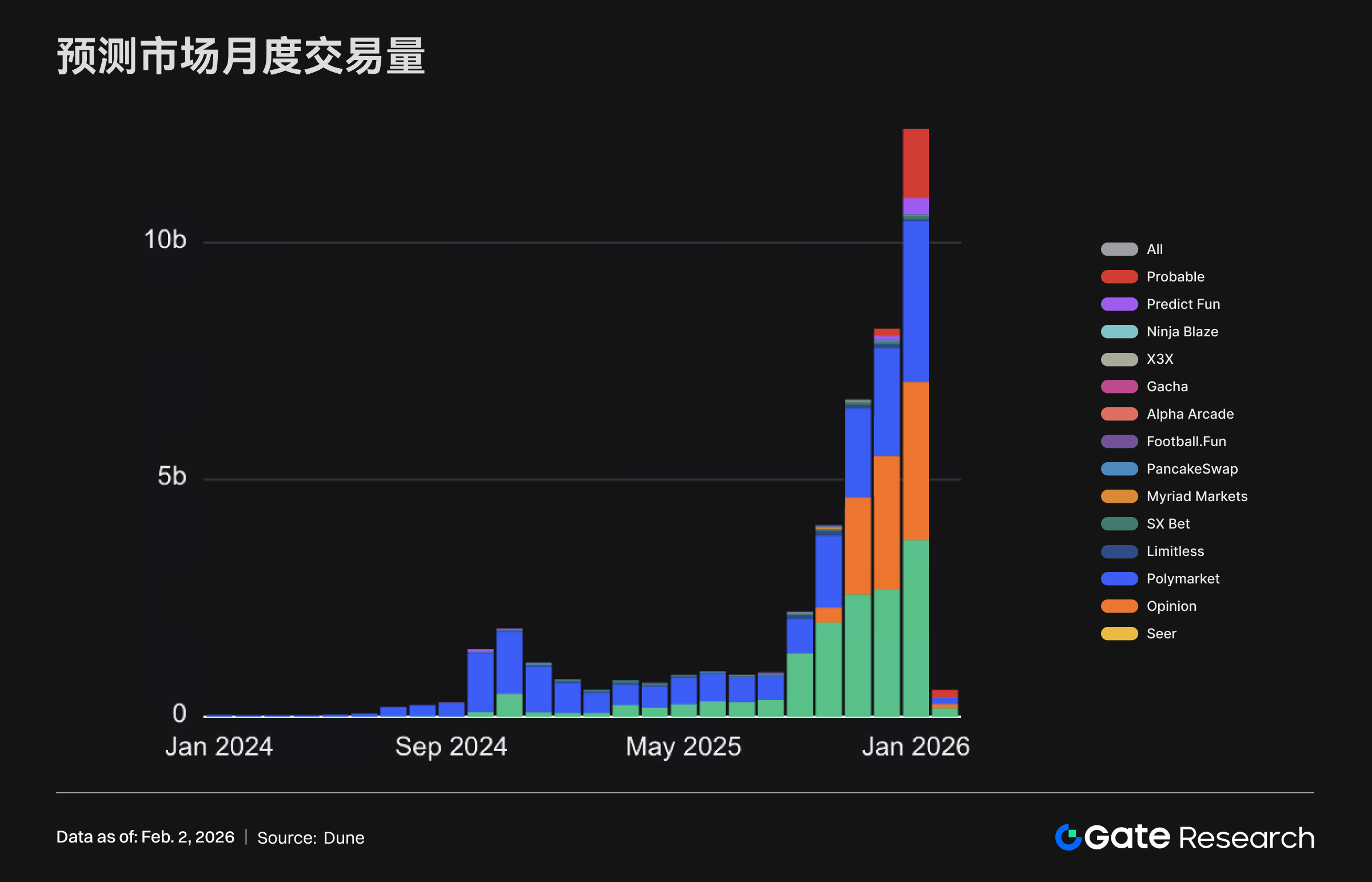

Gate Research Institute: Polygon Leads x402 Intelligent Agent Payment Transactions | Gate TradFi Trading Volume Surpasses $10 Billion

Cryptocurrency Market Overview

BTC (+0.85% | Current Price 89,342 USDT): BTC has shown a volatile correction trend over the past day, with prices repeatedly oscillating within the $88,800–$89,800 range. The rebound following the sharp decline on the 26th continues, but selling pressure above remains. The moving average system has shifted from bearish to bullish, with MA5, MA10, and MA30 forming a bullish alignment, and the current price trading above these three moving averages, indicating a short-term bullish trend but still in the recovery phase. The MACD is above the zero line and maintains a golden cross structure, with the red bars gradually enlarging, suggesting short-term bullish momentum is dominant. Overall, if BTC can hold steady above $89,000 and increase volume to break through $90,000, it may further challenge the previous high near $91,200; conversely, if it falls back below the support zone of $88,800–$88,400, caution should be taken as the rebound may weaken and reverse.

