# BiggestCryptoOutflowsSince2022

48.96K

HighAmbition

#BiggestCryptoOutflowsSince2022

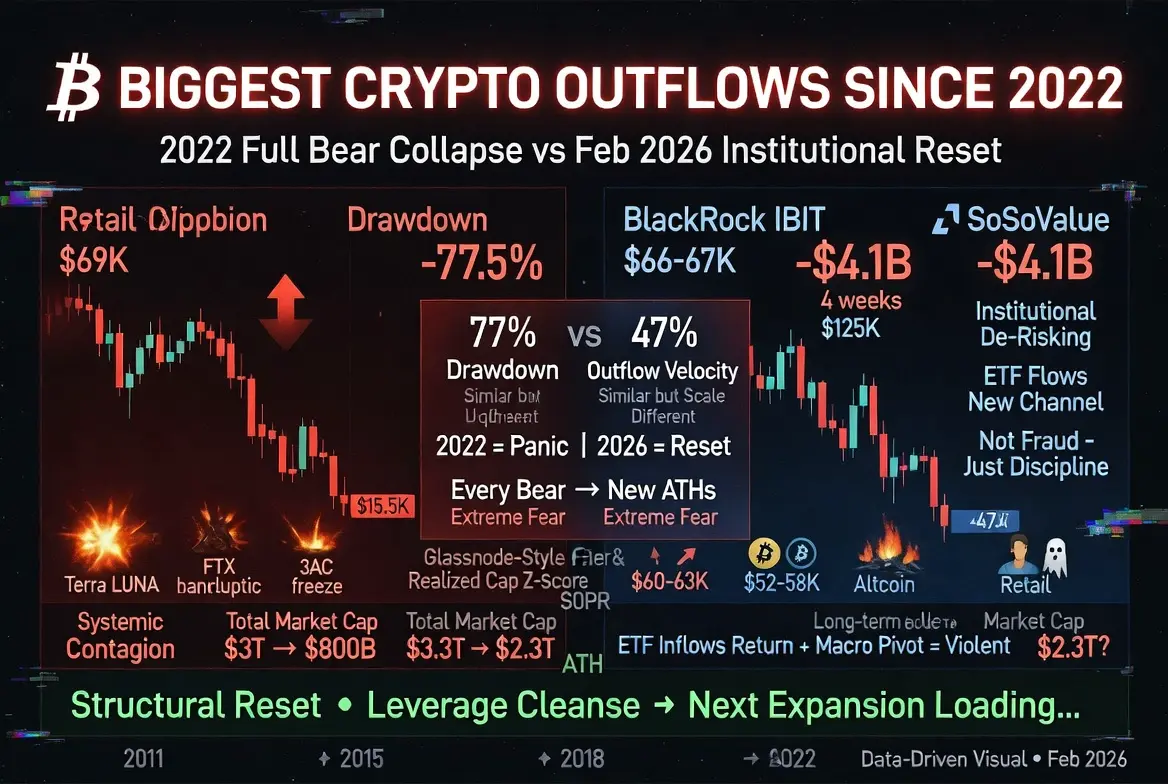

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

- Reward

- 6

- 6

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#BiggestCryptoOutflowsSince2022 📉 Market Snapshot

Current Price: Bitcoin is hovering around $66,500, struggling to find a solid floor after dropping nearly 47% from its October 2025 all-time high of ~$126,000.

Fear & Greed Index: Currently sitting at a dismal 8–9, confirming the "Extreme Fear" you mentioned.

Weekly Performance: The 22.2% drop over the last week is indeed one of the most aggressive technical breakdowns in Bitcoin's history.🛡️ Critical Levels to Watch

Primary Support ($60,000 – $62,000): This is the "must-hold" zone. A break below this could psychologically open the door to th

Current Price: Bitcoin is hovering around $66,500, struggling to find a solid floor after dropping nearly 47% from its October 2025 all-time high of ~$126,000.

Fear & Greed Index: Currently sitting at a dismal 8–9, confirming the "Extreme Fear" you mentioned.

Weekly Performance: The 22.2% drop over the last week is indeed one of the most aggressive technical breakdowns in Bitcoin's history.🛡️ Critical Levels to Watch

Primary Support ($60,000 – $62,000): This is the "must-hold" zone. A break below this could psychologically open the door to th

BTC-1.24%

- Reward

- 2

- Comment

- Repost

- Share

#BiggestCryptoOutflowsSince2022

#BiggestCryptoOutflowsSince2022

The cryptocurrency markets in February 2026 are witnessing one of the deepest institutional capital withdrawals in recent years. Reaching an intensity not seen since the systemic shocks of 2022, these fund outflows signal a new search for equilibrium within the digital asset ecosystem.

