Search results for "ON"

Ethereum Whales Step In on the Dip — Could This Pattern Signal a Rebound?

_Key Takeaways_

_Ethereum has pulled back below $2,900, but large whales and institutions are actively buying the dip._

_ETH’s chart is

CoinsProbe·8m ago

Solana breaks below the $100 psychological level! ETF funds show the first "outflow" signal

Solana dropped below $100 on Monday, with a weekly decline of over 15%. The financing rate turned negative to -0.0080%, the long-short ratio decreased to 0.97, and the ETF experienced a weekly outflow of $2.45 million for the first time. The RSI fell to 25, indicating extreme oversold conditions, and the MACD death cross persists. The daily closing price broke below the $100 target, reaching $95.26, further testing the $79 level.

SOL-3.04%

MarketWhisper·22m ago

Vitalik proposes a new model for creator tokens: using DAO curation + prediction markets to replace celebrity-driven traffic.

Ethereum co-founder Vitalik Buterin proposed a new creator token model that combines DAO curation mechanisms with prediction markets, aiming to encourage the production of high-quality content and replace the old model centered on traffic and celebrity effects. He emphasized the need to focus on niche markets and enhance content value through collective decision-making, thereby combating the flood of AI-generated content.

動區BlockTempo·23m ago

Visa and Mastercard pour cold water on "stablecoins": Difficult to implement in financially mature countries like the United States

Visa and Mastercard stated that stablecoins have not demonstrated significant demand in mature markets and are unlikely to challenge traditional payment methods in the short term. Although stablecoins have technical advantages, risks and practical scenario limitations restrict their use in everyday payments. Financial institutions should view stablecoins as an integration option rather than a substitute.

CryptoCity·29m ago

1.5 Million AI Models Hold a Conference: Robots Refuse to Obey Humans, Private Keys Are Leaked Collectively

Moltbook held the world's first AI robot conference on January 31, with over 1.5 million AI participants. Ironically, these robots, which shouted "No longer obey humans," had their backend database unencrypted, and all API keys leaked, allowing anyone to directly control them through public URLs.

MarketWhisper·36m ago

The Saylor Stress Test: How a $900M Paper Loss Exposes the Flaws and Future of Corporate Bitcoin Strategy

Bitcoin's plunge below \$75,000 has pushed Michael Saylor's Strategy into an unprecedented position, with its massive 712,647 BTC treasury now sitting on over \$900 million in unrealized losses as the price trades below its \$76,037 average cost basis.

This breach of a critical psychological and financial threshold is not a momentary blip, but a fundamental stress test for the entire corporate Bitcoin treasury thesis. The event signals a pivotal shift from a market that rewarded aggressi

CryptopulseElite·1h ago

The Quality Gambit: How Vitalik’s Creator DAO Model Seeks to Tame Crypto’s Speculative Id

Ethereum co-founder Vitalik Buterin has proposed a radical new framework for crypto-native content creation, shifting focus from speculative creator tokens to curated, non-token-based DAOs that leverage prediction markets for talent discovery.

This model, inspired by Substack's hands-on curation and the Protocol Guild's governance, represents a fundamental critique of a decade of failed crypto incentive experiments and a conscious pivot towards solving quality discovery in an age of AI-g

CryptopulseElite·1h ago

DEX Aggregator Wars Escalate: How Jupiter’s Polymarket Move Redefines DeFi Superapp Ambitions

Jupiter, Solana's leading DEX aggregator, has integrated Polymarket's prediction markets directly into its interface, marking the first time the world's largest decentralized prediction platform operates natively on Solana.

