DPET vs XLM: A Comprehensive Comparison of Two Leading Cross-Border Payment Solutions

Introduction: Investment Comparison Between DPET and XLM

In the cryptocurrency market, the comparison between DPET vs XLM has been a topic of interest for investors. The two tokens show distinct differences in market cap ranking, application scenarios, and price performance, representing different positioning within the crypto asset landscape.

DPET (My DeFi Pet): Launched in May 2021, this virtual pet gaming token combines DeFi, collectibles, and player personality. Operating on Binance Smart Chain and KardiaChain, DPET serves as the primary in-game currency for trading, exchanging, and improving pets.

XLM (Stellar): Since its launch in August 2014, Stellar has gained market recognition as a decentralized gateway for transferring digital assets between banks, payment institutions, and individuals with fast, stable, and low-cost transactions.

This article will comprehensively analyze the investment value comparison between DPET vs XLM through historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

DPET (Coin A) and XLM (Coin B) Historical Price Trends

- 2021: DPET experienced notable price activity during its early market phase, with the token reaching a peak of $9.92 on July 26, 2021, following increased interest in blockchain gaming and DeFi-related projects.

- 2018: XLM saw significant price movement during the broader cryptocurrency market rally, achieving a historical high of $0.875563 on January 3, 2018, driven by growing adoption of cross-border payment solutions.

- Comparative Analysis: During the 2021-2025 market cycle, DPET declined from its peak of $9.92 to a low of $0.00120039, representing a substantial price correction. In contrast, XLM demonstrated relatively more stability within its price range, maintaining its position as an established digital asset with sustained utility in the financial infrastructure sector.

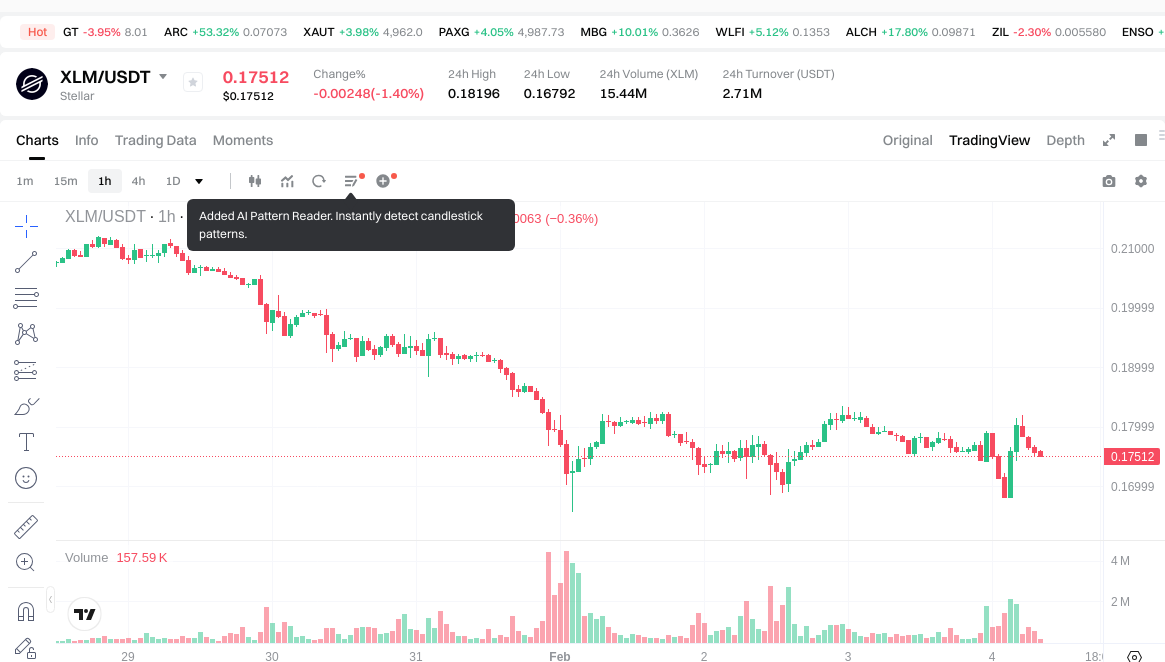

Current Market Status (February 4, 2026)

