2025 ROSE Price Prediction: Expert Analysis and Market Forecast for Oasis Network Token

Introduction: ROSE's Market Position and Investment Value

Oasis Network (ROSE) is a decentralized blockchain network dedicated to building a "cloud computing platform" based on blockchain that achieves privacy protection, security, and performance simultaneously. Since its inception in 2020, the project has been pioneering the implementation of computing-intensive applications such as artificial intelligence on blockchain through its integrated software and hardware technology. As of December 2025, ROSE has achieved a market capitalization of approximately $115.7 million, with a circulating supply of approximately 7.49 billion tokens, maintaining a price around $0.01157.

This asset, recognized as a privacy-focused and performance-oriented blockchain infrastructure solution, continues to play an increasingly important role in enabling decentralized cloud computing applications and AI-driven services across the Web3 ecosystem.

This article will provide a comprehensive analysis of ROSE's price trajectory from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors seeking exposure to privacy-enhancing blockchain infrastructure.

I. ROSE Price History Review and Current Market Status

ROSE Historical Price Evolution

- 2022: ROSE reached its all-time high of $0.597347 on January 15, 2022, marking the peak of its market cycle during the cryptocurrency bull market.

- 2025: ROSE experienced significant downward pressure, declining from its historical highs. The token reached a new all-time low of $0.01115333 on December 16, 2025, representing a massive decline of approximately 98.13% from its peak price.

ROSE Current Market Situation

As of December 17, 2025, ROSE is trading at $0.01157, reflecting a 1H gain of 0.86% but showing weakness across longer timeframes with a 24-hour decline of -1.11%. The token exhibits more pronounced bearish momentum when viewed through a broader lens: the 7-day performance shows a -11.81% drop, the 30-day period reveals a -37.64% decline, and the 1-year performance demonstrates a devastating -89.25% loss.

ROSE has a circulating supply of 7,486,278,824 tokens out of a total and maximum supply of 10,000,000,000 tokens, indicating a circulation ratio of 74.86%. The current market capitalization stands at approximately $86.62 million, while the fully diluted valuation reaches $115.7 million. The 24-hour trading volume is approximately $66,003, indicating relatively modest liquidity. ROSE maintains a market dominance of 0.0036% and is ranked 373rd by market capitalization.

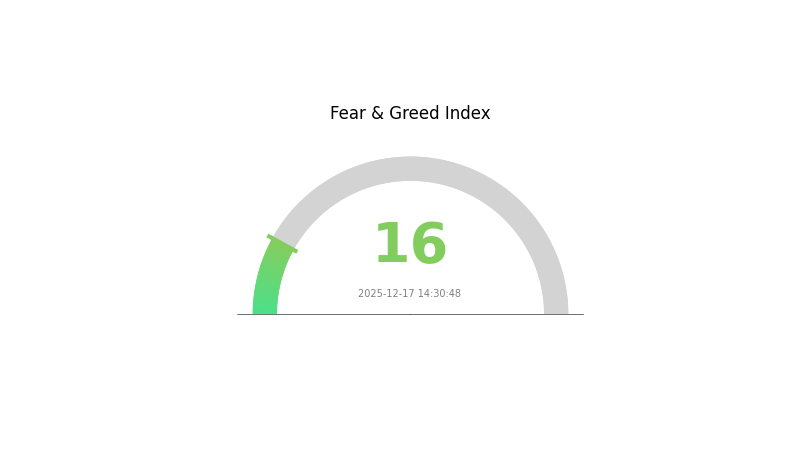

The token is currently held by 309,801 distinct addresses and is available for trading on 19 exchanges. Market sentiment indicators show "Extreme Fear" with a VIX reading of 16, reflecting pessimistic market conditions.

Click to view current ROSE market price

ROSE Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This indicates widespread pessimism and risk aversion among investors. Such extreme fear conditions often present contrarian opportunities, as markets tend to overreact to negative sentiment. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor key support levels and market developments closely during this volatile period. Consider dollar-cost averaging strategies to mitigate timing risk in highly fearful markets.

ROSE Holdings Distribution

The address holdings distribution chart provides a critical metric for assessing the concentration of token ownership across the Oasis Network ecosystem. By analyzing the top holders and their respective percentages of total supply, this indicator reveals the decentralization degree of ROSE and identifies potential concentration risks that could influence market dynamics.

Without specific holding data available in the provided dataset, a comprehensive quantitative analysis cannot be conducted at this time. However, the holdings distribution framework remains essential for evaluating ROSE's market structure. Generally, tokens exhibiting highly concentrated holdings among a small number of addresses face elevated risks of price manipulation and reduced market resilience. Conversely, a well-distributed token base across numerous addresses indicates stronger decentralization characteristics and greater stability against coordinated selling pressures.