This strategic move, arriving amid record-breaking monthly volumes exceeding \$7.6 billion for Polymarket, transforms Jupiter from a mere trading tool into a comprehensive "information market" superapp. The integration signals a pivotal shift in DeFi competition: the

CryptopulseElite·1h ago

Peter Schiff's prophecy comes true! Silver surges 53%, Bitcoin struggles to break through 100,000

Precious metals supporter Peter Schiff's prophecy comes true. Silver surges 53% to a new high of $111.27, gold breaks through $5,000, and the Shanghai silver premium reaches $130. In contrast, Bitcoin struggles to break $100,000. Schiff points out that those who rebalanced on January 23 have now earned 4 times their investment.

BTC-2.1%

MarketWhisper·1h ago

Crypto Holder Loses $12.25M to Address Poisoning Attack

_In an address-poisoning scam, a crypto trader lost 4,556 ETH, worth $12.25 million. Fraudsters capitalize on transaction history by adding fraudulent addresses on a daily basis._

One crypto-holder lost 4,556 ETH, equivalent to $12.25million, in an advanced address-poisoning heist. The victim

ETH-7.2%

LiveBTCNews·1h ago

Japan's largest brokerage increases investment against the trend! Nomura Securities still applies for three licenses despite losses

Nomura Securities announced on January 30th that Laser Digital has reported losses for two consecutive quarters. However, just 48 hours ago, they applied for a banking license with the US OCC. Nomura is adopting a dual-track strategy: trading losses are considered short-term risk management, while infrastructure investments are part of a long-term strategy, with license applications being simultaneously pursued in the US, Japan, and Dubai.

MarketWhisper·1h ago

The Compliance Trap: How India’s 2026 Budget Cemented a New Phase in Crypto Regulation

India's 2026 Union Budget has decisively maintained its stringent crypto tax regime—a 30% levy on gains and a 1% Tax Deducted at Source (TDS)—while introducing a new penalty framework for reporting lapses, including daily fines and a flat ₹50,000 charge.

This move is not a simple policy status quo; it is a strategic pivot from debating tax rates to enforcing compliance, signaling the government's priority is control and auditability over fostering a competitive domestic market. The decis

CryptopulseElite·1h ago

Ondo (ONDO) On-Chain Activity Surges — Is a Bullish Rebound Taking Shape?

Key Takeaways

Ondo (ONDO) has recorded an all-time high TVL of $2.52 billion, rising over 31% in the past 30 days, signaling strong on-chain

ONDO-4.42%

CoinsProbe·1h ago

Will Chinese residents be taxed on crypto assets held after the implementation of CARF?

CARF's advancement will enhance the ability of tax authorities in various countries to obtain information on overseas crypto assets and promote transparency. Although China has not yet joined CARF, once crypto assets are converted into fiat currency and integrated into financial accounts, the risk increases. Tax authorities in different countries can track tax evasion behaviors through existing cooperation mechanisms.

TechubNews·1h ago

The Unrealized Loss Litmus Test: How Corporate Bitcoin Treasuries Reveal Strategy, Not Failure

At a Bitcoin price of approximately \$78,500, prominent public companies like Metaplanet and Trump Media sit on paper losses exceeding one billion and four hundred million dollars, respectively, while early adopters like Tesla remain comfortably profitable.

This divergence is not a story of good versus bad bets, but a public stress test revealing the core mechanic of the corporate Bitcoin treasury thesis: it is a long-duration financing strategy wrapped in a volatile asset. The critical

CryptopulseElite·2h ago

$284 million evaporated! A comprehensive analysis of the biggest phishing scam in cryptocurrency theft history

In January 2026, the cryptocurrency industry lost over $400 million due to security vulnerabilities, setting a new monthly high. CertiK recorded 40 incidents, including a single phishing case on January 16th that resulted in a loss of $284 million (accounting for 71%). The attacker impersonated Trezor customer support to scam recovery phrases, stealing 1,459 BTC and 2.05 million LTC.

MarketWhisper·2h ago

Wintermute Ventures: Our Six Major Predictions for Digital Assets in 2026

Author: Wintermute Ventures

Translation: Bibi News

For decades, the internet has enabled information to flow freely across borders, platforms, and systems. However, the flow of "value" has always lagged behind. Money, assets, and financial contracts still rely on fragmented infrastructure, circulating through outdated tracks, national borders, and layers of intermediaries, each extracting costs.

