2025 RARE Price Prediction: Analysis of Growth Potential and Market Factors Impacting Token Value

Introduction: RARE's Market Position and Investment Value

SuperRare (RARE), as a leading platform for collecting and trading unique digital artworks, has made significant strides since its inception in 2018. As of 2025, RARE's market capitalization has reached $41,104,359, with a circulating supply of approximately 819,464,901 tokens, and a price hovering around $0.05016. This asset, often referred to as the "NFT art pioneer," is playing an increasingly crucial role in the digital art and collectibles market.

This article will provide a comprehensive analysis of RARE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RARE Price History Review and Current Market Status

RARE Historical Price Evolution

- 2021: RARE launched in August, reaching its all-time high of $3.64 on October 11th

- 2022: Market downturn, price declined significantly from its peak

- 2023-2024: Continued bearish trend, price fluctuated at lower levels

- 2025: Price reached its all-time low of $0.04189229 on June 23rd

RARE Current Market Situation

As of October 1, 2025, RARE is trading at $0.05016, with a 24-hour trading volume of $854,478.39. The token has seen a slight increase of 0.82% in the last 24 hours. RARE's market capitalization stands at $41,104,359.46, ranking it at 770th position in the overall cryptocurrency market.

The current price is significantly below its all-time high, indicating a substantial decline over the years. However, the recent 24-hour and 1-hour price changes show slight positive momentum, with increases of 0.82% and 0.84% respectively. Despite this short-term uptick, RARE has experienced negative performance over longer periods, with a 7-day decline of 2.51%, a 30-day drop of 5.71%, and a substantial year-on-year decrease of 64.33%.

RARE's circulating supply is 819,464,901.5897872 tokens, which represents 81.95% of its total supply of 1,000,000,000 tokens. The fully diluted market cap is $50,160,000.

Click to view the current RARE market price

Here's the content in English as requested:

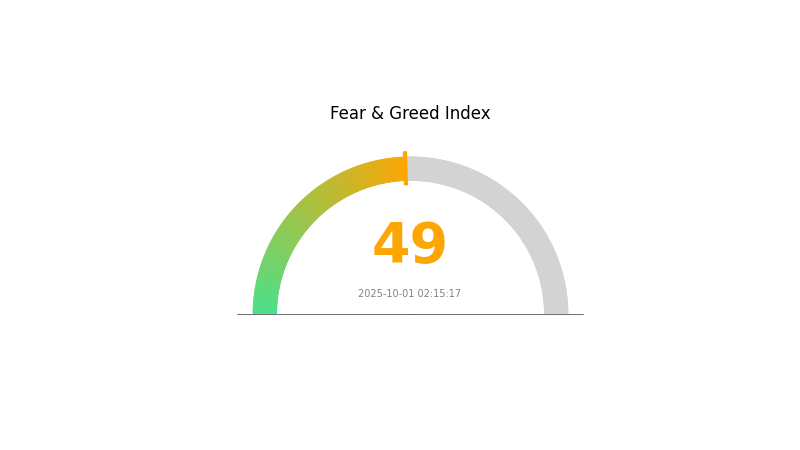

RARE Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for measured decision-making in trading and investment strategies. While the market doesn't show extreme emotions, it's crucial to stay informed and cautious. Remember, Gate.com offers comprehensive tools and analysis to help navigate these market conditions effectively.

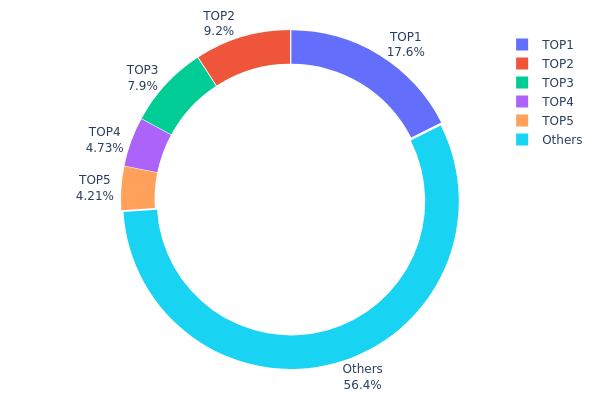

RARE Holdings Distribution

The address holdings distribution data for RARE reveals a relatively concentrated ownership structure. The top address holds 17.55% of the total supply, with the top 5 addresses collectively controlling 43.57% of RARE tokens. This level of concentration suggests a significant influence by a small number of large holders on the market dynamics.

Such concentration raises concerns about potential market manipulation and price volatility. Large holders have the capacity to significantly impact the token's price through substantial buy or sell orders. However, it's worth noting that 56.43% of the supply is distributed among other addresses, indicating some level of decentralization. This distribution pattern reflects a balance between major stakeholders and a broader community of holders, which could contribute to market stability in the long term.

The current address distribution suggests that RARE's market structure is in a developing stage, with room for further decentralization. As the project evolves, monitoring changes in this distribution will be crucial for assessing the token's long-term sustainability and resistance to centralized control.

