Search results for "RATING"

Gate Research Institute: Ethereum-led Tokenization of Commodities Issuance | Prediction Market Trading Volume Reaches New High

Summary

BTC and ETH experienced a rebound after a sharp rise and subsequent correction; funds are leaning towards defensive assets, flowing into tokenized commodities/gold, payments, privacy, and DID among stable altcoin sectors.

Ethereum leads the issuance of tokenized commodities, accounting for 85% of the share.

Long-term holders are accelerating their reduction of positions, with Bitcoin facing the strongest selling pressure since August.

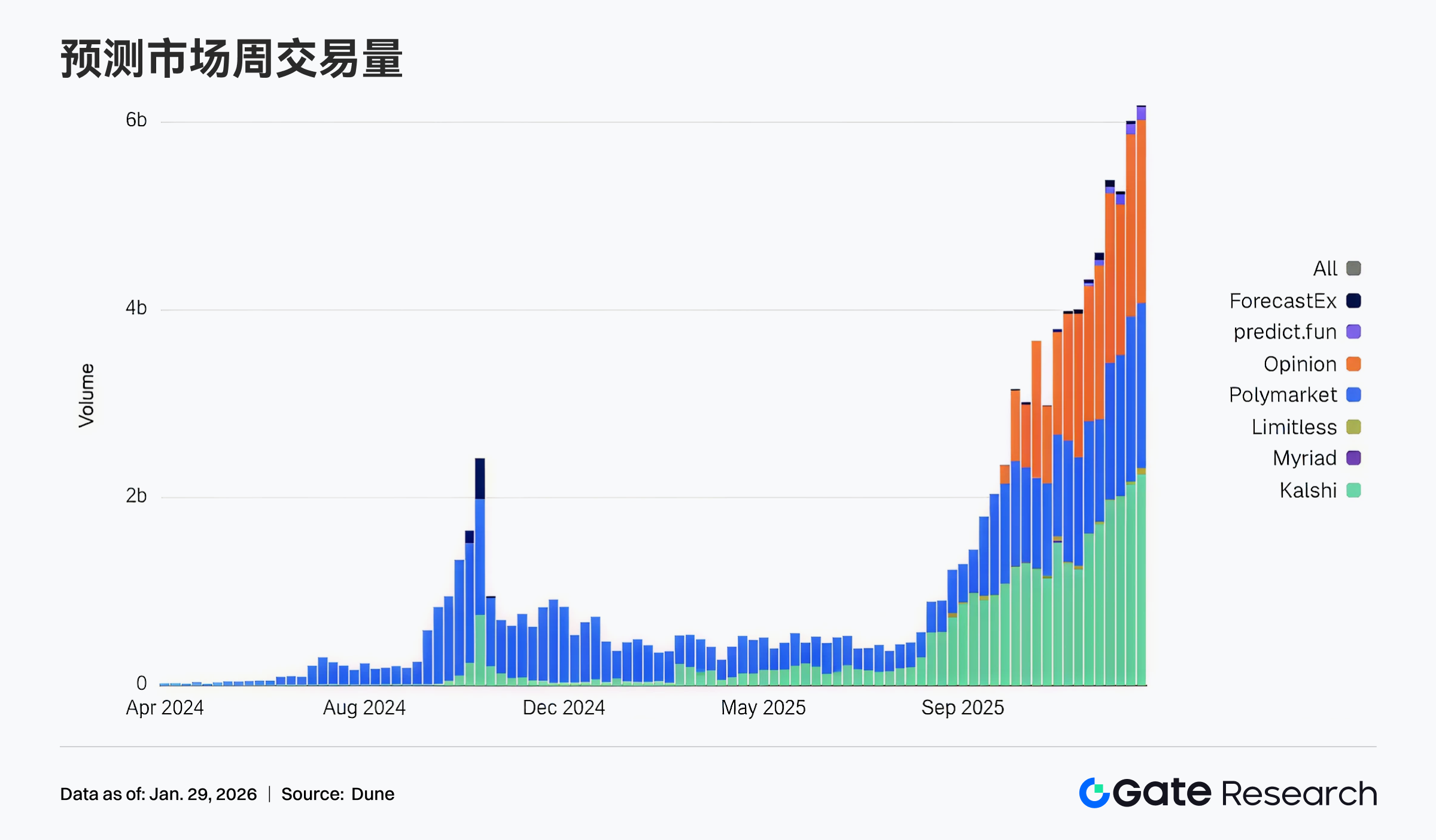

Market trading volume hits a record high, becoming the on-chain "expectation pricing layer."

Polymarket drives a surge in USDC usage, Mizuho upgrades Circle's rating and is optimistic about growth resilience.

SUI will unlock approximately $60.94 million worth of tokens in the next 7 days, representing 11% of the circulating supply.

Market Analysis

Market Commentary

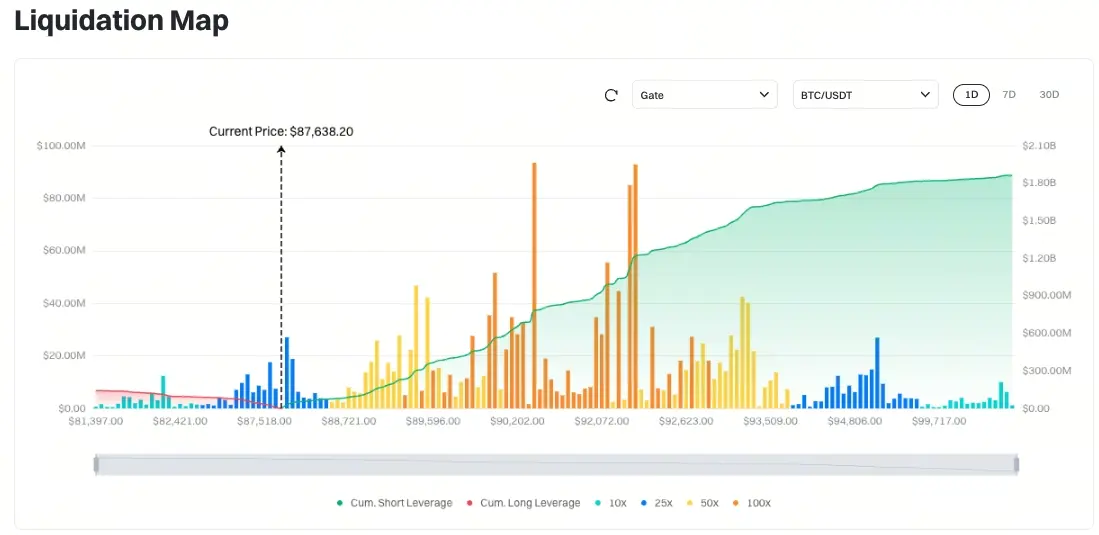

BTC Market — Over the past week, BTC quickly bottomed near $86,100 and rebounded to around $91,200.

