2026 LIY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LIY's Market Position and Investment Value

Lily (LIY), positioned as a next-generation live commerce platform with Web3 token incentive protocol, has been making strides in unifying the Web3 commerce market across the Asia-Pacific region since its launch in 2025. As of 2026, LIY maintains a market capitalization of approximately $507,000, with a circulating supply of around 195 million tokens, and a price hovering near $0.0026. This asset, recognized for integrating blockchain incentives into live streaming commerce, is playing an increasingly significant role in bridging traditional e-commerce with decentralized technologies.

This article will comprehensively analyze LIY's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LIY Price History Review and Market Status

LIY Historical Price Evolution Trajectory

- 2025: Token launched on Gate.com in January with an initial price of $0.013, followed by a significant rally to an all-time high of $0.0575 on January 15

- 2025: Market correction occurred, with price declining from the peak of $0.0575 to reach an all-time low of $0.000322 on February 10

LIY Current Market Situation

As of February 5, 2026, LIY is trading at $0.0026, reflecting a modest decline of 0.49% over the past 24 hours. The token has demonstrated notable recovery from its February 2025 low, with a one-year price appreciation of 79.81%.

The current trading price remains substantially below the historical peak of $0.0575 recorded in January 2025. Recent price activity shows relatively stable movement, with the 24-hour trading range between $0.0026 and $0.002616. Weekly performance indicates a slight downward pressure with a 2.07% decline over seven days, while the 30-day trend shows marginal positive momentum of 0.44%.

The market maintains a trading volume of $36,569.42 over the past 24 hours. With a circulating supply of 195 million tokens out of a maximum supply of 3 billion, the current market capitalization stands at $507,000, representing 6.5% of the fully diluted market cap of $7.8 million. The token holds a market dominance of 0.00031%.

LIY operates on the Polygon network, with 72 holders currently participating in the ecosystem. The project is available for trading on 2 exchanges, with Gate.com serving as a primary trading venue.

Click to view the current LIY market price

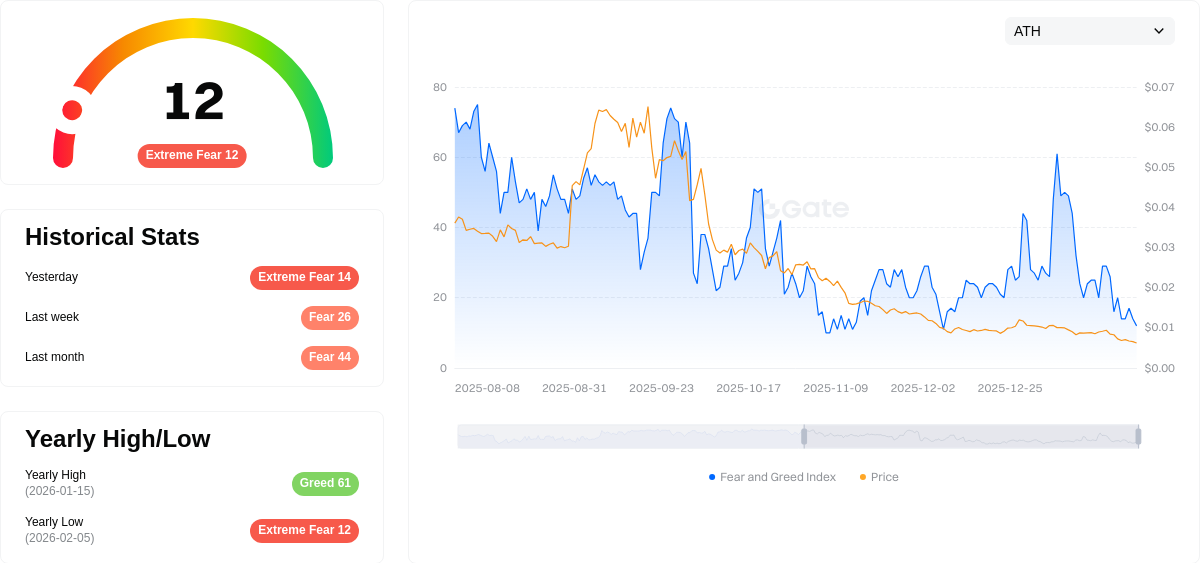

LIY Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 12. This exceptionally low score indicates that investors are highly pessimistic and risk-averse. Market participants are displaying significant concern about price movements and overall market conditions. During such periods of extreme fear, opportunities may emerge for long-term investors, as assets often become oversold. However, caution remains warranted as downward pressure could continue. Monitoring key support levels and market catalysts will be essential for making informed trading decisions.

