Search results for "NET"

XRP Price at Make-or-Break $1.50: Bounce to $1.80 or Collapse to $1.30?

Ripple has executed its scheduled February escrow release, unlocking 1 billion XRP, with a net increase of 300 million tokens entering the circulating supply amidst a broader market downturn that has pushed XRP to October 2025 lows.

The token's weakness is compounded by sobering commentary from Ripple CTO David Schwartz, who challenged wildly optimistic price targets, and external noise from the recently released Epstein files, which have sparked debate over historical surveillance of re

CryptopulseElite·5h ago

Tether profits exceed $10 billion in 2025! USDT issuance hits a new high, with total US debt exposure reaching $141.6 billion

Tether achieved over $10 billion in net profit in 2025, with optimized reserve structure, holding over $122 billion in U.S. Treasury bonds, reaching new highs in market value and issuance. As market demand surged, $USDT circulation exceeded 18.6 billion. The company actively expands compliant and diversified investments, demonstrating a strong market position and financial resilience.

CryptoCity·5h ago

How Record ETF Outflows Signal Crypto’s Painful Shift From Narrative to Fundamentals

In January 2026, U.S. spot Bitcoin ETFs witnessed approximately \$1.6 billion in net outflows, marking the third-worst month in their history and driving Bitcoin’s price below \$80,000 for the first time since April 2025.

This exodus, mirrored in Ethereum ETFs but contrasted by inflows into SOL and XRP products, is not a typical market correction; it is a fundamental repricing event signaling the end of the post-ETF approval narrative cycle and the beginning of crypto’s demanding integra

CryptopulseElite·7h ago

ETF funds have been flowing out for consecutive days! Bitcoin drops to $77,000, and the crypto market faces a critical stress test

Bitcoin recently fell below the $80,000 mark, leading to $1.7 billion in forced liquidations, resulting in a market cap evaporation of $100 billion, reflecting market fragility. Geopolitical tensions and uncertainties in US economic policy have exacerbated this situation. Related ETFs are experiencing the highest net outflows in history, with institutional investors reducing risk exposure, causing market liquidity to decline and signaling potential technical sell-offs. Analysts are divided on the market bottom, with focus on upcoming economic data releases.

CryptoCity·10h ago

XRP Tests Key Sell Wall Near $1.91 as Price Approaches $2.30 Resistance

XRP trades near $1.91 as price presses against a well-defined selling wall on the chart.

Net buying is still visible, and it has helped to reinforce lower lows in the downward channel structure.

The second significant resistance level is the one that is close to the level of $2.30,

XRP0.61%

CryptoNewsLand·20h ago

Bitcoin Cash Price Holds Near $593 as Net Buying Activity Increases

BCH traded close to $ 592.62 with a daily gain of 2.1% and was confined between the resistance level of $ 594.66 and the floor level of 592. 62.

The net buying activity grew despite the suppressed price movement in the short-run, which showed that the market is still active.

Price

CryptoNewsLand·21h ago

Arab Bank Group Reports Record Net Profit of USD 1.13 Billion for 2025, 40% Cash Dividends

Arab Bank Group achieved strong financial performance for the year ending December 31, 2025, with a net profit after tax USD 1130 million compared to USD 1007 million in 2024, reflecting a growth of 12%. The Group’s equity position also reflects financial stability and resilience, standing at USD 13

