Search results for "XAU"

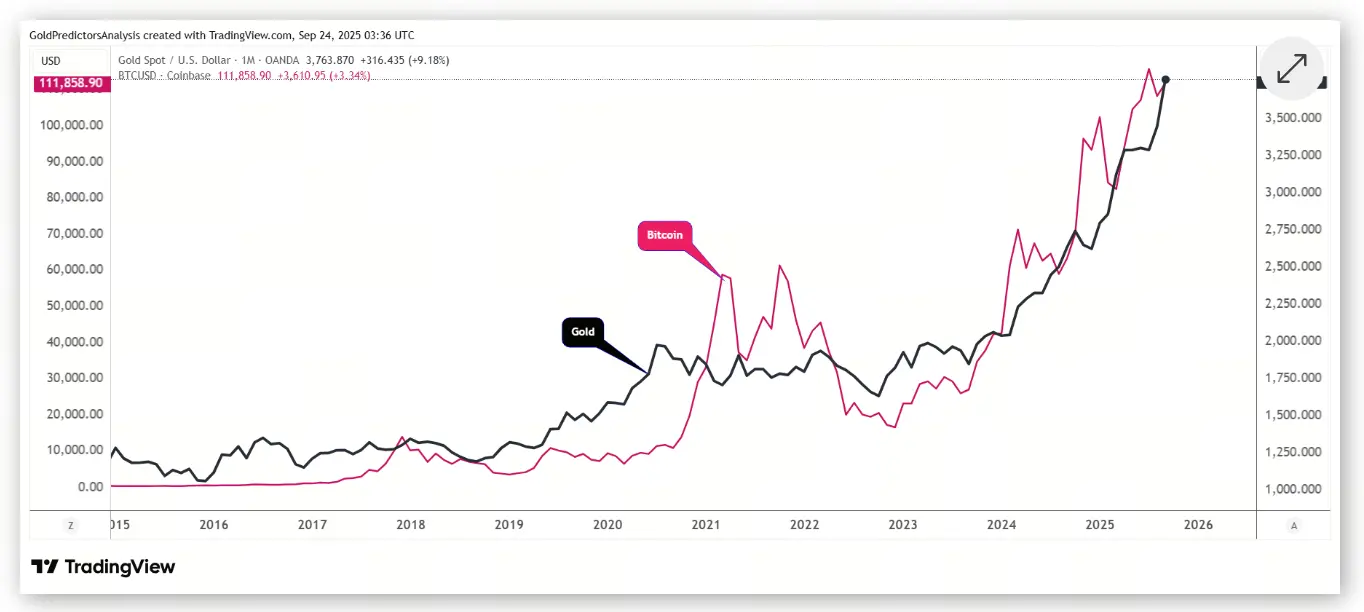

Bitcoin vs. gold: Data shows BTC is a "better opportunity" compared to 2017

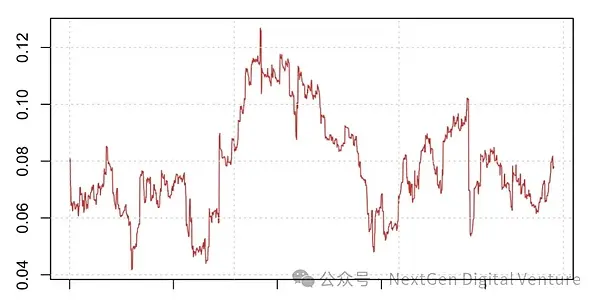

Bitcoin (BTC) has dropped to an all-time low compared to gold (XAU) in January. According to some analysts, this is creating a more attractive buying opportunity than the period just before the 2015–2017 growth cycle.

The shift from gold to Bitcoin may begin in February

Data from Bitwise Europe ch

TapChiBitcoin·02-01 07:09

The hidden whale behind the surge in gold: Tether, which earns billions of dollars annually, has accumulated 140 tons of gold

Tether is rapidly expanding in the gold market, accumulating 140 tons of gold and becoming one of the world's largest physical gold holders. The company plans to actively trade to capture gold arbitrage opportunities and has launched a gold-pegged stablecoin, XAU₮. Tether has earned a net profit of $15 billion from its stablecoin business and holds a large amount of U.S. Treasury bonds and Bitcoin, gradually forming an arbitrage machine that spans traditional finance and the crypto world.

