# FedRateDecisionApproaches

21.48K

No rate cut is expected, but the Fed’s tone—hawkish or dovish—could still move Bitcoin. What’s your read on this meeting? Will Powell stay tough or soften his stance?

MrFlower_

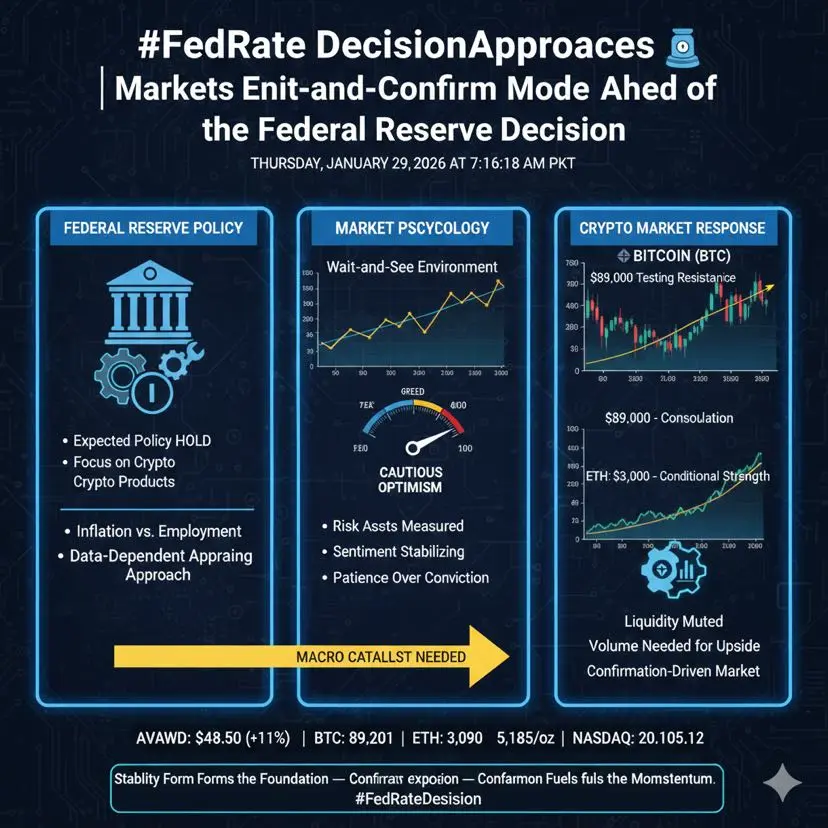

#FedRateDecisionApproaches 🏦 | Markets Enter Wait-and-Confirm Mode Ahead of the Federal Reserve Decision