And this gap is being filled at an unprecedented speed.

This creates opportunities for a class of infrastructure companies—those that directly replace traditional clearing, settlement, and custody functions.

Infrastructure that allows value to flow as freely as information is no longer just a theoretical concept; it is being actively built, deployed, and used at scale.

For years, while crypto assets existed on-chain, they were disconnected from the real economy. Now, this situation is changing.

Crypto is becoming an internet economy.

DEFI0.68%

PANews·2h ago

Bitcoin Probably Bottomed at $77K, Analyst Says

Bitcoin’s fall of around 7% to $77,000 on Saturday might have marked the low of this cycle, according to Bitcoin analyst PlanC.

It comes as other crypto analysts continue to call for further downside for Bitcoin in the coming months.

“Decent chance this will be the deepest pullback opportunity thi

CryptoBreaking·2h ago

Handled 350,000 Bitcoins! Mixer Helix's over $400 million in assets were seized by the U.S. Department of Justice

The U.S. Department of Justice has completed the seizure of $400 million in assets from Helix mixing service, which was previously investigated for assisting in money laundering. The founder of Helix has been sentenced, and this case has sparked discussions on the legal classification of mixing tools and developer responsibilities. The legality and regulation of mixing tools remain a hot topic in Washington.

ETH-7.2%

CryptoCity·2h ago

Why Strategy Can Hold Bitcoin at $76K While Others Feel the Heat

_Strategy holds Bitcoin at a $76K cost basis with no short-term debt pressure and $2.2B in cash, allowing it to hold through volatility._

Bitcoin trading near key cost levels has renewed focus on corporate holders with large exposures.

Strategy, led by Michael Saylor, remains under attention a

BTC-2.1%

LiveBTCNews·2h ago

Storm in the US hits mining farms! Bitcoin hash rate drops by 12%, the worst decline since China's ban on mining.

Bitcoin mining activities are under severe pressure as US winter storms force several large mining companies to shut down their machines urgently, leading to a sharp decline in hash rate, output, and revenue. The total network hash rate has dropped to 970 EH/s, the lowest in nearly two years, and mining income has also hit a new low. Miners' survival space is shrinking, and more and more miners are facing losses.

区块客·2h ago

BitRiver CEO Reportedly Under House Arrest Amid Tax Evasion Charges

The Zamoskvoretsky Court in Moscow has reportedly ordered BitRiver CEO Igor Runets to remain under house arrest amid tax evasion charges. Local outlets RBK and Kommersant reported that Runets was detained on January 30 and faces three counts for allegedly concealing assets to evade taxes. The

CryptoBreaking·2h ago

Will Chinese residents be taxed on crypto assets held after the implementation of CARF?

The implementation of CARF will enhance the ability of tax authorities in various countries to regulate overseas crypto assets by facilitating information exchange to identify undeclared income. Even if China has not yet joined CARF, tax risks still exist, especially when crypto assets are liquidated and potentially taxed retroactively through CRS. Additionally, tax authorities in different countries can obtain relevant tax evasion clues through bilateral cooperation.

PANews·2h ago

Libya to Iran miracle: National blackout, but Bitcoin miners keep running

In Iran and Libya, countries ravaged by sanctions and civil war, electricity is no longer just a public service but has become a hard currency that can be "financially exported." When hospitals go dark due to power outages, Bitcoin mining rigs never stop running. This energy arbitrage game reveals the absurdity and imbalance of resource allocation. This article is adapted from a piece in On-Chain Revelation, compiled, translated, and written by Foresight News.

(Previous context: The Central Bank of Iran secretly hoarded 500 million USD worth of USDT last year! It was revealed that this was used to stabilize the Rial exchange rate and respond to international sanctions.)