BTC-0.39%

CryptoBreaking·21h ago

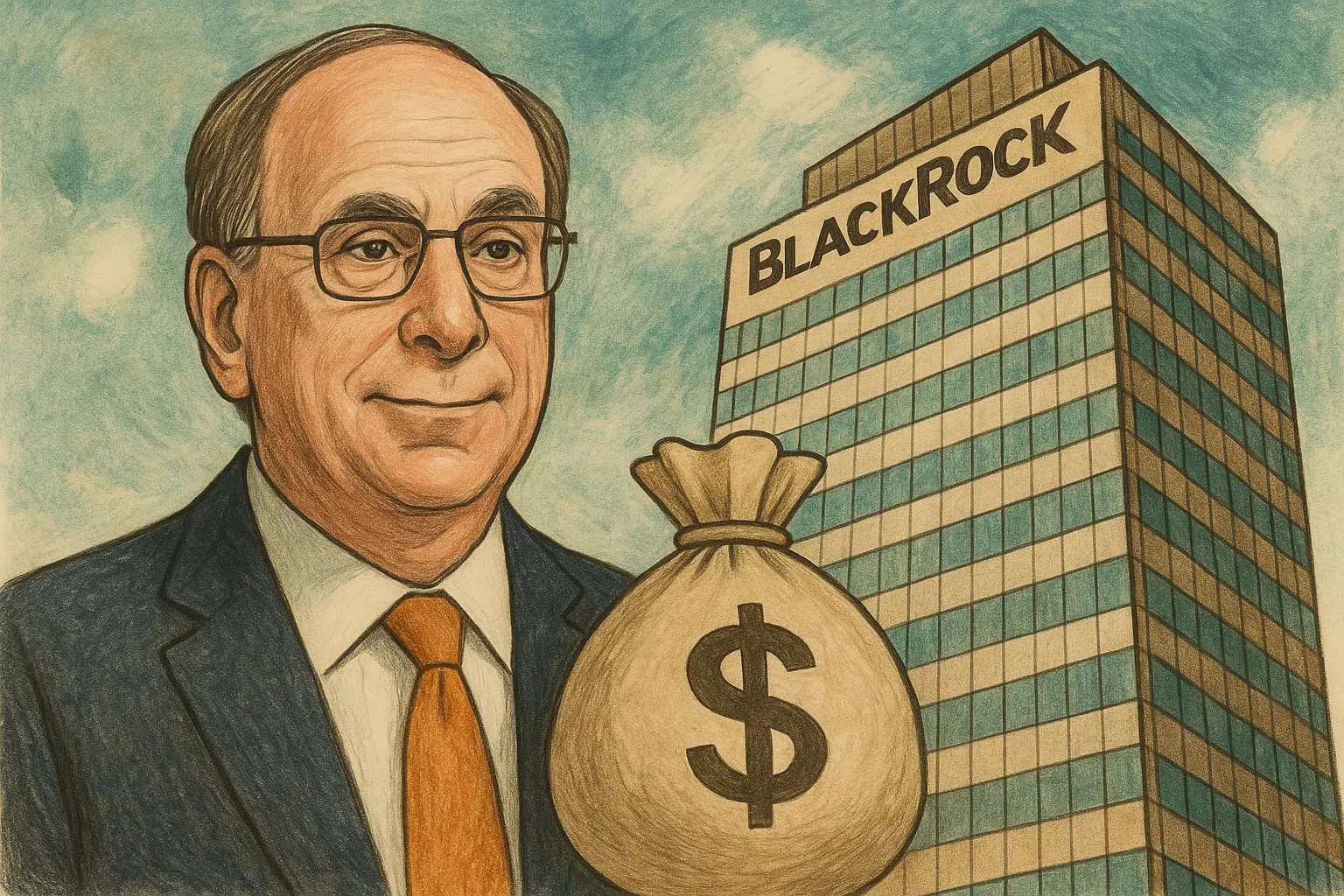

Bitcoin ETFs Halt New Capital Intake Till Day 4 - U.Today

Bitcoin funds experienced a $509.70 million withdrawal, primarily driven by BlackRock, amidst ongoing market volatility. Despite this short-term decline, total net inflows across Bitcoin ETFs remain high at $55.01 billion, indicating continued long-term institutional interest.

UToday·01-31 17:37

XRP Tests Key Sell Wall Near $1.91 as Price Approaches $2.30 Resistance

XRP trades near $1.91 as price presses against a well-defined selling wall on the chart.

Net buying is still visible, and it has helped to reinforce lower lows in the downward channel structure.

The second significant resistance level is the one that is close to the level of $2.30,

XRP0.61%

CryptoNewsLand·01-31 17:31

Bitcoin Cash Price Holds Near $593 as Net Buying Activity Increases

BCH traded close to $ 592.62 with a daily gain of 2.1% and was confined between the resistance level of $ 594.66 and the floor level of 592. 62.

The net buying activity grew despite the suppressed price movement in the short-run, which showed that the market is still active.

Price

CryptoNewsLand·01-31 16:36

Arab Bank Group Reports Record Net Profit of USD 1.13 Billion for 2025, 40% Cash Dividends

Arab Bank Group achieved strong financial performance for the year ending December 31, 2025, with a net profit after tax USD 1130 million compared to USD 1007 million in 2024, reflecting a growth of 12%. The Group’s equity position also reflects financial stability and resilience, standing at USD 13

CryptoBreaking·01-31 16:15

Polkadot Treasury records its first profit on OpenGov

In Q4/2025, Polkadot's treasury reported cautious but active management, with total spending at $7.4 million. After accounting for inflation and token burns, a net profit of 1.6 million DOT was observed. The treasury holds about 32 million DOT, primarily allocated to core areas like development and community engagement.

TapChiBitcoin·01-31 02:25

SoFi achieves quarterly revenue of $1 billion, boosting crypto and blockchain

SoFi Technologies reported a record revenue of $19,283,746,565,748,392,010 for Q1, a 40% increase year-over-year, and its net profit reached $173.5 million. They added 1 million new members, expanding their portfolio and services, including launching crypto transactions for personal customers. Expectations for 2026 include a 30% member growth and adjusted net revenue of $4.66 billion.