A Historic Fracture in Capital Flows

As of mid-February, outflows from crypto investment products have closed their fourth consecutive week in negative territory, reaching a staggering total volume of $3.8 billion. This data clearly demonstrates th

#BiggestCryptoOutflowsSince2022

The cryptocurrency markets in February 2026 are witnessing one of the deepest institutional capital withdrawals in recent years. Reaching an intensity not seen since the systemic shocks of 2022, these fund outflows signal a new search for equilibrium within the digital asset ecosystem.

A Historic Fracture in Capital Flows

As of mid-February, outflows from crypto investment products have closed their fourth consecutive week in negative territory, reaching a staggering total volume of $3.8 billion. This data clearly demonstrates th

BTC-1.24%

- Reward

- 6

- 11

- Repost

- Share

VisitingTheSettingSun :

:

Happy New Year 🧨View More

#BiggestCryptoOutflowsSince2022

The appearance of the largest crypto outflows since 2022 is not a random or isolated event; it is the result of multiple forces converging at the same time. Markets move in cycles, and capital flows are the clearest reflection of where risk appetite stands within those cycles. When outflows reach historical extremes, it usually means that positioning has become one-sided, expectations are being reset, and participants are reassessing their exposure to uncertainty. Rather than signaling collapse, these moments often mark transition phases where excess optimism i

The appearance of the largest crypto outflows since 2022 is not a random or isolated event; it is the result of multiple forces converging at the same time. Markets move in cycles, and capital flows are the clearest reflection of where risk appetite stands within those cycles. When outflows reach historical extremes, it usually means that positioning has become one-sided, expectations are being reset, and participants are reassessing their exposure to uncertainty. Rather than signaling collapse, these moments often mark transition phases where excess optimism i

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

good information about crypto#What’sNextforBitcoin? What’sNextforBitcoin? Structural Crossroads for BTC