GateResearch·01-29 06:23

Masayoshi Son adds $30 billion in funding for OpenAI, credit rating may be downgraded

SoftBank in talks to add $30 billion investment in OpenAI, having sold $5.8 billion worth of NVIDIA stock and reduced T-Mobile holdings for cash. OpenAI's valuation is expected to reach $750 billion, surpassing Arm to become SoftBank's largest holding (accounting for over 30%). S&P warns that BB+ credit rating faces downward pressure. Following the news, SoftBank's stock price rose 8.8%. OpenAI launches research tool Prism.

MarketWhisper·01-29 05:14

One year since Trump returned to the White House: American deterrence is rewriting the global risk order

During the second year of his second term, Trump faced domestic divisions and high inflation challenges. His governing style became increasingly unrestrained, implementing radical policies that raised concerns abroad. His approval rating remained relatively low, with voters dissatisfied with the economic management, which could impact the Republican Party's performance in the upcoming elections. Trump's policies and rhetoric have strengthened his power but have failed to effectively address people's livelihood issues.

動區BlockTempo·01-20 07:05

TD Cowen Trims Strategy Price Target as Bitcoin Yield Outlook Softens

In brief

TD Cowen cut its Strategy price target to $440 but kept a buy rating.

Strategy recently raised a further roughly $1.25 billion and used nearly all of it to buy more Bitcoin.

Analysts link the strategy to broader shifts in Bitcoin’s institutional market structure.

TD Cowen

BTC2.26%

Decrypt·01-15 03:11

AllianceBernstein Reaffirms Confidence in Strategy’s Bitcoin Vision

Institutional confidence in Bitcoin-linked equities continues to strengthen across global markets. AllianceBernstein, an asset manager overseeing 850 billion dollars, has reiterated its buy rating on Strategy. The firm also reaffirmed a price target of 450 dollars for MSTR stock. This endorsement

BTC2.26%

Coinfomania·01-14 13:02

Standard Chartered tips Ethereum to outpace Bitcoin into 2030 cycle

Standard Chartered trims ETH's 2026 target but says Ethereum will regain 2021 highs vs Bitcoin as throughput, DeFi and regulation drive a 2030 re-rating.

Summary

Standard Chartered cuts Ethereum's 2026 dollar target but keeps a higher 2030 goal, arguing ETH's relative outlook vs BTC has

Cryptonews·01-13 10:54

Fitch Ratings warns: Bitcoin-backed securities face "speculative-grade" high risk, comparable to junk bonds

Fitch Ratings, one of the world's three major credit rating agencies, released its latest assessment, categorizing Bitcoin-backed securities as "speculative grade" products with "high market value risk," with credit quality comparable to high-yield junk bonds.

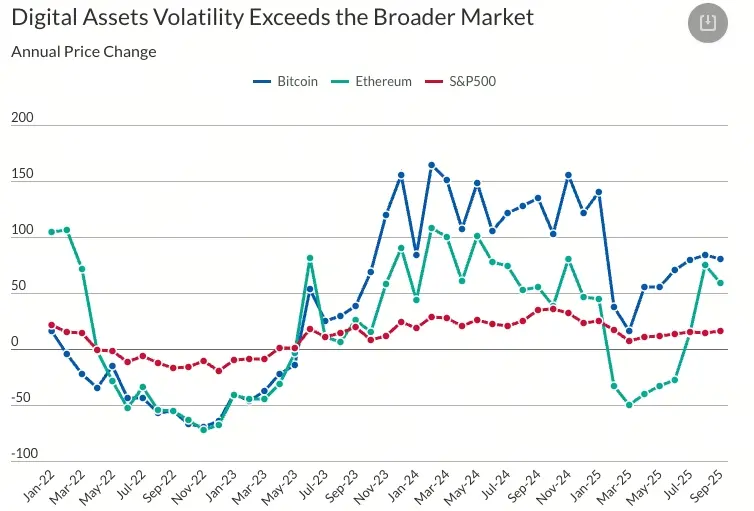

This warning directly points to the core weakness of such financial instruments: the sharp volatility of Bitcoin prices can quickly erode the value of collateral, posing loss risks for lenders and investors. The report specifically cites lessons from the 2022 to 2023 collapses of crypto lending institutions Celsius and BlockFi, emphasizing that reliance on collateral-based models can rapidly break down under market stress. This assessment serves as a wake-up call for institutional investors exploring crypto lending products and may reshape the design and market access standards for such products.

BTC2.26%

MarketWhisper·01-13 02:17

Moody's 2026 Outlook: Stablecoins are Rising as a Core Infrastructure in Global Finance

Top global credit rating agency Moody's released the "Global Outlook 2026" report, explicitly stating that stablecoins have shifted from being a native tool in the cryptocurrency space to an indispensable "core infrastructure" in the institutional market. The report disclosed that in 2025, on-chain settlement volume of stablecoins surged by 87% year-over-year, reaching an astonishing $9 trillion.

This data marks the evolution of stablecoins and tokenized deposits into "digital cash" used by institutions to manage liquidity, transfer collateral, and settle transactions, becoming a key conduit connecting traditional finance with the growing world of tokenized assets. As global regulatory frameworks become clearer and infrastructure investments exceeding $300 billion are anticipated, the role of stablecoins as a "financial pipeline" has become irreversible.

MarketWhisper·01-08 02:07

Korea Credit Rating '2026 Industry Outlook'… Semiconductors smile, construction and chemicals cry

South Korea's credit rating agency forecasts that by 2026, the Korean economy will show a slow recovery supported by a favorable semiconductor cycle and expansionary fiscal policies. However, it also points out that addressing the structural issues caused by widening gaps between industries remains an unresolved challenge.

At the online "2026 Industry Outlook" briefing held on the 7th, Korea Credit Rating Analysis stated that despite good export performance last year, economic growth remained at a low level of around 1.0% due to shrinking private consumption and sluggish construction industry conditions. However, thanks to increased global semiconductor demand, domestic demand recovery, and expanded government fiscal spending this year, the agency is optimistic about the economic outlook, expecting the growth rate to improve to 1.8%.