BTC-0.39%

TapChiBitcoin·01-31 00:19

DeFi Remains Outside Regulation as Regulators Crack Down Elsewhere

The European Union’s DAC8 framework for crypto tax reporting tightens the net on identifiable players while keeping decentralized finance (DeFi) largely at arm’s length for the moment. The regime emphasizes intermediaries—think custodians and exchanges—that will be tasked with gathering and reportin

CryptoBreaking·01-30 19:35

XRP Tests Key Sell Wall Near $1.91 as Price Approaches $2.30 Resistance

XRP trades near $1.91 as price presses against a well-defined selling wall on the chart.

Net buying is still visible, and it has helped to reinforce lower lows in the downward channel structure.

The second significant resistance level is the one that is close to the level of $2.30,

XRP0.61%

CryptoNewsLand·01-30 17:31

Polkadot Levels Up With Runtime Upgrade Focused on Real Apps

Polkadot has announced a runtime upgrade that will boost speed for apps, confirm transactions faster and ease development on the network.

Parity Technologies, the for-profit behind the network, recorded a net profit in Q4 last year for the first time, boosted by the return of founder Gavin

DOT0.39%

CryptoNewsFlash·01-30 09:30

XRP’s $2 Standoff: Why 42 New Whale Wallets Hint at a 2026 Breakout

XRP continues to trade in a constricted range below the critical \$2.00 psychological level as 2026 unfolds, presenting a complex puzzle for investors. Despite the lack of bullish price momentum, on-chain data reveals a compelling narrative of silent accumulation by high-net-worth entities, with 42 new 'millionaire wallets' appearing since January.

This institutional interest, coupled with thinning exchange reserves, sets a potential stage for a supply-driven rally. However, the technica