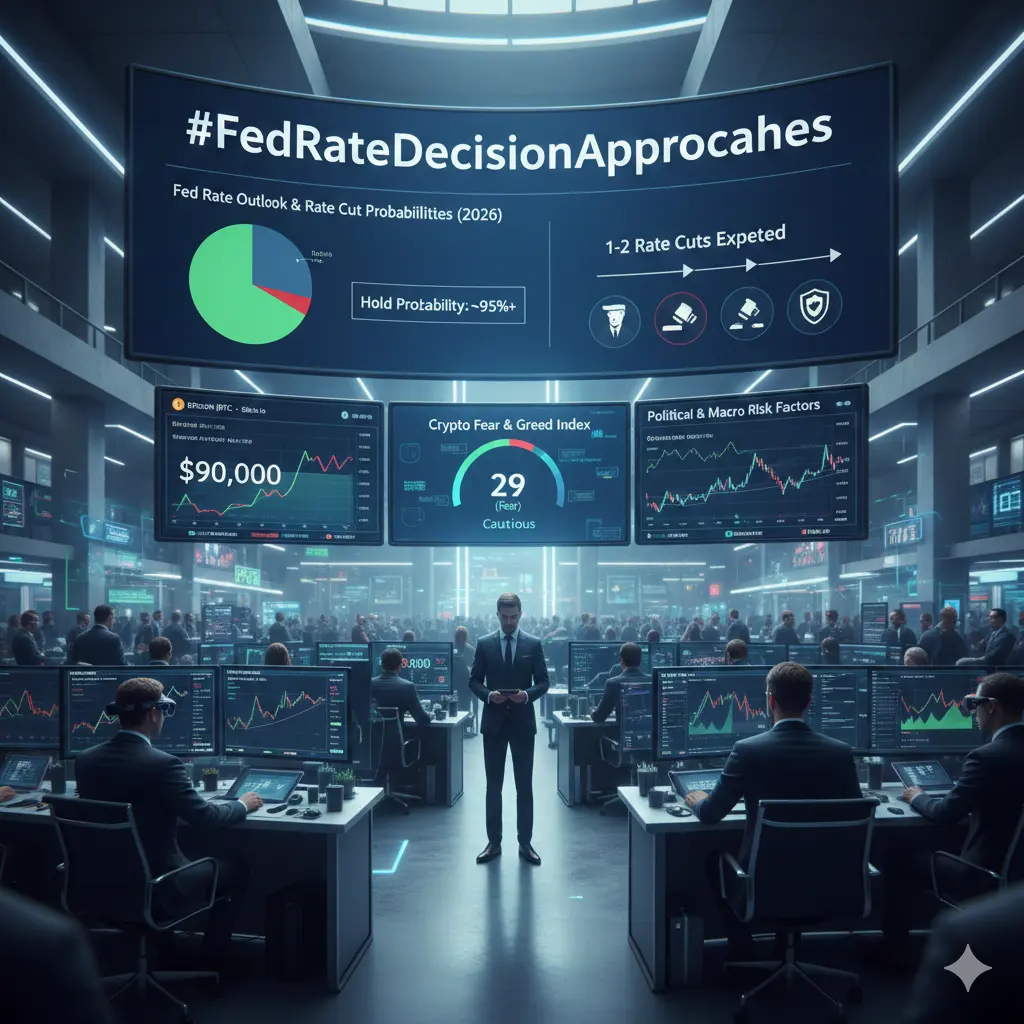

As the Federal Reserve’s upcoming interest rate decision approaches this Wednesday, global financial markets are settling into a cautious and highly observant posture. Current expectations strongly favor a policy hold, with traders assigning minimal probability to either an immediate rate hike or an early rate cut. Following the series of rate reductions implemented toward the end of last year, policymakers now appear focused on stability rather than acceleration, carefully assessing wheth

As the Federal Reserve’s upcoming interest rate decision approaches this Wednesday, global financial markets are settling into a cautious and highly observant posture. Current expectations strongly favor a policy hold, with traders assigning minimal probability to either an immediate rate hike or an early rate cut. Following the series of rate reductions implemented toward the end of last year, policymakers now appear focused on stability rather than acceleration, carefully assessing wheth

- Reward

- 17

- 9

- Repost

- Share

Yunna :

:

2026 gogogoView More

#FedRateDecisionApproaches FedRateDecisionApproaches 🏦 | Markets Enter Wait-and-Confirm Mode Ahead of the Federal Reserve Decision

As the Federal Reserve’s upcoming interest rate decision approaches this Wednesday, global financial markets are settling into a cautious and highly observant posture. Current expectations favor a policy hold, with minimal probability assigned to an immediate hike or early cut. Following last year’s rate reductions, policymakers appear focused on stability, assessing whether inflation is sustainably cooling without straining employment conditions.

With the benchma

As the Federal Reserve’s upcoming interest rate decision approaches this Wednesday, global financial markets are settling into a cautious and highly observant posture. Current expectations favor a policy hold, with minimal probability assigned to an immediate hike or early cut. Following last year’s rate reductions, policymakers appear focused on stability, assessing whether inflation is sustainably cooling without straining employment conditions.