But Korea Credit Rating is concerned that this recovery is likely to be uneven across different industries. The agency stated that sectors such as semiconductors, shipbuilding, and defense are expected to maintain

TechubNews·01-07 14:25

Goldman Sachs bullish on Coinbase! Recommends buying with a target price of 303 dollars, diversified exchange strategies receive approval

Goldman Sachs Upgrades Coinbase Investment Rating to Buy, Believing Revenue Structure Shift to Infrastructure and Subscription Services Will Support Growth by 2026, but Short-term Profitability Still Limited by Competition and Interest Rate Pressures.

Wall Street investment bank Goldman Sachs released a 2026 industry outlook report, officially upgrading Coinbase (NYSE: COIN) from "Neutral" to "Buy." Goldman Sachs believes that with Coinbase's recent series of new product launches and the gradual shift of its revenue structure toward more "infrastructure-like" businesses, the company's growth prospects are more optimistic; however, in the short term, profit margins remain challenged by increased competition and rising sensitivity to interest rates.

Goldman Sachs also set a target price of $303 for Coinbase. If based on the recent price of approximately

CryptoCity·01-07 06:50

Coinbase Stock Jumps 8% as CEO Brian Armstrong Highlights 8 Key Advantages

Coinbase shares surged nearly 8%, boosted by a fresh upgrade from Goldman Sachs, which raised its rating on COIN from neutral to buy amid Bitcoin’s strong upward trend. The upgrade follows CEO Brian Armstrong’s push to position Coinbase as a unified platform offering stock trading and key

Moon5labs·01-06 20:01

Coinbase's diversified business layout receives recognition! Goldman Sachs is bullish and recommends "Buy" with a target price of $303

Goldman Sachs upgrades Coinbase's rating from "Neutral" to "Buy," with a target price set at $303, citing the company's new product launches and a shift in revenue structure toward infrastructure-based businesses. Although the growth outlook is optimistic, it still faces pressures from increasing competition and rising interest rates. Coinbase is gradually reducing its dependence on crypto trading and strengthening revenue stability.

区块客·01-06 12:42

Tom Lee sees 2026 delivering ‘joy, depression and rally’ in one volatile year

Tom Lee expects 2026 to compress early volatility and fear into a late-year rally, with Fed cuts, ISM above 50, and earnings re-rating lifting energy, financials and small caps.

Summary

Tom Lee frames 2026 as a "joy, depression and rally" year, echoing 2025's pattern of early weakness

ETH3.38%

Cryptonews·01-06 10:36

Coinbase Stock Rally Signals Renewed Wall Street Confidence

The Coinbase stock rally sent a strong message across financial markets on Monday. Shares jumped eight percent after Goldman Sachs upgraded the stock to a buy rating. The investment bank also raised its price target to $303, reflecting stronger conviction in Coinbase’s long term strategy. Traders

Coinfomania·01-06 09:39

Goldman Sachs turns bullish on Coinbase, upgrades COIN to ‘buy’ rating

Coinbase shares were up on Monday, Jan. 5, gaining as much as 8% in intraday trading, after Goldman Sachs upgraded their rating for COIN from "neutral" to "buy."

Summary

Coinbase shares jumped as much as 8% after Goldman Sachs upgraded the stock to a buy rating.

Goldman cited Coinbase's

Cryptonews·01-06 07:42

Goldman Sachs recommends buying Coinbase: optimistic about new product expansion, but competition and regulatory variables suppress profits

Goldman Sachs (In its latest 2026 Industry Outlook report, Goldman Sachs announced an upgrade of cryptocurrency exchange Coinbase from "Neutral" to "Buy." Goldman believes that Coinbase has actively expanded its non-trading revenue streams and launched diversified new products in recent years, making the company's long-term growth profile more complete. However, Goldman is cautious about increasing industry competition and the potential for future interest rate cuts, which may put short-term profit margins under pressure. Overall, the outlook is "selectively optimistic" rather than fully optimistic.

Background for the rating upgrade: revenue structure transformation is key

Goldman has upgraded Coinbase's investment recommendation from "Neutral" to "Buy" because Coinbase has continued to expand its non-trading revenue sources in recent years, including custodial, staking, and subscription-based infrastructure services, reducing the company's dependence on cryptocurrency market volatility.

Goldman estimates that Coinbase...

ChainNewsAbmedia·01-06 03:24

Benchmark Reaffirms Buy Rating on MicroStrategy With $705 Target for 2026

Benchmark Company has reiterated its Buy rating on MicroStrategy (MSTR) that indicates a new level of trust in the long-term plan of the company, as well as its approach to business based on Bitcoin. The investment bank had also given a price target of 2026 of 705 per share meaning that there is a s

BTC2.26%

Coinfomania·01-02 08:13

MicroStrategy raises another $100 million to buy Bitcoin, investment bank's target price $500

Bitcoin Reserve Strategy Pioneer MicroStrategy Strategy ( formerly MicroStrategy) announced yesterday that it spent over $100 million to acquire 1,229 Bitcoins, demonstrating the company's ongoing ability to raise funds to buy Bitcoin. Investment bank TD Cowen maintains a "Buy" rating on Strategy, with a target price of $500 over the next 12 months.

Strategy raises $100 million to buy 1,229 BTC

This time, Strategy raised $108.8 million through the issuance of common stock MSTR and used all of it to buy Bitcoin. MicroStrategy bought 1,229 Bitcoins last week, with an average cost of $88,568 per Bitcoin. As of December 29, 2025, Strategy holds a total of 672,497 Bitcoins.

BTC2.26%

ChainNewsAbmedia·2025-12-30 01:04

Motley Fool analyst evaluates Netflix's stock performance over the next five years, only giving a passing grade!

In the latest episode of the Motley Fool Ranking Show, the analysis team conducted a systematic evaluation of streaming giant Netflix (NASDAQ: NFLX), covering its business competitiveness, management decision-making ability, and financial structure, and further explored Netflix's potential performance over the next five years. Overall, Motley Fool analysts believe that Netflix still has a solid industry position and cash flow foundation, but its growth momentum and content influence are no longer as overwhelmingly advantageous as during its peak growth period. The overall rating given to Netflix in the show is 6.7 out of 10, with key considerations including

ChainNewsAbmedia·2025-12-27 09:43

Upside potential reaches 40%! Deutsche Bank's initial rating on Coinbase is Buy, with a target price of $340

Deutsche Bank released its latest report on Wednesday, giving Coinbase (stock ticker: COIN) a "Buy" rating for the first time and setting a target price of $340. Based on the current stock price, this implies a potential upside of 40%.

