2026 INSP Price Prediction: Expert Analysis and Market Forecast for Inspectíon Systems Inc.

Introduction: INSP's Market Position and Investment Value

Inspect (INSP) serves as a Layer 2 solution at the forefront of Web3, providing essential tools and insights for navigating cryptocurrencies and NFTs within social ecosystems like X (Twitter). Since its launch in 2023, the project has built a strong user base of over 300,000 participants. As of February 2026, INSP maintains a market capitalization of approximately $1.55 million, with a circulating supply of around 798.37 million tokens, and its price is trading near $0.00194. This asset, designed to power Web3 social analytics and engagement, is playing an increasingly important role in bridging traditional social platforms with decentralized finance.

This article will comprehensively analyze INSP's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. INSP Price History Review and Market Overview

INSP Historical Price Evolution Trajectory

- 2024: INSP launched on Gate.com in December 2023 with an initial listing price of $0.015, and reached a notable price level of $0.4 in March 2024

- 2025: Following the broader market trends, INSP experienced significant price adjustments throughout the year

- 2026: As of February 2, 2026, the token is trading near $0.001939, representing a substantial decline from previous levels

INSP Current Market Status

As of February 2, 2026, INSP is trading at $0.001939, experiencing a 14.91% decrease over the past 24 hours. The token's recent price movement shows a decline of 0.57% in the last hour and 15.59% over the past week. The 30-day performance indicates a 48.82% decrease, while the one-year change reflects an 84.11% decline.

The current 24-hour trading volume stands at $23,761.17, with the price ranging between $0.001931 and $0.002325 during this period. INSP's market capitalization is approximately $1.55 million, with a circulating supply of 798,366,803 tokens, representing 79.84% of the total supply of 1 billion tokens. The fully diluted market cap is $1.94 million.

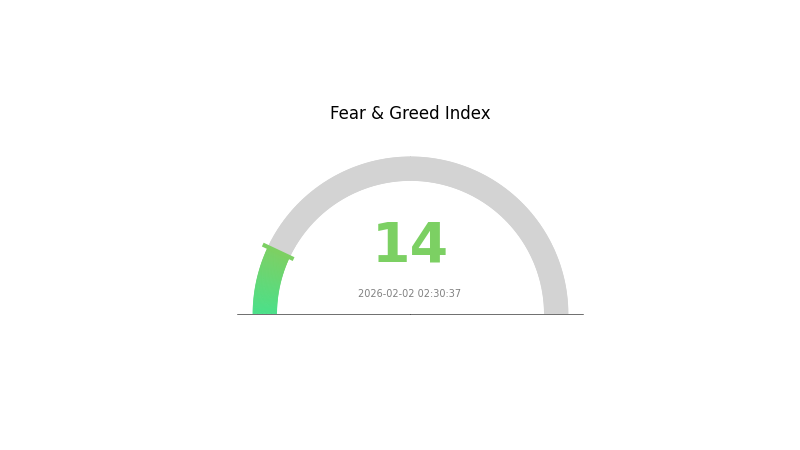

The token currently ranks 2209 in the cryptocurrency market, with a market dominance of 0.000071%. INSP is held by 10,869 addresses and is available on 8 exchanges. The crypto market sentiment index stands at 14, indicating an "Extreme Fear" environment.

Click to view current INSP market price

INSP Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This indicates investors are highly pessimistic about market conditions. Extreme fear often presents contrarian opportunities for long-term investors, as such sentiment typically precedes market recoveries. However, caution remains warranted as additional downside cannot be ruled out. Monitor key support levels closely and consider risk management strategies. Traditional indicators suggest potential accumulation phases may emerge as sentiment reaches such extreme levels.

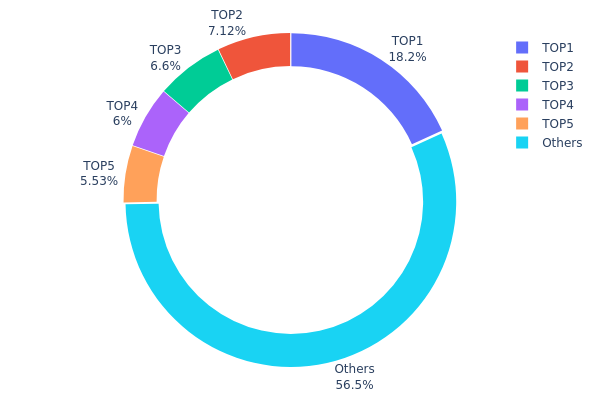

INSP Holding Distribution

The holding distribution chart provides a critical visualization of token concentration across wallet addresses, revealing the degree of decentralization and potential market power dynamics within the INSP ecosystem. This metric serves as a fundamental indicator of market structure health and vulnerability to concentrated selling pressure.