With the benchma

- Reward

- 5

- 2

- Repost

- Share

HilalSafi24 :

:

2026 Go Go Go 👊2026 Go Go Go 👊2026 Go Go Go 👊2026 Go Go Go 👊 View More

#FedRateDecisionApproaches: Markets on Edge as the Federal Reserve Prepares Its Next Move

As the hashtag #FedRateDecisionApproaches trends across financial and crypto communities, global markets are entering a critical phase of uncertainty and anticipation. Investors, traders, and institutions alike are closely watching the U.S. Federal Reserve as it prepares to announce its next interest rate decision — a move that could significantly shape the direction of stocks, crypto assets, commodities, and global currencies.

The Federal Reserve’s interest rate policy is one of the most powerful tools i

As the hashtag #FedRateDecisionApproaches trends across financial and crypto communities, global markets are entering a critical phase of uncertainty and anticipation. Investors, traders, and institutions alike are closely watching the U.S. Federal Reserve as it prepares to announce its next interest rate decision — a move that could significantly shape the direction of stocks, crypto assets, commodities, and global currencies.

The Federal Reserve’s interest rate policy is one of the most powerful tools i

- Reward

- 8

- 7

- Repost

- Share

CryptoChampion :

:

Ape In 🚀View More

📊 Fed Meeting Ahead — Will Bitcoin Feel the Heat?

Markets are bracing for the upcoming Federal Reserve meeting. While no rate cut is expected, traders are watching Powell’s tone closely. Even a subtle hawkish or dovish signal could move Bitcoin and broader crypto sentiment.

🔍 Key Factors to Watch

Inflation commentary – Any hint that inflation is cooling or stubborn could shift expectations.

Monetary policy tone – Hawkish tone → risk-off, BTC may dip; dovish → risk-on, BTC could rally.

Macro correlation – Crypto still reacts strongly to U.S. macro signals and dollar strength.

📊 Possible Scen

Markets are bracing for the upcoming Federal Reserve meeting. While no rate cut is expected, traders are watching Powell’s tone closely. Even a subtle hawkish or dovish signal could move Bitcoin and broader crypto sentiment.

🔍 Key Factors to Watch

Inflation commentary – Any hint that inflation is cooling or stubborn could shift expectations.

Monetary policy tone – Hawkish tone → risk-off, BTC may dip; dovish → risk-on, BTC could rally.

Macro correlation – Crypto still reacts strongly to U.S. macro signals and dollar strength.

📊 Possible Scen

- Reward

- 12

- 6

- Repost

- Share

repanzal :

:

gogogo2026 gogogoView More

#FedRateDecisionApproaches 🏦💹

The Fed’s next rate decision is coming up, and while no cut is expected, all eyes are on Powell’s tone. Hawkish or dovish signals could move not just equities and bonds, but Bitcoin and crypto markets too.

BTC reacts to risk sentiment:

Hawkish → tighter liquidity → pressure on high-beta assets

Dovish → accommodative conditions → potential short-term rally

Powell’s language will be nuanced, balancing inflation control with data-driven guidance. Bitcoin traders should watch for shifts in real yields, liquidity, and risk appetite, not just crypto fundamentals.

Stra

The Fed’s next rate decision is coming up, and while no cut is expected, all eyes are on Powell’s tone. Hawkish or dovish signals could move not just equities and bonds, but Bitcoin and crypto markets too.

BTC reacts to risk sentiment:

Hawkish → tighter liquidity → pressure on high-beta assets

Dovish → accommodative conditions → potential short-term rally

Powell’s language will be nuanced, balancing inflation control with data-driven guidance. Bitcoin traders should watch for shifts in real yields, liquidity, and risk appetite, not just crypto fundamentals.