Deutsche Bank analyst Brian Bedell pointed out that as Coinbase actively promotes its "All-in-One Exchange" strategy, the platform's positioning is no longer just a cryptocurrency exchange but is moving towards a one-stop trading platform covering diverse assets, on-chain finance, and derivative applications.

Deutsche Bank stated that Coinbase's spectacular transformation is moving from slogans to actual practice. With new products being launched successively, the market size that Coinbase can reach will continue to expand, laying the foundation for growth in the coming years.

Coinbase earlier announced the launch of a series of

USDC-0.02%

区块客·2025-12-19 07:11

Upside potential reaches 40%! Deutsche Bank's initial rating on Coinbase is Buy, with a target price of $340

Deutsche Bank released its latest report on Wednesday, giving Coinbase (stock ticker: COIN) a "Buy" rating for the first time and setting a target price of $340. Based on the current stock price, this implies a potential upside of 40%.

Deutsche Bank analyst Brian Bedell pointed out that as Coinbase actively promotes its "All-in-One Exchange" strategy, the platform's positioning is no longer just a cryptocurrency exchange but is moving towards a one-stop trading platform covering diverse assets, on-chain finance, and derivative applications.

Deutsche Bank stated that Coinbase's spectacular transformation is moving from slogans to actual practice. With new products being launched successively, the market size that Coinbase can reach will continue to expand, laying the foundation for growth in the coming years.

Coinbase earlier announced the launch of a series of

USDC-0.02%

区块客·2025-12-19 05:49

Compass Point Cuts Coinbase Price Target Ahead of Expected Stocks, Prediction Market Reveal

In brief

Compass Point analyst reiterated a "Sell" rating for Coinbase shares while cutting COIN's price target.

They foresee tokenized equities as a $230 million opportunity for the exchange.

That's more than the $210 million analysts penciled in for prediction markets.

Decrypt's Art,

Decrypt·2025-12-15 19:51

Moody’s Proposes New Credit Rating System for Stablecoins

Moody’s plans to rate stablecoins by analyzing reserve asset quality, maturity risk and counterparties, not just the dollar peg.

The framework requires strict reserve segregation so assets serve only stablecoin holders, even during issuer bankruptcy.

The proposal aligns with rising regulation

CryptoFrontNews·2025-12-13 18:03

USDT Rating Controversy: S&P’s "Stability Measure," Tether's "Market Debate," and the Transformation into a "Shadow Central Bank"

Article Authors: May P, Janus R

Source: CoinFound

About CoinFound: CoinFound is a TradFi Crypto data technology company serving institutional and professional investors. It offers RWA asset data terminals, RWA asset ratings, Web3 risk relationship graphs, AI analysis tools, and customized data services. From data integration and risk identification to decision support, it helps institutions acquire key intelligence at lower costs and higher efficiency, transforming insights into actionable strategies and building the underlying infrastructure for global RWA.

Takeaway

USDT Rating Downgrade and Controversy: USDT

PANews·2025-12-12 02:14

Fitch Warning: Banks’ Bitcoin Holdings Lack Risk Isolation, Credit Ratings May Be Downgraded

International credit rating agency Fitch has issued a major warning, pointing out that after the Trump administration relaxed regulations, U.S. banks have actively invested in Bitcoin and digital assets. If cryptocurrency exposures lack sufficient risk isolation, credit ratings may be downgraded, leading to higher financing costs. This report serves as a wake-up call for Wall Street giants such as JPMorgan, Bank of America, and Wells Fargo.

USDC-0.02%

MarketWhisper·2025-12-09 05:12

Fitch warns: Banks holding too much Bitcoin may face credit rating downgrades

Fitch warns that US banks may face credit rating downgrades and increased funding cost pressures due to aggressive blockchain deployment. The report points out that the volatility and compliance risks of crypto assets cannot be offset by stable fee income, and the rapid expansion of stablecoins may erode bank liquidity. Banks need to strike a balance between innovation and credit maintenance, or risk affecting their market position.

