# CryptoMarketPullback

375.45K

Major assets declined over the last 24 hours as cascading liquidations intensified volatility. Are you focusing on drawdown control or scanning for structural opportunities?

Pin

Gate广场_Official

Gate Plaza|2/2 Today's Hot Topics: #加密市场回调

🎁【Fan Appreciation Giveaway】Post with a topic, 5 lucky winners * each receive an $100 position experience voucher!

In the past 24 hours, the market has undergone a hardcore “deleveraging.” BTC broke below $76,000, and mainstream assets like ETH, SOL, and others declined simultaneously. When volatility suddenly amplifies, how do you operate now?

💬 This week's hot discussion topics:

1️⃣ Position Management: Facing continuous declines, do you choose to “lighten your position and wait for change” or “hold your full position and stand firm”?

2️⃣ Profit

View Original🎁【Fan Appreciation Giveaway】Post with a topic, 5 lucky winners * each receive an $100 position experience voucher!

In the past 24 hours, the market has undergone a hardcore “deleveraging.” BTC broke below $76,000, and mainstream assets like ETH, SOL, and others declined simultaneously. When volatility suddenly amplifies, how do you operate now?

💬 This week's hot discussion topics:

1️⃣ Position Management: Facing continuous declines, do you choose to “lighten your position and wait for change” or “hold your full position and stand firm”?

2️⃣ Profit

- Reward

- 3

- 7

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

📉 Market Flush: Is This the Bottom or a

Structural Shift?

The crypto market is navigating a major

shakeout. Over the past few days, more than $2.5 billion in liquidations have washed out excess

leverage, resetting market froth and testing the conviction of even the most

seasoned HODLers.

As of February

2, 2026, Bitcoin has lost the psychological $80,000 support, dipping as low as $75,700 before staging a modest bounce.

Ethereum faced even heavier selling pressure, acting as the market’s “pressure

valve” and sliding toward the $2,250 zone.

🔍 What Triggered the

Pullback

📉 Market Flush: Is This the Bottom or a

Structural Shift?

The crypto market is navigating a major

shakeout. Over the past few days, more than $2.5 billion in liquidations have washed out excess

leverage, resetting market froth and testing the conviction of even the most

seasoned HODLers.

As of February

2, 2026, Bitcoin has lost the psychological $80,000 support, dipping as low as $75,700 before staging a modest bounce.

Ethereum faced even heavier selling pressure, acting as the market’s “pressure

valve” and sliding toward the $2,250 zone.