CryptopulseElite·01-30 08:27

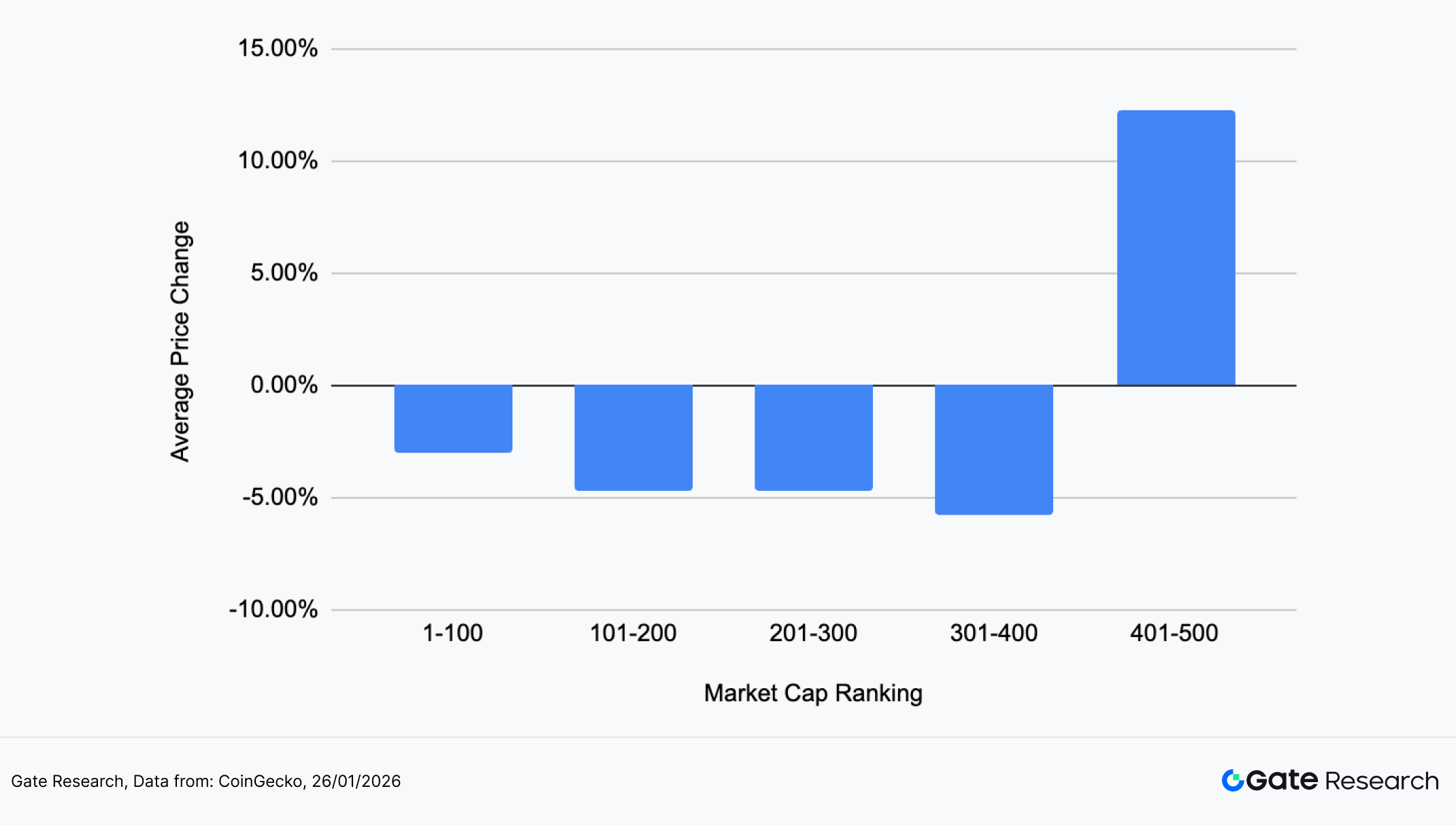

Gate Research Institute: The crypto market continues to oscillate with a defensive stance, with structural funds shifting towards highly elastic small-cap assets

Cryptocurrency Market Overview

From January 13 to January 26, 2026, amid escalating efforts by Trump to acquire Greenland and using additional 10% tariffs on multiple countries as bargaining chips, market concerns over growth, inflation, and geopolitical risks intensified. Risk aversion spread, the US dollar weakened, and global risk assets came under pressure, leading the crypto market to enter a defensive stance. In terms of market performance, BTC rebounded on the 4-hour chart but faced resistance and weakened again, breaking below short-term moving averages and trading below mid-term moving averages, shifting from consolidation to a bearish trend; ETH performed even weaker, remaining below the MA30 and forming a bearish alignment.【1】