According to the current on-chain data, INSP exhibits a moderately concentrated holding pattern. The top address holds 182,480.23K tokens (18.24%), while the subsequent four addresses collectively control 252,567.06K tokens (25.25%). The top five addresses combined account for 43.49% of the total supply, with the remaining 56.51% distributed among other addresses. This concentration level suggests a relatively balanced distribution compared to many emerging tokens, where top holders frequently control over 60% of supply.

The current distribution structure presents both stability factors and potential risks. The largest holder's 18.24% stake, while significant, falls below the critical 20% threshold often associated with single-entity market manipulation concerns. However, the combined influence of top five addresses controlling nearly half the supply warrants attention, as coordinated movements could generate substantial price volatility. The majority holding by "Others" (56.51%) indicates reasonable decentralization at lower tiers, which typically contributes to more organic price discovery and reduced susceptibility to concentrated dumps. This structure reflects a maturing token economy with developing retail participation, though institutional or early investor positions remain notable factors in market dynamics.

Click to view current INSP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf89d...5eaa40 | 182480.23K | 18.24% |

| 2 | 0x2ddf...bf0f55 | 71226.58K | 7.12% |

| 3 | 0x436f...56b3b5 | 66009.25K | 6.60% |

| 4 | 0x929a...c4fc3d | 60000.00K | 6.00% |

| 5 | 0x2677...ccb975 | 55332.23K | 5.53% |

| - | Others | 564951.71K | 56.51% |

II. Core Factors Influencing INSP's Future Price

Supply Mechanism

- Token Distribution: ASTER maintains a circulating supply of approximately 1,657,700,000 tokens, representing 20.72% of the total supply of 8,000,000,000 tokens. The relatively low circulation ratio suggests substantial room for future supply expansion.

- Historical Patterns: Historical data indicates that ASTER has demonstrated varied performance across different periods. The token experienced a cumulative increase of 1178.83% over the past year, though it declined 23.68% in the most recent 30-day period, followed by a 3.15% uptick over the past seven days.

- Current Impact: The low circulation ratio may continue to exert downward pressure on prices as additional tokens potentially enter circulation. The high concentration of holdings, with the top five addresses controlling 81.07% of the total supply, creates conditions where large holder actions could significantly influence price movements.

Institutional and Large Holder Dynamics

- Holder Concentration: Token distribution analysis reveals that the first-largest address holds 40.70% of the supply, while the second-largest controls 19.60%. This substantial concentration in the hands of major holders presents both opportunities and risks for price stability.

- Market Implications: The current structure demonstrates limited decentralization, which may affect ecosystem resilience and governance democracy. High concentration levels could potentially lead to market manipulation scenarios and sharp price volatility, as large holders possess the capacity to materially impact pricing through their trading activities.

Macroeconomic Environment

- Market Sentiment: As of the assessment date, the Fear and Greed Index registered at 16, indicating extreme panic in the cryptocurrency market. Historical patterns suggest that periods of extreme pessimism often correspond with oversold market conditions, potentially presenting entry opportunities for strategic investors.

- Economic Conditions: Broader macroeconomic factors, including monetary policy shifts and inflation trends, continue to play important roles in shaping cryptocurrency valuations. The current environment requires careful evaluation of how traditional economic indicators may influence digital asset performance.

- Risk Considerations: Market sentiment remains highly volatile, and extreme fear does not necessarily forecast continued price declines. Investors should maintain diversified portfolios, implement rational allocation strategies, and exercise prudent risk management.

Technological Development and Ecosystem Building

- Platform Evolution: ASTER has positioned itself as a comprehensive decentralized exchange solution, serving as a one-stop on-chain trading platform for global cryptocurrency traders. The platform facilitates both spot and perpetual contract trading within the cryptocurrency ecosystem.

- Market Position: With a market capitalization of approximately 1.79 billion USD, ASTER ranks 62nd in the cryptocurrency market. The platform's 24-hour trading volume of 30,520,465.13 USD reflects moderate market activity levels.

- Ecosystem Growth: As an all-in-one DEX solution, ASTER continues to play an increasingly important role in the decentralized finance landscape, though specific technical upgrades and application developments require further monitoring as they emerge.