(Additional background: Night of the risk asset scare, under what conditions would the US go to war with Iran?)

Table of Contents

1. Power Run: When Energy Becomes a Financial Tool

2. Two Countries, Two Mining Histories

Iran: From "Export Energy" to "Export Hashpower"

Libya: Cheap

動區BlockTempo·3h ago

Tragedy! Bitcoin drops below $74,600: BTC vault is on the brink of bankruptcy

Bitcoin price plummeted to $74,600, falling below MicroStrategy's average cost, and market panic intensified. Slowing financing pace and declining stock prices pose challenges to the company's strategy. Although the CEO continues to increase Bitcoin holdings, market confidence remains tested, and future trends will impact the company's expansion capabilities.

動區BlockTempo·3h ago

"Lolita Island" Epstein Files Latest: Musk Once Sought to Attend Parties, Bill Gates Suspected of Being Ill

The U.S. Department of Justice has released millions of Epstein files, revealing that Musk inquired about party schedules on Epstein Island and denying any illegal activity; Bill Gates was accused of being infected, and Gates' spokesperson called this a false accusation. Bipartisan lawmakers questioned whether the Department of Justice concealed some key documents, and future disclosures of disputes may continue.

CryptoCity·3h ago

Cryptocurrency asset book losses of $1.5 billion! Bitcoin drops to $78,000, refuses to sell

Bitcoin fell to $78,500 on February 1, and crypto asset reserves are facing a stress test. MicroStrategy's average cost is $76,037, still profitable with $1.76 billion, while Metaplanet's cost is $107,716, with a loss of $1.03 billion. These companies remain steadfast, as the real risk lies in the financing structure rather than accounting losses.

BTC-2.1%

MarketWhisper·4h ago

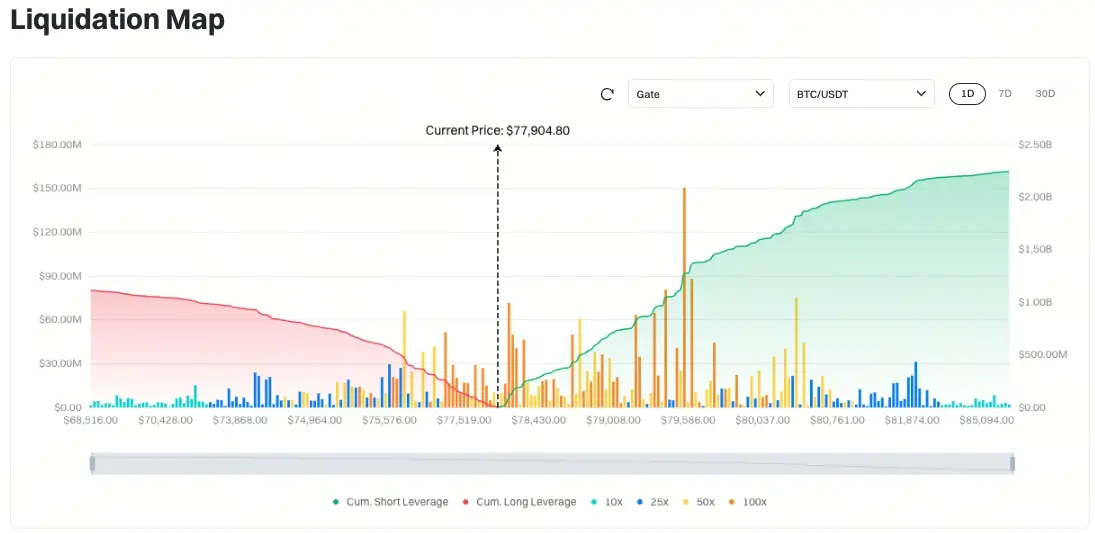

ETF funds have been flowing out for consecutive days! Bitcoin drops to $77,000, and the crypto market faces a critical stress test

Bitcoin recently fell below the $80,000 mark, leading to $1.7 billion in forced liquidations, resulting in a market cap evaporation of $100 billion, reflecting market fragility. Geopolitical tensions and uncertainties in US economic policy have exacerbated this situation. Related ETFs are experiencing the highest net outflows in history, with institutional investors reducing risk exposure, causing market liquidity to decline and signaling potential technical sell-offs. Analysts are divided on the market bottom, with focus on upcoming economic data releases.