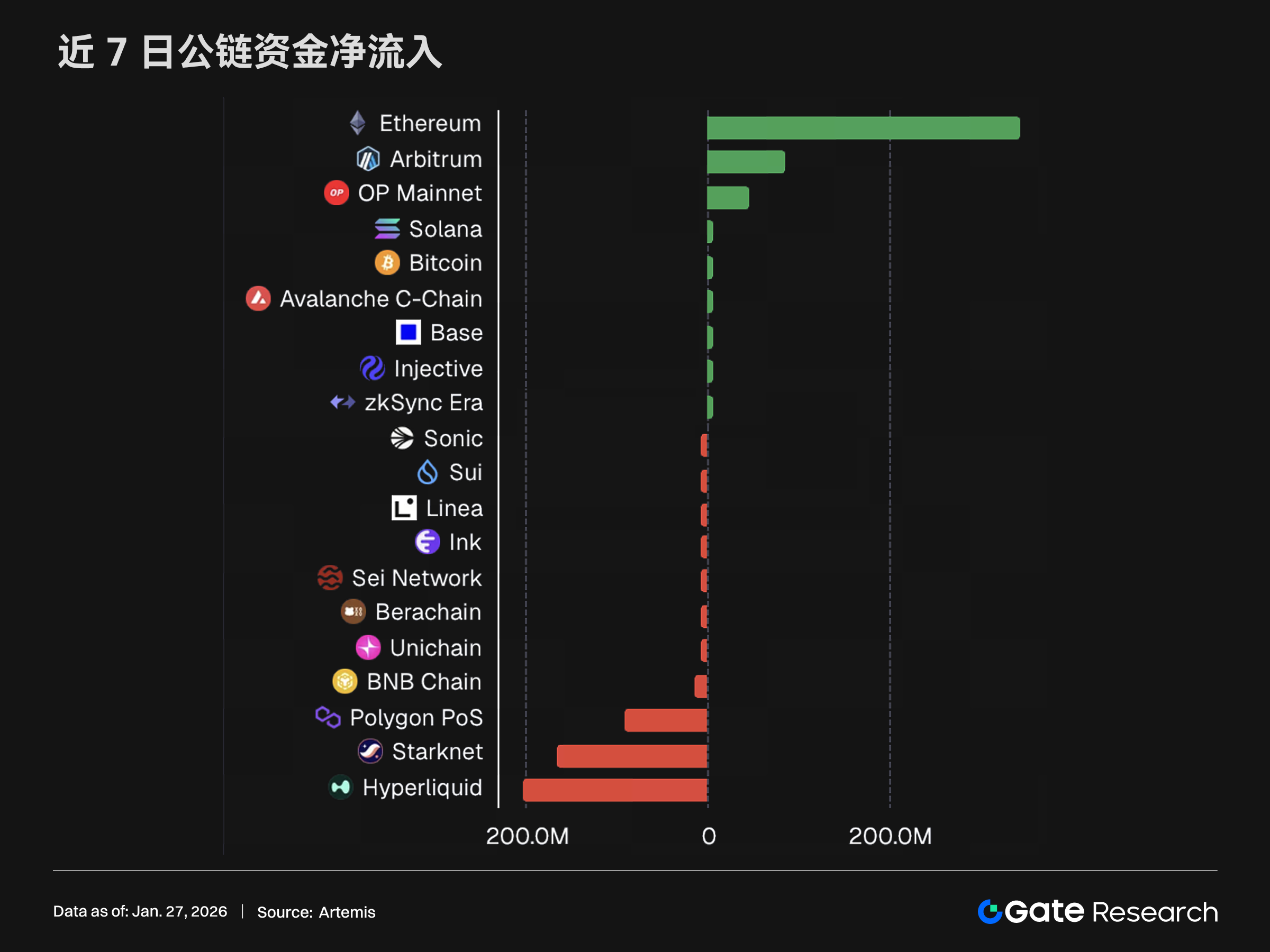

On-chain and ecosystem levels, funds showed a defensive reflow, with Ethereum becoming the main recipient, net inflows approaching $350 million, while high-leverage active networks such as Hyperliquid and StarkNet.

GateResearch·01-30 06:04

XRP Today's News: ETF Loses 93 Million in a Single Day, Market Structure Bill Becomes a Lifeline

XRP ETF net outflow of $92.92 million hits a new high, with Grayscale releasing $98.39 million ending 6 days of inflow. Price dropped 5.37% to $1.8054, breaking the double moving averages. The risk aversion wave hits, but the Senate Agriculture Committee passing the Market Structure Bill supports the medium-term outlook. Technically, it needs to break $1.85 to challenge $2, with a medium-term target of $2.5.

XRP0.61%

MarketWhisper·01-30 03:34

Why did Bitcoin plummet today? Trump's Cuban tariffs and the US-Iran conflict triggered a wave of 460 million liquidations

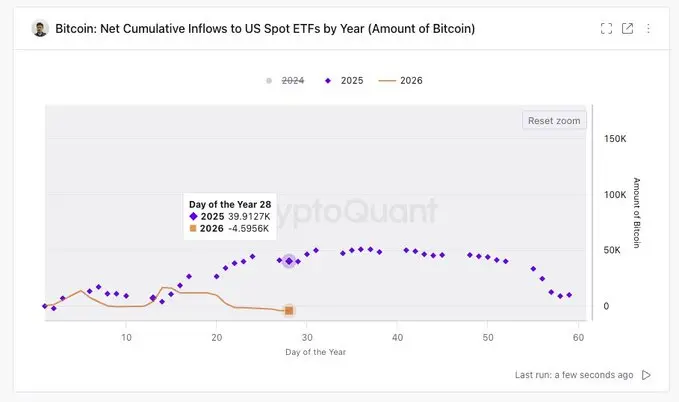

Bitcoin plummeted 6% to $83,000 on January 29. Three major negatives: Trump's declaration of a national emergency threatens Cuban oil tariffs, the escalation of the US-Iran conflict, and concerns about a government shutdown. Structural pressure is even more deadly, with a net outflow of 4,600 ETFs at the beginning of the year, and retail demand collapsing. liquidations exceeded $4.6 billion, and $83,000 became a life-and-death line.

BTC-0.39%

MarketWhisper·01-30 00:36

Mastercard’s Q4 Profit Hits $4.1B Amid Spending Boom

_Mastercard reported $4.1B in Q4 net income with EPS at $4.52, up 24%. The payment giant’s revenue jumped 18% to $8.8B on strong activity._

Mastercard wrapped up Q4 2025 with $4.1 billion in net income, according to the company’s earnings release. Earnings per share came in at $4.52, which

LiveBTCNews·01-29 19:10

Bitcoin Cash Price Holds Near $593 as Net Buying Activity Increases

BCH traded close to $ 592.62 with a daily gain of 2.1% and was confined between the resistance level of $ 594.66 and the floor level of 592. 62.

The net buying activity grew despite the suppressed price movement in the short-run, which showed that the market is still active.

