Ripple CLO leaks: TradFi banks are willing to discuss stablecoin reward exemptions for the first time

Ripple Chief Legal Officer Stuart Alderoty stated on X that the White House meeting on Tuesday was “productive,” with a strong atmosphere of compromise, and that both parties still maintain consensus on legislation for the crypto market. Reports indicate that both sides made concessions, with banks willing to discuss stablecoin reward exemptions for the first time. The White House urges all parties to reach an agreement by March 1. However, Polymarket data shows that the probability of the bill passing this year has dropped from 70% to 56%.

Stuart Alderoty’s Optimistic Tone: Is the Atmosphere of Compromise Really Strong?

(Source: X)

Ripple’s Chief Legal Officer Stuart Alderoty recently posted on X that negotiations regarding the bill have indeed been fruitful. He also added that all parties are approaching a compromise, while the U.S. is waiting for further clarity on crypto market regulations. “Today’s White House meeting was productive — the atmosphere of compromise is very strong. Both parties still maintain a clear consensus on reasonable legislation for the crypto market structure. We should seize this moment, take action, and bring real wins for consumers and the U.S.,” he said.

This optimistic tone is consistent with Alderoty’s usual PR strategy. As Ripple’s top legal officer, he plays a key role in promoting crypto regulation legislation, frequently participating in lobbying and negotiations in Washington. His public statements tend to be positive, aiming to stabilize market sentiment and protect Ripple’s brand image. However, his optimistic assessment contrasts with the market’s actual reaction.

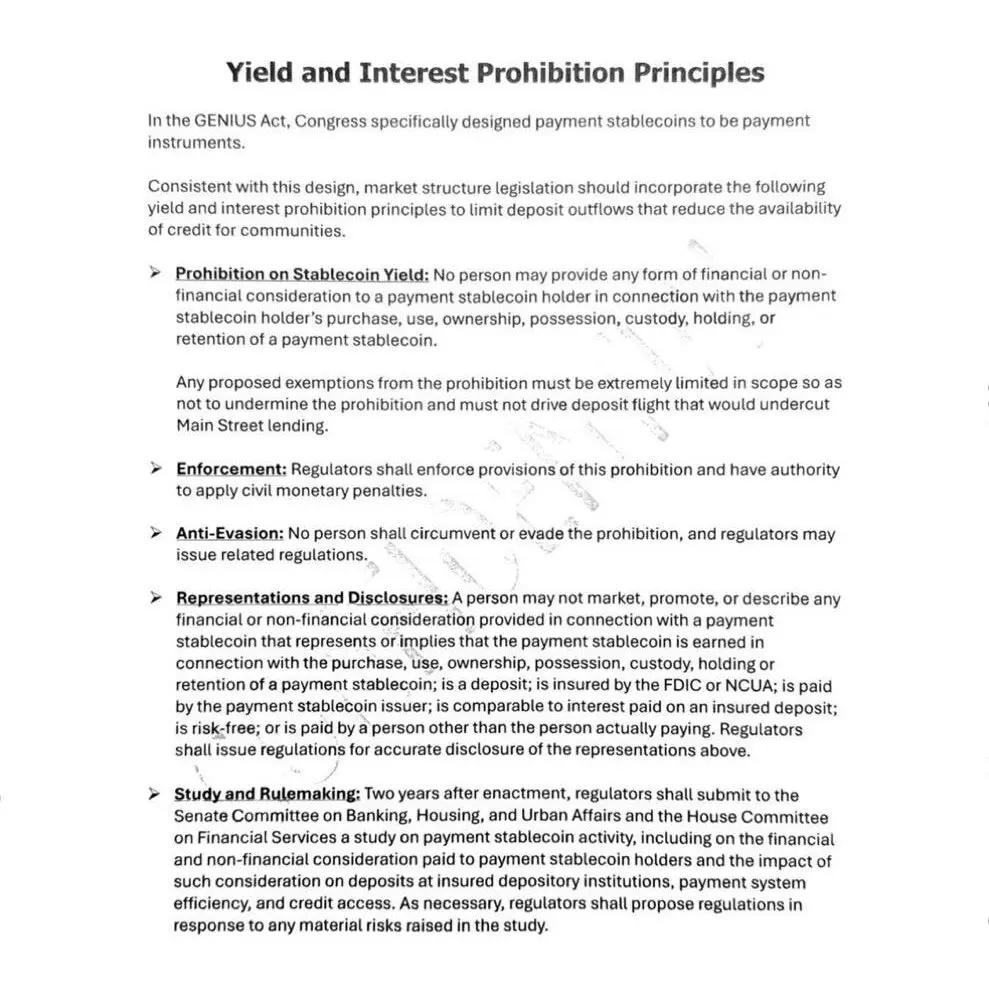

The White House held another negotiation meeting on Tuesday regarding the crypto market legislation. Reports show that both sides made some concessions but have not reached a final agreement. According to Eleanor Terrett, both parties are optimistic about the negotiations, and progress has been made on key issues. For example, unlike the previous meeting where bank executives seemed reluctant to discuss differences, this time they proposed a series of rules willing to compromise on, including aspects related to stablecoin rewards.

This shift in attitude marks an important development in the negotiations. Previously, banks insisted on a complete ban on stablecoin rewards and refused to discuss any exemptions or exceptions. Now, banks are willing to include reward exemptions in the discussion, indicating a softening of their stance. However, there remains a significant gap between “willing to discuss” and “reaching an agreement.” Banks may only agree to allow rewards under very limited circumstances, such as only for wholesale clients or with very low reward rate caps.