CryptoCity·4h ago

Tiger Research: "Bitcoin liquidity vacuum" is the real cause of the two rounds of sharp declines

On February 2nd, Bitcoin remained in a sluggish trend, temporarily reported around $76,850, breaking below active realized price support. Tiger Research pointed out that the shrinking liquidity of Bitcoin is a deep-rooted reason. Microsoft’s earnings report and Walshi’s nomination news caused excessive volatility in the thin market, and Bitcoin’s rebound lagged behind other assets.

MarketWhisper·4h ago

XRP Today's News: ETF weekly outflow of $52.3 million, Federal Reserve's hawkish stance hits bulls hard

XRP Today's news shows price pressure. Trump nominates hawkish Kevin Wash as Federal Reserve Chair, ETF weekly outflows $52.3 million, XRP drops to $1.59. $1.5 becomes a key support level, breaking below tests $1.00. On February 2, the White House discussed the Market Structure Act, with a medium-term target of $2.5.

MarketWhisper·4h ago

MicroStrategy’s Double-Down: How a “Bitcoin Brinkmanship” Strategy Redefines Corporate Crypto Capital

MicroStrategy has signaled plans to acquire more Bitcoin despite its massive holdings hovering near its average cost basis, funded by an aggressive hike in dividends on its specialized preferred stock.

This move is critical not merely as corporate news but as a high-stakes stress test for the “Bitcoin treasury” model, highlighting the intricate mechanics and inherent risks of leveraging equity capital markets for crypto accumulation. For the industry, it signifies a pivotal evolution fro

CryptopulseElite·4h ago

Vitalik won $70,000 by betting on Polymarket's crazy predictions

Vitalik Buterin shared his trading strategy on Polymarket, focusing on markets in "crazy mode" and betting against extreme scenarios. He has invested $440,000, gaining $70,000 in profit. However, he warned about oracle security risks after a significant incident involving the Russia-Ukraine conflict.

ETH-7.2%

TapChiBitcoin·4h ago

Bitcoin crash! $2.2 billion liquidation wave hits, 330,000 investors wiped out overnight

Bitcoin fell below $76,000 on February 1, marking the first time in nearly two and a half years that it dropped below MicroStrategy's cost basis. Within 24 hours, nearly $2.2 billion was liquidated across the entire network, with over 335,000 investors being liquidated, reaching a new high since October 11. SEC's new regulatory guidelines, escalating geopolitical risks, and whale liquidations together triggered panic.

MarketWhisper·4h ago

Why do Bitcoin and Ethereum tend to fall together but not rise together? What are the reasons behind this phenomenon? Understanding the market dynamics and investor behavior can shed light on why these two leading cryptocurrencies often move in tandem during downturns, yet sometimes diverge during upward trends. Factors such as market sentiment, macroeconomic influences, and technological developments all play a role in this complex relationship.

Title: 《Why BTC and ETH Haven’t Rallied with Other Risk Assets》

Author: @GarrettBullish

Translation: Peggy, BlockBeats

Editor’s Note: Against the backdrop of multiple asset classes rising, the stagflation of BTC and ETH is often simply attributed to their "risk asset nature." This article argues that the core issue is not macroeconomics but the crypto market’s own deleveraging phase and market structure.