動區BlockTempo·2025-12-09 02:32

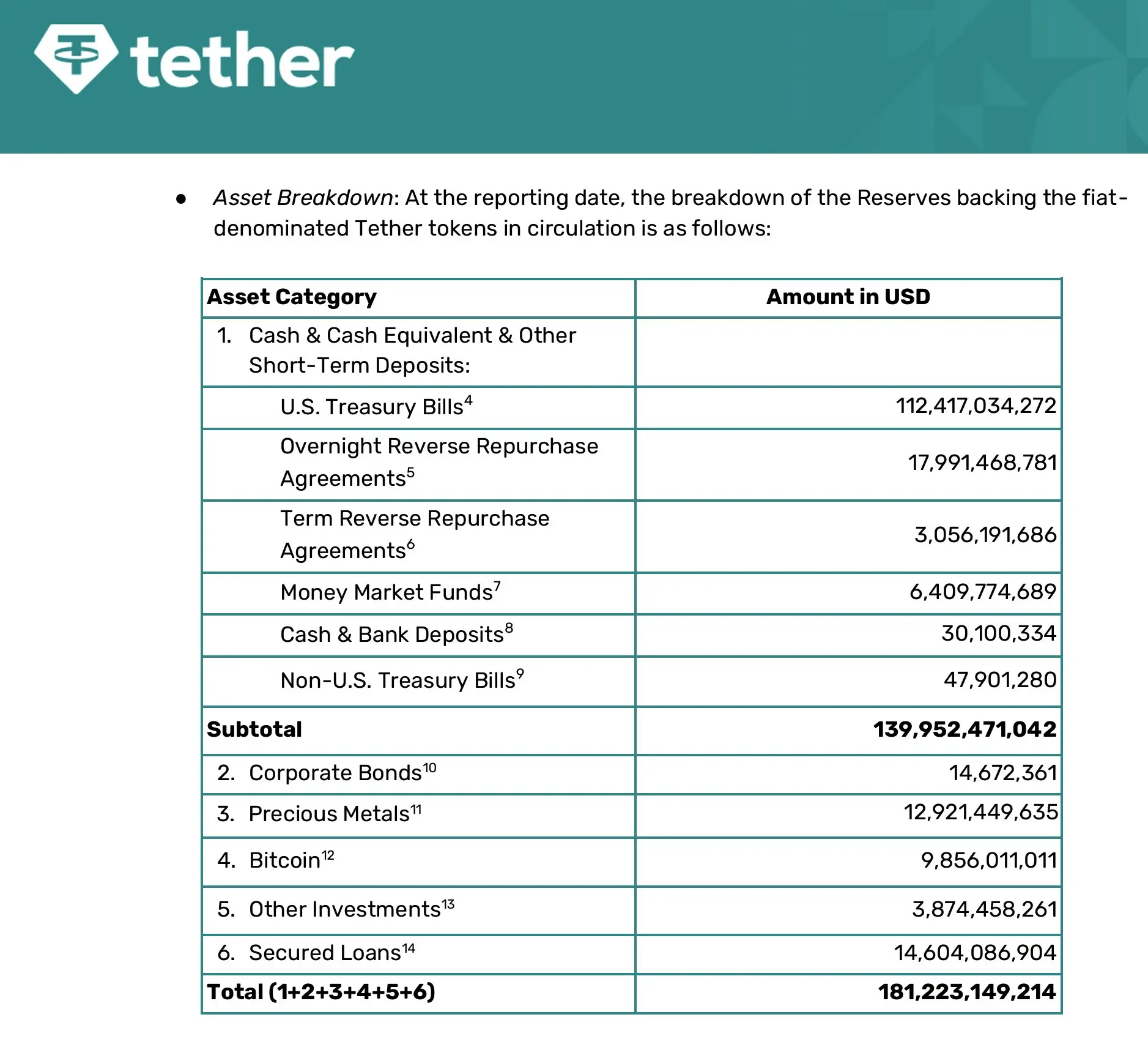

2025 Tether Financial Analysis: Needs an Additional $4.5 Billion in Reserves to Maintain Stability

According to an analysis based on the Basel capital framework, Tether basically meets the minimum regulatory requirements under the baseline assumption, but still needs an additional approximately $4.5 billion in capital compared to large banks. If a stringent approach to handling Bitcoin is adopted, the capital shortfall could range from $12.5 billion to $25 billion.

(Previous context: $30 billion stablecoin defense battle: Tether CEO attacks Wall Street rating agencies and Arthur Hayes)

(Background supplement: Arthur Hayes: If Tether's Bitcoin and gold drop by 30%, USDT will be insolvent)

If an even stricter, fully punitive $BTC approach is adopted, the capital shortfall could range from $12.5 billion to $25 billion.

When I graduated from college and applied for my first management consulting job, I did what many ambitious but timid male graduates often do:

BTC2.26%

動區BlockTempo·2025-12-08 08:14

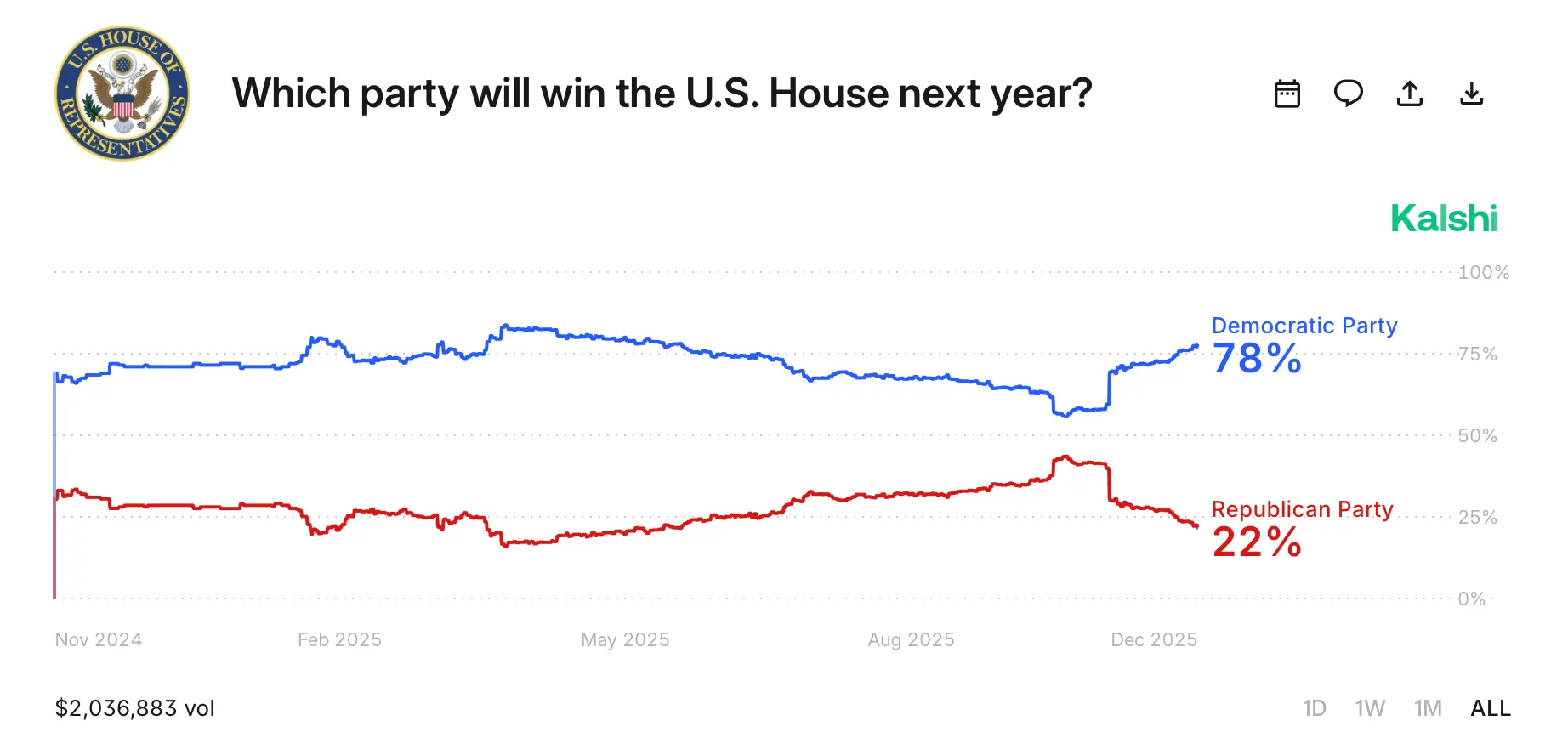

Prediction Market Odds: House Democrat, Senate GOP Ahead of 2026 Elections

According to the latest figures, President Donald Trump has logged 320 days of his second term, and his approval rating has slipped from the brief highs that followed his Jan. 20 inauguration. Meanwhile, prediction markets indicate Democrats are currently positioned to snag a few congressional

Coinpedia·2025-12-05 23:09

Tether's Decade-Long Gamble: How Did It Evolve from a "Stablecoin" to the "Shadow Central Bank" of the Crypto World?