区块客·01-28 16:10

Bitcoin-to-Gold Bottom Fractal Breaks as BTC Seeks Bottom

For years, Bitcoin (BTC) traders have watched its price relative to gold (XAU) for clues on when BTC bottoms in US dollar terms. But in 2026, that BTC-to-gold signal is starting to look less dependable as macro dynamics shift and the ratio migrates away from previously established benchmarks. The la

BTC1.71%

CryptoBreaking·01-28 15:35

Bitcoin Price Prediction: BTC and USD Fractal Reappearance, Traders Watch Closely for Surge Signals

The US Dollar Index 96.3 is approaching a critical inflection point. History shows that after the dollar fell below 96 in 2017, BTC surged tenfold, and in 2020, it increased by 540%. If the fractal repeats, it could reach $150,000. However, current interest rates and real yields are relatively high, increasing the risk of yen arbitrage unwind. The BTC/XAU ratio has fallen back below the 200-week moving average, and historically, every four years after touching this level, a new cycle begins.

BTC1.71%

MarketWhisper·01-28 07:04

Tether Gold Surpasses $4B in Gold-Backed Stablecoins

Tether Gold (XAU₮) dominated the gold-backed stablecoin market, surpassing $4 billion by December 2025, capturing 60% market share. Fully backed by physical gold in Swiss vaults, it ranks among the top global gold holders, reflecting increasing demand for secure, tokenized assets.

XAUT2.15%

CryptoFrontNews·01-27 20:46

Bitcoin RSI Against Gold Drops Below 30 for Fourth Time in History

The Bitcoin RSI against gold has dropped below the 30 mark for only the fourth time in history, suggesting that BTC may be oversold compared to XAU.

This structure recently played out amid the divergence in performance between Bitcoin (BTC), the leading cryptocurrency, and gold (XAU), the leading p

TheCryptoBasic·01-27 15:53

Bitcoin-to-Gold Bottom Fractal Breaks as BTC Seeks Bottom

For years, Bitcoin (BTC) traders have watched its price relative to gold (XAU) for clues on when BTC bottoms in US dollar terms. But in 2026, that BTC-to-gold signal is starting to look less dependable as macro dynamics shift and the ratio migrates away from previously established benchmarks. The la

BTC1.71%

CryptoBreaking·01-27 15:30

Geopolitical Tremors Reshape 2026 Markets: Gold Soars Past $4,800 as Bitcoin Retreats Below $90,000

Escalating geopolitical instability, fueled by renewed US-Europe trade tensions and territorial disputes, has triggered a dramatic flight to safety in global markets. Gold (XAU) has surged decisively above the $4,800 mark, while Silver (XAG) eyes the critical $100 level, as investors seek traditional safe havens.

Conversely, Bitcoin has tumbled back below $90,000, mirroring a broad sell-off in risk assets like equities and bonds. This divergence underscores a classic market shift: capi

BTC1.71%

CryptopulseElite·01-21 06:13

Gate launches the precious metals zone, with XAU and XAG USDT perpetual contracts officially open for 24-hour trading

Gate Exchange Launches Precious Metals Zone, Offering USDT-Margined Perpetual Contracts for Gold and Silver, Supporting 50x Leverage and 24/7 Trading. This new product combines the stability of safe-haven assets with the flexibility of digital markets, aiming to enhance liquidity and price discovery efficiency. The design of precious metals contracts balances stability and transparency, providing diverse trading strategies for both traditional and crypto markets. The platform will continue to explore the potential for further tokenization of traditional assets in the future.

BTC1.71%

GateLearn·01-16 01:51

Is Tether's gold token XAUT worth buying?

Author: Wenser, Odaily Planet Daily

2026, Survival is King.

In the previous article "2026, Survive: A Bear Market Survival and Counterattack Manual for Crypto Enthusiasts," we systematically outlined this year's "survival strategies," emphasizing asset allocation in precious metals like gold as a key focus. For those aiming to hedge against inflation, fiat devaluation, and the falling US dollar exchange rate through gold, the next challenge is how to allocate gold-related assets.

In this regard, based on the author's personal understanding, XAUT issued by Tether may be the best way for crypto enthusiasts to allocate gold assets. Coupled with Tether's recent launch of a new accounting unit "Scudo" for Tether Gold (XAU₮), the barrier to entry for gold tokens has sharply dropped to just a few dollars.

This article

XAUT2.15%

区块客·01-12 15:01

Break gold into smaller pieces! Tether Gold mimics Bitcoin's "Satoshi" and introduces the Scudo valuation system

Tether introduces the Scudo pricing unit for XAU₮, dividing gold into one-thousandth to lower the threshold and promote digital gold payments and practicality.