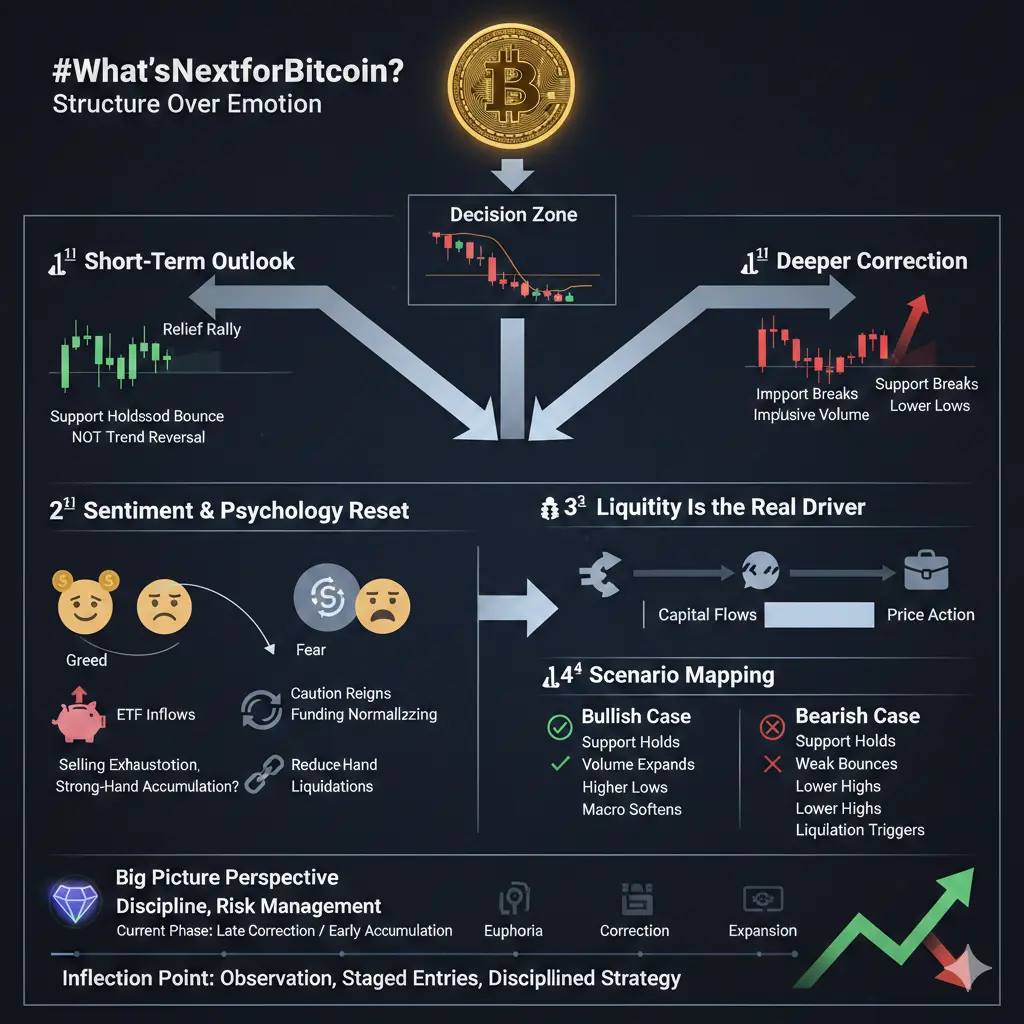

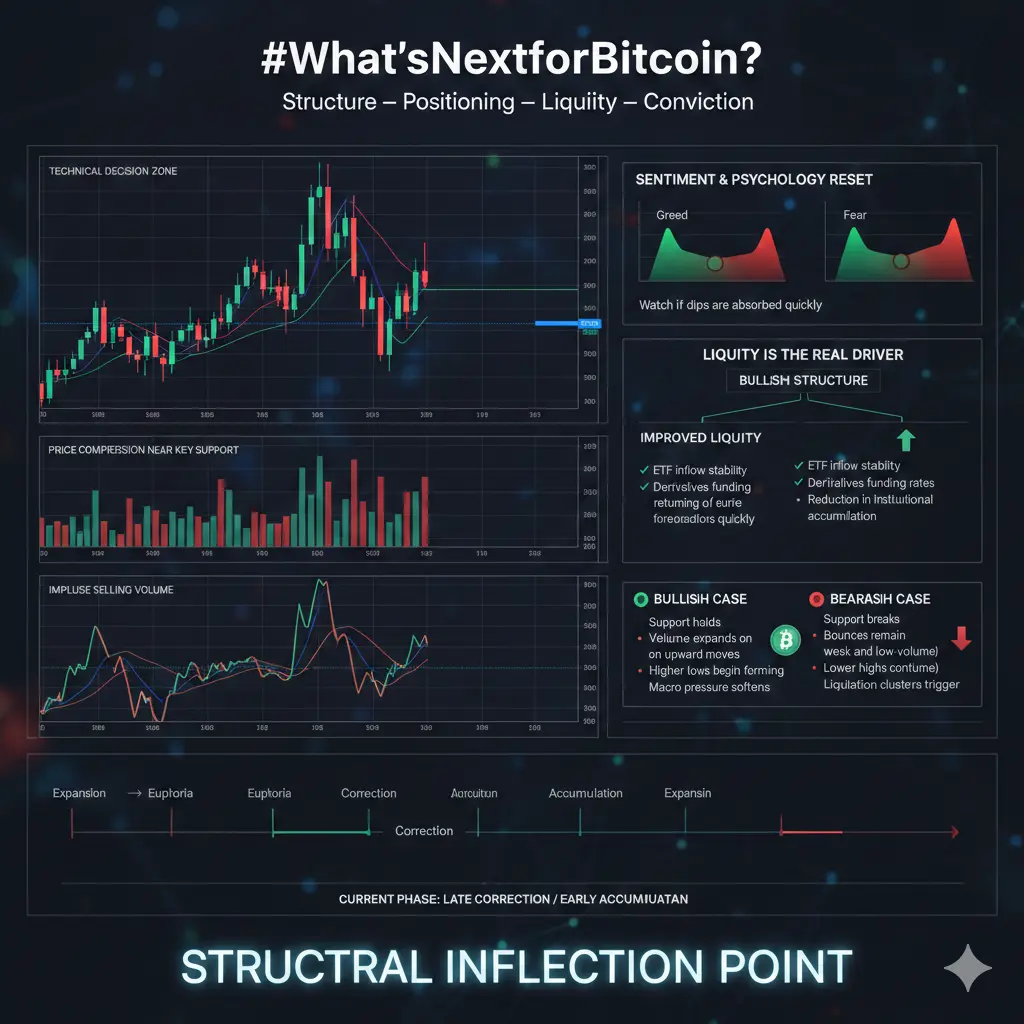

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

BTC-1.24%

- Reward

- 2

- Comment

- Repost

- Share

#What’sNextforBitcoin? Bitcoin (BTC) is at a structural crossroads. Headlines, social media hype, or sudden macro news may sway short-term sentiment, but true market direction is dictated by positioning, liquidity, and conviction. Currently, BTC is compressing near key support zones, a classic decision point where the next major move will be defined by how buyers and sellers interact — not by speculation or emotional reactions.