Author: BlockWeeks

What supports the $2.6 trillion crypto market’s liquidity is not the sovereign credit of any nation, but a private company that moved its headquarters from Hong Kong to Switzerland, and ultimately settled in El Salvador—Tether. Its issued US dollar stablecoin, USDT, holds over 70% of the market share. Over the past decade, it has expanded amid crises and doubts, and is now attempting to define the industry's boundaries with its profits.

However, a recent “weak” rating from S&P Global has once again revealed the core contradiction of this grand experiment: a currency tool designed to be “stable” is itself becoming the system’s greatest point of risk.

>

> It’s like an elephant dancing on a tightrope, with a base of hundreds of billions of dollars in US Treasury bonds, but taking adventurous steps into AI, brain-computer interfaces, and Argentine farmland. — This is how the BlockWeeks editorial team describes it.

>

Part I

PANews·2025-12-04 02:06

CryptoQuant: Strategy sets up $1.44 billion reserve to address Bitcoin bear market risks

According to TechFlow news on December 4, The Block reported that CryptoQuant analysis shows Michael Saylor’s Bitcoin treasury company, Strategy, established a $1.44 billion USD reserve this week to prepare for a potential Bitcoin bear market. The reserve will be used to support preferred stock dividend payments and debt interest, with plans to eventually cover 24 months of financial needs. Julio Moreno, Head of Research at CryptoQuant, stated that if the bear market persists, Bitcoin prices may fluctuate between $70,000 and $55,000 next year. Strategy’s purchasing volume has dropped from 134,000 Bitcoins in November 2024 to 9,100 Bitcoins in November 2025. Investment bank Mizuho has maintained its "outperform" rating on Strategy, highlighting the US

BTC2.26%

DeepFlowTech·2025-12-04 00:33

MicroStrategy strengthens capital structure, Mizuho maintains "Outperform" rating and target price of $484

Investment bank Mizuho Securities recently reiterated its "Outperform" rating on MicroStrategy (MSTR) and maintained its price target of $484 per share. This update came shortly after a Q&A session between the firm's analyst Dan Dolev and MicroStrategy CFO Andrew Kang. The meeting revealed several key insights into the company's capital management strategies and its approach to managing Bitcoin assets.

Successfully Raised $1.44 Billion to Cover 21 Months of Preferred Stock Dividends

MicroStrategy recently raised $1.44 billion in capital to bolster its US dollar reserves and ensure that it can pay 21 months of preferred stock dividends without needing to tap into its Bitcoin assets. This funding will also strengthen the company's overall financial stability, enabling it to

ChainNewsAbmedia·2025-12-03 14:53

OSL Group will offer compliant digital asset spot and derivatives trading services in Europe.

Asia’s leading digital asset platform, OSL Group, has announced a major advancement in its globalization strategy, planning to launch compliant digital asset services in the European market in the first quarter of 2026.

(Background: OSL Group approved to launch payment business in Australia)

(Additional background: Daiwa Securities reiterates OSL Group “Buy” rating, global expansion and payment business building differentiated advantages)

(This article is an advertorial written and provided by OSL. It does not represent the views of BlockTempo and is not investment advice or a recommendation to buy or sell. See disclaimer at the end.)

OSL Group, Asia’s leading stablecoin trading and payment infrastructure platform, announced today that it will offer compliant digital asset spot and derivatives trading services in Europe through direct operations and collaboration with local partners. The services are expected to officially launch in the first quarter of 2026.

This expansion, both geographically and in terms of product offerings, marks

SOL3.53%

動區BlockTempo·2025-12-03 08:14

Daiwa Securities reiterated the "Buy" rating for OSL Group, highlighting its differentiated advantages through global expansion and payment business.

Daiwa Securities has released its latest report, maintaining a "Buy" rating for OSL Group (863.HK) and setting a target price of HKD 18.8. (Previous context: Comparison of USD withdrawal platforms in 2025: Which one is the most suitable for your withdrawals - OSL, Kraken, Bitfinex, Backpack?) (Background information: OSL Group has been granted permission to conduct payment business in Australia) (This article is an advertisement, written and provided by OSL, and does not represent the position of the BitZone, nor is it investment advice, purchase, or sale recommendation. Please refer to the disclaimer at the end of the article.) Daiwa Securities released its latest research report on December 1, reiterating a "Buy" rating for OSL Group (863.HK), with a target price of HKD 18.8 per share, optimistic about OSL Group's global expansion and payment transformation. The report pointed out that OSL Group is expanding globally and moving towards...

動區BlockTempo·2025-12-02 07:50

Benchmark Is Bullish on Strategy Even as Stock Plunges Amid Possibility of Selling Bitcoin

In brief

Strategy stock is down significantly this year, leading some observers to speculate that the Bitcoin treasury might have to sell crypto.

But analysts at Benchmark have said that the skeptics don't understand how the company works.

They reiterated a "buy" rating for the firm.

Decrypt·2025-12-01 21:27

The strongest money printer? Tether CEO responds to FUD: ratings underestimated the monthly cash flow of 500 million USD in government bond interest.

S&P Global has downgraded the rating of USDT to the lowest level, raising questions about Tether in the market. Tether's CEO countered that the rating ignores its capital structure and robust profit model, emphasizing that the company has excess reserves and substantial interest income. A former Citibank analyst supported Tether, arguing that its asset structure is safe and its profitability is strong, pointing out that Tether is unlikely to go bankrupt.

ChainNewsAbmedia·2025-12-01 02:43

Tether's reserve transformation sparks controversy: Arthur Hayes warns of significant downside risks in Bitcoin's gold allocation, Paolo Ardoino responds strongly.