Another key issue discussed at the meeting is what types of account activities crypto companies can offer to distribute rewards. The details of this matter are extremely critical. If the agreement only permits rewards for “trading activity” and prohibits rewards for “holding,” many crypto platforms’ business models could still be severely impacted. Both sides are expected to continue negotiations on the crypto market legislation.

Terrett states: “Next, both sides are expected to continue negotiations in the coming days, but it’s unclear whether such a large-scale meeting will occur before the end of the month. The White House has urged both sides to reach an agreement by March 1.” About 18 days remain until March 1, making this a very tight schedule. Considering the ongoing disagreements on core issues like stablecoin rewards, reaching a comprehensive agreement within 18 days is highly challenging.

Market Confidence Plummets: Polymarket’s Drop from 70% to 56% as a Warning

Despite major industry leaders still negotiating, confidence among crypto traders that the bill will pass continues to decline. This may also be related to the prevailing pessimism in the current market. Polymarket data shows that the likelihood of the bill passing has been decreasing. The latest figures indicate a probability of 56%, down from a previous high of around 70%.

This drop from 70% to 56% is quite significant. As a prediction market platform, Polymarket’s odds reflect real capital bets. As more bettors wager that the bill will not pass or withdraw bets on its passage, the probability naturally declines. This market sentiment sharply contrasts with Alderoty’s optimistic tone.

Why does the market distrust the progress of negotiations? Possible reasons include: first, multiple reports of “close agreements” in the past that ultimately fell through, leading to market fatigue; second, even if banks are willing to discuss compromises, the specific terms may still be highly unfavorable to the crypto industry; third, even if the bill passes the Senate Banking Committee, it still needs to be voted on by the full Senate and approved by the House, with potential obstacles at each stage.

Deeper reasons may involve the overall pessimism infecting the crypto market. When Bitcoin drops from $126,000 to $60,000 and the market remains under pressure, investors tend to react more cautiously to any positive news. In a bear market environment, the phenomenon of “good news being priced in as bad” is common; even if the bill passes, the market may not rally but instead decline because it “meets expectations.”

Despite efforts by key officials to push for the passage of crypto legislation, the situation remains the same. As CoinGape reports, U.S. Treasury Secretary Scott Bessent has urged world leaders to reach an agreement. He also criticized actions opposing the bill, which hinder progress. Bessent’s firm stance indicates that the Trump administration is actively pushing for the bill, but the Treasury Secretary’s support alone cannot directly influence Congress members’ voting intentions.

From a political reality perspective, passing the bill faces multiple hurdles. Democratic senators in the Senate Banking Committee may oppose it due to conflicts of interest with Trump, and within the Republican Party, there may be divisions over protecting the banking industry. Although the House passed a similar bill last year, the political environment has changed this year. With midterm elections approaching, legislators are more cautious on controversial issues and reluctant to cast votes that could impact their re-election prospects.

The Reality and Challenges of the March 1 Deadline

The White House has urged both sides to reach an agreement by March 1. With about 18 days remaining, this is an extremely tight timeline for such complex legislative negotiations. To meet this deadline, all parties need to make rapid breakthroughs on key issues:

Stablecoin reward exemptions: What types of account activities can be rewarded? What is the cap on reward rates? How to prevent large-scale deposit outflows? Negotiating these technical details could take weeks.

Handling Trump’s conflict of interest: Democrats insist on including restrictions, while Republicans strongly oppose. This political issue may require high-level political bargaining, such as exchanges on other legislative matters.

CFTC personnel arrangements: Democrats want all CFTC commissioners in place before rules are drafted, while Republicans want to push forward quickly. This involves presidential nominations and Senate confirmations, which may not be completed before March 1.

Three Major Obstacles to Bill Passage

Stablecoin Reward Dispute: Banks worry about deposit outflows; crypto industry insists on their business models; limited room for compromise.

Trump’s Conflict of Interest: Democrats demand restrictions; the White House explicitly rejects them, leading to a political deadlock.

Procedural Time Pressure: Senate schedule is crowded; limited legislative time before midterm elections.

The bill’s eventual passage could bring some relief to the market, which has been in a downward trend since reaching a high point in October last year. Regulatory clarity is a key prerequisite for institutional capital inflow. If the Clarity Act passes, it would provide a clear legal framework for the U.S. crypto industry and attract more compliant funds. However, given the current negotiation progress and market confidence, the likelihood of reaching an agreement before March 1 is quite low.

Even if an agreement is not reached by March 1, the progress of negotiations itself remains a positive signal. The willingness of banks to discuss compromises, ongoing contact between parties, and the active push by the Treasury Secretary all suggest that the bill’s final passage remains possible, just possibly delayed into the second quarter or later. For Ripple and the broader crypto industry, patience may be the only option at this stage.

Related Articles

Gate releases January Private Wealth Management Report: Market Volatility Intensifies, Quantitative Strategies Demonstrate Steady Return Capabilities

TerraFlow TOF Blind Box launches globally on February 12, 2026: Computing power assetization, Web3 enters the era of engineering value

Polymarket scandal! Claimed Logan Paul bet millions of dollars on the Super Bowl, exposed as false marketing

ALCH (Alchemist AI) increased by 33.06% in the past 24 hours

ZRO (LayerZero) increased by 21.99% in the past 24 hours

Ethereum spot ETF saw a total net inflow of $13,818,400 yesterday, with Grayscale ETH leading at a net inflow of $13,317,300.