Stra

BTC-0.57%

- Reward

- 7

- 8

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches

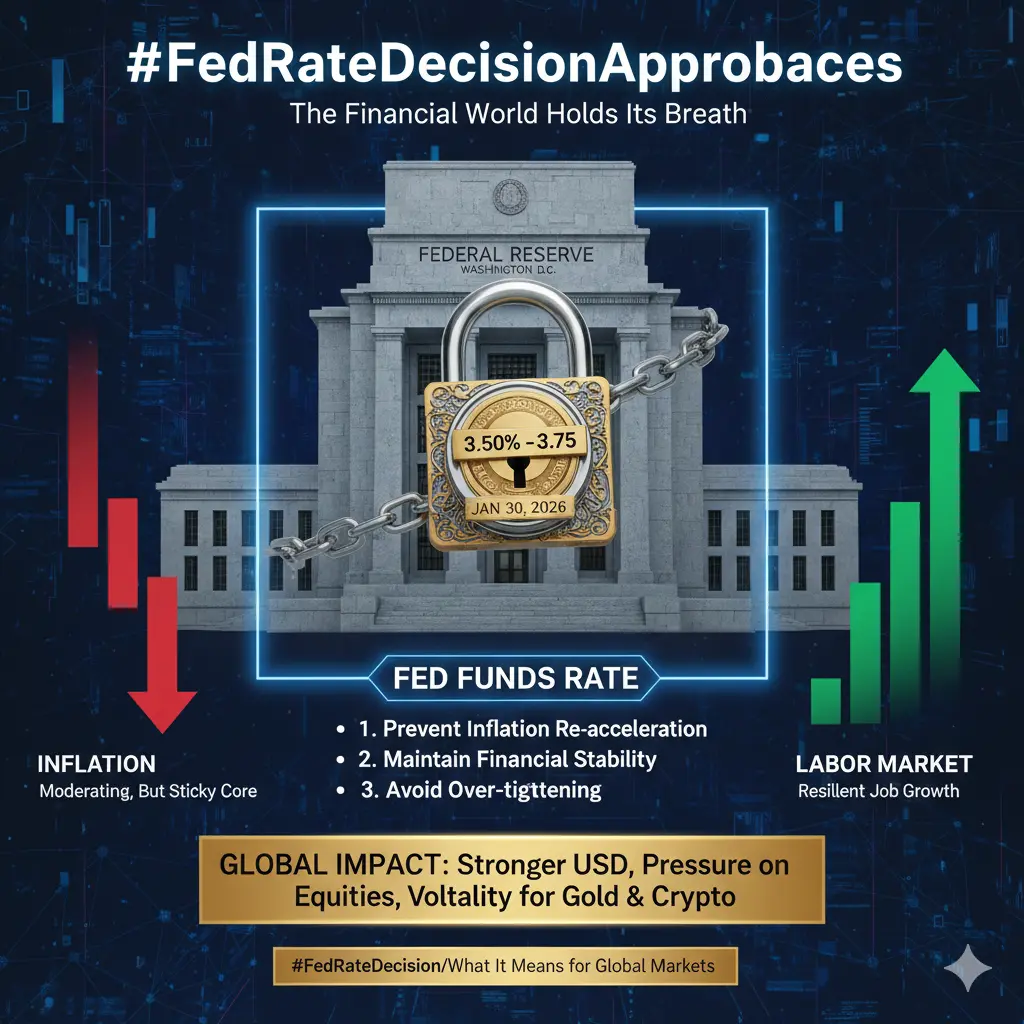

🏛️ The Financial World Holds Its Breath: Why FedRateDecisionApproaches is the Ultimate Market Mover