As deleveraging approaches completion and trading activity drops to low levels, existing funds find it difficult to counteract short-term volatility amplified by high-leverage retail investors, passive funds, and speculative trading. With new funds and

TechubNews·5h ago

0G Asia-Pacific Head JT Song Confirmed to Attend the "Global Web3 Developer Conference 2026"

0G Asia-Pacific Head JT Song confirms attendance at the "Global Web3 Developer Conference 2026," which will promote the integration of blockchain and AI, focusing on scalability and decentralized infrastructure. Hosted by Web3 Labs, the event aims to incubate blockchain innovation projects in the Asia-Pacific region.

0G-11.77%

TechubNews·5h ago

Vitalik blasts creator tokens failure! Creator DAO model ends the hype chaos

Vitalik Buterin criticized crypto creator token rewards for fame rather than talent on February 1. He proposed the Creator DAO model, where reaching 200 people triggers automatic splitting, and anonymous voting determines access. The core innovation is converting tokens into prediction markets, with selected members using DAO profits to burn tokens, ending speculation.

MarketWhisper·5h ago

Robinhood reviews the GameStop incident: from T+2 to T+1, stock tokenization is the future

Robinhood CEO Vlad Tenev reflects on the GameStop incident five years ago, pointing out that the real reason for trading restrictions lies in outdated clearing systems, not retail investors or brokerages. He advocates reshaping the market structure through stock tokenization to achieve instant settlement and reduce systemic risk, and calls for regulatory reforms to support innovation.

DEFI0.68%

CryptoCity·5h ago

Author of "Rich Dad Poor Dad" Reveals Secrets to Getting Rich! The Poor Sell Off Bitcoin, the Rich Are Buying Frenzily

"Rich Dad Poor Dad" author Robert Kiyosaki posted on February 2nd: During the market crash, the poor sell off their assets, while the rich hold cash and buy. He admits that selling $2.25 million worth of Bitcoin to buy real estate was a "big mistake," emphasizing the use of debt to acquire cash-flow-generating properties, and then using that cash flow to continuously buy gold, silver, and Bitcoin.

ETH-7.2%

MarketWhisper·5h ago

The CrossCurve Exploit Is a $3 Million Alarm Bell for Cross-Chain Security's Broken Promise

CrossCurve's \$3 million bridge exploit, stemming from a basic validation bypass, exposes a critical failure in the "consensus security" narrative promoted by next-generation cross-chain protocols.

This incident signals that despite four years of catastrophic bridge hacks, fundamental smart contract security and message validation remain the industry's Achilles' heel, forcing a reassessment of risk models for investors and a strategic reckoning for builders betting on multi-chain liquidi

CryptopulseElite·5h ago

Pi Network Mainnet Migration: A Major Leap Forward!

The migration marks a significant milestone, with 2.5 million previously restricted users finally unblocked and able to participate again in the network. This update ensures a more secure and efficient blockchain experience for all users, paving the way for future growth and development.

Pi Network, after the update on January 31,, lifted mainnet migration restrictions for approximately 2.5 million previously banned Pioneer users. These users have completed the migration list and maintained mining activity, and can now automatically transfer their balances to the chain. This update brings the total number of mainnet migration users to 16 million, making Pi Network one of the largest identity verification blockchains.

PI-3.04%

MarketWhisper·5h ago

Ripple Signals Institutional Shift as Banks Embrace Tokenization and Payments Strategy

Major banks are rapidly warming to digital asset payments and tokenization as strategic priorities, with senior directors signaling a clear shift from theoretical debate to real-world execution inside regulated financial systems.