Notable industry figure Arthur Hayes pointed out that Tether is shifting its reserve assets towards Bitcoin and gold to respond to the Fed's interest rate cut cycle, but warned that if the prices of these two assets fall by 30%, it could deplete the company's equity capital. S&P Global Ratings downgraded the stability rating of USDT to "weak," reflecting an increase in high-risk asset exposure to nearly 23 billion USD. Tether CEO Paolo Ardoino strongly responded, revealing that the group's total assets reached 215 billion USD, with monthly profits exceeding 500 million USD, emphasizing that the company's financial strength far exceeds market perception. This debate highlights the value judgment discrepancies between traditional rating agencies and crypto-native enterprises.

MarketWhisper·2025-12-01 02:33

$30 billion stablecoin defense: Tether CEO fires at Wall Street rating agencies and Arthur Hayes

Standard & Poor's has downgraded Tether to the lowest rating of "weak". Tether refutes this, stating that having $30.5 billion in equity is enough to absorb the fluctuations of Bitcoin and gold. (Background: Arthur Hayes: If Bitcoin and gold held by Tether fall by 30%, USDT will be insolvent.) (Context: Tether's purchase of Bitcoin drags down USDT; "S&P gives the worst rating": the proportion of risky assets increases the possibility of depeg.) The old adage of cash is king encounters a direct conflict with USDT in the crypto market in 2025. S&P Global (S&P Global) has downgraded this circulating stablecoin worth $184.5 billion to the lowest tier of "weak", citing that 18% of reserves are tied up in Bitcoin and gold. In the face of this label almost equivalent to "junk status", Tether CEO Paolo A.

動區BlockTempo·2025-12-01 02:32

Gate Daily (December 1): Tether announces $7 billion excess profits to counter S&P; Yearn yETH suffers from a vulnerability attack incident.

Bitcoin (BTC) started this week with a sharp fall, reporting at 87,500 USD on December 1. The CEO of Tether countered the panic over S&P's downgrade of the USDT rating, stating they have about 7 billion USD in excess profits. The CEO of MicroStrategy mentioned that if Bitcoin's net worth falls and funds are insufficient, the company will sell Bitcoin. Yearn yETH was attacked, with about 3 million USD worth of ETH flowing into Tornado Cash.

MarketWhisper·2025-12-01 01:24

Paolo Ardoino Fires Shots At S&P For Tether’s ‘Weak’ Rating

Tether CEO Paolo Ardoino fired back at S&P’s latest downgrade of his company.

The ratings firm gave the stablecoin company a “weak” rating of 5 due to its reserve’s exposure to high-risk assets, which could risk the USDT’s 1:1 peg to the US dollar.

S&P recently downgraded Tether’s ratings.

Blockzeit·2025-12-01 01:08

Tether strikes back at S&P ratings! USDT earns 500 million a month, is the bankruptcy theory panic or truth?

S&P Global has downgraded the USD peg rating of USDT to "weak," the lowest score in its rating system, triggering panic in the crypto market. Tether CEO Paolo Ardoino countered that as of the end of Q3 2025, Tether's total assets amount to approximately 215 billion USD. Ardoino emphasized that the monthly yield from U.S. Treasury bonds alone generates $500 million in basic profit, but the S&P rating overlooked this crucial data.

MarketWhisper·2025-12-01 00:35

Tether bets on Bitcoin and gold in preparation for interest rate cuts, Arthur Hayes: a 30% drop in shareholder equity will drop to zero.

The credit rating agency Standard & Poor's Global (S&P Global) recently downgraded Tether's USDT stability assessment to the lowest level of 5. The main reason is the increasing proportion of high-risk assets in the USDT reserves, raising concerns that there may not be enough buffer to absorb Bitcoin's fall. BitMex founder Arthur Hayes strongly agrees, suggesting that Tether is making a large-scale bet on the possibility of The Federal Reserve (FED) cutting interest rates, as this would significantly reduce their interest income. They are buying gold and Bitcoin, but if these assets drop by 30%, the shareholders' equity will drop to zero!

( Bitcoin is exposed beyond the safety margin, S&P downgraded USDT to the lowest rating for stablecoins )

Tether is making a large-scale bet on the Federal Reserve cutting interest rates.

Arthur Hayes believes that the Tether team is currently in

ChainNewsAbmedia·2025-11-30 02:45

Who are the "winners"? Who are the "disasters"? Performance rating of TGE under the 2025 atypical bull run.

Author: Stacy Muur

Compiled by: Tim, PANews

How to evaluate the performance of a project's TGE?

For each token, I examined it from three aspects:

1. Current price compared to the historical highest price: how much has it retraced from the peak?

2. Time: How long has it been since the historical peak (early projects ≠ completely "stand the test")

3. Liquidity to Market Cap Ratio: Is this real price discovery or market noise due to insufficient liquidity?

You can understand it as follows: if you bought during the TGE and did not sell at the highest point, how does your profit and loss situation compare to other tokens of the same level?

Note: This article only represents the author's views, not PANews's views, and is not investment advice.

S-Class: TGE Winner

Avici (AVICI) unique, S+

Performance: Highest price $5.6, current price $4.3, only 20-25%

PANews·2025-11-28 13:08

Tether CEO Paolo Ardoino Responds to S&P’s USDT Downgrade, Says Stablecoin Giant Takes It With Pride

Tether CEO Paolo Ardoino defends the company's stablecoin USDT following a lowered stability rating by S&P Global Ratings, emphasizing Tether's resilience and profitability despite traditional finance criticisms. He claims outdated rating models led to significant investment failures.

BTC2.26%

TheBitTimesCom·2025-11-28 12:56

Bottom of the rankings, why does S&P not recognize USDT?

Written by: KarenZ, Foresight News

On the evening of November 26, S&P Global Ratings released a stability assessment report for Tether, downgrading the rating of Tether (USDT) from level 4 (restricted) to level 5 (weak).

This rating is at the lowest level of the S&P 1-5 rating assessment system, marking a new height of concern regarding the safety of this stablecoin with a circulation of over $180 billion.

Why is it being lowered?

The downgrade by S&P is not unfounded, but rather based on multiple hidden risks in Tether's reserve asset structure and information disclosure.

1. Bitcoin exposure exceeds safe buffer.

The core issue lies in the uncontrolled growth of Bitcoin exposure. As of September 30, 2025,

DeepFlowTech·2025-11-27 12:45

Tether CEO hits back at S&P over weak stablecoin rating

Tether CEO Paolo Ardoino slammed S\&P Global Ratings after it gave the company's stablecoin its lowest stability score, citing disclosure gaps and high-risk reserves.