Price

CryptoNewsLand·01-29 16:35

Ethereum Sees Rapid Capital Movement Amid Changing Network Economics

Ethereum recorded a sharp shift in on-chain capital movement within a single day as data revealed $168 million in net bridged outflows. This development highlights growing sensitivity among traders and liquidity providers toward transaction costs, execution speed, and network efficiency. Ethereum br

Coinfomania·01-29 11:57

Amazon profits hit a new high but cuts 16,000 employees, Amazon launches AI gamble "Dawn Project"

Although Amazon posted a net profit of $21 billion in Q4 2025, it also announced layoffs of 16,000 employees, indicating the trend of AI replacing human labor. The layoffs mainly targeted middle management and development positions, reflecting the company's focus on cloud computing and AI research and development. This move could impact the structure of the labor market, with future tech jobs becoming more concentrated in AI-related fields. Investors and job seekers need to reassess the role of human resources within companies.

動區BlockTempo·01-29 09:30

Polkadot Levels Up With Runtime Upgrade Focused on Real Apps

Polkadot has announced a runtime upgrade that will boost speed for apps, confirm transactions faster and ease development on the network.

Parity Technologies, the for-profit behind the network, recorded a net profit in Q4 last year for the first time, boosted by the return of founder Gavin

DOT0.39%

CryptoNewsFlash·01-29 09:26

XRP Price Lags, but 'Millionaire' Wallets Stage Comeback - U.Today

XRP's 2026 has seen modest price movement, yet high-net-worth wallets are increasing, indicating institutional interest. Recent data suggests a developing supply shock, as large buyers accumulate assets amid market uncertainty.

XRP0.61%

UToday·01-29 05:42

Optimism through buyback mechanism: Superchain net income 50% buy back OP starting February

Optimism governance platform passes buyback proposal with 84.4% support. Starting from February this year, it will use 50% of Superchain net income to buy back OP tokens to enhance token value capture. However, Superchain income is highly concentrated on the Base chain, which may pose risks. Despite transitioning to an "income-driven" model, the performance of the OP token has been poor, declining approximately 95% since the beginning of the year.

OP-0.64%

動區BlockTempo·01-29 02:50

Optimism Makes History: Groundbreaking Buyback Ties OP Token Value Directly to Superchain Profits

In a decisive move that could reshape Layer 2 economics, Optimism's decentralized governance has ratified a pioneering proposal to allocate 50% of net Superchain sequencer revenue to a recurring OP token buyback program.

The plan, passed with an overwhelming 84.4% majority, establishes a direct, mechanical link between the financial performance of the growing Superchain ecosystem and demand for its native OP token. This strategic shift moves OP beyond its governance roots, embedding it a

CryptopulseElite·01-29 02:22

Optimism for the first time in history! Superchain revenue repurchases 50% of OP, governance layer voting passes with 84% approval

Optimism governance layer approved the proposal with 84.4% of the votes. Starting from February, a 12-month pilot will be launched, with 50% of the net revenue from the super chain sequencer used to buy back OP tokens. This is the first time that OP demand is linked to network activity, changing its pure governance token positioning. Over the past year, approximately 5900 ETH in revenue has been generated, with significant growth expected as chains like Base go live. The repurchased tokens are stored in the treasury, with future use determined by governance.

MarketWhisper·01-29 02:04

XRP ETF asset size exceeds 1.3 billion! 21Shares reveals three major bullish scenarios for 2026

Asset management company 21Shares reports that XRP has a 30% chance to reach $2.69, a 50% chance to reach $2.45, and a 20% chance to drop to $1.60 by 2026. The XRP spot ETF managed over $1.3 billion in assets within a month of launch, with 50 consecutive days of net inflows breaking historical records. The RLUSD stablecoin market cap soared to $1.38 billion in less than a year.

MarketWhisper·01-29 01:08

XRP Holds Three-Day Rally as ETF Inflows and Resistance Tests Shape Outlook

Key Insights

XRP recorded three consecutive daily gains, ending a multi-week pause in short-term momentum.

Spot XRP ETFs have posted net inflows since Jan. 21, signaling continued institutional exposure.

Price remains below $2 resistance, leaving uncertainty around follow-through strength.

XRP c

XRP0.61%

CryptoBreaking·01-28 19:40

The hidden whale behind the surge in gold: Tether, which earns billions of dollars annually, has accumulated 140 tons of gold

Tether is rapidly expanding in the gold market, accumulating 140 tons of gold and becoming one of the world's largest physical gold holders. The company plans to actively trade to capture gold arbitrage opportunities and has launched a gold-pegged stablecoin, XAU₮. Tether has earned a net profit of $15 billion from its stablecoin business and holds a large amount of U.S. Treasury bonds and Bitcoin, gradually forming an arbitrage machine that spans traditional finance and the crypto world.

区块客·01-28 16:10

Robert Kiyosaki Admits Regret Over Bitcoin and Gold as Silver Becomes His Safety Net

The essay discusses how rumors about Robert Kiyosaki selling Silver to buy Bitcoin misrepresented his actions. He clarified that he sold Bitcoin and Gold for a home, expressing regret as it disrupted his long-term investment system. Kiyosaki emphasizes the strategic role of Silver as a protective asset and discusses the importance of using income from real estate to manage expenses without compromising core holdings.