- DPET Current Price: $0.016002

- XLM Current Price: $0.17574

- 24-Hour Trading Volume: DPET recorded $13,086.42 compared to XLM's $2,704,125.57

- Market Sentiment Index (Fear & Greed Index): 17 (Extreme Fear)

View real-time prices:

- Check DPET current price Market Price

- Check XLM current price Market Price

II. Core Factors Influencing DPET vs XLM Investment Value

Supply Mechanism Comparison (Tokenomics)

- DPET: The supply mechanism is influenced by DeFi market dynamics, with price fluctuations tied to decentralized finance ecosystem activities and liquidity patterns.

- XLM: Supply mechanisms are designed to support cross-border payment infrastructure, with distribution patterns aligned with global financial network expansion.

- 📌 Historical Pattern: Supply mechanisms create distinct price cycles, with DPET responding to DeFi market sentiment shifts and XLM correlating with cross-border payment adoption trends.

Institutional Adoption and Market Application

- Institutional Holdings: Market data suggests varying levels of institutional interest, with positioning influenced by regulatory clarity and use case alignment.

- Enterprise Adoption: DPET finds applications within DeFi protocols and decentralized gaming ecosystems, while XLM focuses on cross-border payment solutions and financial institution partnerships.

- Regulatory Landscape: Different jurisdictions maintain distinct approaches toward DeFi tokens versus payment-focused cryptocurrencies, affecting adoption trajectories.

Technological Development and Ecosystem Construction

- DPET Technical Evolution: Development centers on DeFi protocol integration, gaming mechanics enhancement, and ecosystem token utility expansion.

- XLM Technical Advancement: Focus areas include payment infrastructure optimization, network scalability improvements, and financial institution integration capabilities.

- Ecosystem Comparison: DPET concentrates on DeFi and gaming applications, while XLM emphasizes payment systems, remittance solutions, and financial services integration.

Macroeconomic Factors and Market Cycles

- Inflationary Environment Performance: Both assets demonstrate sensitivity to macroeconomic conditions, with different response patterns based on their primary use cases.

- Monetary Policy Impact: Interest rate adjustments and USD index movements create varying effects on DeFi tokens versus payment-focused cryptocurrencies.

- Geopolitical Considerations: Cross-border transaction demand, international regulatory developments, and global financial stability influence adoption patterns differently for gaming/DeFi tokens versus payment infrastructure tokens.

III. 2026-2031 Price Prediction: DPET vs XLM

Short-term Prediction (2026)

- DPET: Conservative $0.0116-$0.0166 | Optimistic $0.0166-$0.0227

- XLM: Conservative $0.105-$0.175 | Optimistic $0.175-$0.251

Mid-term Prediction (2028-2029)

- DPET may enter a gradual growth phase, with projected price range of $0.0173-$0.0405

- XLM may enter an expansion phase, with projected price range of $0.151-$0.417

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Prediction (2030-2031)

- DPET: Baseline scenario $0.0293-$0.0364 | Optimistic scenario $0.0364-$0.0397

- XLM: Baseline scenario $0.239-$0.427 | Optimistic scenario $0.427-$0.508

Disclaimer

DPET:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.02268035 | 0.016555 | 0.0115885 | 2 |

| 2027 | 0.02726856825 | 0.019617675 | 0.01118207475 | 21 |

| 2028 | 0.03164821419375 | 0.023443121625 | 0.0173479100025 | 45 |

| 2029 | 0.040492131826781 | 0.027545667909375 | 0.0220365343275 | 70 |

| 2030 | 0.038781545849609 | 0.034018899868078 | 0.029256253886547 | 110 |

| 2031 | 0.039676242916139 | 0.036400222858843 | 0.032760200572959 | 125 |

XLM:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.2506218 | 0.17526 | 0.105156 | 0 |