III. 2026-2031 INSP Price Forecast

2026 Outlook

- Conservative prediction: $0.00132 - $0.00194

- Neutral prediction: $0.00194 (average scenario)

- Optimistic prediction: $0.00205 (requires favorable market conditions)

Based on current market dynamics, INSP is expected to trade within a relatively narrow range throughout 2026. The token may experience moderate volatility with prices fluctuating between the lower bound of $0.00132 and potential highs reaching $0.00205. Market participants should note that the projected average price of $0.00194 reflects stable market conditions without significant catalysts.

2027-2029 Mid-term Outlook

- Market stage expectation: gradual accumulation phase with emerging growth momentum

- Price range forecast:

- 2027: $0.00143 - $0.00219

- 2028: $0.00115 - $0.00276

- 2029: $0.00170 - $0.00286

- Key catalysts: potential ecosystem expansion, community development, and broader cryptocurrency market recovery

During this mid-term period, INSP may demonstrate increasing price variance as the market matures. The year 2028 could present both opportunities and challenges, with price ranges widening significantly. By 2029, the token is projected to show a year-over-year growth of approximately 25%, suggesting strengthening market fundamentals and improved investor sentiment.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00169 - $0.00291 (assuming steady market development)

- Optimistic scenario: $0.00265 - $0.00292 (requires sustained adoption and positive market sentiment)

- Transformative scenario: potential breakthrough above $0.00292 (contingent on exceptional technological advancement or mainstream adoption)

The long-term forecast indicates continued upward momentum for INSP. By 2030, the token may achieve approximately 36% growth compared to 2026 levels, with average prices potentially reaching $0.00265. The 2031 projection suggests further consolidation around the $0.00278 average price level, representing a cumulative growth of approximately 43% from the 2026 baseline. These projections assume continued project development, expanding utility, and favorable macroeconomic conditions within the cryptocurrency sector.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00205 | 0.00194 | 0.00132 | 0 |

| 2027 | 0.00219 | 0.00199 | 0.00143 | 2 |

| 2028 | 0.00276 | 0.00209 | 0.00115 | 7 |

| 2029 | 0.00286 | 0.00243 | 0.0017 | 25 |

| 2030 | 0.00291 | 0.00265 | 0.00169 | 36 |

| 2031 | 0.00292 | 0.00278 | 0.00144 | 43 |

IV. INSP Professional Investment Strategies and Risk Management

INSP Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Individuals seeking exposure to Web3 social analytics infrastructure with moderate to high risk tolerance

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry timing risk given the token's significant volatility (down 84.11% over 1 year)

- Monitor user growth metrics and platform adoption beyond the current 300,000+ user base as key long-term value indicators

- Storage Solution: Utilize Gate Web3 Wallet for secure self-custody, ensuring private key backup and multi-signature options where available

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume ($23,761) relative to market cap ($1.55M) to identify liquidity conditions and potential volatility

- Support/Resistance Levels: Track the recent low of $0.001929 (ATL on February 2, 2026) and 24-hour high of $0.002325 for short-term trading ranges

- Swing Trading Considerations:

- Given the 14.91% 24-hour decline and 15.59% weekly drop, wait for price stabilization signals before entering positions

- Set stop-loss orders below the ATL of $0.001929 to limit downside exposure during volatile periods

INSP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation maximum

- Aggressive Investors: 3-5% allocation with close monitoring of platform development milestones

- Professional Investors: Up to 5-8% allocation with active hedging strategies and regular rebalancing

(2) Risk Hedging Approaches

- Position Sizing: Limit initial exposure due to the token's circulating supply of 798.37M (79.84% of max supply) and relatively small market cap

- Diversification: Balance INSP holdings with established Web3 infrastructure tokens to reduce concentration risk

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers convenient access for active traders while maintaining custody control

- Multi-signature Setup: For larger holdings, implement multi-sig wallet configurations to enhance security

- Security Precautions: Never share private keys, verify contract address (0x186eF81fd8E77EEC8BfFC3039e7eC41D5FC0b457 on Ethereum) before transactions, and beware of phishing attempts targeting social analytics platform users

V. INSP Potential Risks and Challenges

INSP Market Risks

- High Volatility: The token has declined 84.11% from its all-time high of $0.4 (March 9, 2024) to the current price of $0.001939, indicating substantial price instability

- Limited Liquidity: With a 24-hour trading volume of $23,761 and market cap of $1.55M, large transactions may experience significant slippage

- Market Share Concentration: INSP represents only 0.000071% of the total crypto market cap, suggesting limited institutional adoption and higher susceptibility to market sentiment shifts