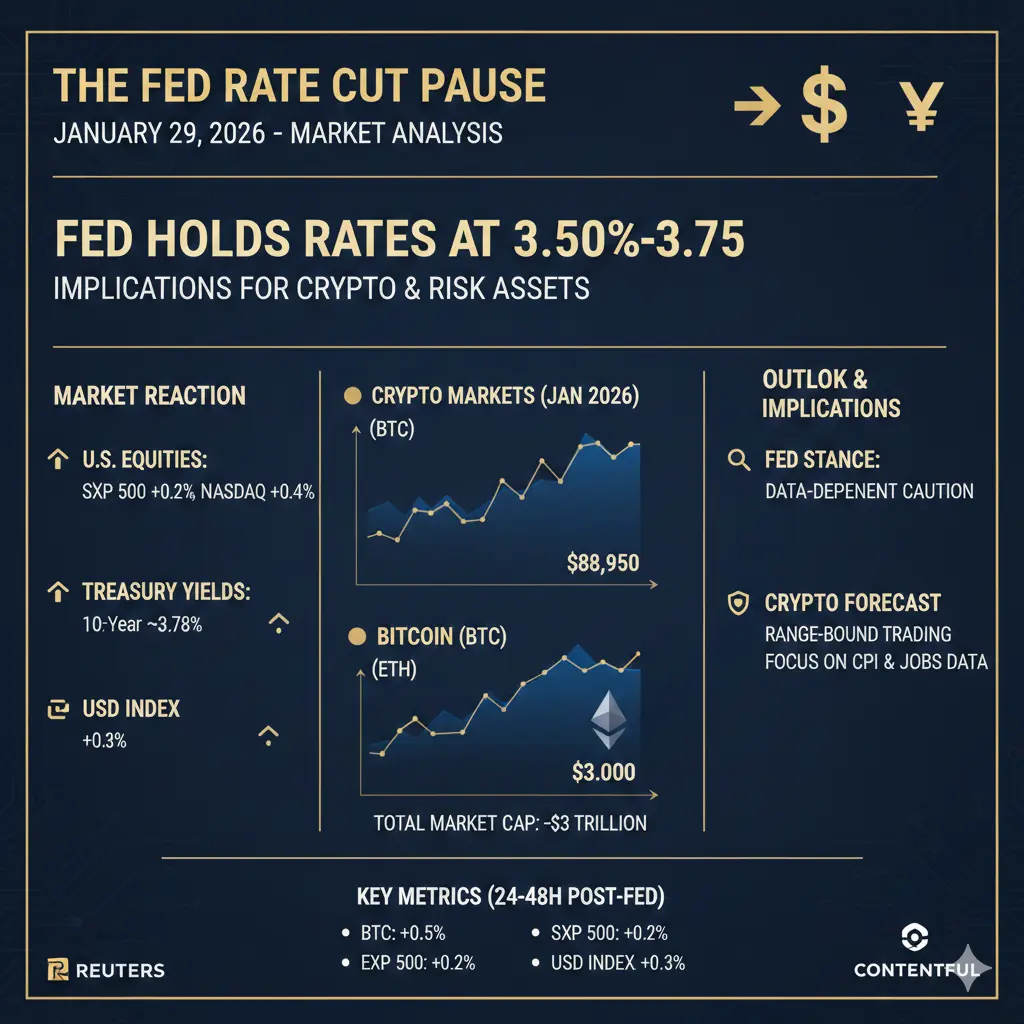

The wait is over for the first decision of 2026. The Federal Open Market Committee (FOMC) has officially decided to hold interest rates steady at 3.50% – 3.75%. After three consecutive cuts at the end of 2025, the Fed has hit the "pause" button, signaling a cautious "wait-and-see" approach that has sent ripples through the stock market, crypto, and real estate.

📉 The "Dovish Pause": What Just Happened?

While many hoped for a fourth straight cut to keep the momentum

🏛️ The Financial World Holds Its Breath: Why FedRateDecisionApproaches is the Ultimate Market Mover

The wait is over for the first decision of 2026. The Federal Open Market Committee (FOMC) has officially decided to hold interest rates steady at 3.50% – 3.75%. After three consecutive cuts at the end of 2025, the Fed has hit the "pause" button, signaling a cautious "wait-and-see" approach that has sent ripples through the stock market, crypto, and real estate.

📉 The "Dovish Pause": What Just Happened?