Click to view the current RARE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x860a...b48da9 | 175565.05K | 17.55% |

| 2 | 0xf977...41acec | 91953.90K | 9.19% |

| 3 | 0x5a52...70efcb | 79000.00K | 7.90% |

| 4 | 0xb521...b36323 | 47310.37K | 4.73% |

| 5 | 0x76ec...78fbd3 | 42070.47K | 4.20% |

| - | Others | 564100.22K | 56.43% |

II. Key Factors Affecting Future RARE Prices

Supply Mechanism

- Global Production: Global rare earth mine production increased from 132,000 tons in 2017 to approximately 170,000 tons in 2018, a 28.8% year-on-year growth.

- Historical Pattern: China's supply has maintained a strong influence globally, accounting for over 70% of global rare earth supply.

- Current Impact: Environmental protection measures and crackdowns on illegal mining have partially suppressed the black market supply chain, particularly for ion-adsorption rare earth mines.

Institutional and Major Holder Dynamics

- Institutional Holdings: China, Japan, and the United States remain the main consumers of global rare earth smelting and separation products.

- National Policies: China's rare earth mining quotas have been adjusted, with an increase of 15,000 tons in 2018 to offset the impacts of environmental protection and illegal mining crackdowns in the previous two years.

Macroeconomic Environment

- Geopolitical Factors: The geographical distribution imbalance of rare earth resources is the most direct factor in the generation of energy power. The changing perspectives on energy security from the oil crisis era to the future new energy era are important factors influencing changes in international geopolitical power in the energy sector.

Technological Development and Ecosystem Construction

- Technological Upgrades: As a structure-sensitive material, the magnetic properties of rare earth permanent magnetic materials are affected by multiple factors in the sintering and heat treatment processes.

- Ecosystem Applications: The relationship between "composition-performance-price" of rare earth materials is being analyzed to quickly identify specific performance improvements.

III. RARE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03116 - $0.05026

- Neutral prediction: $0.05026 - $0.06000

- Optimistic prediction: $0.06000 - $0.06333 (requires strong market momentum and positive project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.05922 - $0.06533

- 2028: $0.04234 - $0.06761

- Key catalysts: Project ecosystem expansion, broader crypto market recovery

2030 Long-term Outlook

- Base scenario: $0.06000 - $0.07500 (assuming steady market growth)

- Optimistic scenario: $0.07500 - $0.09000 (with significant project milestones achieved)

- Transformative scenario: $0.09000 - $0.09867 (with widespread adoption and favorable market conditions)

- 2030-12-31: RARE $0.069 (average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06333 | 0.05026 | 0.03116 | 0 |

| 2026 | 0.06531 | 0.05679 | 0.03351 | 13 |

| 2027 | 0.06533 | 0.06105 | 0.05922 | 21 |

| 2028 | 0.06761 | 0.06319 | 0.04234 | 25 |

| 2029 | 0.0726 | 0.0654 | 0.03335 | 30 |

| 2030 | 0.09867 | 0.069 | 0.04761 | 37 |

IV. RARE Professional Investment Strategies and Risk Management

RARE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: NFT art collectors and long-term cryptocurrency investors

- Operational suggestions:

- Accumulate RARE tokens during market dips

- Participate in the SuperRare ecosystem to understand its value

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor NFT market trends and their impact on RARE token price

RARE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance RARE with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for RARE

RARE Market Risks

- NFT market volatility: Fluctuations in the broader NFT market can impact RARE token value

- Competition: Emerging NFT platforms may challenge SuperRare's market position

- Liquidity risk: Lower trading volume may lead to increased price volatility

RARE Regulatory Risks

- NFT classification: Potential changes in how NFTs are legally classified could affect SuperRare

- Copyright issues: Regulatory challenges related to digital art ownership and copyright

- Cross-border regulations: Varying international laws may impact global operations

RARE Technical Risks

- Smart contract vulnerabilities: Potential exploits in the SuperRare platform

- Scalability issues: Ethereum network congestion could affect platform performance

- Interoperability challenges: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

RARE Investment Value Assessment

RARE token presents a unique opportunity in the NFT art market, with long-term potential tied to SuperRare's growth. However, investors should be aware of short-term volatility and regulatory uncertainties in the NFT space.

RARE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about NFT markets

✅ Experienced investors: Consider RARE as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence and consider RARE for NFT exposure

RARE Trading Participation Methods

- Gate.com: Trade RARE tokens on this reputable exchange

- SuperRare platform: Engage directly with the ecosystem by buying/selling NFTs

- DeFi protocols: Explore liquidity provision or yield farming opportunities involving RARE tokens

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will SuperRare coins go up?

Yes, SuperRare coins are projected to increase. Predictions suggest a price of $0.089465 by 2025, indicating potential growth in line with market trends.

What is the rare stock price prediction?

Analysts predict RARE stock price to reach $86.05 by 2026, with estimates ranging from $34.00 to $128.00, based on current market analysis.

Why is SuperRare pumping?

SuperRare is pumping due to increased NFT market activity, growing interest in digital art, and rising demand for its tokens, driving the price up significantly.

What is the price prediction for RSR in 2025?

Based on current market analysis, the price prediction for RSR in 2025 ranges from $0.00566928 to $0.02267966, potentially seeing a 301% increase.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

2026 KP3R Price Prediction: Expert Analysis and Market Outlook for Keep3r Network Token

2026 CEL Price Prediction: Expert Analysis and Market Forecast for Celsius Token

2026 MOBI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 ALMANAK Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Next Bull Cycle