To properly assess ROSE's current concentration profile and its implications for market stability and price discovery mechanisms, real-time holdings data would be required. Investors and researchers are encouraged to monitor these metrics continuously through on-chain analysis tools to understand how distribution evolves over time and whether the network maintains healthy decentralization standards aligned with its protocol governance principles.

Click to view current ROSE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing ROSE's Future Price

Supply Mechanism

- Supply-Demand Dynamics: ROSE's price is primarily influenced by supply-demand relationships. When demand exceeds supply, prices rise; conversely, prices fall when supply surpasses demand.

- Historical Price Patterns: Supply adjustments have previously caused significant price fluctuations for ROSE.

- Current Market Impact: The current supply dynamics continue to influence price movements as the project evolves.

Ecosystem and Strategic Development

- Ecosystem Expansion: Project ecosystem and partnership extensions have emerged as important drivers of price growth. As of October 2025, ROSE was trading at $0.85, representing a 150% increase compared to 2023.

- Privacy-Focused Innovation: ROSE operates as a privacy-centric blockchain project, leveraging innovative technology and strong mainstream application prospects to attract market attention.

- Strategic Partnerships: Continued expansion of partnerships and collaborations within the ecosystem supports long-term value appreciation.

Three、2025-2030 ROSE Price Forecast

2025 Outlook

- Conservative Forecast: $0.00865 - $0.01153

- Neutral Forecast: $0.01153

- Optimistic Forecast: $0.0143 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with moderate growth trajectory as the project strengthens its technological foundation and expands developer community engagement.

- Price Range Forecast:

- 2026: $0.0093 - $0.01343 (11% upside potential)

- 2027: $0.00843 - $0.01778 (13% upside potential)

- Key Catalysts: Mainnet upgrades, ecosystem partnerships, DeFi protocol integrations, and enterprise adoption initiatives.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01393 - $0.01857 (33% cumulative growth by 2028, assuming steady market conditions and consistent platform development)

- Optimistic Scenario: $0.01702 - $0.02247 (47% growth by 2029, contingent upon breakthrough technological innovations and significant mainstream adoption)

- Transformative Scenario: $0.01975 - $0.02646 (70% growth by 2030, predicated on exceptional regulatory clarity, enterprise-level partnerships, and emergence as a leading infrastructure platform)

Note: These forecasts are based on historical data analysis and market trend projections. Investors should conduct their own due diligence and consider trading on platforms like Gate.com with appropriate risk management strategies. Actual price movements may deviate significantly from these predictions based on broader market conditions and unforeseen developments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0143 | 0.01153 | 0.00865 | 0 |

| 2026 | 0.01343 | 0.01291 | 0.0093 | 11 |

| 2027 | 0.01778 | 0.01317 | 0.00843 | 13 |

| 2028 | 0.01857 | 0.01548 | 0.01393 | 33 |

| 2029 | 0.02247 | 0.01702 | 0.01175 | 47 |

| 2030 | 0.02646 | 0.01975 | 0.01284 | 70 |

Oasis Network (ROSE) Professional Investment Strategy and Risk Management Report

IV. ROSE Professional Investment Strategy and Risk Management

ROSE Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in privacy-focused blockchain infrastructure and decentralized computing platforms

- Operation Recommendations:

- Accumulate ROSE during market downturns when the token trades significantly below all-time highs, leveraging dollar-cost averaging to reduce timing risk

- Hold positions through market cycles, recognizing that infrastructure tokens require extended periods to demonstrate utility adoption

- Monitor ecosystem development milestones and artificial intelligence application deployments on the Oasis Network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Use historical price points at $0.01146 (24h low) and $0.01178 (24h high) as primary trading boundaries for range-bound positioning

- Volume Analysis: Monitor the 24-hour trading volume of approximately $66,003 to identify breakout opportunities and validate price movements

- Range Trading Considerations:

- The token's -1.11% 24-hour decline and -11.81% 7-day decline suggest bearish medium-term sentiment requiring cautious entry timing

- Current year-to-date performance of -89.25% indicates substantial distance from previous highs, creating both accumulation opportunities and validation that fundamentals must drive recovery

ROSE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio allocation

- Active Investors: 2-5% of diversified crypto holdings

- Professional Investors: 3-8% with systematic rebalancing protocols

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance ROSE holdings with established layer-1 blockchain networks to reduce single-project concentration risk

- Position Sizing: Never allocate capital exceeding individual loss tolerance levels; implement stop-loss orders at 15-20% below entry prices

(3) Secure Storage Solution

- Self-Custody Method: Transfer ROSE tokens to secure wallets after purchase, maintaining private key custody for maximum security control

- Security Considerations: Enable multi-factor authentication on all exchange accounts, use hardware security devices for critical transactions, and never share recovery phrases or private keys with third parties