GateResearch·01-28 06:06

Tether sweeps 140 tons of gold! USDT giant becomes the world's fourth-largest reserve holder

Cryptocurrency giant Tether Holdings has become the world's largest gold reserve holder outside of banks and nations, currently holding approximately 140 tons of gold with a total value of $23,000,000,000, and continues to increase holdings at a rate of 1 to 2 tons per week. These gold reserves are stored in a top Swiss nuclear bunker. Analysts point out that Tether's purchases may have contributed to the 65% increase in gold prices last year.

MarketWhisper·01-28 02:17

Gate Research Institute: Macro multi-asset one-stop coverage, Gate TradFi connects precious metals, forex, indices, and stock CFDs

Summary

User trading demands are shifting from single-asset crypto to macro multi-asset strategies. TradFi offers CEX longer trading cycles, higher capital retention, and stronger hedging capabilities.

Gate TradFi leverages the MT5 trading system to support traditional asset CFDs, covering precious metals, stock CFDs, indices, forex, and commodities. Trading is based on price fluctuations rather than holding the underlying assets, with no expiration and no delivery required.

Gate TradFi uses USDx as the accounting and display unit, supported 1:1 by USDT, allowing users to participate in TradFi trading within a familiar trading system without manual currency exchange.

1. Background: TradFi is the next growth curve for CEX

In the past two years, user trading demands have shifted from single-asset crypto to macro multi-asset allocation. The reason is that not all high-certainty opportunities occur in the crypto market.

GateResearch·01-28 02:13

PaiCoin drops below $0.18! Fear Index crashes, is the next wave of liquidation coming?

Pi Network trading price is close to $0.1744, despite the testnet USDT trading volume reaching 59,000 coins indicating community activity, the mainnet token faces heavy selling pressure. PiScan data shows that over 1,300,000 PI coins flowed into centralized exchanges within 24 hours, with approximately 1,120,000 coins flowing into the exchanges.

MarketWhisper·01-28 01:52

Pi Network Testnet integrates USDT! 100 dApp ecosystems are about to explode

Pi Network Testnet has launched Tether USD (USDT) trading functionality, allowing 35 million Pioneers users to test DeFi operations in a controlled environment. The core team announced a strategic shift, prioritizing the development of 100 decentralized application ecosystems rather than seeking listings on mainstream exchanges.

PI2.38%

MarketWhisper·01-28 01:33

Fake exchange scam exposed! Online dating誘 investment money laundering $37 million caught

45-year-old Chinese citizen Jingliang Su was sentenced to nearly 4 years in federal prison and ordered to pay $26,000,000 for participating in a $37,000,000 cross-border cryptocurrency money laundering scam. The organization used fake trading platforms and online dating to lure 174 American victims. After converting funds through Bahamian banks into USDT, the money flowed to a Cambodian scam center, highlighting the organized nature of transnational crypto crimes.

MarketWhisper·01-28 01:30

Pi Network Advances Mainnet Preparation With Testnet USDT Integration

Pi Network testnet wallet now supports simulated USDT, letting users send and receive tokens for practice.

Testnet users can try swaps and liquidity pools while developers test DeFi tools before mainnet.

Pi Network is encouraging users to test USDT activity through its testnet wallet as it c

PI2.38%

CryptoNewsFlash·01-27 16:10

Zama Launches on Mainnet With First Confidential USDT Transfer on Ethereum

After several years of development, Zama has officially launched on Ethereum mainnet, completing the first confidential USDT (cUSDT) transfer using fully homomorphic encryption. In the days following the launch, the Zama

ICOHOIDER·01-27 11:29

FBI's Top 10 Most Wanted Caught! Olympic skier used Bitcoin USDT for drug trafficking and money laundering

44-year-old Ryan Wedding represented Canada in the 2002 Winter Olympics snowboarding event and is now a top ten FBI wanted fugitive, arrested in Mexico. The cross-country cocaine smuggling cartel used Bitcoin and USDT to receive payments via QR codes, engaging in cross-chain Bitcoin and other multi-chain money laundering. Authorities seized 1 ton of cocaine and $3.2 million in cryptocurrency assets, with the suspect facing life imprisonment for conspiracy to murder witnesses.