Drawing inspiration from Bitcoin's "Satoshi" concept, Tether launches a new pricing unit for XAU₮ — Scudo

---------------------------------------

The leading stablecoin Tether officially announced on January 6, 2026, the introduction of a new accounting and pricing unit for its gold-pegged digital token Tether Gold (XAU₮): "Scudo."

This move directly borrows the logic of Bitcoin (Bitcoin) dividing its basic unit into "Satoshi." According to official definitions, 1 Scudo equals 1,000 cents.

CryptoCity·01-07 09:20

Tether Introduces Scudo to Simplify Digital Gold Payments

Tether introduced Scudo, a new unit for its gold-backed token XAU₮, representing 1/1,000 of a troy ounce. This change simplifies pricing and enhances usability while maintaining XAU₮'s gold backing and reserves.

CryptoFrontNews·01-07 08:36

Tether Introduces Scudo as a New Unit of Account for Tether Gold

On 6 January 2026, Tether announced the launch of Scudo, a new unit of account for Tether Gold (XAU₮), designed to make gold usable as a practical means of payment for everyday transactions. The move comes as global interest in gold and its price reach record highs.

Record Gold Prices Highlight

ICOHOIDER·01-06 14:33

Full Analysis: Price Predictions for Bitcoin, Gold, and Silver Ahead of FOMC Minutes

Bitcoin (BTC), Gold (XAU), and Silver (XAG) are all hovering at critical technical levels ahead of the release of the October FOMC minutes, which are expected to provide the only real signal regarding a potential December rate cut before year-end. Overall, all three assets show signs of bullish

BTC1.71%

Coinstagess·2025-11-21 06:02

The relationship between Bitcoin and gold: How to choose between BTC, gold, and USD?

Author: NDV

The NDV research team recently conducted a systematic analysis of the price relationship between Bitcoin (BTC) and gold (XAU). The reason for focusing on this topic is that these two types of assets are often seen by the market as "stores of value" and "hedging tools": gold has been a traditional safe-haven asset and a "safe harbor" for global investors for decades; while BTC is increasingly referred to as "digital gold" by many investors and has gained a new status against the backdrop of rising macroeconomic uncertainty.

The starting point of the research is: how to balance volatility and improve the Sharpe Ratio (a measure of return per unit of risk) by configuring gold and BTC in an investment portfolio with a high Crypto weight.

In other words, are the two in a substitute relationship or a complementary relationship?

After analyzing the data and market mechanisms of the past four years

BTC1.71%

金色财经_·2025-11-13 03:14

NDV: A Comparative Study of Bitcoin, Gold, and US Dollar Cash

Author | NDV

The content of this article does not constitute any investment or financial advice. Readers should strictly adhere to the laws and regulations of their location. This article was published on September 27, and some information and data may be outdated.

The NDV research team recently conducted a systematic analysis of the price relationship between Bitcoin (BTC) and gold (XAU). The reason for focusing on this topic is that these two asset classes are often viewed by the market as "stores of value" and "hedging tools": gold has been a traditional safe-haven asset and a "safe harbor" for global investors for decades; while BTC is increasingly being referred to as "digital gold" by a growing number of investors, gaining a new status amid rising macroeconomic uncertainty.

Our research starting point is: in an investment portfolio with a high Crypto weight, how to balance volatility and enhance the Sharpe Ratio by configuring gold and BTC.

BTC1.71%

WuSaidBlockchainW·2025-11-12 23:38

Rumble Strikes $100M Tether Deal to Boost Creator Monetization

Rumble’s $100M Tether deal integrates USD₮, XAU₮, and BTC for direct crypto payments to creators.

Tether invests $150M in Rumble GPUs to build decentralized AI infrastructure empowering global creators.

Rumble’s 2026 ad model aims to attract more creators, blending free speech with crypto

BTC1.71%

CryptoFrontNews·2025-11-11 10:13

Gold Weekly Forecast: Correction deepens on hawkish Fed tone, US-China trade truce

Gold extended its downward correction into a second consecutive week.

The technical outlook is yet to reflect a convincing bearish reversal.

Comments from Fed officials and US economic data will be watched closely.

Gold (XAU/USD) remained under bearish pressure and touched its weakest level

BeInCrypto·2025-11-04 13:27

Gold and Bitcoin are severely depegged! Gold prices are overheating and experiencing a sharp pullback, with Bitcoin at 107,500 support.