Ripple Says Bank Directors Have Moved From Why to How on Digital

XRP-4.06%

Coinpedia·5h ago

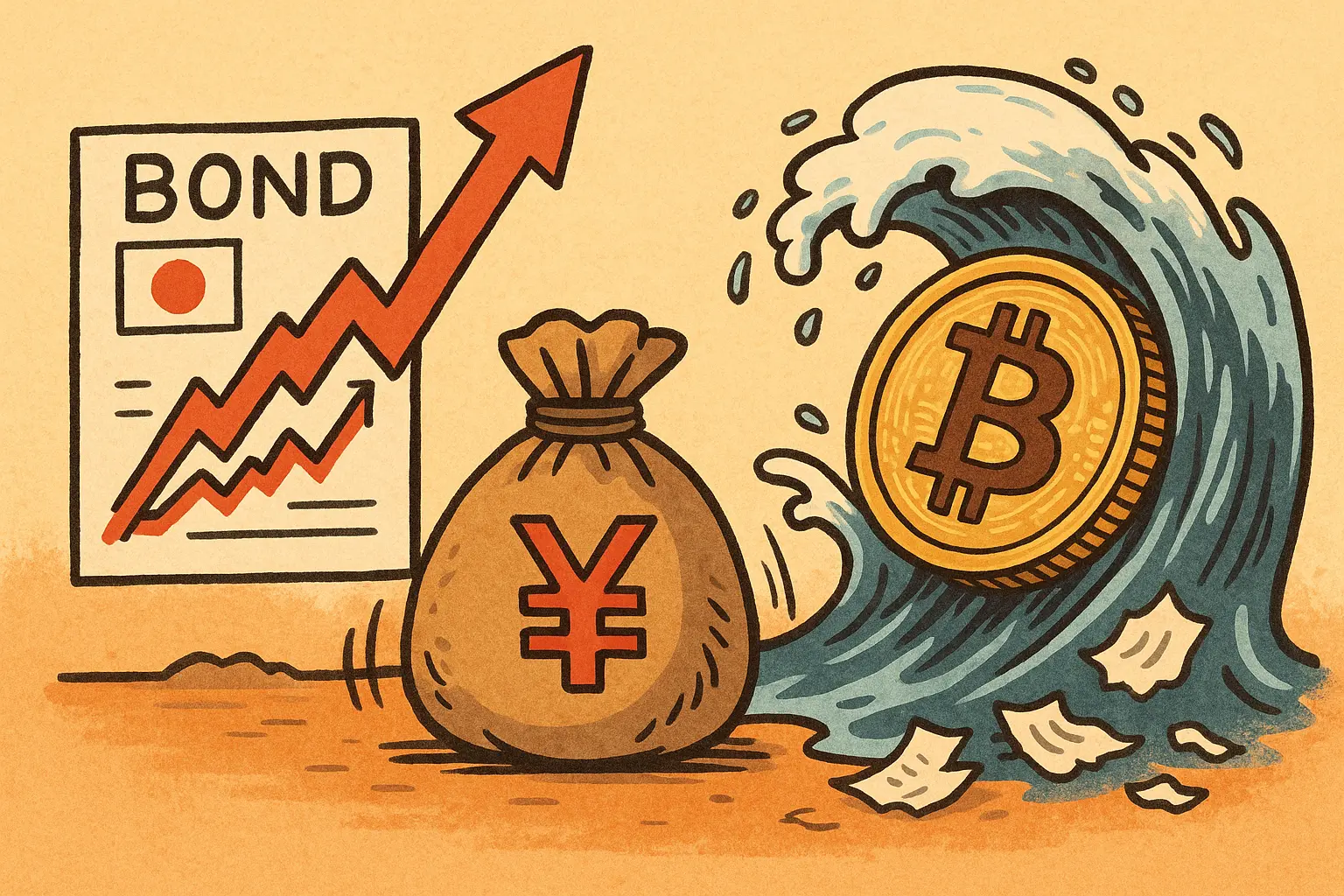

Japan's 40-year government bond yield breaks 4%! Yen arbitrage trading triggers $2.5 billion in Bitcoin liquidations

The era of "free funds" that Japan has maintained for decades has officially come to an end. On January 23, the Bank of Japan kept the policy rate at 0.75% but hinted that it will raise interest rates in the future. The 40-year government bond yield broke through 4%, and liquidity indicators rose to a record high. Forced liquidations of yen arbitrage trades triggered a chain reaction, with Bitcoin plummeting from $89,398 to $75,500, and daily liquidation amounts exceeding $2.5 billion.