MarketWhisper·01-27 08:28

Tether is the New Central Bank: How Stablecoin Profits Fuel a $4.4B Gold Rush

In a stunning display of financial firepower, Tether, the issuer of the world's largest stablecoin USDT, is buying physical gold at a pace that rivals the world's largest central banks. In the fourth quarter of 2025 alone, Tether added roughly 27 metric tons to its coffers, a sovereign-scale acquisition funded entirely by profits from its \$187 billion dollar-pegged stablecoin.

This aggressive accumulation, valued at approximately \$4.4 billion, coincides with gold smashing through the \$

CryptopulseElite·01-27 06:54

Gate Research Institute: VanEck's First AVAX Spot ETF | Zerohash is in talks for a new round of financing

Cryptocurrency Market Overview

BTC (+0.98% | Current price 88,575 USDT): The risk of government shutdown and tariff-related policies are jointly suppressing global economic growth expectations, leading to a significant increase in market risk aversion. Over the weekend, Bitcoin briefly dropped nearly 3%, touching the 86,000–86,500 USD range, then rebounded about 1.3%, climbing back to around 87,000 USD. However, after the rebound, the price remains below the local low formed last week and is trading below the 50-day and 200-day moving averages, indicating that, in the context of temporarily controlled volatility, short-term selling pressure still dominates. Last week, spot Bitcoin experienced a net outflow of approximately 1.32 billion USD, the highest level since February 2025. Although Bitcoin is still in a controlled retracement phase, the overall price structure has shown clear signs of fatigue.

ETH (+1.88% | Current price

GateResearch·01-27 06:04

Analysis of Hong Kong Stablecoin Regulations! USDT Faces Licensing Challenges and Full Compliance Roadmap

Hong Kong's "Stablecoin Ordinance" requires licensed banks or a capital of 25 million, full reserves, and is limited to professional investors (8 million / 40 million threshold). Tether, registered in the British Virgin Islands, faces three challenges: capital, auditing, and access. Circle has already aligned with regulations, and Hong Kong is promoting the Digital Hong Kong Dollar to position itself as an Asian hub.

MarketWhisper·01-27 05:13

Tether Gold supply is growing faster than USDT

Tether's gold token, XAUT, has seen significant growth, with supply increasing 38% in Q4, contrasting with only a 7% rise in USDT. XAUT aims to provide a hedge amid weakened confidence in fiat currency, backed by physical gold in Switzerland. While it competes with PAX Gold, it has quickly gained market leadership. However, concerns persist regarding the lack of full audits by BDO Italia.

TapChiBitcoin·01-27 03:08

Pi Coin Key Upgrade! Testnet supports USDT trading, DeFi features fully enabled

Pi Network launched a testnet USDT wallet before the mainnet, encouraging millions of early adopters to test transactions, token swaps, and liquidity pool features. Currently, approximately 59,000 test USDT are in circulation. Users can experience DeFi applications for free and help identify vulnerabilities, making the final preparations for the official mainnet connection.

PI2.38%

MarketWhisper·01-27 03:01

VIP Exclusive Airdrop Carnival Phase 9 Begins: Complete Trading to Receive Airdrops, with a Maximum Value of 30,000 USDT Mysterious Tokens Incoming

The 9th VIP Exclusive Airdrop Carnival offers VIP traders up to 30,000 USDT in mystery tokens as incentives. Participation requires advancing to VIP 5 or above through trading. The event emphasizes trading volume requirements; after successful registration, participants must achieve a contract trading volume of 1,000,000 USD. The prize pool is distributed in tiers, with higher VIP levels receiving more generous rewards. Participants must complete identity verification and follow the event rules; violations will result in disqualification.

GateLearn·01-27 02:31

Zama ICO pioneers crypto auctions! 3 days to attract 118 million in oversubscription at 218%

Zama is the first to complete a confidential auction ICO, with a total transaction volume of $118,500,000, and a TVS exceeding $100 million in 3 days. 11,103 people participated in bidding with a clearing price of $0.05, representing an oversubscription of 218%. On January 24, it became the most used application on Ethereum, surpassing USDT and Uniswap, demonstrating that FHE technology has reached production level.

MarketWhisper·01-27 01:48

Binance announces the launch of "Tesla Stock" perpetual contracts on 1/28! Offering up to 5x leverage and 24/7 trading

Binance announces the launch of USDT-margined Tesla equity perpetual contracts on January 28, 2026, allowing investors to participate in Tesla's stock price fluctuations through their cryptocurrency accounts. These contracts offer 5x leverage and 24/7 trading, demonstrating the trend of integration between traditional finance and cryptocurrencies.