While many hoped for a fourth straight cut to keep the momentum

BTC-0.57%

- Reward

- 13

- 14

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎View More

#FedRateDecisionApproaches

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

- Reward

- 5

- 10

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches

As the Fed’s next rate decision approaches, markets are bracing for a critical signal on the trajectory of U.S. monetary policy. While no rate cut is expected at this meeting, investors are focusing on the tone rather than the headline whether Fed Chair Powell leans hawkish or dovish could move not only equities and bonds but also Bitcoin and broader crypto markets. Historically, Bitcoin reacts to shifts in risk sentiment: hawkish commentary tends to tighten liquidity and depress high-beta assets, while dovish or cautious language can trigger short-term rallies as

As the Fed’s next rate decision approaches, markets are bracing for a critical signal on the trajectory of U.S. monetary policy. While no rate cut is expected at this meeting, investors are focusing on the tone rather than the headline whether Fed Chair Powell leans hawkish or dovish could move not only equities and bonds but also Bitcoin and broader crypto markets. Historically, Bitcoin reacts to shifts in risk sentiment: hawkish commentary tends to tighten liquidity and depress high-beta assets, while dovish or cautious language can trigger short-term rallies as

BTC-0.57%

- Reward

- 6

- 9

- Repost

- Share

BeautifulDay :

:

Buy To Earn 💎View More

#FedRateDecisionApproaches

Fed Rate Decision Approaches: Market Expectations, Bitcoin Implications, and My Take

As the Federal Reserve prepares to announce its latest policy decision, market participants are closely watching not only whether a rate cut occurs which is widely not expected but also the tone of the Fed’s communication. Jerome Powell and the FOMC have a range of tools to influence expectations, and even subtle shifts toward a hawkish or dovish stance can reverberate across global markets, including cryptocurrencies. Bitcoin, in particular, remains highly sensitive to macro cond

Fed Rate Decision Approaches: Market Expectations, Bitcoin Implications, and My Take

As the Federal Reserve prepares to announce its latest policy decision, market participants are closely watching not only whether a rate cut occurs which is widely not expected but also the tone of the Fed’s communication. Jerome Powell and the FOMC have a range of tools to influence expectations, and even subtle shifts toward a hawkish or dovish stance can reverberate across global markets, including cryptocurrencies. Bitcoin, in particular, remains highly sensitive to macro cond

BTC-0.57%

- Reward

- 12

- 10

- Repost

- Share

BeautifulDay :

:

Thanks for sharing this informationView More

#FedRateDecisionApproaches #FedRateDecisionApproaches

The Fed decision is approaching, and most traders are still asking the wrong question.

They’re debating direction when they should be analyzing damage.

Rate cuts, rate holds, dot plots, forward guidance — these are surface-level narratives.

Markets don’t move on narratives. They move on misalignment.

Right now, risk assets are not priced for policy clarity — they are priced for policy rescue.

That distinction matters.

Equities, crypto, and high-beta assets are leaning into a future where inflation quietly fades, growth slows without breakin

The Fed decision is approaching, and most traders are still asking the wrong question.

They’re debating direction when they should be analyzing damage.

Rate cuts, rate holds, dot plots, forward guidance — these are surface-level narratives.

Markets don’t move on narratives. They move on misalignment.

Right now, risk assets are not priced for policy clarity — they are priced for policy rescue.

That distinction matters.

Equities, crypto, and high-beta assets are leaning into a future where inflation quietly fades, growth slows without breakin

- Reward

- 8

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.32K Popularity

6.81K Popularity

6.74K Popularity

4.1K Popularity

2.77K Popularity

4.81K Popularity

2.48K Popularity

3.17K Popularity

2.17K Popularity

23 Popularity

54.05K Popularity

68.92K Popularity

20.38K Popularity

26.61K Popularity

201.43K Popularity

News

View MoreSpot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

2 m

Analysis: CME Bitcoin futures show a clear price gap, offering a glimmer of hope for the bulls

6 m

Hong Kong Monetary Authority: Plans to issue the first stablecoin issuer licenses in March

14 m

Foreign media: ICE actions trigger turmoil in the U.S. House of Representatives, government shutdown may affect this week's non-farm payrolls

16 m

Digital asset market infrastructure provider Prometheum completes an additional $23 million funding

18 m

Pin