CaptainAltcoin·01-28 11:20

[Stable Flow] Inflows to Solana and infrastructure, large-scale outflows from Ethereum and centralized exchanges

In the past week, there has been a significant change in stablecoin capital flows, with large-scale outflows from centralized exchanges and Ethereum, while Solana and the infrastructure sector experienced capital inflows. Infrastructure saw a net increase of $251.7 million, and centralized exchanges experienced a net outflow of $1.9 billion. Additionally, Solana became the leader in supply growth, with stablecoins like USD1 and USDY performing strongly, while USDC faced a net outflow of $2.6 billion.

TechubNews·01-28 07:56

Trump Family Net Worth Doubles to $10B: Crypto Empire Behind Surge

Trump family net worth stands at $10B, doubling since 2024. Donald Trump hit $7.3B, Eric $750M, Barron $150M at 19, Don Jr. $500M, Jared Kushner $1B. They generated $1.8B+ since November, with $1.2B from crypto.

MarketWhisper·01-28 06:42

Vlad Tenev Net Worth: 38-Year-Old Robinhood CEO Worth $5.9 Billion

Vlad Tenev net worth stands at $5.9B as of January 28, 2026, ranking 678 globally. The 38-year-old Robinhood CEO's wealth surged sixfold over the past year through strategic crypto expansion, with his 6%+ equity stake in Robinhood Markets driving gains as the platform revolutionized commission-free trading since 2013.

MarketWhisper·01-28 06:33

Standard Chartered: 500 billion in TradFi deposits will migrate to stablecoins before 2028

Standard Chartered Bank Digital Asset Research Director Jeff Kendrick predicted on Monday that by the end of 2028, up to $500 billion of US bank deposits could shift to stablecoins, accounting for about one-third of the total. He emphasized that "the tail is starting to wag the dog," indicating a rapid increase in the influence of stablecoins. Regional banks, heavily reliant on net interest margins, face the greatest risk, and delays in the 《CLARITY Act》 could accelerate the shift.

MarketWhisper·01-28 05:07

XRP Today's News: Senate resumes review of the bill, spot ETF attracts 1.25 billion for five consecutive days

XRP continues its rebound on Monday, with spot ETF experiencing its fifth consecutive day of net inflows, attracting $9,160,000 on January 27. Since its launch in November, total inflows have reached $1.25 billion, surpassing SOL ETF's $877 million. The Senate Agriculture Committee will review the "Market Structure Bill" on January 29, boosting legislative expectations. Short-term target is $2.5, and mid-term target is $3.0.

MarketWhisper·01-28 03:33

The US dollar experiences its largest decline in six months, with Ethereum receiving defensive capital inflows|Gate VIP Weekly Report (January 19, 2026 – January 25, 2026)

Last week, the market performance was weak, with BTC and ETH both showing weak oscillations, and the rebound mainly due to technical correction. On-chain capital flow was defensive, with Ethereum attracting net inflows, while multiple networks experienced capital outflows. This report will analyze these trends in depth, providing market data and technical insights.

GateResearch·01-27 09:43

Larry Fink Net Worth 2026: $1.3B From Managing $11.6 Trillion BlackRock

Larry Fink net worth stands at $1.3B as of January 2026, ranking 2822 on Forbes. As BlackRock's founder and CEO managing $11.6T, Larry Fink built his fortune from 0.7% equity stake and $20M+ annual compensation since founding the firm in 1988.

MarketWhisper·01-27 07:30

MICA Daily|CryptoQuant: The crypto market keeps falling, who is actually selling off?

Recent Bitcoin pullbacks have sparked investor concern. The selling behavior of miners and large investors indicates that the current market is in a controlled "absorption phase." The miner holdings index and net flow suggest their selling volume is below average; exchange reserves and net flows are declining, reflecting risk-averse behavior rather than panic; meanwhile, whale activity shows small-scale inflows, but far below previous levels, implying the market is still undergoing strategic adjustments.

BTC-0.39%

区块客·01-27 06:40

Gate Research Institute: VanEck's First AVAX Spot ETF | Zerohash is in talks for a new round of financing

Cryptocurrency Market Overview

BTC (+0.98% | Current price 88,575 USDT): The risk of government shutdown and tariff-related policies are jointly suppressing global economic growth expectations, leading to a significant increase in market risk aversion. Over the weekend, Bitcoin briefly dropped nearly 3%, touching the 86,000–86,500 USD range, then rebounded about 1.3%, climbing back to around 87,000 USD. However, after the rebound, the price remains below the local low formed last week and is trading below the 50-day and 200-day moving averages, indicating that, in the context of temporarily controlled volatility, short-term selling pressure still dominates. Last week, spot Bitcoin experienced a net outflow of approximately 1.32 billion USD, the highest level since February 2025. Although Bitcoin is still in a controlled retracement phase, the overall price structure has shown clear signs of fatigue.