動區BlockTempo·01-26 12:30

Digitap ($TAP) Projected to Hit $1 After Solana Deposits Go Live: Best Crypto to Buy in 2026

Digitap ($TAP) has entered a new phase of its rollout with Solana deposits now officially live on the platform. The update allows users to fund their Digitap wallets using SOL, USDT, and USDC on Solana, unlocking faster settlement times and lower transaction costs across the app. This

CaptainAltcoin·01-26 11:05

Pi Network Pushes Testnet USDT Ahead of Mainnet

The Pi Network encourages users to test its USDT wallet in a testnet environment, facilitating hands-on experience with decentralized finance features. This approach enhances user engagement and prepares them for a smoother transition to the mainnet, fostering confidence and skill without financial risk.

PI2.38%

Coinfomania·01-26 07:18

Gate Research Institute: Crypto Market Risks Contract | SocialFi Narrative Enters a Downtrend

Cryptocurrency Asset Panorama

BTC (-1.69% | Current price 87,655.4 USDT)

After a sustained decline from previous highs, BTC experienced an emotional accelerated drop on the 26th, with a low of approximately $86,100. Subsequently, driven by oversold conditions and short-term short covering, it showed a technical rebound, but the rebound was limited. The current price remains below medium-term moving averages such as MA30, and the overall structure remains in a bearish arrangement. From macro and fundamental perspectives, there is no single major negative factor; ETF and long-term supply and demand logic have not been broken. In the short term, BTC is likely to fluctuate within the $86,000–$88,500 range to digest selling pressure, with caution needed for repeated tests after rebound resistance in the medium term. Over a longer cycle, as long as macroeconomic conditions do not significantly worsen and long-term capital logic remains unchanged, BTC is more likely to oscillate within a wide range at high levels rather than trend downward unilaterally.

GateResearch·01-26 07:00

Gate Research Institute: Market Sentiment Extremely Fearful | Stablecoin Real Payment Share Less Than 0.02%

Cryptocurrency Market Overview

BTC (-1.69% | Current price 87,655.4 USDT): After weakening at high levels, BTC experienced an accelerated pullback on the 26th, with a low of approximately 86,100 USD. It then rebounded from oversold conditions, but the rebound was limited, and the price remains below medium-term moving averages such as MA30, indicating a generally bearish structure. On the macro and fundamental levels, there are no major negative factors, and the ETF and long-term supply and demand dynamics remain intact. In the short term, BTC may fluctuate within the 86,000–88,500 USD range to digest selling pressure, with potential risks of a pullback after a rebound stalls; over a longer cycle, if macro conditions remain stable, Bitcoin is more likely to oscillate within a high range rather than trend downward unilaterally, thus building conditions for subsequent market movements.

ETH (-2.35% | Current price 2,881.78 USDT): ETH at 2

GateResearch·01-26 06:43

Tether Posts $5.2B Revenue in 2025, Dominating Crypto with Unshakeable Stablecoin Profits

Tether, the issuer of USDT, has solidified its position as the undisputed financial powerhouse of the cryptocurrency industry, posting a staggering \$5.2 billion in revenue for 2025.

This figure, accounting for 41.9% of all stablecoin revenue, dwarfs its competitors and underscores the transformation of dollar-pegged digital currencies into crypto's most reliable profit engine. While trading platforms saw volatile earnings tied to meme coin frenzies, Tether's revenue remained robust, bac

IN-0.8%

CryptopulseElite·01-26 06:09

Olympic Snowboarder Turned Alleged Crypto Crime Kingpin Arrested in Mexico

Former Olympic snowboarder Ryan James Wedding was arrested for allegedly running a crypto-backed cocaine trafficking operation using Tether (USDT) to handle drug proceeds. He faces charges including orchestrating murders and is being extradited to the U.S. for trial.

Decrypt·01-25 18:21

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, reaching a record high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-25 08:20

XRP Price Prediction: DeepSnitch AI’s 100x Presale Sparks Investor FOMO as Iran’s $507M Tether Purchase Impacts Markets

Iran’s Central Bank has purchased $507 million in USDT to stabilize its declining rial, according to blockchain analytics firm Elliptic. The move has sent ripples through crypto markets, impacting major assets including XRP and TRON.

While investors monitor the latest XRP price prediction

CaptainAltcoin·01-24 12:45

Load More