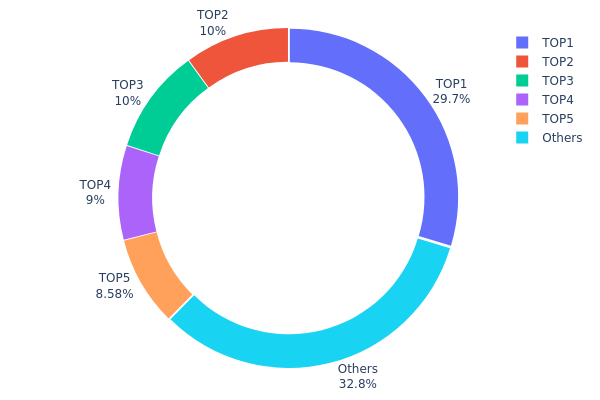

LIY Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By analyzing the distribution pattern of LIY tokens among top holders and general addresses, we can assess potential risks of price manipulation and evaluate the health of the token's circulation ecosystem.

According to the current on-chain data, LIY exhibits a relatively high concentration pattern. The top holder controls 890,089.20K tokens, accounting for 29.66% of the total supply, while the top five addresses collectively hold 67.2% of all tokens. This significant concentration in the hands of a few addresses indicates a highly centralized distribution structure. Such concentration levels typically amplify market volatility, as large holders possess substantial influence over price movements through their trading activities.

From a market structure perspective, this holding distribution presents both opportunities and challenges. The high concentration may facilitate coordinated project development and strategic decision-making in the short term. However, it simultaneously exposes the market to elevated manipulation risks and liquidity concerns. The remaining 32.8% held by other addresses suggests limited retail participation, which could constrain organic price discovery mechanisms and increase susceptibility to sudden sell-offs from major holders. This distribution pattern underscores the importance of monitoring large holder activities and emphasizes the need for continued efforts toward broader token distribution to enhance long-term ecosystem stability.

Click to view current LIY Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4bd7...52dce7 | 890089.20K | 29.66% |

| 2 | 0xcd46...aa0dda | 300000.00K | 9.99% |

| 3 | 0x901f...5e56c0 | 300000.00K | 9.99% |

| 4 | 0x8593...7f49ea | 270000.00K | 8.99% |

| 5 | 0xfd61...8abecb | 257307.69K | 8.57% |

| - | Others | 982603.11K | 32.8% |

II. Core Factors Influencing LIY's Future Price

Market Demand and Investor Sentiment

- Market Demand Dynamics: The future price trajectory of LIY is closely tied to overall market demand within the cryptocurrency sector. As investor interest in digital assets fluctuates based on broader market trends, LIY's valuation may experience corresponding shifts.

- Investor Confidence: Sentiment among both retail and institutional investors plays a significant role in price movements. Positive sentiment driven by technological advancements or favorable market conditions can support price appreciation, while uncertainty may lead to volatility.

- Market Trends: Current trends in the cryptocurrency market, including trading volumes and liquidity conditions, continue to shape price expectations for LIY.

Technological Innovation and Development

- Technical Progress: Ongoing technological innovation within the LIY ecosystem serves as a key driver of long-term value. Advancements in blockchain infrastructure, scalability solutions, and protocol improvements can enhance the token's utility and appeal.

- Competitive Landscape: LIY operates in a competitive environment where technological differentiation matters. The project's ability to deliver unique features or superior performance compared to alternatives may influence adoption rates and price performance.

- Ecosystem Expansion: Growth in decentralized applications and ecosystem partnerships can strengthen LIY's market position and support sustainable price development.

Macroeconomic Environment

- Monetary Policy Considerations: Global monetary policies, including interest rate decisions by major central banks, can impact risk appetite for digital assets. Shifts in monetary conditions may affect capital flows into or out of the cryptocurrency market.

- Economic Uncertainty: Broader economic factors, including inflation expectations and geopolitical developments, can influence investor behavior toward alternative assets like cryptocurrencies.

- Market Cycles: Historical patterns suggest that cryptocurrency valuations are influenced by cyclical market dynamics, with periods of expansion and contraction affecting price trajectories across the sector.

III. 2026-2031 LIY Price Forecast

2026 Outlook

- Conservative prediction: $0.00146 - $0.00261

- Neutral prediction: Around $0.00261

- Optimistic prediction: Up to $0.00272 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility

- Price range forecast:

- 2027: $0.00168 - $0.00277 (approximately 2% increase)

- 2028: $0.00264 - $0.00337 (approximately 4% increase)

- 2029: $0.00180 - $0.00366 (approximately 17% increase)

- Key catalysts: Progressive market adoption and ecosystem development

2030-2031 Long-term Outlook

- Baseline scenario: $0.00174 - $0.00382 (assuming steady market conditions)

- Optimistic scenario: $0.00240 - $0.00462 (assuming enhanced adoption and favorable regulatory environment)

- Transformative scenario: Potential to reach upper price ranges if significant technological breakthroughs or major partnerships materialize

- February 5, 2026: LIY trading within $0.00146 - $0.00272 range (initial forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00272 | 0.00261 | 0.00146 | 0 |

| 2027 | 0.00277 | 0.00267 | 0.00168 | 2 |

| 2028 | 0.00337 | 0.00272 | 0.00264 | 4 |

| 2029 | 0.00366 | 0.00305 | 0.0018 | 17 |

| 2030 | 0.00382 | 0.00335 | 0.00174 | 28 |

| 2031 | 0.00462 | 0.00358 | 0.0024 | 37 |

IV. LIY Professional Investment Strategies and Risk Management

LIY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Web3 commerce and live streaming sectors with moderate risk tolerance