Gold (XAU) prices have fallen nearly 7% since their all-time high, marking the largest drop in 12 years. However, Bitcoin (BTC) prices have held at the support level of $107,500, demonstrating remarkable resilience. Although the two previously showed a positive correlation, the current indicator shows a correlation of 0.19, indicating almost no correlation.

BTC1.71%

MarketWhisper·2025-10-23 07:46

Tether Gold surpasses PAXG with gold reserves, XAU₮ market capitalization exceeds 2.2 billion.

Recently, gold prices have surged, and the market capitalization of the gold token XAU₮ issued by Tether has surpassed PAXG, reaching 2.2 billion USD. Tether is collaborating with Antalpha to enter the digital gold reserve market, planning to facilitate investments through brokerage accounts. Additionally, gold has become a safe-haven asset, and investor demand for tokenized gold is on the rise.

ChainNewsAbmedia·2025-10-20 01:33

Economic Alert! Gold market capitalization skyrockets to a record high of $30 trillion, crushing Bitcoin and tech giants, indicating global economic instability.

Gold (XAU), a traditional "non-productive" store of value asset, saw its market capitalization soar to over $30 trillion in 2025, with prices reaching a record $4,380 per ounce, significantly surpassing Bitcoin and U.S.-listed tech giants. This surge was primarily driven by economic uncertainty, geopolitical tensions, and declining confidence in the dollar. Citadel CEO Ken Griffin expressed concern over this, suggesting it indicates problems with the stability of the U.S. economy.

BTC1.71%

MarketWhisper·2025-10-17 06:49

DL & Antalpha US$100M Gold, US$100M Bitcoin Plan

Media OutReach Newswire covers tokenised gold assets and Bitcoin mining infrastructure On the gold-asset side, DL Holdings is in the process of delivering the initial US$5 million investment in Tether Gold (XAU₮) and plans to further acquire and distribute up to US$100 million in XAU₮ over the

AsiaTokenFund·2025-10-17 03:22

Bitcoin flashes "bottom signal": BTC/XAU RSI falls into oversold zone, indicating a 90% rebound?

Bitcoin (BTC) is quietly flashing a historically familiar bottom signal, as the daily relative strength index (RSI) of the Bitcoin/Gold ratio (BTC/XAU) has fallen below 30 into the oversold territory. This signal indicates that Bitcoin's performance relative to gold has reached an extreme level of sluggishness. Historically, this setup often marks the "capitulation phase" of the crypto market and the exhaustion of dumping, after which the BTC/USD price tends to experience a strong rebound. In August 2024 and March 2025, similar oversold readings triggered increases of 30% to 90% in BTC/USD.

BTC1.71%

MarketWhisper·2025-10-17 01:07

GOLD Price Prediction: Is a $3,000 Pullback Coming After the Record $4,200 Rally?

Gold just made history. For the first time ever, XAU/USD surged past $4,200, marking a fresh all-time high and extending one of the strongest multi-year uptrends in its modern history. But as with every major rally, the question traders are asking now is: Is this sustainable – or are we due for a he

CaptainAltcoin·2025-10-15 20:04

Gold breaks through 4000 USD to reach a historic high! Luxembourg's sovereign fund enters the market, and Bitcoin becomes the new darling for institutional hedging.

Driven by multiple factors such as global market turbulence, rising industrial demand, and the continued weakness of the dollar, the precious metals market is witnessing a historic moment: Spot gold (XAU) has surged to $4,059 per ounce, breaking the key psychological barrier of $4,000 for the first time; at the same time, silver (XAG) has also reached a historic high, breaking $50. While precious metals are setting historical records, the institutional acceptance of digital gold Bitcoin has also made a breakthrough: the Luxembourg sovereign wealth fund announced that it will allocate 1% of its $730 million assets to Bitcoin ETF, becoming the first national fund in the Eurozone to make such an investment. This series of events marks an accelerated shift in global asset allocation towards tangible store of value tools, with unprecedented demand for hedging and anti-inflation narratives.

BTC1.71%

MarketWhisper·2025-10-10 03:23

Dual Hedging Era: Gold and Bitcoin Hit New Highs! Turbulent US Political Landscape and Central Bank Gold Purchases Drive a Parabolic Rise?

Due to geopolitical instability factors such as the risk of a U.S. government shutdown and political turmoil in France, risk aversion in the global financial markets has sharply increased, driving both gold (XAU) and Bitcoin (BTC) to set historical highs this week. The price of gold has surpassed the key level of $4,000, while Bitcoin has skyrocketed to over $125,000. The strong performance of these two major assets not only highlights investors' deep concerns about Inflation, surging debt, and political instability but also signifies that the market's preference for inflation hedging tools and reserve asset alternatives has become a dominant trend for 2025.