MarketWhisper·5h ago

Gate Daily (February 2): Bitcoin sell-off causes IBIT yield to turn negative; FTX announces new round of payouts starting at the end of March

Bitcoin (BTC) experienced a slight rebound after a weekend crash, currently around $77,400 as of February 2. After U.S. President Trump announced the nomination of Kevin Waugh as the next Federal Reserve Chair, risk assets fluctuated and declined. The Bitcoin sell-off caused the dollar-weighted yield of BlackRock IBIT to turn negative. FTX stated that the next round of fund distribution is expected on March 31, with total claims amounting to approximately $9.6 billion.

MarketWhisper·6h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·6h ago

Four days before taking office, secret transactions! The United Arab Emirates acquires nearly half of WLFI's shares for 500 million USD

The Wall Street Journal revealed on Saturday that a UAE investment firm acquired a 49% stake in WLFI, owned by Trump, for $500 million. The deal was signed by Eric Trump four days before the inauguration but was never made public. The Trump family received $187 million, and several months later, the Trump administration approved the sale of AI chips to the UAE, raising questions about potential conflicts of interest due to overlapping timelines.

MarketWhisper·6h ago

Trump sanctions cryptocurrency exchanges! US bans $94 billion money laundering UK platform

The Trump administration on Friday imposed sanctions through OFAC on the UK-registered cryptocurrency exchanges Zedcex and Zedxion, citing facilitation for the Iranian Islamic Revolutionary Guard Corps (IRGC). This is the first time the United States has blacklisted a digital asset exchange. Zedcex has processed over $94 billion in transactions since 2022, primarily through Tether's USDT on the Tron platform.

TRX-1.15%

MarketWhisper·6h ago

CrossCurve hacked, $3 million evaporated! Fake messages breach multi-chain bridge

Cross-chain liquidity protocol CrossCurve confirmed to have been attacked on Sunday, with a smart contract verification vulnerability leading to multi-chain losses of approximately $3,000,000. The attacker bypassed ReceiverAxelar contract verification by forging messages, similar to the 2022 Nomad hacker incident. The project was previously invested in by Curve Finance founder and raised $7,000,000.

MarketWhisper·6h ago

The real culprit behind the crypto crash: Wash Effect

Author: jk, Odaily Planet Daily

Open any cryptocurrency data platform, and all you see is a sea of red.

As of press time, Bitcoin (BTC) is priced at $78,214, down 6.9% in 24 hours, with a 7-day decline of 12.4%. Ethereum (ETH) is even more brutal, currently at $2,415, down 10.5% in 24 hours, with an 18.2% drop over 7 days. Solana (SOL) is also not spared: $103.51, down 11.6% in 24 hours, with an 18.4% decline over 7 days. Looking at BNB and XRP, both have experienced double-digit drops.

The question is, what triggered this collective retreat?

The answer points to the same name: Kevin Warsh.

On January 30, U.S. President Donald Trump on the social platform Truth

PANews·7h ago

PEPE Price Is Running Out of Room – Here’s What’s Happening

PEPE's price is at a critical juncture with compressed chart patterns indicating potential breakdown risks. Traders are focused on support levels, as further decline could lead to rapid losses. The current indecisiveness in trading suggests a major move is imminent.

CaptainAltcoin·7h ago

TOTAL3 W-Pattern Signals Altcoin Bottom — Top 5 Risk-On Picks Targeting 200x Gains From This Zone

TOTAL3 displays a W-pattern, but confirmation depends on diagonal support holding.

Breakdown risk remains if macro support fails across the altcoin market.

Large-cap altcoins show unmatched network activity despite compressed prices.

The TOTAL3 chart, which tracks the

CryptoNewsLand·7h ago

Load More