INSP Regulatory Risks

- Social Platform Integration Uncertainty: As a Layer 2 solution operating within social ecosystems like X (Twitter), regulatory changes affecting data analytics or token utility on social platforms could impact the project's core functionality

- Securities Classification Concerns: Token models tied to platform features may face scrutiny regarding utility versus security token classifications in various jurisdictions

- Cross-border Compliance: Operating across multiple social ecosystems may require navigation of diverse regulatory frameworks for data privacy and crypto asset management

INSP Technical Risks

- Smart Contract Vulnerabilities: The Ethereum-based token contract (ERC-20 standard) requires ongoing security audits to prevent exploitation risks

- Platform Dependency: Heavy reliance on third-party social platforms (X/Twitter) creates single points of failure if API access changes or platform policies shift

- Scalability Challenges: As user base expands beyond 300,000 users, the platform must maintain performance while managing increased data processing demands

VI. Conclusion and Action Recommendations

INSP Investment Value Assessment

INSP presents a specialized investment opportunity within the Web3 social analytics sector, leveraging an established user base of over 300,000 to provide crypto and NFT insights across social ecosystems. However, the token's performance shows significant challenges, with an 84.11% decline from its all-time high and market capitalization of only $1.55 million. The long-term value proposition depends on successful platform tokenization and expanded utility for $INSP within existing features. Short-term risks include extreme volatility (down 48.82% in 30 days), limited liquidity, and uncertainty around adoption metrics beyond the initial user base. The token's circulating supply of 79.84% suggests limited supply-side pressure, but demand growth will be critical for price recovery.

INSP Investment Recommendations

✅ Beginners: Approach with extreme caution due to high volatility and limited track record since December 2023 launch; consider allocating no more than 1% of crypto portfolio and prioritize education about Web3 analytics platforms before investing

✅ Experienced Investors: May consider small speculative positions (2-3% allocation) with strict stop-losses below $0.00193 (recent ATL); monitor platform development announcements and user growth metrics quarterly before increasing exposure

✅ Institutional Investors: Conduct thorough due diligence on platform revenue models, token utility expansion roadmap, and competitive positioning against established blockchain analytics providers; consider waiting for demonstrated user monetization before significant capital allocation

INSP Trading Participation Methods

- Spot Trading on Gate.com: Access INSP trading pairs with competitive fees; utilize advanced order types like stop-limit orders to manage volatility risk

- Gate Web3 Wallet Integration: Store INSP tokens securely while maintaining custody control; verify Ethereum contract address before any transfers

- Research-Driven Approach: Follow Inspect's official channels (Twitter @inspectxyz, Gitbook documentation) for platform updates and token utility expansions that may impact valuation

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is INSP? What are its main uses and application scenarios?

INSP is the primary utility token for the Inspect ecosystem, used for paying service fees including subscriptions, advertising, and API costs. It enhances operational efficiency, reduces transaction fees, and minimizes price volatility impacts for users.

How has INSP performed historically in terms of price? What are the main factors affecting its price fluctuations?

INSP has experienced significant volatility since inception, reaching an all-time high of NT$ 41.04 and trading near lower levels currently. Price fluctuations are primarily driven by market sentiment, trading volume, project developments, and broader cryptocurrency market conditions.

What is the INSP price prediction for 2024? What are expert views on its future trends?

2024 INSP price predictions have not been officially published, and experts have not issued clear forecasts. As of February 2026, reliable prediction data remains insufficient to provide accurate information on future price movements.

What are the main risks of investing in INSP? How to assess its investment value?

INSP faces crypto market volatility and adoption risks. Evaluate by analyzing project fundamentals, team credibility, technology innovation, market demand, and trading volume. Strong community growth and consistent development indicate positive investment potential.

What are the advantages and disadvantages of INSP compared to similar tokens?

INSP serves as a governance token, empowering holders with voting rights on ecosystem proposals. Its advantage lies in clear governance functionality and community participation mechanisms. However, it may lack diversified use cases compared to multi-utility tokens in the market.

How is the market liquidity and trading volume of INSP? On which exchanges can it be traded?

INSP demonstrates strong market liquidity with substantial trading volume across major exchanges. The token maintains robust liquidity pools, ensuring efficient price discovery and minimal slippage for traders seeking exposure to this digital asset.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

2026 NEURO Price Prediction: Expert Analysis and Market Forecast for Neurocoin's Future Value

2026 TEN Price Prediction: Expert Analysis and Market Forecast for Tensor Network Token

2026 PAI Price Prediction: Expert Analysis and Market Forecast for the Next Three Years

2026 ARCH Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Is P00LS (P00LS) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Performance, and Risk Factors for 2024