BTC1.71%

MarketWhisper·2025-10-09 01:13

Tether and Antalpha create a new DAT company, raising $200 million in XAUT gold stablecoin reserves.

Tether has partnered with Antalpha to raise $200 million to create a digital asset vault, focusing on managing the gold token XAU₮, aiming to develop it into an institutional-grade hedging tool. XAU₮ will enhance liquidity and expand market share, and will be further integrated into multiple public chains to support Decentralized Finance applications.

XAUT2.15%

動區BlockTempo·2025-10-04 05:40

Gold consolidates after hitting a historical high of $3790: Multiple hawkish data suppresses, and the non-farm payroll week will set the tone for Fed rate cut expectations.

At the beginning of last week, driven by the increased safe-haven demand due to escalating geopolitical tensions, gold (XAU/USD) prices reached a historical high of nearly $3,790. However, mid-week, the dollar index strengthened due to the combined pressure from the cautious policy remarks of Fed Chairman Powell and strong U.S. economic data (including Q2 GDP revised up to 3.8%, durable goods orders significantly exceeding expectations, and a surge in new home sales), causing gold prices to retreat and consolidate around $3,750. As the market widely anticipates another rate cut in October, investors will closely monitor the upcoming U.S. employment and manufacturing data to assess the Fed's next policy path.

MarketWhisper·2025-09-29 07:23

Macroeconomic and encryption dual focus: Gold breaks through $3780, Bitcoin/Ether ETF encounters a $1.7 billion sell-off!

Driven by the fact that the U.S. August core PCE data met expectations and strengthened the Fed's expectation of further rate cuts this year, the price of gold (XAU) continued to rise in the early Asian session on Monday, breaking through $3,780. Technical analysis shows that both gold and silver are in a strong bullish trend. However, the cryptocurrency market presents an opposite trend: last week, U.S. Bitcoin and Ether ETFs recorded a net outflow of over $1.7 billion, marking the largest single-week loss since the launch of the Ether ETF. Institutional investors, amid geopolitical and Fed policy uncertainties, are turning their attention to other altcoin assets like Solana and XRP.

MarketWhisper·2025-09-29 05:35

Bitcoin vs Gold: After gold reached a historic high, it faces a pullback, while the Bitcoin fear index is experiencing a big dump, presenting a good opportunity to buy the dip.

Spot gold (XAU/USD) has risen for the sixth consecutive week, reaching a historic high of 3791.26 USD. Technically, gold has far exceeded its 52-week moving average of 3067.26 USD, and the RSI indicator is in an overbought state, significantly increasing the risk of a pullback. This week, the market focus will be on the US non-farm payroll report, as this data will directly impact the Fed's interest rate cut path: strong employment data may delay rate cut expectations, thereby putting pressure on gold prices. Meanwhile, after Bitcoin's price fell below a significant threshold, the Fear and Greed Index plummeted to 28, indicating that the crypto market may be approaching a rebound phase, providing tactical get on board opportunities for long-term investors.

MarketWhisper·2025-09-28 08:08

Gold vs Bitcoin: Multiple countries accelerating the adoption of Bitcoin strategies may build a global reserve system alongside gold.

In 2025, Bitcoin (BTC) is no longer just a speculative asset, but has gradually become an important component of strategic reserves for various countries. The latest report from the Bitcoin Policy Institute shows that 32 countries around the world are actively promoting Bitcoin initiatives, among which 27 countries already hold Bitcoin, and 13 countries are formulating related legislation. The United States, Argentina, the United Arab Emirates, and other countries are accelerating the adoption of Bitcoin through national reserves, energy-driven mining, and payment and ETF investments. Meanwhile, enterprises and fintech companies are also incorporating Bitcoin into their asset portfolios and consumer financial products, signifying that Bitcoin is gradually moving towards a global reserve asset status alongside gold (XAU).

BTC1.71%

MarketWhisper·2025-09-24 05:08

XAU/USD Bulls Take Charge: Why Patience Is Fueling a Major Gold Rally

Gold has broken through the $3,500 resistance after months of consolidation, signaling a bullish trend. The breakout indicates increased buying interest, although traders should remain cautious of potential pullbacks as momentum builds. Patience has proven vital in this market.

CryptoFrontNews·2025-09-08 02:01

Gold has soared to near historical highs! The U.S. Treasury yield curve is steepening in a bull run, which may also be favorable for Bitcoin.