Summary

S\&P rated tether's stablecoin "5 (weak)", pointing to limited transparency and growing exposure to bitcoin, gold,

BTC2.26%

Cryptonews·2025-11-27 12:06

Tether CEO Reacts as American Credit Rating Agency Calls Tether a High-Risk Stablecoin

S&P Global Ratings has assigned Tether its lowest rating due to concerns over inconsistent disclosure and increased investment in high-risk assets. Tether's CEO criticized the rating methodology and defended the company's resilience and reserve management.

BTC2.26%

TheCryptoBasic·2025-11-27 09:12

S&P Downgrades USDT Dollar Peg Rating to Lowest Score: Key Concerns and Tether's Response

S&P Global Ratings has downgraded Tether's USDt (USDT) stablecoin to its lowest stability rating, citing risks to the token's ability to maintain its $1 peg. The assessment, released on November 27, 2025, highlights exposure to volatile assets and potential collateral shortfalls, raising fresh questions about USDT's reserves in a market where stablecoins underpin over $170 billion in daily crypto volume.

CryptopulseElite·2025-11-27 06:44

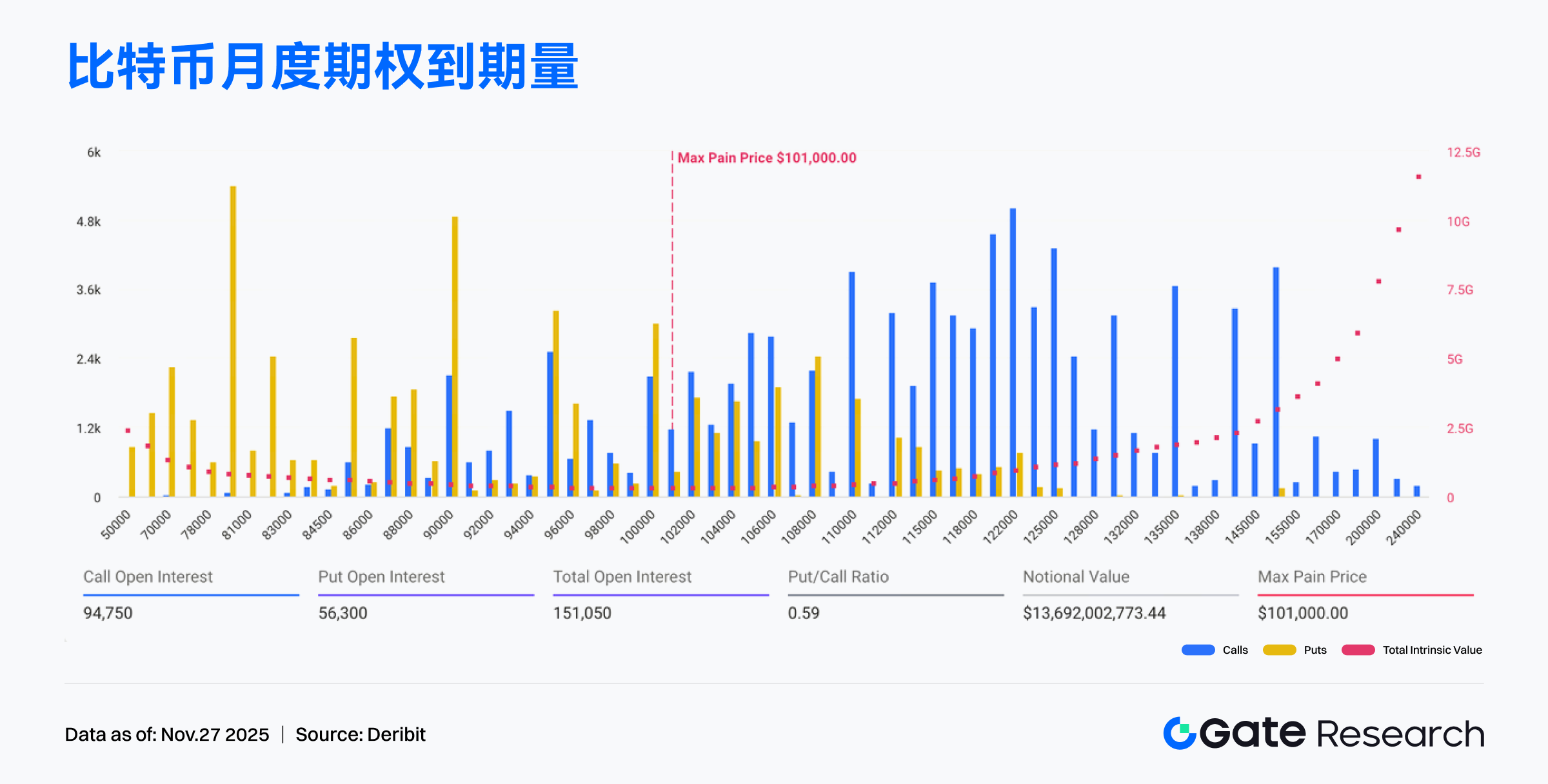

Gate Research Institute: Plasma Token has fallen 90% from its early peak | Bitcoin faces $13.6 billion monthly options expiration

Abstract

BTC and ETH have respectively returned to the key levels of $90,000 and $3,000, market sentiment has clearly recovered, and there are signs of capital rotation in multiple sectors such as platform tokens, public chains, and Meme.

S&P has downgraded the stability rating of USDT to "Weak"; the Cosmos community has initiated research on the new tokenomics for ATOM; Ethereum co-founder Vitalik has called for donations for privacy communication.

Plasma token has dropped 90% from its early peak, and the project has yet to fulfill its grand vision, becoming one of the most representative cases of new coin listing failures in recent times.

benefiting from investors' interest in

GateResearch·2025-11-27 05:40

S&P downgrades USDT to the lowest rating, Tether CEO retorts: We take pride in being disliked by you.

The global authoritative rating agency S&P Global downgraded the stablecoin rating of Tether (USDT) from "restricted (4)" to "weak (5)" on Wednesday, which is the lowest level in the rating system. S&P pointed out that the main reason for the downgrade is the increasing proportion of high-risk assets such as Bitcoin, gold, and corporate bonds in Tether's reserve assets, along with a "persistent information disclosure gap." Tether's CEO Paolo Ardoino responded vehemently, stating, "We take pride in being disliked by you," and accused traditional rating models of being unable to assess the value of digital native currencies. Currently, the circulating supply of USDT has reached 184 billion USD, continuing to hold the position as the leader of global stablecoins.

MarketWhisper·2025-11-27 03:11

Load More