🔍 What Triggered the

Pullback

- Reward

- 1

- Comment

- Repost

- Share

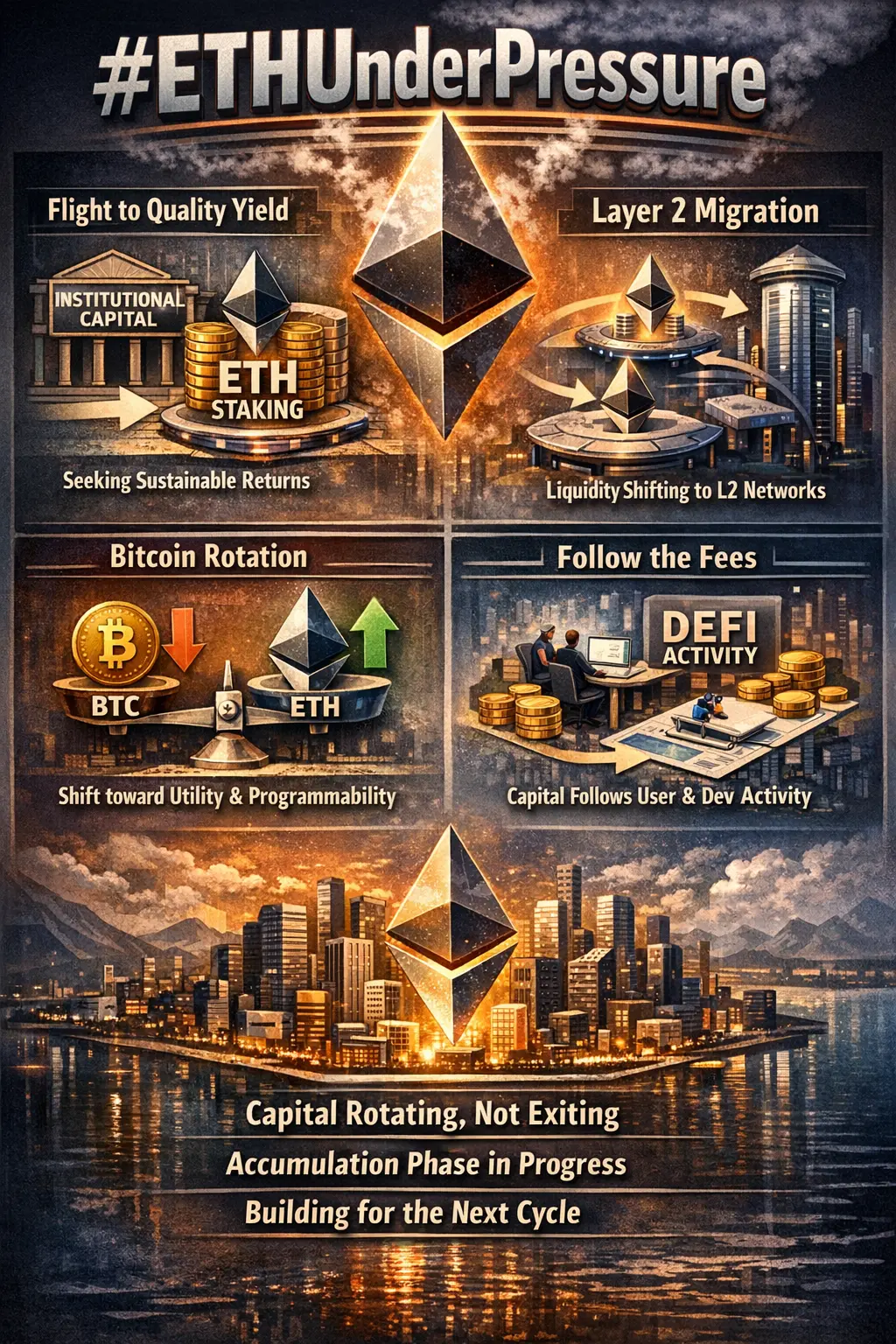

#ETHUnderPressure Capital rotation is one of the most misunderstood forces in the crypto market. It is not capital leaving the ecosystem, but capital changing its location based on risk, yield, and narrative strength. At the moment, the market is experiencing a multi-layered rotation that explains much of the current pressure, especially on Ethereum, while quietly laying the groundwork for the next expansion phase.

The first major shift is a renewed flight toward quality yield. As global rates stabilize, speculative capital is moving away from low-utility assets and into networks that offer su

The first major shift is a renewed flight toward quality yield. As global rates stabilize, speculative capital is moving away from low-utility assets and into networks that offer su

- Reward

- 1

- 2

- Repost

- Share

cryptoKnowledge :

:

HODL Tight 💪View More

#CryptoMarketPullback

📉 Market Flush: Is This the Bottom or a

Structural Shift?

The crypto market is navigating a major

shakeout. Over the past few days, more than $2.5 billion in liquidations have washed out excess

leverage, resetting market froth and testing the conviction of even the most

seasoned HODLers.

As of February

2, 2026, Bitcoin has lost the psychological $80,000 support, dipping as low as $75,700 before staging a modest bounce.

Ethereum faced even heavier selling pressure, acting as the market’s “pressure

valve” and sliding toward the $2,250 zone.

🔍 What Triggered the

Pullback

📉 Market Flush: Is This the Bottom or a

Structural Shift?