Gold (XAU) prices have recently surged, breaking through $3,480 per ounce, reaching a new high since April, just a step away from the historical peak. The key driver behind this rally is a frequently overlooked signal from the bond market—the steepening of the U.S. Treasury yield curve bull market. This bond market dynamic not only drops the opportunity cost of holding gold but may also bring potential favourable information for Bitcoin (BTC).

MarketWhisper·2025-09-02 02:49

Rare! Bitcoin outflows from gold but did not benefit, both major safe-haven assets are under pressure.

Historically, the capital flow of Bitcoin (BTC) and gold (XAU) has often exhibited a pattern of one rising while the other falls—when BTC experiences capital outflows, gold usually sees an influx of safe-haven money. However, the latest ETF data shows that this "safe-haven rotation" pattern was broken in August 2025: both assets experienced capital outflows simultaneously, reflecting the current macroeconomic uncertainty and changes in investor sentiment.

MarketWhisper·2025-09-01 01:48

Where to go after the big dump in gold prices? Fed policy expectations and geopolitical factors are key variables, and encryption investors need to closely monitor the fluctuation of safe-haven assets.

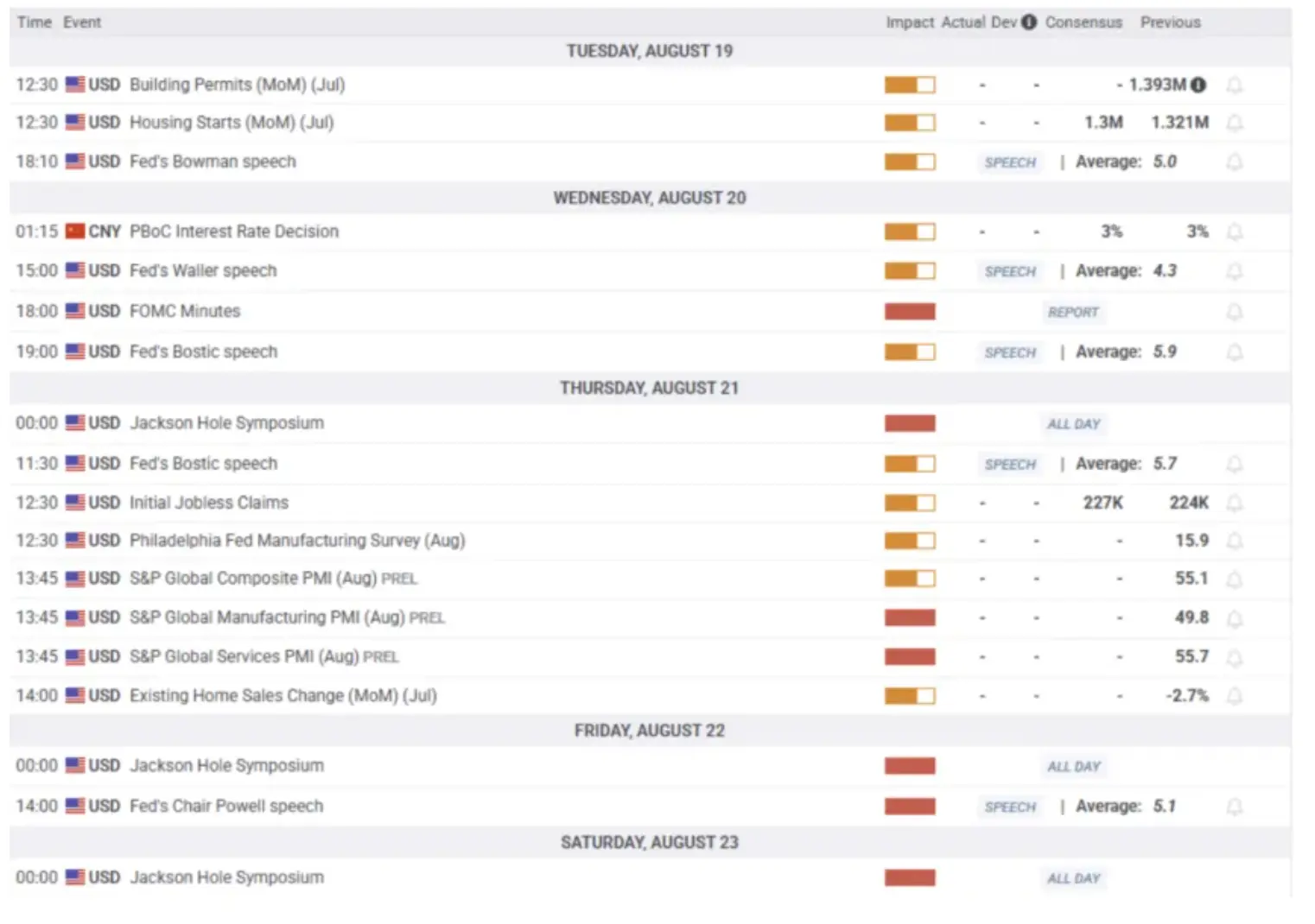

Gold ( XAU/USD ) has experienced a weak rebound after a big dump at the beginning of the week, as easing geopolitical tensions have diminished its safe-haven appeal. The U.S. inflation and retail data are mixed, raising doubts about the Fed's rate cut path, while fluctuations in U.S. Treasury yields dominate the short-term direction of gold prices. This week focuses on the Fed's meeting minutes, PMI data, and Powell's speech at Jackson Hole, with policy divergences increasing market uncertainty. The technical outlook shows gold prices trapped in a neutral zone, with $3,355-$3,360 becoming a key pivot. Crypto market investors need to follow the potential correlation between gold as a traditional safe-haven asset and crypto assets (especially Bitcoin), managing positions ahead of macro risk events.

TRUMP2.07%

MarketWhisper·2025-08-18 06:43

CoinRank Crypto Digest (8/15)|Lido’s Ethereum Staking Market Share Drops to 24.4%

Tether integrates Spark into its WDK, enabling non-custodial wallets for USD₮, XAU₮, and BTC with Lightning Network capabilities.

The partnership with Lightspark enhances Tether’s privacy-focused, permissionless payment infrastructure, lowering barriers for developer wallet creation.

Dinari to

ETH2.42%

CoinRank·2025-08-15 11:29