V. ROSE Potential Risks and Challenges

ROSE Market Risk

- Severe Drawdown from All-Time Highs: ROSE has declined 98.06% from its $0.597347 all-time high recorded on January 15, 2022, indicating substantial downside realization and potential further volatility

- Low Market Capitalization and Liquidity: With approximately $86.6 million in market capitalization and only $66,003 in 24-hour trading volume, ROSE exhibits limited liquidity that could amplify price swings during significant buy or sell orders

- Negative Price Momentum: The token faces persistent selling pressure with consecutive negative performance across all measured timeframes (-1.11% in 24 hours, -37.64% in 30 days), suggesting weak market confidence

ROSE Regulatory Risk

- Evolving Cryptocurrency Regulatory Environment: Privacy-focused blockchain projects face increasing scrutiny from regulatory authorities across major jurisdictions concerned with compliance and anti-money laundering requirements

- Potential Compliance Challenges: Privacy-enhancing technologies incorporated into the Oasis Network may attract regulatory attention requiring operational adjustments or restrictions in certain markets

- Jurisdictional Uncertainty: Changes in global cryptocurrency regulation could impact the project's development roadmap, user adoption, or token utility mechanisms

ROSE Technical Risk

- Adoption and Competition: The artificial intelligence and privacy computing market faces intense competition from both centralized cloud providers and alternative blockchain solutions with larger developer communities

- Network Security and Scalability: As a relatively smaller network by total value locked and validator count compared to established blockchains, potential vulnerabilities in consensus mechanisms or smart contract security remain concerns

- Ecosystem Development Dependency: Success depends on attracting meaningful developer adoption and real-world enterprise applications; failure to demonstrate practical use cases beyond theoretical applications represents significant execution risk

VI. Conclusion and Action Recommendations

ROSE Investment Value Assessment

Oasis Network presents a technically ambitious privacy-preserving blockchain infrastructure project targeting artificial intelligence and confidential computing applications. However, the token currently trades at historically depressed valuations following the 98% decline from previous peaks, reflecting market skepticism about near-term catalysts and monetization mechanisms. Investment in ROSE requires conviction in long-term blockchain privacy adoption trends and tolerance for extended periods of sideways or declining prices as the ecosystem matures.

ROSE Investment Recommendations

✅ Beginners: Execute minimal position sizing (less than 1% of crypto portfolio) using Gate.com's trading platform with predetermined stop-loss orders at clear technical levels; prioritize learning about privacy-focused blockchain use cases before substantial capital deployment

✅ Experienced Investors: Consider strategic accumulation during extreme drawdown periods as tactical positions, implementing disciplined profit-taking protocols at 20-30% gains while maintaining awareness that the token faces structural headwinds requiring fundamental breakthrough developments

✅ Institutional Investors: Evaluate ROSE as part of diversified blockchain infrastructure exposure only after conducting extensive due diligence on Oasis Labs' technical roadmap, enterprise partnership pipeline, and artificial intelligence application adoption metrics; implement position sizing reflecting the speculative nature of privacy-computing infrastructure tokens

ROSE Trading Participation Methods

- Spot Trading on Gate.com: Purchase ROSE directly using fiat currency or other cryptocurrencies through Gate.com's comprehensive trading interface, maintaining positions in secure wallets

- Strategic Accumulation: Establish regular purchase schedules during specific price levels to implement dollar-cost averaging strategies across extended timeframes

- Liquidity Considerations: Execute limit orders rather than market orders given the relatively modest 24-hour trading volume to minimize slippage and achieve optimal entry prices

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions according to their individual risk tolerance and financial situation. Consulting with professional financial advisors is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

Can rose coins reach $1 dollar?

Yes, ROSE can potentially reach $1. With significant adoption and market growth, this price target is achievable. Current price sits much lower, offering substantial upside potential for long-term believers in the Oasis network.

Is rose an AI coin?

Yes, ROSE is an AI-focused cryptocurrency built on the Oasis Network. It leverages artificial intelligence as a core feature, with AI agents serving as its main proposition. ROSE positions itself at the forefront of AI-driven crypto trends expected to dominate beyond 2025.

How much is rose crypto coin worth?

As of 2025-12-17, ROSE (Oasis Network) is valued at approximately $0.0134. This price reflects current market conditions and may fluctuate based on trading activity and market demand for the native token of the Oasis Network privacy-enabled blockchain platform.

How much will 1 pi be worth in 2025?

Pi Network is forecasted to trade within a range of $0.1387 and $0.5463 in 2025. If it reaches the upper price target, PI could increase by 171.23%, representing significant growth potential for the network.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

2025 PUFF Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 XVS Price Prediction: Expert Analysis and Market Outlook for Venus Token in the Coming Year

2025 BLUR Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 WHITE Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 CFG Price Prediction: Expert Analysis and Market Outlook for Centrifuge Token