| 2027 | 0.306634896 | 0.2129409 | 0.189517401 | 21 |

| 2028 | 0.35850729924 | 0.259787898 | 0.15067698084 | 47 |

| 2029 | 0.417349258137 | 0.30914759862 | 0.1823970831858 | 75 |

| 2030 | 0.490385378310975 | 0.3632484283785 | 0.243376447013595 | 106 |

| 2031 | 0.507912114980237 | 0.426816903344737 | 0.239017465873053 | 142 |

IV. Investment Strategy Comparison: DPET vs XLM

Long-term vs Short-term Investment Strategies

- DPET: May be considered by investors interested in DeFi gaming ecosystems and blockchain-based entertainment applications, particularly those comfortable with higher volatility and emerging market segments

- XLM: May appeal to investors focused on cross-border payment infrastructure, financial institution partnerships, and established utility within the digital asset ecosystem

Risk Management and Asset Allocation

- Conservative Investors: DPET 10-15% vs XLM 20-30%

- Aggressive Investors: DPET 25-35% vs XLM 40-50%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- DPET: Exposure to DeFi market sentiment shifts, gaming sector adoption cycles, and liquidity constraints associated with lower market capitalization

- XLM: Subject to cross-border payment competition, financial institution adoption rates, and regulatory developments affecting payment-focused cryptocurrencies

Technical Risk

- DPET: Scalability considerations, network stability during usage peaks, smart contract vulnerabilities in DeFi integrations

- XLM: Network consensus mechanisms, transaction throughput during high-demand periods, protocol upgrade implementation risks

Regulatory Risk

- Global regulatory frameworks present different considerations: DeFi gaming tokens face evolving guidelines around decentralized applications and gaming mechanics, while payment-focused cryptocurrencies encounter regulatory scrutiny related to cross-border transactions, financial institution partnerships, and money transmission frameworks

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- DPET Characteristics: Positioning within DeFi gaming sector, exposure to blockchain entertainment adoption, potential correlation with decentralized application growth

- XLM Characteristics: Established presence in cross-border payment infrastructure, financial institution partnerships, longer operational history with demonstrated utility

✅ Investment Considerations:

- Beginning Investors: Consider established assets with demonstrated utility and lower volatility profiles, implementing gradual position building with strict risk management protocols

- Experienced Investors: Evaluate portfolio diversification across different use case categories, balancing exposure between emerging gaming/DeFi applications and established payment infrastructure

- Institutional Investors: Assess alignment with investment mandates, regulatory compliance requirements, and portfolio construction objectives considering liquidity profiles and market capitalization differences

⚠️ Risk Disclosure: Cryptocurrency markets exhibit substantial volatility. This analysis does not constitute investment advice. Conduct independent research and consult qualified financial professionals before making investment decisions.

VII. FAQ

Q1: What is the current price difference between DPET and XLM, and which has higher trading volume?

As of February 4, 2026, XLM is priced at $0.17574, approximately 11 times higher than DPET's $0.016002. XLM demonstrates significantly higher market liquidity with a 24-hour trading volume of $2,704,125.57, compared to DPET's $13,086.42. This substantial volume difference reflects XLM's established market position as a payment infrastructure token with broader institutional adoption, while DPET operates within the more specialized DeFi gaming sector with lower overall market participation and liquidity constraints.

Q2: Which cryptocurrency experienced greater historical price volatility?

DPET exhibited more extreme price volatility, declining approximately 99.8% from its July 2021 peak of $9.92 to a low of $0.00120039. In contrast, XLM showed relatively more moderate price movements, reaching $0.875563 in January 2018 and maintaining price levels within a more stable range throughout subsequent market cycles. The difference stems from DPET's exposure to DeFi gaming market sentiment shifts and its lower market capitalization, while XLM benefits from established utility in cross-border payment infrastructure and financial institution partnerships that provide more consistent demand patterns.