The crypto market is navigating a major

shakeout. Over the past few days, more than $2.5 billion in liquidations have washed out excess

leverage, resetting market froth and testing the conviction of even the most

seasoned HODLers.

As of February

2, 2026, Bitcoin has lost the psychological $80,000 support, dipping as low as $75,700 before staging a modest bounce.

Ethereum faced even heavier selling pressure, acting as the market’s “pressure

valve” and sliding toward the $2,250 zone.

🔍 What Triggered the

Pullback

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

1000x VIbes 🤑#CryptoMarketPullback MARKET CRASH ALERT … HEAVY BLOOD ON THE STREETS 🚨

The crypto market has seen a sharp sell-off, with major coins dumping hard over the last few days. Bitcoin has fallen aggressively from the $92K zone down to the $75K area in just 3 days, shaking market confidence and triggering widespread fear.

$BNB is down 5.6%,

$BTC dropped over 4.2%,

$ETH saw a deep crash of nearly 10%,

$SOL is down 7%,

$XRP lost more than 6.6%,

$DOGE slipped 3.6%,

$TRX remains relatively strong but still red,

$PEPE continues to bleed,

$ADA, $SUI, and $LINK all posted heavy losses between 5%–8%,

even

The crypto market has seen a sharp sell-off, with major coins dumping hard over the last few days. Bitcoin has fallen aggressively from the $92K zone down to the $75K area in just 3 days, shaking market confidence and triggering widespread fear.

$BNB is down 5.6%,

$BTC dropped over 4.2%,

$ETH saw a deep crash of nearly 10%,

$SOL is down 7%,

$XRP lost more than 6.6%,

$DOGE slipped 3.6%,

$TRX remains relatively strong but still red,

$PEPE continues to bleed,

$ADA, $SUI, and $LINK all posted heavy losses between 5%–8%,

even

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback

The crypto market is currently experiencing a significant correction as we enter February 2026. After a volatile January, the "Extreme Fear" sentiment has taken hold, with Bitcoin slipping to 9-month lows and the broader market shedding billions in value.

Below is a detailed breakdown of why this pullback is happening and what the technicals are signaling.

📉 Market Status: The "Extreme Fear" Phase

As of February 2, 2026, the Crypto Fear & Greed Index has plummeted to a staggering 14, indicating deep anxiety among investors.

Bitcoin (BTC): Trading near $77,000, down si

The crypto market is currently experiencing a significant correction as we enter February 2026. After a volatile January, the "Extreme Fear" sentiment has taken hold, with Bitcoin slipping to 9-month lows and the broader market shedding billions in value.

Below is a detailed breakdown of why this pullback is happening and what the technicals are signaling.

📉 Market Status: The "Extreme Fear" Phase

As of February 2, 2026, the Crypto Fear & Greed Index has plummeted to a staggering 14, indicating deep anxiety among investors.

Bitcoin (BTC): Trading near $77,000, down si

- Reward

- 2

- 3

- Repost

- Share

HighAmbition :

:

DYOR 🤓View More

#CryptoMarketPullback

Over the last 24 hours, the crypto market has experienced a pronounced pullback, driven by cascading liquidations that amplified volatility across major assets. Bitcoin, Ethereum, and select altcoins faced accelerated sell pressure as leveraged positions unwound, triggering a chain reaction that intensified market drawdowns. BTC tested short-term support near $24,000–$24,500, while ETH approached $1,740–$1,780, XRP $1.80–$1.90, DOGE $0.115–$0.12, and SUI $1.10–$1.33. The sharp movement highlights the sensitivity of highly leveraged positions to sudden market shifts, emph

Over the last 24 hours, the crypto market has experienced a pronounced pullback, driven by cascading liquidations that amplified volatility across major assets. Bitcoin, Ethereum, and select altcoins faced accelerated sell pressure as leveraged positions unwound, triggering a chain reaction that intensified market drawdowns. BTC tested short-term support near $24,000–$24,500, while ETH approached $1,740–$1,780, XRP $1.80–$1.90, DOGE $0.115–$0.12, and SUI $1.10–$1.33. The sharp movement highlights the sensitivity of highly leveraged positions to sudden market shifts, emph