XLM, HBAR, ALGO recorded a breakout increase, far surpassing the overall market bounce back.

Bitcoin (BTC) just set a historical peak at $122k on Monday, reinforcing its position as a safe-haven asset like gold (XAU) amid escalating global trade tensions under President Donald Trump.

The influx of capital into the cryptocurrency market has created a wave

TapChiBitcoin·2025-07-14 02:00

Transak lists Tether Gold (XAU₮) on its platform

Transak has officially listed Tether Gold (XAU₮), a gold-backed stablecoin issued by Tether, on its global stablecoin onboarding platform, as per the reports shared with Finbold on Monday, July 7,

The listing allows users worldwide to purchase,

XAUT2.15%

TheBitTimesCom·2025-07-07 14:08

Mankun Lawyer | The issuer of USDT, Tether, issues gold tokens, interpretation of Thailand's digital asset regulatory policies.

On May 13, 2025, the stablecoin USDT issuer Tether announced that it will launch the Tether Gold Token (XAU₮) on the Thai digital asset exchange Maxbit. According to Tether, 1 XAU₮ corresponds to 1 ounce of gold in the real world.

Prior to this, on March 10, 2025, the Thai SEC announced USDT as an approved cryptocurrency, and the Deputy Prime Minister of Thailand also announced the country's intention to utilize cryptocurrency and blockchain technology to promote the development of the local tourism industry.

Figure 1

MancunBlockchainLegal·2025-07-03 11:25

The issuer of USDT, Tether, is issuing gold Tokens, interpreting Thailand's digital asset regulatory policies.

Tether will launch the gold token XAU₮ at the Maxbit exchange in Thailand, with 1 token corresponding to 1 ounce of gold. The Thai government is actively embracing digital assets, aiming to leverage them to boost tourism. Tether's strategy in Thailand includes collaborating with Bitkub to promote blockchain education and continuously embracing regulation, striving to gain market share and legal identification.

TechubNews·2025-07-03 01:56

USDT issuance party Tether issues gold Token, interpretation of Thailand's digital asset regulatory policies.

> Thailand's regulatory attitude towards encryption assets has undergone a transformation from cautious observation to active embrace, a shift closely related to the global trends in the digital economy and the adjustments in Thailand's domestic economic strategy.

Written by: Deron, Mankiw

On May 13, 2025, Tether, the issuer of the stablecoin USDT, announced the launch of Tether Gold Token (XAU₮) on the Thai digital asset exchange Maxbit. According to Tether, 1 XAU₮ corresponds to 1 ounce of gold in the real world.