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

BTC-1.24%

- Reward

- 8

- 15

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#What’sNextforBitcoin? Let’s pause the headlines and look at structure — because Bitcoin doesn’t move on emotion, it moves on positioning, liquidity, and conviction. 📊

Right now, BTC is sitting in a technical decision zone. After recent volatility, price is compressing near key support. When markets compress after expansion, they prepare for expansion again — the only question is direction. This phase is less about prediction and more about confirmation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels continue to hold, a technical relief rally becomes likely.

Right now, BTC is sitting in a technical decision zone. After recent volatility, price is compressing near key support. When markets compress after expansion, they prepare for expansion again — the only question is direction. This phase is less about prediction and more about confirmation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels continue to hold, a technical relief rally becomes likely.

BTC-1.24%

- Reward

- 7

- 14

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin? Let’s step back from the noise and focus on structure over emotion. Bitcoin doesn’t move on headlines or hype — it moves on positioning, liquidity, and conviction. Currently, BTC is compressing near key support, a classic decision zone where the next major move is determined by how buyers and sellers react, not by speculation.

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels hold, a technical relief rally becomes likely. Oversold conditions often produce short-term bounces as short sellers take profit and sidelined buyers test entries. But

📉 1️⃣ Short-Term Outlook: Relief Rally or Continuation?

If major support levels hold, a technical relief rally becomes likely. Oversold conditions often produce short-term bounces as short sellers take profit and sidelined buyers test entries. But

BTC-1.24%

- Reward

- 9

- 15

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

#What’sNextforBitcoin?

Bitcoin is at a critical crossroads. After falling sharply from its all time high near 126K, the market is now consolidating around the mid 60K range, leaving traders asking one question. What comes next?

Current Market Position

BTC recently dropped to around 60K to 68K

Roughly 45 to 50 percent below peak

Volatility remains high

Market sentiment ranges from fear to cautious optimism

Bitcoin even tested levels near 61K before rebounding, showing buyers are still active.

Key Price Levels That Will Decide the Next Move

Bullish Scenario

If Bitcoin regains strength

Break abo

Bitcoin is at a critical crossroads. After falling sharply from its all time high near 126K, the market is now consolidating around the mid 60K range, leaving traders asking one question. What comes next?

Current Market Position

BTC recently dropped to around 60K to 68K

Roughly 45 to 50 percent below peak

Volatility remains high

Market sentiment ranges from fear to cautious optimism

Bitcoin even tested levels near 61K before rebounding, showing buyers are still active.

Key Price Levels That Will Decide the Next Move

Bullish Scenario

If Bitcoin regains strength

Break abo

BTC-1.24%

- Reward

- 6

- 8

- Repost

- Share

Korean_Girl :

:

To The Moon 🌕View More

BTC Technical Outlook: Bitcoin Consolidates Near Macro Base After Breakdown Below 0.236

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

BTC-1.24%

- Reward

- 7

- 7

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

216.2K Popularity

854.73K Popularity

48.96K Popularity

90.1K Popularity

459.92K Popularity

289.76K Popularity

60.17K Popularity

35.41K Popularity

23.52K Popularity

22.21K Popularity

22.52K Popularity

19.8K Popularity

21.59K Popularity

49.22K Popularity

News

View MoreThe current unrealized loss for Strategy has expanded to $6.7 billion

24 m

The White House plans to hold the third stablecoin yield meeting tomorrow

1 h

Analysis: Bitcoin rebounds to $67,000, and Trump's tariff remarks reignite expectations of macro tightening

1 h

Federal Reserve researchers say Kalshi data can provide real-time insights for policy making

1 h

Wu Jie Zhuang: Hong Kong will issue the first batch of stablecoin issuer licenses in March, hoping that the government will promote the use of cryptocurrencies among all residents of Hong Kong through stablecoin airdrops.

1 h

Pin