- Reward

- 2

- 3

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback 1) Market Pulse — Continued Volatility Amid Macro & Liquidation Pressure

Over the past week, the cryptocurrency market has remained in flux, driven by both macroeconomic uncertainty and intensified liquidation events. Bitcoin recently slid sharply, dipping by over 6% to near $78,800 as geopolitical concerns and central bank leadership changes rattled risk assets. This downturn has spilled into other major tokens, underscoring the persistent sensitivity of crypto to external shocks. Liquidations have not been confined to major coins alone. Traditional markets also impacted

Over the past week, the cryptocurrency market has remained in flux, driven by both macroeconomic uncertainty and intensified liquidation events. Bitcoin recently slid sharply, dipping by over 6% to near $78,800 as geopolitical concerns and central bank leadership changes rattled risk assets. This downturn has spilled into other major tokens, underscoring the persistent sensitivity of crypto to external shocks. Liquidations have not been confined to major coins alone. Traditional markets also impacted

- Reward

- 3

- 1

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊#CryptoMarketPullback The crypto market is moving through a decisive corrective phase as February unfolds, and the tone has clearly shifted from optimism to caution. What we are witnessing is not a sudden collapse, but a controlled repricing after months of aggressive upside expansion. Sentiment has swung sharply toward fear, and this emotional reset is playing a central role in driving volatility. Markets often move faster on emotion than logic, and the current environment reflects a collective pause where participants reassess risk, liquidity, and long-term conviction.

Bitcoin continues to a

Bitcoin continues to a

- Reward

- 1

- Comment

- Repost

- Share

$RIVER Dumped 70%+ → RIVER3S Got Absolutely Rekt… Bounce Incoming?

$RIVER3S/USDT (the 3× short leveraged ETF token) and RIVER/USDT perpetual futures.

● What These Instruments Are.

RIVER is the underlying token of the River protocol (a chain-abstraction stablecoin system using satUSD, cross-chain liquidity without bridges). It has seen very strong hype and volatility recently, with massive pumps followed by sharp corrections.

$RIVER/USDT Perp — normal leveraged perpetual futures on the base RIVER token.

RIVER3S/USDT — leveraged ETF token (3× inverse / short). This means it aims to deliver app

$RIVER3S/USDT (the 3× short leveraged ETF token) and RIVER/USDT perpetual futures.

● What These Instruments Are.

RIVER is the underlying token of the River protocol (a chain-abstraction stablecoin system using satUSD, cross-chain liquidity without bridges). It has seen very strong hype and volatility recently, with massive pumps followed by sharp corrections.

$RIVER/USDT Perp — normal leveraged perpetual futures on the base RIVER token.

RIVER3S/USDT — leveraged ETF token (3× inverse / short). This means it aims to deliver app

RIVER3S-83.91%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

375.45K Popularity

3.85K Popularity

3.78K Popularity

2.7K Popularity

1.51K Popularity

2.98K Popularity

1.25K Popularity

1.92K Popularity

1.81K Popularity

23 Popularity

52.96K Popularity

67.72K Popularity

19.95K Popularity

25.08K Popularity

200.6K Popularity

News

View MoreData: In the past 24 hours, the entire network has been liquidated by $800 million, with long positions liquidated by $597 million and short positions liquidated by $204 million.

3 m

Bitcoin pullback severely impacts Treasury Company! Strategy's unrealized loss on the books once approached $1 billion

6 m

"ZEC's largest short" closes nearly 80% of ETH short positions, with weekly profits reaching $15.5 million

7 m

Ripple has been granted a full license by the Luxembourg CSSF as an Electronic Money Institution (EMI) within the European Union.

8 m

ETH whale sells $371 million in the past 48 hours to repay Aave debt, DeFi leverage risk intensifies across the board

11 m

Pin