Q3: What are the projected price ranges for DPET and XLM by 2031?

According to long-term projections, DPET's baseline scenario suggests a price range of $0.0293-$0.0364 by 2031, with an optimistic scenario reaching $0.0364-$0.0397. XLM's projections indicate a baseline range of $0.239-$0.427, with optimistic estimates between $0.427-$0.508. These predictions reflect XLM's larger market capitalization, established utility in payment systems, and broader institutional adoption trajectory. DPET's lower projected prices correspond to its positioning within the emerging DeFi gaming sector, though percentage gains may vary based on ecosystem development and adoption rates.

Q4: How do the supply mechanisms differ between DPET and XLM?

DPET's supply mechanism responds primarily to DeFi market dynamics, with price fluctuations tied to decentralized finance ecosystem activities, liquidity patterns, and gaming sector participation. XLM's supply mechanisms are designed specifically to support cross-border payment infrastructure, with distribution patterns aligned with global financial network expansion and institutional partnership development. These fundamental differences create distinct price cycles—DPET correlates with DeFi market sentiment shifts and blockchain gaming adoption, while XLM tracks cross-border payment demand trends and financial institution integration rates.

Q5: What risk management strategies should investors consider when allocating between DPET and XLM?

Conservative investors might consider allocating 10-15% to DPET versus 20-30% to XLM within their cryptocurrency portfolio, reflecting the different risk-return profiles. Aggressive investors could allocate 25-35% to DPET and 40-50% to XLM, accepting higher exposure to volatility in exchange for potential upside. Both allocation strategies should incorporate stablecoin reserves, options-based hedging tools, and cross-asset diversification. The lower allocation recommendations for DPET reflect its higher volatility, lower liquidity, and exposure to emerging DeFi gaming market dynamics, while XLM's higher allocation potential stems from its established utility, institutional adoption, and longer operational history.

Q6: Which cryptocurrency is more suitable for beginning investors?

XLM presents characteristics that may be more appropriate for beginning investors, including established market presence since August 2014, demonstrated utility in cross-border payment infrastructure, financial institution partnerships, and relatively lower volatility compared to DPET. The higher trading volume ($2.7 million vs $13,086 daily) provides better liquidity for entry and exit positions. Beginning investors should implement gradual position building with strict risk management protocols regardless of asset selection. DPET's exposure to DeFi gaming sectors, lower liquidity profile, and higher volatility may present challenges for investors without experience managing emerging cryptocurrency market segments.

Q7: What are the primary regulatory considerations affecting DPET versus XLM?

DPET faces evolving regulatory guidelines around DeFi applications, blockchain gaming mechanics, and decentralized protocol operations, which vary significantly across jurisdictions with limited global standardization. XLM encounters regulatory scrutiny related to cross-border payment systems, money transmission frameworks, financial institution partnerships, and compliance requirements specific to payment infrastructure. Payment-focused cryptocurrencies like XLM typically face more established regulatory frameworks compared to DeFi gaming tokens, though this creates both compliance obligations and potential clarity for institutional adoption. Regulatory developments in either category can significantly impact adoption trajectories and market positioning.

Q8: How do technological development priorities differ between DPET and XLM ecosystems?

DPET's technological development centers on DeFi protocol integration, gaming mechanics enhancement, smart contract functionality for in-game transactions, and ecosystem token utility expansion within decentralized entertainment applications. XLM focuses on payment infrastructure optimization, network scalability improvements for high-volume cross-border transactions, consensus mechanism efficiency, and financial institution integration capabilities. These different technical priorities reflect their distinct use cases—DPET serves blockchain gaming and DeFi ecosystems, while XLM addresses global payment system requirements, remittance solutions, and financial services integration needs.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Understanding NGMI and WAGMI: Key Terms in the Cryptocurrency Industry

2026 SMURFCAT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2026 BST Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2026 FIR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 OVL Price Prediction: Expert Analysis and Market Outlook for Overlay Protocol Token