- Operational recommendations:

- Consider accumulating positions during market corrections when LIY trades below its 30-day average

- Monitor the project's development milestones and partnership announcements for potential catalysts

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection and regular backup procedures

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Track 7-day and 30-day moving averages to identify trend reversals and potential entry/exit points

- Volume Analysis: Monitor trading volume patterns; increased volume on price advances may signal strengthening momentum

- Swing trading considerations:

- Set stop-loss orders 5-8% below entry points to manage downside risk

- Take partial profits during sharp upward movements exceeding 15-20% to lock in gains

LIY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio diversification: Balance LIY exposure with established large-cap cryptocurrencies

- Position sizing: Limit single-token exposure based on market capitalization and liquidity constraints

(3) Secure Storage Solutions

- Hot wallet option: Gate Web3 Wallet for active trading with enhanced security features

- Cold storage approach: Hardware wallet solutions for long-term holdings with offline key management

- Security precautions: Enable two-factor authentication, verify contract addresses (0x24fd25a49627ce2e4be711e76dc22234c83539fe on Polygon), and avoid sharing private keys

V. LIY Potential Risks and Challenges

LIY Market Risks

- High volatility: LIY has experienced significant price fluctuations with a 24-hour change of -0.49% and 7-day decline of -2.07%

- Limited liquidity: With a 24-hour trading volume of approximately $36,569 and market cap around $507,000, large trades may face slippage

- Low circulation ratio: Only 6.5% of total supply is currently circulating, potential token unlocks could create selling pressure

LIY Regulatory Risks

- Web3 commerce regulations: Evolving regulatory frameworks for tokenized commerce platforms may impact project operations

- Cross-border compliance: Operating across Asia-Pacific markets requires navigating multiple jurisdictional requirements

- Token classification uncertainty: Regulatory clarity on LIY's token utility versus security classification remains evolving

LIY Technical Risks

- Smart contract vulnerabilities: Polygon-based token contract requires ongoing security audits and monitoring

- Platform dependency: Reliance on Polygon network exposes LIY to potential network congestion or technical issues

- Adoption challenges: Success depends on user acquisition and creator engagement in competitive live commerce space

VI. Conclusion and Action Recommendations

LIY Investment Value Assessment

LIY represents an emerging opportunity in the Web3 commerce and live streaming sector with a focus on the Asia-Pacific market. The project's token incentive protocol aims to bridge traditional e-commerce with blockchain technology. However, investors should carefully weigh the early-stage nature of the project, limited liquidity, and relatively small market capitalization against its growth potential. The token's performance since launch shows both volatility and resilience, with a one-year gain of approximately 79.81%, though recent short-term trends indicate consolidation.

LIY Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio) to gain exposure while learning about Web3 commerce projects; use dollar-cost averaging to build positions gradually ✅ Experienced investors: Consider swing trading opportunities around technical support and resistance levels; maintain strict risk management with stop-loss orders ✅ Institutional investors: Conduct thorough due diligence on platform adoption metrics and team execution; consider pilot allocation with regular performance review

LIY Trading Participation Methods

- Spot trading: Purchase LIY directly through Gate.com's spot markets for straightforward exposure

- Portfolio allocation: Include LIY as part of a diversified Web3 commerce basket alongside complementary projects

- Active monitoring: Track project developments through official channels (https://www.lilynhaper.com/en and https://x.com/lilynhaper) for strategic entry and exit decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LIY? What are its uses and application scenarios?

LIY is a utility token designed for decentralized applications and blockchain ecosystems. It serves as a governance token, enabling community participation in protocol decisions and offering rewards for user engagement and liquidity provision across Web3 platforms.

What is the price prediction for LIY in 2024? What are the main factors affecting the price?

LIY price prediction for 2024 remains uncertain. Key factors influencing price include global commodity trends, market sentiment, trading volume, adoption rate, and macroeconomic conditions. Monitor market developments for updated forecasts.

How is LIY's historical price movement? What stage is it currently in?

LIY has experienced significant price volatility throughout its history. Currently, the token is in an uncertain phase with market trends difficult to predict. Supply mechanisms and market demand remain the primary factors influencing price movements and future performance.

What are the risks of investing in LIY? What precautions should I take?

LIY investment involves market volatility, liquidity, and regulatory risks. Monitor price fluctuations carefully, diversify your portfolio, and conduct thorough research before investing. Stay informed about market conditions and only invest what you can afford to lose.

What are the advantages and disadvantages of LIY compared to similar tokens?

LIY offers decentralized stability and global accessibility advantages. However, it faces regulatory challenges and lacks direct currency pegging like traditional stablecoins, limiting mainstream adoption.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

2026 WING Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

2026 ADAPAD Price Prediction: Expert Analysis and Market Forecast for the Next Bull Cycle

Who Is Satoshi Nakamoto?

2026 AM Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2026 THINK Price Prediction: Expert Analysis and Market Outlook for the Next Generation Blockchain Token