ETH (+1.88% | Current price

GateResearch·01-27 06:04

Bullish feast over? Bitcoin unexpectedly shows "bear market signal": holders "cut losses and exit" for the first time in 2 years

After more than a year of profit peaks, the Bitcoin market has recently experienced "net realized losses" among holders, indicating a deteriorating market condition and suggesting that the bull market may have ended. The CryptoQuant report points out that investor behavior has shifted from taking profits to admitting losses, with profit momentum continuously declining and current net realized profits also hitting new lows, indicating that the internal strength supporting the price is weakening.

区块客·01-27 03:55

$1.73B Crypto Exodus: Inside the 3 Forces Driving Fund Flight

In a stark reversal of sentiment, institutional cryptocurrency investment products witnessed a massive \$1.73 billion in net outflows last week, marking the largest weekly capital flight since November 2025.

According to data from CoinShares, the sell-off was led by Bitcoin products (\$1.09B outflows) and Ethereum funds (\$630M outflows), concentrated heavily in the United States. Analysts point to a triple-threat of negative catalysts: fading expectations for near-term Federal Reserve i

CryptopulseElite·01-27 03:11

Strategy’s Latest Bitcoin Buy: A Warning Sign for Shareholders?

Strategy has executed its fourth Bitcoin acquisition of January 2026, purchasing 2,932 BTC for approximately \$264.1 million. While this reinforces the company's unwavering commitment to its Bitcoin treasury strategy, a deeper analysis reveals growing structural cracks.

The purchase was funded entirely by selling new shares while the company's stock trades at a discount to its Bitcoin-backed net asset value (mNAV). This critical shift means the once-accretive model of issuing equity to b

CryptopulseElite·01-27 02:19

Vitalik Retracts 2017 “Mountain Man” Take, Citing ZK-SNARKs as Ethereum’s Safety Net

Key Takeaways:

Vitalik Buterin publicly walked back a 2017 remark dismissing full user self-verification

Advances in ZK-SNARKs now allow blockchain state verification without replaying all history

Buterin identifies self-verification as a backup to make Ethereum resistant to failures and

CryptoNinjas·01-26 15:29

Bitcoin spot ETF suffers heavy losses: net outflow of $1.33 billion in a single week, marking the worst record in nearly a year

The US Bitcoin spot ETF experienced its largest weekly outflow since 2025 last week, totaling $1.33 billion, with a single-day outflow of $709 million on Wednesday. Despite the severe short-term capital withdrawal, the total net inflow of Bitcoin ETFs since January 2024 still reached $56.5 billion. The Ethereum spot ETF also faced redemptions, with a weekly outflow of $611 million.

ETH-2.08%

区块客·01-26 11:25

UBS plans to open up crypto investments! Top private clients will have priority, with direct buying and selling of Bitcoin and Ethereum

UBS plans to offer Bitcoin and Ethereum spot trading services to Swiss private banking clients, symbolizing the gradual embrace of digital assets by traditional banks. The initial plan targets specific clients in Switzerland, with potential expansion to Asia-Pacific and the United States if successful. UBS competes with other financial institutions to retain high-net-worth clients and enhances the application and integration of blockchain technology. The global regulatory environment is gradually improving, facilitating broader adoption of digital assets.

CryptoCity·01-26 08:06

Binance Founder Predicts AI Job Crisis, Calls Crypto the ‘Silver Bullet’

Changpeng Zhao highlights that AI advancements may lead to significant job losses, presenting cryptocurrencies as a potential financial safety net. He also discusses ongoing government initiatives to tokenize state assets using blockchain, emphasizing transparency and increased capital access for local development.

LiveBTCNews·01-26 05:00

Bitcoin ETFs Bleed $1.33 Billion: Worst Weekly Outflow in a Year Rattles Market

U.S. spot Bitcoin exchange-traded funds (ETFs) have recorded their most significant weekly withdrawal since February 2025, with investors pulling a net \$1.33 billion out of the products.

The selling pressure, led by heavy redemptions from BlackRock's industry-leading IBIT fund, signals a sharp reversal from the prior week's inflows and coincides with on-chain data showing Bitcoin holders moving into a "loss-realization" phase. While Ethereum ETFs mirrored the trend with \$611 million in

CryptopulseElite·01-26 04:17

Load More