Before this, on March 10, 2025, the Thai SEC announced USDT as an approved encryption currency, and the Thai Deputy Prime Minister also announced that Thailand intends to utilize encryption currency and blockchain technology to promote the development of the local tourism industry.

ForesightNews·2025-07-02 12:28

Bitcoin (BTC) New ATH: Large Crypto to Hit Level Unseen Since 2021

Bitcoin (BTC) is predicted to exceed its all-time-high against Gold (XAU) soon, according to analyst Checkmate. The rising interest in Gold-pegged stablecoins reflects increased demand for Gold amid global uncertainties, highlighting BTC's growth as a macro asset.

UToday·2025-06-28 12:50

Bitcoin Moves Ahead of Gold After Rare Golden Cross Momentum Shift

Bitcoin recently formed a rare golden cross with gold, signaling a shift in short-term momentum and attracting investor interest. The BTC/XAU ratio has increased to 31.6, indicating Bitcoin's strength relative to gold amid mixed economic signals.

BTC1.71%

CryptoFrontNews·2025-06-17 02:46

Tether Gold Debuts on Maxbit, Opens Access for Thai Investors

Key Notes

Tether Gold (XAU₮) is now available on Maxbit, the first Thai platform to offer it.

Each XAU₮ is backed by one troy ounce of gold stored in a secure vault.

Tether’s plans to expand into regulated markets, including the U.S continues to gain traction.

Tether has announced that its gol

XAUT2.15%

Coinspeaker·2025-05-13 04:59

Bitcoin Nears Highest Level Against S&P 500: Mike McGlone Says, But Here's Catch

Bitcoin's value relative to gold is dropping, as indicated by the BTC-to-XAU ratio. Bloomberg's Mike McGlone warns of a potential crash from $100,000. Meanwhile, Robert Kiyosaki prefers Bitcoin due to its fixed supply of 21 million coins compared to gold's expandability.

UToday·2025-05-08 05:10

Is Bitcoin Ready to Replace Gold? BTC Targets $100K Amid Improving US-China Sentiment

The Bitcoin price (BTC) has exceeded major resistance levels in the crypto market while gold (XAU/USD) encounters difficulties after achieving its peak at $3,500. Improving US-China relations leads to declining anxiety about safe havens, thus driving investors to choose Bitcoin over gold as their pr

Coinfomania·2025-04-30 10:22

When the US dollar loses Trustless, gold RWA quietly becomes the new ballast.

In April 2025, the market capitalization of Tether Gold reached $770 million, with each Token valued at $3,123.57. Gold, as the cornerstone of global wealth, is making a comeback and experiencing rapid rise in digital gold assets. The market capitalization of gold RWA reached $1.45 billion, with PAXG and XAU₮ accounting for over 95% of the market capitalization, becoming the leaders. The success of gold RWA is related to physical backing and high Compliance standards, showcasing the new significance and challenges of gold in the digital world.

ForesightNews·2025-04-29 03:58

Tether Gold stablecoin XAUT market capitalization reached 770 million, and encryption assets can also be invested in gold.

Tether has launched the gold stablecoin XAU₮, backed by 7.7 tons of gold, providing investors with an alternative investment method. XAU₮ is backed 1:1 by gold stored in a dedicated vault in Switzerland, with issuance under strict regulation and a market capitalization of approximately 770 million USD. Investors can purchase PAXG and XAU₮ to invest in gold through exchanges or Decentralized Finance. Global economic uncertainty is driving the growth of Tether Gold, proving that the inventory reflected in the middle is more important than the price.

ChainNewsAbmedia·2025-04-29 02:24

The Bitcoin/gold ratio risks falling by 35% after Wall Street loses 13 trillion USD.

Bitcoin is expected to drop 35% against gold (XAU) due to market signals. Historical patterns show a potential decline towards EMA 200. Analysts predict a similar drop, reflecting the US stock market decrease. BTC/XAU weakening signals a significant Bitcoin price drop, as seen in previous cycles. This may lead to Bitcoin testing EMA 200, potentially reaching around $50,950 by the end of the year.

BTC1.71%

TapChiBitcoin·2025-04-23 05:37

Gold: The euphoria of the markets slows down, but the bull trend remains solid

After reaching a new all-time high near 3,500 dollars per ounce, the price of gold (XAU/USD) experienced a slight decline on Tuesday morning. This movement is attributed to a temporary pause by investors, after weeks of continuous growth.

However, despite the retracement, the underlying sentiment r

NEAR-0.16%

TheCryptonomist·2025-04-22 12:48

Load More